|

Suspicious Activity Report (banking)

In financial regulation, a Suspicious Activity Report (SAR) or Suspicious Transaction Report (STR) is a report made by a financial institution about suspicious or potentially suspicious activity. The criteria to decide when a report must be made varies from country to country, but generally is any financial transaction that does not make sense to the financial institution; is unusual for that particular client; or appears to be done only for the purpose of hiding or obfuscating another, separate transaction. The report is filed with that country's financial crime enforcement agency, which is typically a specialist agency designed to collect and analyse transactions and then report these to relevant law enforcement. Front line staff in the financial institution have the responsibility to identify transactions that may be suspicious and these are reported to a designated person that is responsible for reporting the suspicious transaction. This means that the front line staff can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Regulation

Financial regulation is a form of regulation or supervision, which subjects financial institutions to certain requirements, restrictions and guidelines, aiming to maintain the stability and integrity of the financial system. This may be handled by either a government or non-government organization. Financial regulation has also influenced the structure of banking sectors by increasing the variety of financial products available. Financial regulation forms one of three legal categories which constitutes the content of financial law, the other two being market practices and case law. History In the early modern period, the Dutch were the pioneers in financial regulation. The first recorded ban (regulation) on short selling was enacted by the Dutch authorities as early as 1610. Aims of regulation The objectives of financial regulators are usually: * market confidence – to maintain confidence in the financial system * financial stability – contributing to the protection and e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Union

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit organization, nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provision of Credit (finance), credit, and other financial services. In several African countries, credit unions are commonly referred to as SACCOs (Savings and Credit Co-Operative Societies). Worldwide, credit union systems vary significantly in their total assets and average institution asset size, ranging from volunteer operations with a handful of members to institutions with hundreds of thousands of members and assets worth billions of US dollars. In 2018, the number of members in credit unions worldwide was 274 million, with nearly 40 million members having been added since 2016. Leading up to the financial crisis of 2007–2008, commercial banks engaged in approximately five times more subprime lending relative t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jewelry

Jewellery ( UK) or jewelry (U.S.) consists of decorative items worn for personal adornment, such as brooches, rings, necklaces, earrings, pendants, bracelets, and cufflinks. Jewellery may be attached to the body or the clothes. From a western perspective, the term is restricted to durable ornaments, excluding flowers for example. For many centuries metal such as gold often combined with gemstones, has been the normal material for jewellery, but other materials such as glass, shells and other plant materials may be used. Jewellery is one of the oldest types of archaeological artefact – with 100,000-year-old beads made from ''Nassarius'' shells thought to be the oldest known jewellery.Study reveals 'oldest jewellery' , '' |

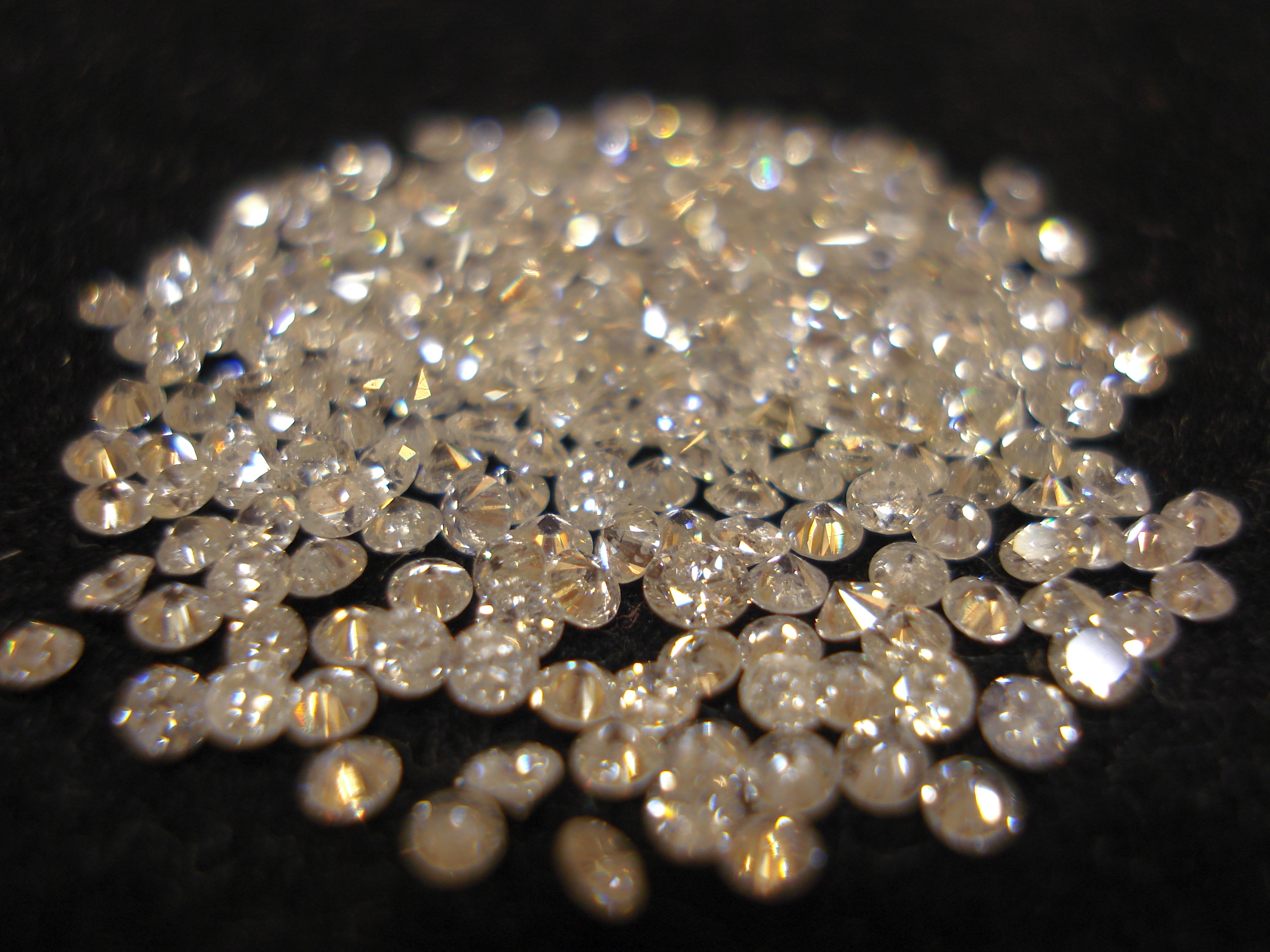

Gemstone

A gemstone (also called a fine gem, jewel, precious stone, or semiprecious stone) is a piece of mineral crystal which, in cut and polished form, is used to make jewelry or other adornments. However, certain rocks (such as lapis lazuli, opal, and obsidian) and occasionally organic materials that are not minerals (such as amber, jet, and pearl) are also used for jewelry and are therefore often considered to be gemstones as well. Most gemstones are hard, but some soft minerals are used in jewelry because of their luster or other physical properties that have aesthetic value. Rarity and notoriety are other characteristics that lend value to gemstones. Apart from jewelry, from earliest antiquity engraved gems and hardstone carvings, such as cups, were major luxury art forms. A gem expert is a gemologist, a gem maker is called a lapidarist or gemcutter; a diamond cutter is called a diamantaire. Characteristics and classification The traditional classification in the West, wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Precious Metal

Precious metals are rare, naturally occurring metallic chemical elements of high economic value. Chemically, the precious metals tend to be less reactive than most elements (see noble metal). They are usually ductile and have a high lustre. Historically, precious metals were important as currency but are now regarded mainly as investment and industrial raw materials. Gold, silver, platinum, and palladium each have an ISO 4217 currency code. The best known precious metals are the coinage metals, which are gold and silver. Although both have industrial uses, they are better known for their uses in art, jewelry, and coinage. Other precious metals include the platinum group metals: ruthenium, rhodium, palladium, osmium, iridium, and platinum, of which platinum is the most widely traded. The demand for precious metals is driven not only by their practical use but also by their role as investments and a store of value. Historically, precious metals have commanded much higher pri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Card Club

A cardroom or card room is a gaming establishment that exclusively offers card games for play by the public. The term poker room is used to describe a dedicated room in casinos that is dedicated to playing poker and in function is similar to a card room. Such rooms typically do not offer slot machines or video poker, or other table games such as craps or roulette as found in casinos. However, a casino will often use the term "cardroom" or "poker room" (usually the latter) to refer to a separate room that offers card games where players typically compete against each other, instead of against "the house". Overview In the United States, stand-alone cardrooms are typically the result of local or state laws and regulations, which often prohibit full-fledged casino gambling. This was typically the case in California until the advent of casino gambling offered by Native American tribes in the 1990s, though card rooms continue to flourish and even expand there. Since games played in c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Casino

A casino is a facility for certain types of gambling. Casinos are often built near or combined with hotels, resorts, restaurants, retail shopping, cruise ships, and other tourist attractions. Some casinos are also known for hosting live entertainment, such as stand-up comedy, concerts, and sports. and usage ''Casino'' is of Italian origin; the root means a house. The term ''casino'' may mean a small country villa, summerhouse, or social club. During the 19th century, ''casino'' came to include other public buildings where pleasurable activities took place; such edifices were usually built on the grounds of a larger Italian villa or palazzo, and were used to host civic town functions, including dancing, gambling, music listening, and sports. Examples in Italy include Villa Farnese and Villa Giulia, and in the US the Newport Casino in Newport, Rhode Island. In modern-day Italian, a is a brothel (also called , literally "closed house"), a mess (confusing situation), or a noisy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Order

A money order is a directive to pay a pre-specified amount of money from prepaid funds, making it a more trusted method of payment than a cheque. History The money order system was established by a private firm in Great Britain in 1792 and was expensive and not very successful. Around 1836 it was sold to another private firm which lowered the fees, significantly increasing the popularity and usage of the system. The Post Office noted the success and profitability, and it took over the system in 1838. Fees were further reduced and usage increased further, making the money order system reasonably profitable. The only draw-back was the need to send an advance to the paying post office before payment could be tendered to the recipient of the order. This drawback was likely the primary incentive for establishment of the Postal Order System on 1 January 1881. Usage A money order is purchased for the amount desired. In this way it is similar to a certified cheque. The main difference i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bureau De Change

A bureau de change (plural bureaux de change, both ) (British English) or currency exchange (American English) is a business where people can exchange one currency for another. Nomenclature Although originally French, the term "bureau de change" is widely used throughout Europe and French-speaking Canada, where it is common to find a sign saying "exchange" or "change". Since the adoption of the euro, many exchange offices have started incorporating its logotype prominently on their signage. In the United States and English-speaking Canada the business is described as "currency exchange" and sometimes "money exchange", sometimes with various additions such as "foreign", "desk", "office", "counter", "service", etc.; for example, "foreign currency exchange office". Location A bureau de change is often located at a bank, at a travel agent, airport, main railway station or large stores—namely, anywhere there is likely to be a market for people needing to convert currency. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Services Business

A money services business (MSB) is a legal term used by financial regulators to describe businesses that transmit or convert money. The definition was created to encompass more than just banks which normally provide these services to include non-bank financial institutions. An MSB has specific meanings in different jurisdictions, but generally includes any business that transmits money or representatives of money, provides foreign currency exchange such as Bureaux de change, or cashes cheques or other money related instruments. It is often used in the context of Anti Money Laundering (AML) legislation and rules. Money services businesses are governed by their local regulators and have to adhere with record-keeping requirements to conduct customer due diligence if customers request for an amount of foreign currency that exceeds a certain threshold set to detect money laundering. An MSB often provides an essential financial service to underdeveloped regions with limited or no banki ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |