|

Samba Effect

The samba effect is a nick name for the financial crisis in Brazil in 1999 where there was a 35% drop in the value of the Brazilian real. The effect was caused by the 1997 Asian financial crisis, which led Brazil to increase interest rates and to institute spending cuts and tax increases in an attempt to maintain the value of its currency."Bearing the Burden: The Impact of Global Financial Crisis on Workers and Alternative Agendas for the IMF and Other Institutions" Institute for Policy Studies, April 2000. These measures failed to produce the intended effect, and the |

Financial Crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types Banking crisis When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brazilian Real

The Brazilian real (plural, pl. '; currency symbol, sign: R$; ISO 4217, code: BRL) is the official currency of Brazil. It is subdivided into 100 centavos. The Central Bank of Brazil is the central bank and the issuing authority. The real replaced the Brazilian cruzeiro real, cruzeiro real in 1994. As of April 2019, the real was the twentieth most traded currency. History Currencies in use before the current real include: * The ''Portuguese real'' from the 16th to 18th centuries, with 1,000 ''réis'' called the ''milréis''. * The ''Brazilian real (old), old Brazilian real'' from 1747 to 1942, with 1,000 ''réis'' also called the ''milréis''. * The ''Brazilian cruzeiro (1942–1967), first cruzeiro'' from 1942 to 1967, at 1 cruzeiro = 1 ''milréis'' or 1,000 ''réis''. * The ''Brazilian cruzeiro novo, cruzeiro novo'' from 1967 to 1970, at 1 cruzeiro novo = 1,000 first cruzeiros. From 1970 it was simply called the ''Brazilian cruzeiro (1967-1986), (second) cruzeiro'' and was u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1997 Asian Financial Crisis

The Asian financial crisis was a period of financial crisis that gripped much of East Asia and Southeast Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid and worries of a meltdown subsided. The crisis started in Thailand (known in Thailand as the ''Tom Yam Kung crisis''; th, วิกฤตต้มยำกุ้ง) on 2 July, with the financial collapse of the Thai baht after the Thai government was forced to float the baht due to lack of foreign currency to support its currency peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, most of Southeast Asia and later South Korea and Japan saw slumping currencies, devalued stock markets and other asset prices, and a precipitous rise in private debt. South Korea, Indonesia and Thailand were ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brazil

Brazil ( pt, Brasil; ), officially the Federative Republic of Brazil (Portuguese: ), is the largest country in both South America and Latin America. At and with over 217 million people, Brazil is the world's fifth-largest country by area and the seventh most populous. Its capital is Brasília, and its most populous city is São Paulo. The federation is composed of the union of the 26 States of Brazil, states and the Federal District (Brazil), Federal District. It is the largest country to have Portuguese language, Portuguese as an List of territorial entities where Portuguese is an official language, official language and the only one in the Americas; one of the most Multiculturalism, multicultural and ethnically diverse nations, due to over a century of mass Immigration to Brazil, immigration from around the world; and the most populous Catholic Church by country, Roman Catholic-majority country. Bounded by the Atlantic Ocean on the east, Brazil has a Coastline of Brazi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rates

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brazilian Government

The politics of Brazil take place in a framework of a federal presidential representative democratic republic, whereby the President is both head of state and head of government, and of a multi-party system. The political and administrative organization of Brazil comprises the federal government, the 26 states and a federal district, and the municipalities. The federal government exercises control over the central government and is divided into three independent branches: executive, legislative and judicial. Executive power is exercised by the President, advised by a cabinet. Legislative power is vested upon the National Congress, a two-chamber legislature comprising the Federal Senate and the Chamber of Deputies. Judicial power is exercised by the judiciary, consisting of the Supreme Federal Court, the Superior Court of Justice and other Superior Courts, the National Justice Council and the Regional Federal Courts. The states are autonomous sub-national entities with the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Floating Exchange Rate

In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange market events. A currency that uses a floating exchange rate is known as a ''floating currency'', in contrast to a ''fixed currency'', the value of which is instead specified in terms of material goods, another currency, or a set of currencies (the idea of the last being to reduce currency fluctuations). In the modern world, most of the world's currencies are floating, and include the most widely traded currencies: the United States dollar, the euro, the Swiss franc, the Indian rupee, the pound sterling, the Japanese yen, and the Australian dollar. However, even with floating currencies, central banks often participate in markets to attempt to influence the value of floating exchange rates. The Canadian dollar most closely resembles a pure f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Dollar

The United States dollar (symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color. The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank. The U.S. dollar was originally defined under a bimetallic standard of (0.7735 troy ounces) fine silver or, from 1837, fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, its equi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South America

South America is a continent entirely in the Western Hemisphere and mostly in the Southern Hemisphere, with a relatively small portion in the Northern Hemisphere at the northern tip of the continent. It can also be described as the southern subregion of a single continent called America. South America is bordered on the west by the Pacific Ocean and on the north and east by the Atlantic Ocean; North America and the Caribbean Sea lie to the northwest. The continent generally includes twelve sovereign states: Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Guyana, Paraguay, Peru, Suriname, Uruguay, and Venezuela; two dependent territories: the Falkland Islands and South Georgia and the South Sandwich Islands; and one internal territory: French Guiana. In addition, the ABC islands of the Kingdom of the Netherlands, Ascension Island (dependency of Saint Helena, Ascension and Tristan da Cunha, a British Overseas Territory), Bouvet Island ( dependency of Norway), Pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Austerity

Austerity is a set of political-economic policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both. There are three primary types of austerity measures: higher taxes to fund spending, raising taxes while cutting spending, and lower taxes and lower government spending. Austerity measures are often used by governments that find it difficult to borrow or meet their existing obligations to pay back loans. The measures are meant to reduce the budget deficit by bringing government revenues closer to expenditures. Proponents of these measures state that this reduces the amount of borrowing required and may also demonstrate a government's fiscal discipline to creditors and credit rating agencies and make borrowing easier and cheaper as a result. In most macroeconomic models, austerity policies which reduce government spending lead to increased unemployment in the short term. These reductions in employment usually occur di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world." Formed in 1944, started on 27 December 1945, at the Bretton Woods Conference primarily by the ideas of Harry Dexter White and John Maynard Keynes, it came into formal existence in 1945 with 29 member countries and the goal of reconstructing the international monetary system. It now plays a central role in the management of balance of payments difficulties and international financial crises. Countries contribute funds to a pool through a quota system from which countries experiencing balance of payments problems can borrow money. , the fund had XDR 477 billion (a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

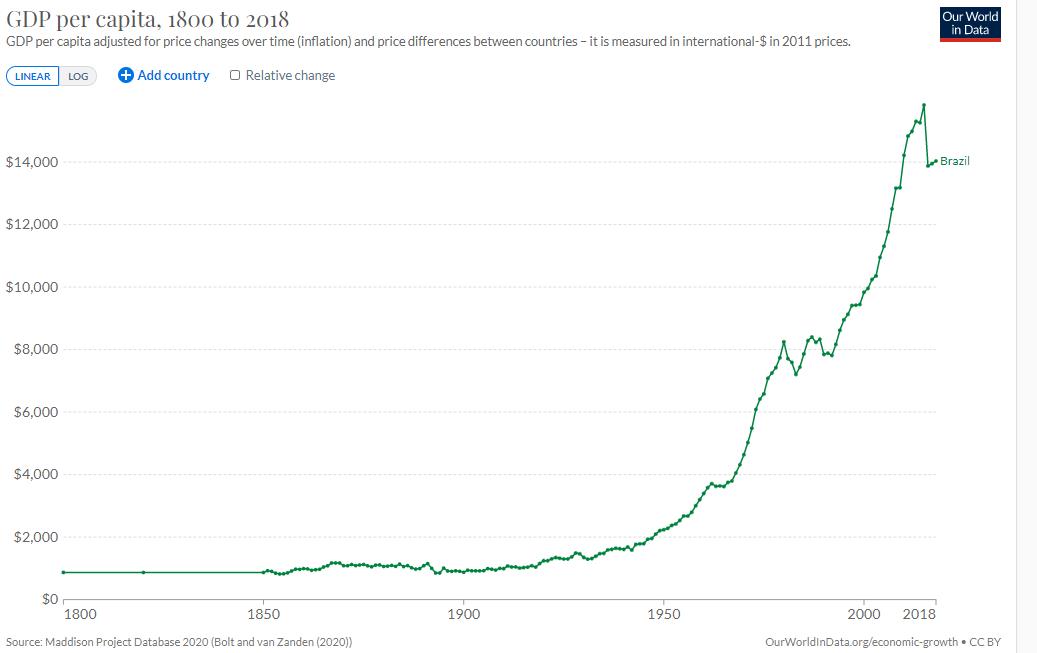

Economic History Of Brazil

The economic history of Brazil covers various economic events and traces the changes in the Brazilian economy over the course of the history of Brazil. Portugal, which first colonized the area in the 16th century, enforced a colonial pact with Brazil, an imperial mercantile policy, which drove development for the subsequent three centuries.Charles C. Mueller and Werner Baer. "The economy". In . Independence was achieved in 1822. Slavery was fully abolished in 1888. Important structural transformations began in the 1930s, when important steps were taken to change Brazil into a modern, industrialized economy. A socioeconomic transformation took place rapidly after World War II. In the 1940s, only 31.3% of Brazil's 41.2 million inhabitants resided in towns and cities; by 1991, of the country's 146.9 million inhabitants 75.5% lived in cities, and Brazil had two of the world's largest metropolitan centers: São Paulo and Rio de Janeiro. The share of the primary sector in th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |