|

Tax Form

A tax return is the completion of documentation that calculates an entity or individual's income earned and the amount of taxes to be paid to the government or government organizations or, potentially, back to the taxpayer. Taxation is one of the biggest sources of income for the government. There are two types of taxes—direct and indirect—which are both parts of the tax revenue. Tax revenue is the income gained by government from taxes that are levied on income, profit, goods and services, land revenue, ownership, and transfer of property, and other taxes. Total tax revenue calculated as a percentage of GDP shows the share of the country’s output collected by the government through taxes. Tax revenue is used by governments to grant sums of money to communities, the military, education, hospitals, and infrastructure. In the United States the Internal Revenue Service (IRS) administers federal tax laws. It is a government entity that fulfils three main functions. Firstly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form W-2

Form W-2 (officially, the "Wage and Tax Statement") is an Internal Revenue Service (IRS) tax form used in the United States to report wages paid to employees and the taxes withheld from them. Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship. An employer must mail out the Form W-2 to employees on or before January 31. This deadline gives these taxpayers about 2 months to prepare their returns before the April 15 income tax due date. The form is also used to report FICA taxes to the Social Security Administration. The Form W-2, along with Form W-3, generally must be filed by the employer with the Social Security Administration by the end of February. Relevant amounts on Form W-2 are reported by the Social Security Administration to the Internal Revenue Service. In territories, the W-2 is issued with a two letter code indicating which territory, such as W-2GU for Guam. If corrections ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Deduction

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax. Above and below the line Above and below the line refers to items above or below adjusted gross income, which is item 37 on the tax year 2017 1040 tax form. Tax deductions above the line lessen adjusted gross income, while deductions below the line can only lessen taxable income if the aggregate of those deductions exceeds the standard deduction, which in tax year 2018 in the U.S., for example, was $12,000 for a single taxpayer and $24,000 for married couple. Limitations Often, deductions are subject to conditions, such as being allowed only for expenses incurred that produce current benefits. C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (United States)

Tax returns in the United States are reports filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency (California Franchise Tax Board, for example) containing information used to calculate income tax or other taxes. Tax returns are generally prepared using forms prescribed by the IRS or other applicable taxing authority. Federal returns Under the Internal Revenue Code returns can be classified as either ''tax returns'' or ''information returns'', although the term "tax return" is sometimes used to describe both kinds of returns in a broad sense. Tax returns, in the more narrow sense, are reports of tax liabilities and payments, often including financial information used to compute the tax. A very common federal tax form is IRS Form 1040. A tax return provides information so that the taxation authority can check on the taxpayer's calculations, or can determine the amount of tax owed if the taxpayer is not required to calculate that amount.Vict ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (United Kingdom)

In the United Kingdom, a tax return is a document that must be filed with HM Revenue & Customs declaring liability for taxation. Different bodies must file different returns with respect to various forms of taxation. The main returns currently in use are: *SA100 for individuals paying income tax *SA800 for partnerships *SA900 for trusts and estates of deceased persons *CT600 for companies paying corporation tax *VAT100 for value added tax Income tax self-assessment Most employees paying tax under the PAYE system are not required to file a tax return, because the PAYE system operates to withhold the correct amount of tax from their wages or salaries. However, some tax payers, including employees, may have income that has not been taxed at source and needs to be declared to HMRC, usually by submitting a self assessment tax return. Legally, a tax payer is obliged to submit a tax return when HMRC request one by sending a notice to file a tax return, either because the tax payer has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax Return (India)

Income tax return is the form in which assessee files information about his/her income and tax thereon to Income Tax Department. Various forms are ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 and ITR 7. When you file a belated return, you are not allowed to carry forward certain losses. The Income Tax Act, 1961, and the Income Tax Rules, 1962, obligates citizens to file returns with the Income Tax Department at the end of every financial year. These returns should be filed before the specified due date. Every Income Tax Return Form is applicable to a certain section of the Assessees. Only those Forms which are filed by the eligible Assessees are processed by the Income Tax Department of India. It is therefore imperative to know which particular form is appropriate in each case. Income Tax Return Forms vary depending on the criteria of the source of income of the Assessee and the category of the Assessee. Filing of income tax returns: obligation by law Individuals who fulfil any o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (Canada)

A tax return is the completion of documentation that calculates an entity or individual's income earned and the amount of taxes to be paid to the government or government organizations or, potentially, back to the taxpayer. Taxation is one of the biggest sources of income for the government. There are two types of taxes—Direct tax, direct and Indirect tax, indirect—which are both parts of the tax revenue. Tax revenue is the income gained by government from taxes that are levied on income, profit, goods and services, land revenue, ownership, and transfer of property, and other taxes. Total tax revenue calculated as a percentage of GDP shows the share of the country’s output collected by the government through taxes. Tax revenue is used by governments to grant sums of money to communities, the military, education, hospitals, and infrastructure. In the United States the Internal Revenue Service (IRS) administers federal tax laws. It is a government entity that fulfils thre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (Australia)

Australian tax returns for the tax year beginning 1 July and ending 30 June of the following year are generally due on 31 October after the end of the tax year. Australian individual taxpayers can file their return online with the ATO's myTax software, by ordering a printed copy of the tax return form, or with the assistance of a tax agent. Until 2011, the Australian Taxation Office (ATO) published TaxPack, a free document designed to help individuals complete their return. In 2012, TaxPack was replaced with a smaller instruction document, due to increased usage of the e-tax software. Extensions of the deadline for lodging a tax return are automatically available to those individuals using a Registered Tax Agent operating on an extended lodgement system, and extensions can be made available under some circumstances. In Australia, individuals and taxpaying entities with taxable income might need to lodge different returns with the ATO in respect of various forms of taxation. Se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Information Reporting

Tax information reporting in the United States is a requirement for organizations to report wage and non-wage payments made in the course of their trade or business to the Internal Revenue Service (IRS). This area of government reporting and corporate responsibility is continuously growing, carrying with it a large number of regulatory requirements established by the federal government and the states. There are currently more than 30 types of tax information returns required by the federal government, and they provide the primary cross-checking measure the IRS has to verify accuracy of tax returns filed by individual taxpayers. Information returns The tax information return most familiar to the greatest number of people is the Form W-2, which reports wages and other forms of compensation paid to employees. There are also many forms used to report non-wage income, and to report transactions that may entitle a taxpayer to take a credit on an individual tax return. These non-wage f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IRS Tax Forms

Internal Revenue Service (IRS) tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of the United States. They are used to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments. Individual forms 1040 As of the 2018 tax year, Form 1040, U.S. Individual Income Tax Return, is the only form used for personal (individual) federal income tax returns filed with the IRS. In prior years, it had been one of three forms (1040 he "Long Form" 1040A he "Short Form"and 1040EZ - see below for explanations of each) used for such returns. The first Form 1040 was published for use for the tax years 1913, 1914, and 1915. For 1916, Form 1040 was converted to an annual form (i.e., updated each ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Opportunity Tax Credit

The American Opportunity Tax Credit is a partially refundable tax credit first detailed in Section 1004 of the American Recovery and Reinvestment Act of 2009. The act specifies: # Provisions were originally specific to tax years 2009 and 2010, later extended, and finally made permanent by the Bipartisan Budget Act of 2015, for the first 4 years of post-secondary education. # Increases the Hope credit to 100 percent qualified tuition, fees and course materials paid by the taxpayer during the taxable year not to exceed $2,000, plus 25 percent of the next $2,000 in qualified tuition, fees and course materials. The total credit does not exceed $2,500. # 40% of the credit is refundable. # This tax credit is subject to a phase-out for taxpayers with adjusted gross income in excess of $80,000 ($160,000 for married couples filing jointly). The act directs several Treasury studies: # Coordination with non-tax student financial assistance; # Coordinate the credit allowed under the Federal P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

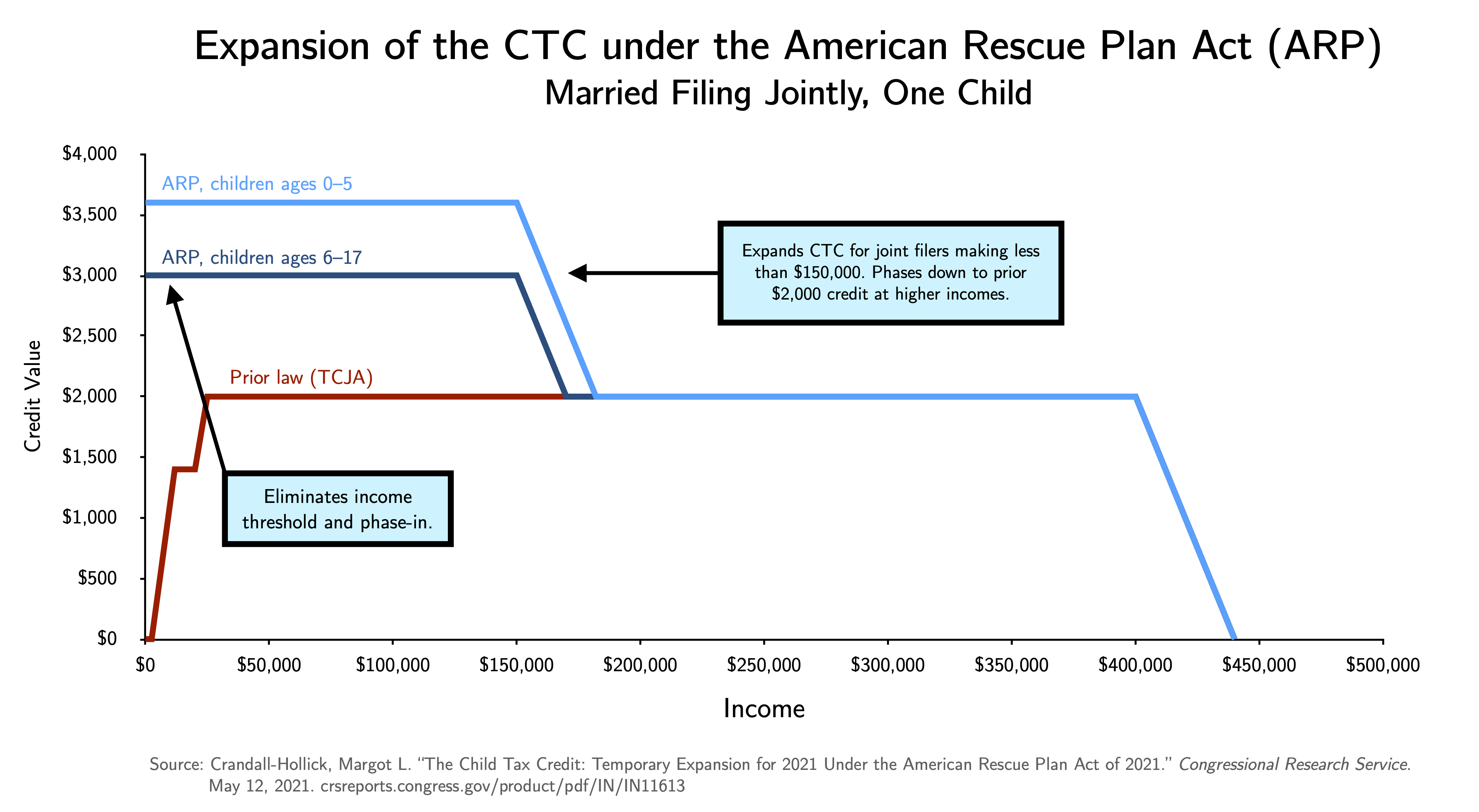

Child Tax Credit

A child tax credit (CTC) is a tax credit for parents with dependent children given by various countries. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer's income level. For example, in the United States, only families making less than $400,000 per year may claim the full CTC. Similarly, in the United Kingdom, the tax credit is only available for families making less than £42,000 per year. Germany Germany has a programme called the which, despite technically being a tax exemption and not a tax credit, functions similarly. The child allowance is an allowance in German tax law, in which a certain amount of money is tax-free in the taxation of parents. In the income tax fee paid, child benefit and tax savings through the child tax credit are compared against each other, and the parents pay whichever results in the lesser amount of tax. United Kingdom In the United Kingdom, a family with children and an income below about ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |