|

Tally Technologies

Tally Technologies, Inc. (or simply Tally) is a San Francisco, California-based American financial services company founded by Jason Brown and Jasper Platz in 2015. The company's smartphone app helps its users pay down their credit card debt, based on an analysis of their personal financial profiles and a new line of credit it provides with a lower interest rate. The app also manages credit card payments, allowing its users to avoid credit card late fees. Tally earns revenue by charging interest when a user carries a balance. The company does not charge annual, balance transfer, late, prepayment or insufficient funds fees, and generates revenue only when it charges a lower APR than its users' credit cards. Founders and Investors Jason Brown and Jasper Platz, who previously founded Gen110, Inc., a solar energy company funded by Kleiner Perkins Caufield & Byers, started Tally in 2015. Brown and Platz realized that since credit card annual percentage rates (APRs) are typicall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Privately Held Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

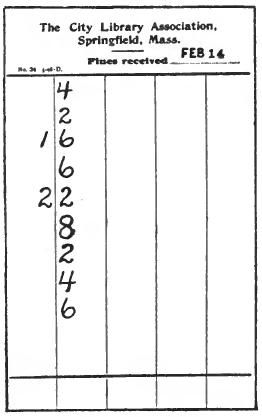

Late Fee

A late fee, also known as an ''overdue fine'', ''late fine'', or ''past due fee'', is a charge fined against a client by a company or organization for not paying a bill or returning a rented or borrowed item by its due date. Its use is most commonly associated with businesses like creditors, video rental outlets and libraries. Late fees are generally calculated on a per day, per item basis. Organizations encourage the payment of late fees by suspending a client's borrowing or rental privileges until accumulated fees are paid, sometimes after these fees have exceeded a certain level. Late fees are issued to people who do not pay on time and don't honor a lease or obligation for which they are responsible. Library fine Library fines, also known as overdue fines, late fees, or overdue fees, are small daily or weekly fees that libraries in many countries charge borrowers after a book or other borrowed item is kept past its due date. Library fines are an enforcement mechanism designed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Of The United States

Finance is the study and discipline of money Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are as ..., currency and capital assets. It is related to, but not synonymous with economics, the study of Production (economics), production, Distribution (economics), distribution, and Consumption (economics), consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in Financial system, financial systems at various scopes, thus the field can be roughly divided into Personal finance, personal, Corporate finance, corporate, and public finance. In a financial system, assets are bought, sold, or traded as Financial instrument, financial instruments, such as Currency, currencies, Loan, loans, Bond (finance), bonds, Shar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Based In San Francisco

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is generating profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duty according to the publicly declared incorporation, or published policy. When a company closes, it may need to be liquidated to avoid further legal obligations. Companies may associate and collectively register themselves as new companies; the resulting entities are often known as corporate groups. Meanings and definitions A company can be defined as an "artificial per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Score In The United States

A credit score is a number that provides a comparative estimate of an individual's creditworthiness based on an analysis of their credit report. It is an inexpensive and main alternative to other forms of consumer loan underwriting. Lenders, such as banks and credit card companies, use credit scores to evaluate the risk of lending money to consumers. Lenders contend that widespread use of credit scores has made credit more widely available and less expensive for many consumers. Under the Wall Street reform bill passed in 2010, a consumer is entitled to receive a free report of the specific credit score used if they are denied a loan, credit card or insurance due to their credit score. History Before credit scores, credit was evaluated using credit reports from credit bureaus. During the late 1950s, banks started using computerized credit scoring to redefine creditworthiness as abstract statistical risk. The Equal Credit Opportunity Act banned denying credit on gender or mari ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FICO

FICO (legal name: Fair Isaac Corporation), originally Fair, Isaac and Company, is a data analytics company based in Bozeman, Montana, focused on credit scoring services. It was founded by Bill Fair and Earl Isaac in 1956. Its FICO score, a measure of consumer credit risk, has become a fixture of consumer lending in the United States. In 2013, lenders purchased more than 10 billion FICO scores and about 30 million American consumers accessed their scores themselves. The company reported a revenue of $1.29 billion dollars for the fiscal year of 2020. History FICO was founded in 1956 as Fair, Isaac and Company by engineer William R. "Bill" Fair and mathematician Earl Judson Isaac. The two met while working at the Stanford Research Institute in Menlo Park, California. Selling its first credit scoring system two years after the company's creation, [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revolving Account

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit card diffe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Line Of Credit

A line of credit is a credit facility extended by a bank or other financial institution to a government, business or individual customer that enables the customer to draw on the facility when the customer needs funds. A line of credit takes several forms, such as an overdraft limit, demand loan, special purpose, export packing credit, term loan, discounting, purchase of commercial bills, traditional revolving credit card account, etc. It is effectively a source of funds that can readily be tapped at the borrower's discretion. Interest is paid only on money actually withdrawn. Lines of credit can be secured by collateral, or may be unsecured. Lines of credit are often extended by banks, financial institutions and other licensed consumer lenders to creditworthy customers (though certain special-purpose lines of credit may not have creditworthiness requirements) to address fluctuating cash flow needs of the customer. The maximum amount of funds a customer is allowed to draw from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth (in terms of number of employees, annual revenue, scale of operations, etc). Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the firms they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology or biotechnology. The typical venture capital investment occurs after an initial "seed funding" round. The first ro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Silicon Valley Bank

Silicon Valley Bank is an American commercial bank. SVB is on the list of largest banks in the United States, and is the biggest bank in Silicon Valley based on local deposits. It is a subsidiary of SVB Financial Group. History Silicon Valley Bank (SVB) was founded in 1982 by Bill Biggerstaff and Robert Medearis over a poker game. Its first office opened in 1983 on North First Street in San Jose. The Palo Alto office opened in 1985. The bank’s main strategy was collecting deposits from businesses financed through venture capital. It then expanded into banking and financing venture capitalists themselves, and added services aimed at allowing the bank to keep clients as they matured from their startup phase. In 1986, SVB merged with National InterCity Bancorp and opened an office in Santa Clara. In 1988, the bank completed its IPO, raising $6 million. In the same year they opened another office in San Jose. In 1990, the bank opened its first office on the East Coast, near Boston. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shasta Ventures

Shasta Ventures is an early-stage venture capital investment firm located in Silicon Valley that invests in enterprise and technology consumer startups. It is located on Sand Hill Road in Menlo Park. Funds Shasta's second fund of US$250 million included Nest Labs, which almost all by itself repaid the entire fund when it was sold to Google for $3.2 billion. Shasta's third fund of $265 million was announced in September 2011. The fourth fund, of $300 million, was announced in June 2014. Investment philosophy Shasta was originally focused on companies in the consumer technology space, with then managing director Tod Francis calling Mint.com a "classic Shasta" investment in September 2011. In September 2013, Rob Coneybeer of Shasta, the new managing director, said that he was betting big on hardware startups, citing Moore's Law-style continued performance improvements making opportunities for new hardware possible. Companies Mint.com Shasta Ventures was an early investor in Min ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |