|

Santiago Principles

The Santiago Principles or formally the Sovereign Wealth Funds: Generally Accepted Principles and Practices (GAPP) are designed as a common global set of 24 voluntary guidelines that assign best practices for the operations of Sovereign Wealth Funds (SWFs). They are a consequence of the concern of investors and regulators to establish management principles addressing the inadequate transparency, independence, and governance in the industry. They are guidelines to be followed by sovereign wealth fund management to maintain a stable global financial system, proper controls around risk, regulation and a sound governance structure. As of 2016 30 funds have formally signed up to the Principles and joined the IFSWF representing collectively 80% of assets managed by sovereign funds globally or US$5.5 trillion. The principles are maintained and promoted by the International Forum of Sovereign Wealth Funds (IFSWF) and whose membership have to either have implemented or aspire to implement t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Best Practice

A best practice is a method or technique that has been generally accepted as superior to other known alternatives because it often produces results that are superior to those achieved by other means or because it has become a standard way of doing things, e.g., a standard way of complying with legal or ethical requirements. Best practices are used to maintain quality as an alternative to mandatory legislated standards and can be based on self-assessment or benchmarking. Best practice is a feature of accredited management standards such as ISO 9000 and ISO 14001. Some consulting firms specialize in the area of best practice and offer ready-made templates to standardize business process documentation. Sometimes a best practice is not applicable or is inappropriate for a particular organization's needs. A key strategic talent required when applying best practice to organizations is the ability to balance the unique qualities of an organization with the practices that it has in common ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. The international standard definition of risk for common understanding in different applications is “effect of uncertainty on objectives”. The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas (business, economics, environment, finance, information technology, health, insurance, safety, security etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and generic guidelines on managing risks faced by organizations. Definitions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sovereign Wealth Funds

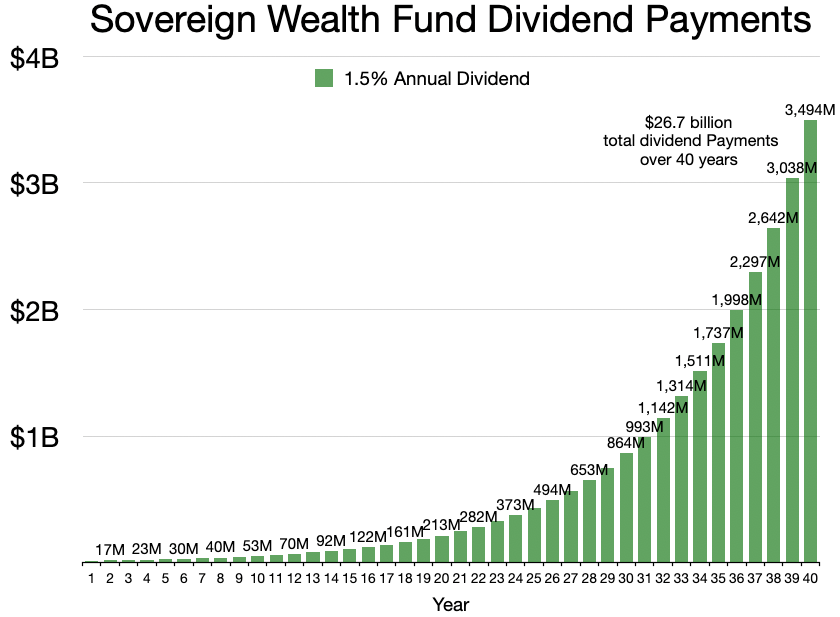

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank. Some sovereign wealth funds may be held by a central bank, which accumulates the funds in the course of its management of a nation's banking system; this type of fund is usually of major economic and fiscal importance. Other sovereign wealth funds are simply the state savings that are invested by various entities for the purposes of investment return, and that may not have a significant role in fiscal management. The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and In ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standards Organization

A standards organization, standards body, standards developing organization (SDO), or standards setting organization (SSO) is an organization whose primary function is developing, coordinating, promulgating, revising, amending, reissuing, interpreting, or otherwise contributing to the usefulness of technical standards to those who employ them. Such an organization works to create uniformity across producers, consumers, government agencies, and other relevant parties regarding terminology, product specifications (e.g. size, including units of measure), protocols, and more. Its goals could include ensuring that Company A's external hard drive works on Company B's computer, an individual's blood pressure measures the same with Company C's sphygmomanometer as it does with Company D's, or that all shirts that should not be ironed have the same icon (a clothes iron crossed out with an X) on the label. Most standards are voluntary in the sense that they are offered for adoption by people ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Standard

international standard is a technical standard developed by one or more international standards organizations. International standards are available for consideration and use worldwide. The most prominent such organization is the International Organization for Standardization (ISO). Other prominent international standards organizations including the International Telecommunication Union (ITU) and the International Electrotechnical Commission (IEC). Together, these three organizations have formed the World Standards Cooperation alliance. Purpose International standards may be used either by direct application or by a process of modifying an international standard to suit local conditions. Adopting international standards results in creating national standards that are equivalent, or substantially the same as international standards in technical content, but may have (i) editorial differences as to appearance, use of symbols and measurement units, substitution of a point for a com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accountability

Accountability, in terms of ethics and governance, is equated with answerability, blameworthiness, liability, and the expectation of account-giving. As in an aspect of governance, it has been central to discussions related to problems in the public sector, nonprofit and private (corporate) and individual contexts. In leadership roles, accountability is the acknowledgment and assumption of responsibility for actions, products, decisions, and policies including the administration, governance, and implementation within the scope of the role or employment position and encompassing the obligation to report, explain and be answerable for resulting consequences. In governance, accountability has expanded beyond the basic definition of "being called to account for one's actions". It is frequently described as an account giving relationship between individuals, e.g. "A is accountable to B when A is obliged to inform B about A's (past or future) actions and decisions, to justify them, and t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Risk

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial loss and uncertainty about its extent. A science has evolved around managing market and financial risk under the general title of modern portfolio theory initiated by Dr. Harry Markowitz in 1952 with his article, "Portfolio Selection". In modern portfolio theory, the variance (or standard deviation) of a portfolio is used as the definition of risk. Types According to Bender and Panz (2021), financial risks can be sorted into five different categories. In their study, they apply an algorithm-based framework and identify 193 single financial risk types, which are sorted into the five categories market risk, liquidity risk, credit risk, business risk and investment risk. Market risk The four standard market risk factors are equity ri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation

A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and recognized as such in law for certain purposes. Early incorporated entities were established by charter (i.e. by an ''ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: by whether they can issue stock, or by whether they are formed to make a profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this article) or '' sole'' (a legal entity consisting of a single incorporated office occupied by a single natural person). One of the most att ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sovereign Wealth Fund

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank. Some sovereign wealth funds may be held by a central bank, which accumulates the funds in the course of its management of a nation's banking system; this type of fund is usually of major economic and fiscal importance. Other sovereign wealth funds are simply the state savings that are invested by various entities for the purposes of investment return, and that may not have a significant role in fiscal management. The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Standard

international standard is a technical standard developed by one or more international standards organizations. International standards are available for consideration and use worldwide. The most prominent such organization is the International Organization for Standardization (ISO). Other prominent international standards organizations including the International Telecommunication Union (ITU) and the International Electrotechnical Commission (IEC). Together, these three organizations have formed the World Standards Cooperation alliance. Purpose International standards may be used either by direct application or by a process of modifying an international standard to suit local conditions. Adopting international standards results in creating national standards that are equivalent, or substantially the same as international standards in technical content, but may have (i) editorial differences as to appearance, use of symbols and measurement units, substitution of a point for a com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |