|

Tax Law Rewrite Project

The Tax Law Rewrite Project of HM Revenue and Customs was a major effort to re-write the entire tax legislation of the United Kingdom in a format which is both more consistent and more understandable. It aimed to remove archaic language and impenetrable terminology from tax law and to replace it with modern language and terminology. History The project was set up in 1996 and produced five pieces of primary legislation and one piece of secondary legislation. A sixth and seventh bill went before Parliament. The project focussed purely on primary legislation but special dispensation was given to the re-writing of the regulations governing PAYE by the project. The project began its work with the legislation covering capital allowances and the first legislation passed thanks to the project was the Capital Allowances Act 2001. The project then moved on to consider income tax. Three pieces of primary legislation relating to income tax—the Income Tax (Earnings and Pensions) Act 20 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HM Revenue And Customs

HM Revenue and Customs (His Majesty's Revenue and Customs, or HMRC) is a non-ministerial government department, non-ministerial Departments of the United Kingdom Government, department of the His Majesty's Government, UK Government responsible for the tax collection, collection of Taxation in the United Kingdom, taxes, the payment of some forms of Welfare state in the United Kingdom, state support, the administration of other regulatory Regime#Politics, regimes including the national minimum wage and the issuance of national insurance numbers. HMRC was formed by the merger of the Inland Revenue and HM Customs and Excise, which took effect on 18 April 2005. The department's logo is the St Edward's Crown enclosed within a circle. Prior to the Elizabeth II, Queen's death on 8 September 2022, the department was known as ''Her'' Majesty's Revenue and Customs and has since been amended to reflect the change of monarch. Departmental responsibilities The department is responsible for the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Tax In The United Kingdom

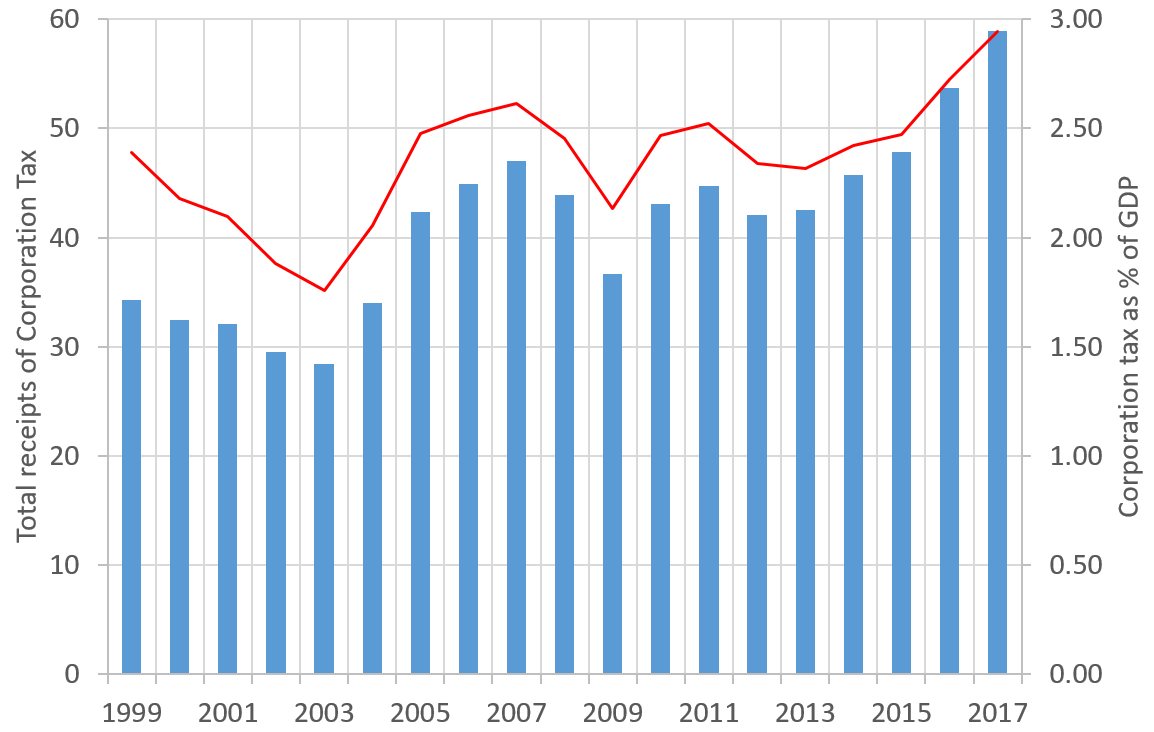

: ''Throughout this article, the term "pound" and the £ symbol refer to the Pound sterling.'' Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies and on the profits of entities registered overseas with permanent establishments in the UK. Until 1 April 1965, companies were taxed at the same income tax rates as individual taxpayers, with an additional profits tax levied on companies. Finance Act 1965 replaced this structure for companies and associations with a single corporate tax, which took its basic structure and rules from the income tax system. Since 1997, the UK's Tax Law Rewrite ProjectTax Law Rewrite , |

1997 Establishments In The United Kingdom

File:1997 Events Collage.png, From left, clockwise: The movie set of ''Titanic'', the highest-grossing movie in history at the time; ''Harry Potter and the Philosopher's Stone'', is published; Comet Hale-Bopp passes by Earth and becomes one of the most observed comets of the 20th century; Golden Bauhinia Square, where sovereignty of Hong Kong is handed over from the United Kingdom to the People's Republic of China; the 1997 Central European flood kills 114 people in the Czech Republic, Poland, and Germany; Korean Air Flight 801 crashes during heavy rain on Guam, killing 229; Mars Pathfinder and Sojourner land on Mars; flowers left outside Kensington Palace following the death of Diana, Princess of Wales, in a car crash in Paris., 300x300px, thumb rect 0 0 200 200 Titanic (1997 film) rect 200 0 400 200 Harry Potter rect 400 0 600 200 Comet Hale-Bopp rect 0 200 300 400 Death of Diana, Princess of Wales rect 300 200 600 400 Handover of Hong Kong rect 0 400 200 600 Mars Path ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Law Of The United Kingdom

The United Kingdom has four legal systems, each of which derives from a particular geographical area for a variety of historical reasons: English and Welsh law, Scots law, Northern Ireland law, and, since 2007, purely Welsh law (as a result of the passage of Welsh devolution and the Government of Wales Act 2006 by Parliament). Overarching these systems is the law of the United Kingdom, also known as United Kingdom law (often abbreviated UK law), or British law. UK law arises from laws applying to the United Kingdom and/or its citizens as a whole, most obviously constitutional law, but also other areas - for instance, tax law. In fulfilment of its former EU treaty obligations, European Union directives were actively transposed into the UK legal systems under the UK parliament's law-making power. Upon Brexit, EU law was transplanted into domestic law as "retained EU law", though the UK remained temporarily in alignment with EU regulations during the transition period from 3 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United Kingdom

Taxation in the United Kingdom may involve payments to at least three different levels of government: central government (HM Revenue & Customs), devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion. History A uniform Land tax, originally was introduced in England during the late 17th century, formed the main source of government revenue throughout the 18th century and the early 19th century. Stephen Dowell, ''History of Taxation and Taxes in England'' (Rou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joint Committee On Tax Law Rewrite Bills

The Joint Committee on Tax Law Rewrite Bills was a joint committee of the Parliament of the United Kingdom. The remit of the committee was to scrutinise bills intended to make the language of tax law simpler, while preserving the effect of the existing law, subject to minor changes. It scrutinized the Tax Law Rewrite Project. History The Joint Committee on Tax Simplification sat between January 2001 to May 2002. It was replaced by the Joint Committee on Tax Law Rewrite Bills in May 2002, which scrutinised the Tax Law Rewrite Project until April 2010. The committee has not been active since then. Membership As of December 2019, the membership of the committee has not been selected for the current Parliament. See also * Joint Committee of the Parliament of the United Kingdom *Parliamentary Committees of the United Kingdom References External linksThe records of the Joint Committee on Tax Law Rewrite Bills are held by the Parliamentary Archives [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ICAEW

The Institute of Chartered Accountants in England and Wales (ICAEW) is a professional membership organisation that promotes, develops and supports chartered accountants and students around the world. As of July 2022, it has over 198,000 members and students in 147 countries. ICAEW was established by royal charter in 1880. Overview The institute is a member of the Consultative Committee of Accountancy Bodies (CCAB), formed in 1974 by the major accountancy professional bodies in the UK and Ireland. The fragmented nature of the accountancy profession in the UK is in part due to the absence of any legal requirement for an accountant to be a member of one of the many Institutes, as the term ''accountant'' does not have legal protection. However, a person must belong to ICAEW, ICAS or CAI to hold themselves out as a '' chartered accountant'' in the UK (although there are other chartered bodies of British qualified accountants whose members are likewise authorised to conduct restr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation (International And Other Provisions) Act 2010

The Taxation (International and Other Provisions) Act 2010 is an Act of Parliament Acts of Parliament, sometimes referred to as primary legislation Primary legislation and secondary legislation (the latter also called delegated legislation or subordinate legislation) are two forms of law, created respectively by the legislat ... in the United Kingdom that aims to ‘restate, with minor changes, certain enactments relating to tax; to make provision for purposes connected with the restatement of enactments by other tax law rewrite Acts; and for connected purposes’. External links * United Kingdom Acts of Parliament 2010 Tax legislation in the United Kingdom {{UK-statute-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Tax Act 2010

The Corporation Tax Act 2010 (c.4) is an Act of the Parliament of the United Kingdom that received Royal Assent on 3 March 2010. It was first presented (first reading) in the House of Commons on 19 November 2009 and received its third reading on 4 February 2010. It was first read in the House of Lords on 4 February 2010 and received its second and third readings on 2 March 2010. Overview Section 1 of the Act gives a summary of the contents of the 2010 Act, and the changes it made, primarily to the Income and Corporation Taxes Act 1988 Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. Fo .... References External linksCorporation Tax Act 2010 on legislation.gov.uk United Kingdom Acts of Parliament 2010 Tax legislation in the United Kingdom {{UK-statute-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Tax Act 2009

The Corporation Tax Act 2009 (c 4) is an Act of the Parliament of the United Kingdom. It restated certain legislation relating to corporation tax, with minor changes that were mainly intended "to clarify existing provisions, make them consistent or bring the law into line with well established practice." The Bill was the work of the Tax Law Rewrite Project team at HM Revenue and Customs. Sections 1310, 1323, 1324, 1325(2) and (3) and 1328 to 1330 came into force on 26 March 2009. Section 1329(3) confers a power on the Treasury to bring paragraphs 71 and 99 of Schedule 2, and section 1325(1) so far as relating to those paragraphs, and Part 2 of Schedule 3, and section 1326 so far as relating to that Part of that Schedule, into force by order. The other provisions of the Act came into force on 1 April 2009. The amendments, repeals and revocations contained in Schedules 1 and 3 have the same extent as the provisions they amend, repeal or revoke. The other provisions of the Act ex ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax (PAYE) Regulations 2003

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdict ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the European mainland, continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The United Kingdom includes the island of Great Britain, the north-eastern part of the island of Ireland, and many List of islands of the United Kingdom, smaller islands within the British Isles. Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the United Kingdom is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. The total area of the United Kingdom is , with an estimated 2020 population of more than 67 million people. The United Kingdom has evolved from a series of annexations, unions and separations of constituent countries over several hundred years. The Treaty of Union between ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)