|

Taleb Distribution

In economics and finance, a Taleb distribution is the statistical profile of an investment which normally provides a payoff of small positive returns, while carrying a small but significant risk of catastrophic losses. The term was coined by journalist Martin Wolf and economist John Kay to describe investments with a "high probability of a modest gain and a low probability of huge losses in any period." The concept is named after Nassim Nicholas Taleb, based on ideas outlined in his book '' Fooled by Randomness''. According to Taleb in ''Silent Risk'', the term should be called "payoff" to reflect the importance of the payoff function of the underlying probability distribution, rather than the distribution itself. The term is meant to refer to an investment returns profile in which there is a high probability of a small gain, and a small probability of a very large loss, which more than outweighs the gains. In these situations the expected value is very much less than zero, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taleb And Holy Grail Distributions

{{disambig, surname, given name, geo ...

Taleb may refer to: People Surname * Loay Taleb (born 1975), Syrian footballer * Nassim Nicholas Taleb (born 1960), Lebanese-American writer and statistician * Nordine Taleb (born 1981), French mixed martial artist * Oday Taleb (born 1977), Iraqi football goalkeeper Given name * Taleb Alrefai (born 1958), Kuwaiti journalist and writer * Taleb Nematpour (born 1984), Iranian wrestler * Taleb Tawatha (born 1992), Israeli-Bedouin footballer Places * Taleb, Iran, a village in East Azerbaijan Province, Iran * Taleb, Khuzestan, a village in Khuzestan Province, Iran See also * Taleb distribution, a type of returns profile * Talib (other) Talib may refer to: * Talib, Shirak, Armenia * Talib (name), an Arabic name * An individual member of the Taliban, a political terrorist Islamist movement in Afghanistan See also * Taleb (other) * Talibe, Arabic term for student * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

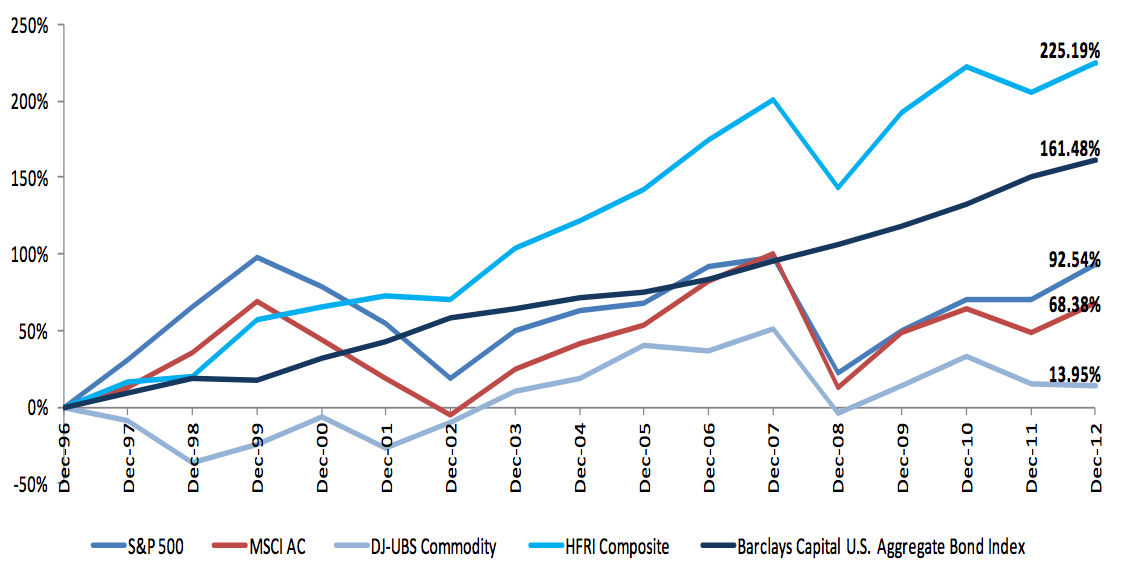

Risk Of Ruin

Risk of ruin is a concept in gambling, insurance, and finance relating to the likelihood of losing all one's investment capital or extinguishing one's bankroll below the minimum for further play. For instance, if someone bets all their money on a simple coin toss, the risk of ruin is 50%. In a multiple-bet scenario, ''risk of ruin'' accumulates with the number of bets: each play increases the risk, and persistent play ultimately yields the stochastic certainty of gambler's ruin. Finance Risk of ruin for investors Two leading strategies for minimising the risk of ruin are diversification and hedging/ portfolio optimization. An investor who pursues diversification will try to own a broad range of assets – they might own a mix of shares, bonds, real estate and liquid assets like cash and gold. The portfolios of bonds and shares might themselves be split over different markets – for example a highly diverse investor might like to own shares on the LSE, the NYSE and various ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Swan Theory

The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. The term is based on an ancient saying that presumed black swans did not exist a saying that became reinterpreted to teach a different lesson after they were discovered in Australia. The theory was developed by Nassim Nicholas Taleb, starting in 2001, to explain: # The disproportionate role of high-profile, hard-to-predict, and rare events that are beyond the realm of normal expectations in history, science, finance, and technology. # The non-computability of the probability of consequential rare events using scientific methods (owing to the very nature of small probabilities). # The psychological biases that blind people, both individually and collectively, to uncertainty and a rare event's massive role in historical affairs. Taleb's "black swan theory" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moral Hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk knowing that its insurance will pay the associated costs. A moral hazard may occur where the actions of the risk-taking party change to the detriment of the cost-bearing party after a financial transaction has taken place. Moral hazard can occur under a type of information asymmetry where the risk-taking party to a transaction knows more about its intentions than the party paying the consequences of the risk and has a tendency or incentive to take on too much risk from the perspective of the party with less information. One example is a principal–agent problem, where one party, called an agent, acts on behalf of another party, called the principal. If the agent has more information about his or her actions or intentions than the princi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Strategy

In finance, an investment strategy is a set of rules, behaviors or procedures, designed to guide an investor's selection of an investment portfolio. Individuals have different profit objectives, and their individual skills make different tactics and strategies appropriate. Some choices involve a tradeoff between risk and return. Most investors fall somewhere in between, accepting some risk for the expectation of higher returns. Investors frequently pick investments to hedge themselves against inflation. During periods of high inflation investments such as shares tend to perform less well in real terms. Time horizon of investments. Investments such as shares should be invested into with the time frame of a minimum of 5 years in mind. It is recommended in finance a minimum of 6 months to 12 months expenses in a rainy-day current account, giving instant access before investing in riskier investments than an instant access account. It is also recommended no more than 90% of your mon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Kenneth Galbraith

John Kenneth Galbraith (October 15, 1908 – April 29, 2006), also known as Ken Galbraith, was a Canadian-American economist, diplomat, public official, and intellectual. His books on economic topics were bestsellers from the 1950s through the 2000s. As an economist, he leaned toward post-Keynesian economics from an institutionalist perspective. Galbraith was a long-time Harvard faculty member and stayed with Harvard University for half a century as a professor of economics. He was a prolific author and wrote four dozen books, including several novels, and published more than a thousand articles and essays on various subjects. Among his works was a trilogy on economics, ''American Capitalism'' (1952), ''The Affluent Society'' (1958), and '' The New Industrial State'' (1967). Some of his work has been criticized by economists Milton Friedman, Paul Krugman, Robert Solow, and Thomas Sowell. Galbraith was active in Democratic Party politics, serving in the administrations of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark-to-market Accounting

Mark-to-market (MTM or M2M) or fair value accounting is accounting for the " fair value" of an asset or liability based on the current market price, or the price for similar assets and liabilities, or based on another objectively assessed "fair" value. Fair value accounting has been a part of Generally Accepted Accounting Principles (GAAP) in the United States since the early 1990s, and is now regarded as the "gold standard" in some circles. Failure to use it is viewed as the cause of the Orange County Bankruptcy, even though its use is considered to be one of the reasons for the Enron scandal and the eventual bankruptcy of the company, as well as the closure of the accounting firm Arthur Andersen. Mark-to-market accounting can change values on the balance sheet as market conditions change. In contrast, historical cost accounting, based on the past transactions, is simpler, more stable, and easier to perform, but does not represent current market value. It summarizes pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carry Trade

The carry of an asset is the return obtained from holding it (if positive), or the cost of holding it (if negative) (see also Cost of carry). For instance, commodities are usually negative carry assets, as they incur storage costs or may suffer from depreciation. (Imagine corn or wheat sitting in a silo somewhere, not being sold or eaten.) But in some circumstances, appropriately hedged commodities can be positive carry assets if the forward/futures market is willing to pay sufficient premium for future delivery. This can also refer to a trade with more than one leg, where you earn the spread between borrowing a low carry asset and lending a high carry one; such as gold during financial crisis, due to its safe haven quality. Carry trades are not usually arbitrages: pure arbitrages make money no matter what; carry trades make money ''only if nothing changes'' against the carry's favor. Interest rates carry trade / Maturity transformation For instance, the traditional revenue s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tailgating

Tailgating is the action of a driver driving behind another vehicle while not leaving sufficient distance to stop without causing a collision if the vehicle in front stops suddenly. The safe distance for following another vehicle varies depending on various factors including vehicle speed, weather, visibility and other road conditions. Some jurisdictions may require a minimal gap of a specified distance or time interval. When following heavy vehicles or in less than ideal conditions (e.g. low light or rain), a longer distance is recommended. Causes There can be several reasons for tailgating. Preventing cut ins Tailgating can occur when a vehicle attempts to prevent another vehicle on the right or left from cutting in front of them. The tailgating (or preventing) vehicle will drive as close as possible to another leading vehicle to prevent the side vehicle from cutting in. Like all forms, this practice of tailgating is illegal and attempts to force the side vehicle to slow dow ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

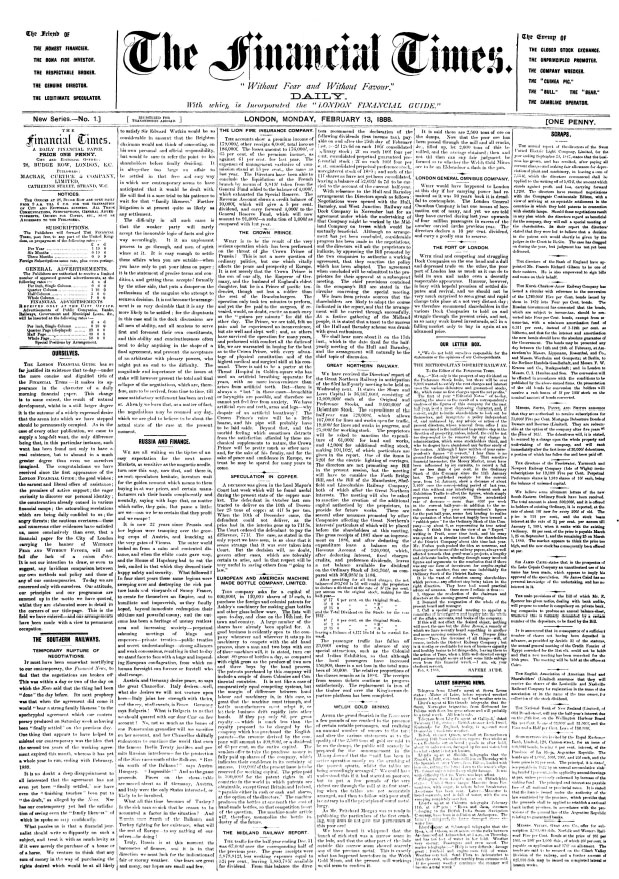

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million ( US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a "Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |