|

Tax On Cash Withdrawal

Tax on cash withdrawal is a form of advance taxation and is a strategy to keep tax evasion in check. This mode of tax collection is also called the presumptive tax regime. Globally, 3 countries are known to consider this approach namely, Pakistan, India and Greece. Greece - Cashpoint During 2015, when Greek economy was on the verge of bankruptcy, millions of panicked citizens completely cleared their accounts - by pulling more than €28 billion out of banks and pushing the total cash revenue held in the country's financial institutions to a 10-year low. To combat this Greek banks proposed taxing cash withdrawals and requiring use of debit and credit cards for all transaction in order to prevent tax evasion. A surcharge for all cashpoint withdrawals was introduced approximately amounting to €1 for every €1,000 transaction. It was expected that it won't impact day-to-day withdrawals and it will deter citizens from clearing out their bank accounts. Ministers of the Athens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

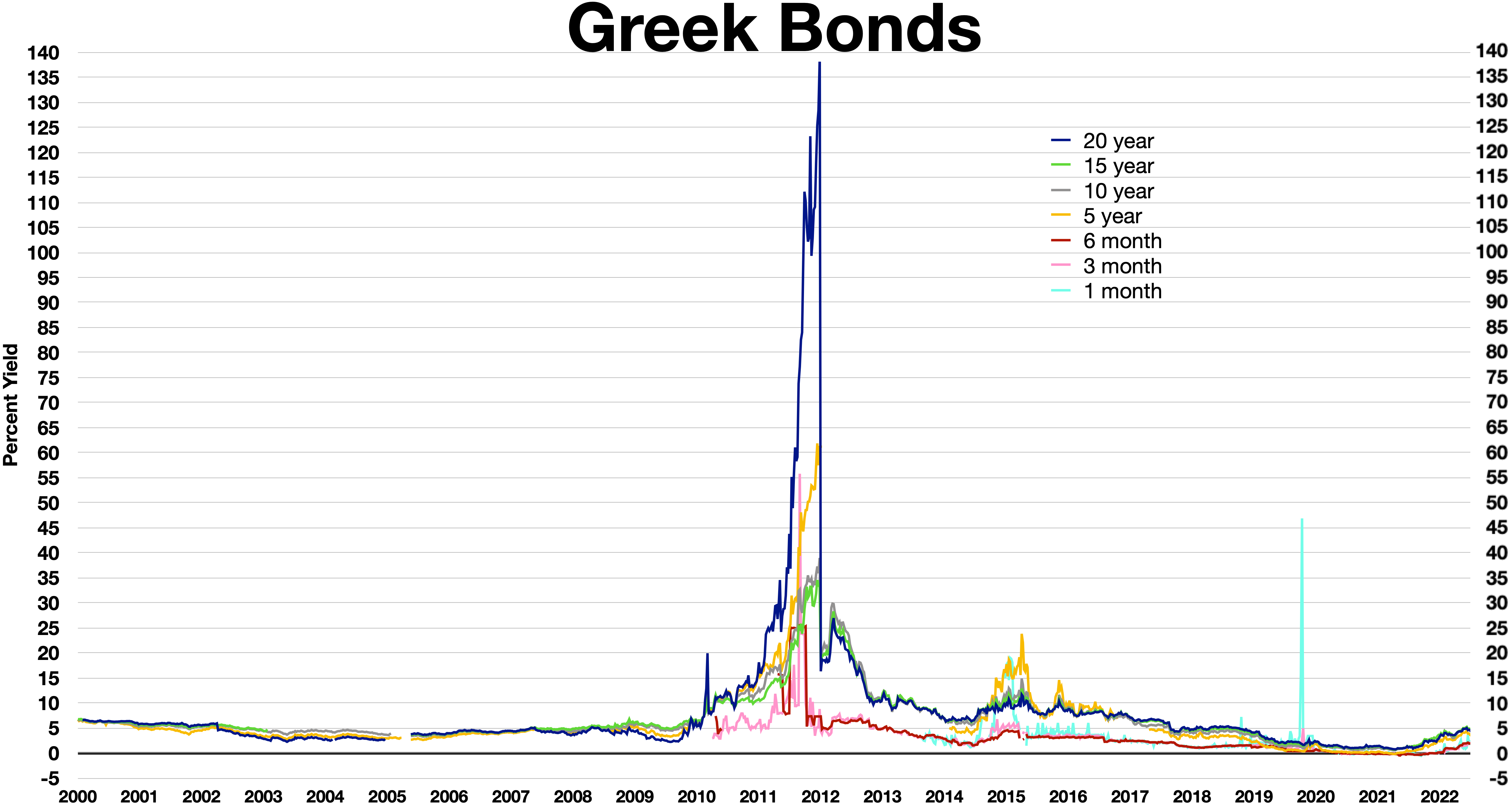

Greece Gmnt Bonds

Greece,, or , romanized: ', officially the Hellenic Republic, is a country in Southeast Europe. It is situated on the southern tip of the Balkans, and is located at the crossroads of Europe, Asia, and Africa. Greece shares land borders with Albania to the northwest, North Macedonia and Bulgaria to the north, and Turkey to the northeast. The Aegean Sea lies to the east of the Geography of Greece, mainland, the Ionian Sea to the west, and the Sea of Crete and the Mediterranean Sea to the south. Greece has the longest coastline on the Mediterranean Basin, featuring List of islands of Greece, thousands of islands. The country consists of nine Geographic regions of Greece, traditional geographic regions, and has a population of approximately 10.4 million. Athens is the nation's capital and List of cities and towns in Greece, largest city, followed by Thessaloniki and Patras. Greece is considered the cradle of Western culture, Western civilization, being the birthplace of Athenian ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Greek Government-debt Crisis

Greece faced a sovereign debt crisis in the aftermath of the financial crisis of 2007–2008. Widely known in the country as The Crisis ( Greek: Η Κρίση), it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis. In all, the Greek economy suffered the longest recession of any advanced mixed economy to date. As a result, the Greek political system has been upended, social exclusion increased, and hundreds of thousands of well-educated Greeks have left the country. The Greek crisis started in late 2009, triggered by the turmoil of the world-wide Great Recession, structural weaknesses in the Greek economy, and lack of monetary policy flexibility as a member of the Eurozone. The crisis included revelations that previous data on government debt levels and deficits had been underreported by the Greek government: the official forecast for the 2009 budg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nitin Gadkari

Nitin Jairam Gadkari (; born 27 May 1957) is an Indian politician from Maharashtra who is the current Minister for Road Transport & Highways in the Government of India. He is also the longest serving Minister for Road Transport & Highways currently running his tenure for over 8 years. Gadkari earlier served as the President of the Bharatiya Janata Party (BJP) from 2009 to 2013. He is also known for his work as the Public Works Department Minister of the State of Maharashtra, where, under his leadership, a series of roads, highways and flyovers across the state were constructed – including the Mumbai-Pune Expressway, India's first six-lane concrete, high-speed expressway. Gadkari is closely associated with the Rashtriya Swayamsevak Sangh (RSS), which is headquartered in his home constituency of Nagpur. He currently represents the Nagpur constituency in the Lok Sabha, and is a lawyer by occupation. During the cabinet reshuffle on 7 July 2021 the portfolio for Ministry of MSM ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ArthaKranti

On 8 November 2016, the Government of India announced the demonetisation of all ₹500 and ₹1,000 banknotes of the Mahatma Gandhi Series. It also announced the issuance of new ₹500 and ₹2,000 banknotes in exchange for the demonetised banknotes. Prime Minister Narendra Modi claimed that the action would curtail the shadow economy, increase cashless transactions and reduce the use of illicit and counterfeit cash to fund illegal activity and terrorism. The announcement of demonetisation was followed by prolonged cash shortages in the weeks that followed, which created significant disruption throughout the economy. People seeking to exchange their banknotes had to stand in lengthy queues, and several deaths were linked to the rush to exchange cash. According to a 2018 report from the Reserve Bank of India ₹15.3 trillion of the ₹15.41 trillion in demonetised bank notes, or approximately 99.3%, were deposited in banks, leading analysts to state that the effort had f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Transaction Tax

A bank transaction tax is a tax levied on debit (and/or credit) entries on bank accounts. In 1989, at the Buenos Aires meetings of the International Institute of Public Finance, University of Wisconsin–Madison Professor of Economics Edgar L. Feige proposed extending the tax reform ideas of John Maynard Keynes, James Tobin and Lawrence Summers, to their logical conclusion, namely to tax all transactions. Feige's Automated Payment Transaction tax (''APT tax'') proposed taxing the broadest possible tax base at the lowest possible tax rate. Since all transactions must ultimately be paid for by a final means of payment, namely via a transfer from a bank account or by settlement with currency, Feige proposed collecting his tax by levying the tax automatically on the debit and credit entries to bank accounts, thereby splitting the tax between the buyer and seller of every transaction. The APT tax is a uniform flat-rate tax on all transactions, assessed and collected automatically wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Transaction Tax

A currency transaction tax is a tax placed on the use of currency for various types of transactions. The tax is associated with the financial sector and is a type of financial transaction tax, as opposed to a consumption tax paid by consumers, though the tax may be passed on by the financial institution to the customer. Types of currency transaction taxes Currency transaction taxes have been proposed as taxes on domestic currency usage as part of the automated payment transaction (APT) tax and on international currency transactions, the Tobin tax and the Spahn tax. APT tax The automated payment transaction (APT) tax was first proposed in Buenos Aires at the International Institute of Public Finance Conference by Edgar L. Feige in 1989 and an extended version of the proposal appeared in Economic Policy in 2000. The APT tax proposal is a generalization of the Keynes tax and the Tobin tax. The APT tax consists of a small flat tax levied on all transactions. The tax is automatica ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash

In economics, cash is money in the physical form of currency, such as banknotes and coins. In bookkeeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-immediately (as in the case of money market accounts). Cash is seen either as a reserve for payments, in case of a structural or incidental negative cash flow or as a way to avoid a downturn on financial markets. Etymology The English word "cash" originally meant "money box", and later came to have a secondary meaning "money". This secondary usage became the sole meaning in the 18th century. The word "cash" derives from the Middle French ''caisse'' ("money box"), which derives from the Old Italian ''cassa'', and ultimately from the Latin ''capsa'' ("box").. History In Western Europe, after the fall of the Western Roman Empire, coins, silver jewelry and hacksilver (silver objects hacked into pieces) were for centuries the only form of mone ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cashless Society

In a cashless society, financial transactions are not conducted with physical banknotes or coins, but instead with digital information (usually an electronic representation of money). Cashless societies have existed from the time when human society came into existence, based on barter and other methods of exchange, and cashless transactions have also become possible in modern times using credit cards, debit cards, mobile payments, and digital currencies such as bitcoin. However, this article focuses on the term "cashless society" in the sense of a move towards a society in which cash is replaced by its digital equivalent—in other words, legal tender (money) exists, is recorded, and is exchanged only in electronic digital form. Such a concept has been discussed widely, particularly because the world is experiencing a rapid and increasing use of digital methods of recording, managing, and exchanging money in commerce, investment and daily life in many parts of the world, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Pakistan

Pakistan's current Taxation system is defined by Income Tax Ordinance 2001 (for direct taxes) and Sales Tax Act 1990 (for indirect taxes) and administrated by Federal Board of Revenue (FBR). History The Income Tax Act of 1922 The Income Tax Act of 1922 was prevalent during the British Raj and was inherited by both the governments of India and Pakistan upon independence and partition in 1947. This act initially formed the basis of both countries' Income Tax codes. The Income Tax Ordinance (1979) The Income Tax Ordinance was the first law on Income Tax which was promulgated in Pakistan from 28 June 1979 by the Government of Pakistan. The Income Tax Ordinance, 2001 To update the tax laws and bring the country's tax laws into line with international standards, the Income Tax Ordinance 2001 was promulgated on 13 September 2001. It became effective from 1 July 2002. IT rules 2002 IT (Income Tax) rules 2002 were promulgated by the Federal Board of Revenue (FBR) on 1 July 2002 in exerci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |