|

Superior Bancorp

Superior Bancorp was a bank holding company for Superior Bank, headquartered in Birmingham, Alabama. It had 73 Branch (banking), branches in Alabama and Florida. In April 2011, it suffered from bank failure and its assets were acquired by an affiliate of Cadence Bank (1887–2021), Cadence Bank. History The company was founded in 1997. In December 1998, the company became a public company via an initial public offering. On April 15, 2011, Superior Bank suffered from bank failure and its assets were acquired by an affiliate of Cadence Bank (1887–2021), Cadence Bank in a transaction facilitated by the Federal Deposit Insurance Corporation (FDIC). The bank failure cost the FDIC more than $530 million. In 2014, the FDIC sued former executives of the Florida division of the bank, claiming they took “unreasonable financial risks” in making unsafe loans. References {{Reflist, 1 Bank failures in the United States Banks established in 1997 Banks disestablished in 2011 Defunct ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Failure

A bank failure occurs when a bank is unable to meet its obligations to its depositors or other creditors because it has become insolvent or too illiquid to meet its liabilities. A bank usually fails economically when the market value of its assets declines to a value that is less than the market value of its liabilities. The insolvent bank either borrows from other solvent banks or sells its assets at a lower price than its market value to generate liquid money to pay its depositors on demand. The inability of the solvent banks to lend liquid money to the insolvent bank creates a bank panic among the depositors as more depositors try to take out cash deposits from the bank. As such, the bank is unable to fulfill the demands of all of its depositors on time. A bank may be taken over by the regulating government agency if its shareholders' equity are below the regulatory minimum. The failure of a bank is generally considered to be of more importance than the failure of other types of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defunct Banks Of The United States

{{Disambiguation ...

Defunct (no longer in use or active) may refer to: * ''Defunct'' (video game), 2014 * Zombie process or defunct process, in Unix-like operating systems See also * * :Former entities * End-of-life product * Obsolescence Obsolescence is the state of being which occurs when an object, service, or practice is no longer maintained or required even though it may still be in good working order. It usually happens when something that is more efficient or less risky r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Disestablished In 2011

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1997

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Failures In The United States

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sarasota Herald-Tribune

The ''Sarasota Herald-Tribune'' is a daily newspaper, located in Sarasota, Florida, founded in 1925 as the ''Sarasota Herald''. History The newspaper was owned by The New York Times Company from 1982 to 2012. It was then owned by Halifax Media Group from 2012 to 2015, when New Media Investment Group acquired Halifax. The ''Herald-Tribune'' was one of the first newspapers in the nation to have an in-house 24-hour cable news channel. SNN was founded in 1995 along with partner Comcast. SNN was sold to private investors in January 2009. The original former headquarters for the newspaper was added to the National Register of Historic Places and still exists, containing the Sarasota Woman's Exchange and several other small businesses; the 1969 replacement building torn down in 2010 to make room for a new Publix. The new headquarters building was designed by Arquitectonica and won the American Institute of Architect's Award of Excellence. In early 2017, the ''Herald-Tribune'' moved t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. The FDIC is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this was increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc), i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cadence Bank (1887–2021)

Cadence Bank was a US-based bank with 99 branches in Alabama, Florida, Georgia, Mississippi, Tennessee and Texas. The bank was based in Atlanta, with executive and operations headquarters in Birmingham, Alabama. It was the primary subsidiary of Houston, Texas based Cadence Bancorporation, a bank holding company. The bank owned the naming rights to the Cadence Bank Amphitheatre in Atlanta. History Cadence Bank was founded as the First National Bank of Aberdeen, on April 30, 1887. In 1972, it changed its name to the First National Bank of Monroe County in 1972. In March 1974, it merged with Peoples Bank in Starkville, Mississippi, becoming the National Bank of Mississippi in May of that year. In October 1974, it merged with the National Bank of Commerce of Columbus to become the National Bank of Commerce of Mississippi. In 2005, it changed its name to Cadence Bank, N.A. The bank's parent company formed in 2009 as Community Bancorp LLC. In 2010, it secured $ of capital commitments. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Failure

A bank failure occurs when a bank is unable to meet its obligations to its depositors or other creditors because it has become insolvent or too illiquid to meet its liabilities. A bank usually fails economically when the market value of its assets declines to a value that is less than the market value of its liabilities. The insolvent bank either borrows from other solvent banks or sells its assets at a lower price than its market value to generate liquid money to pay its depositors on demand. The inability of the solvent banks to lend liquid money to the insolvent bank creates a bank panic among the depositors as more depositors try to take out cash deposits from the bank. As such, the bank is unable to fulfill the demands of all of its depositors on time. A bank may be taken over by the regulating government agency if its shareholders' equity are below the regulatory minimum. The failure of a bank is generally considered to be of more importance than the failure of other types of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

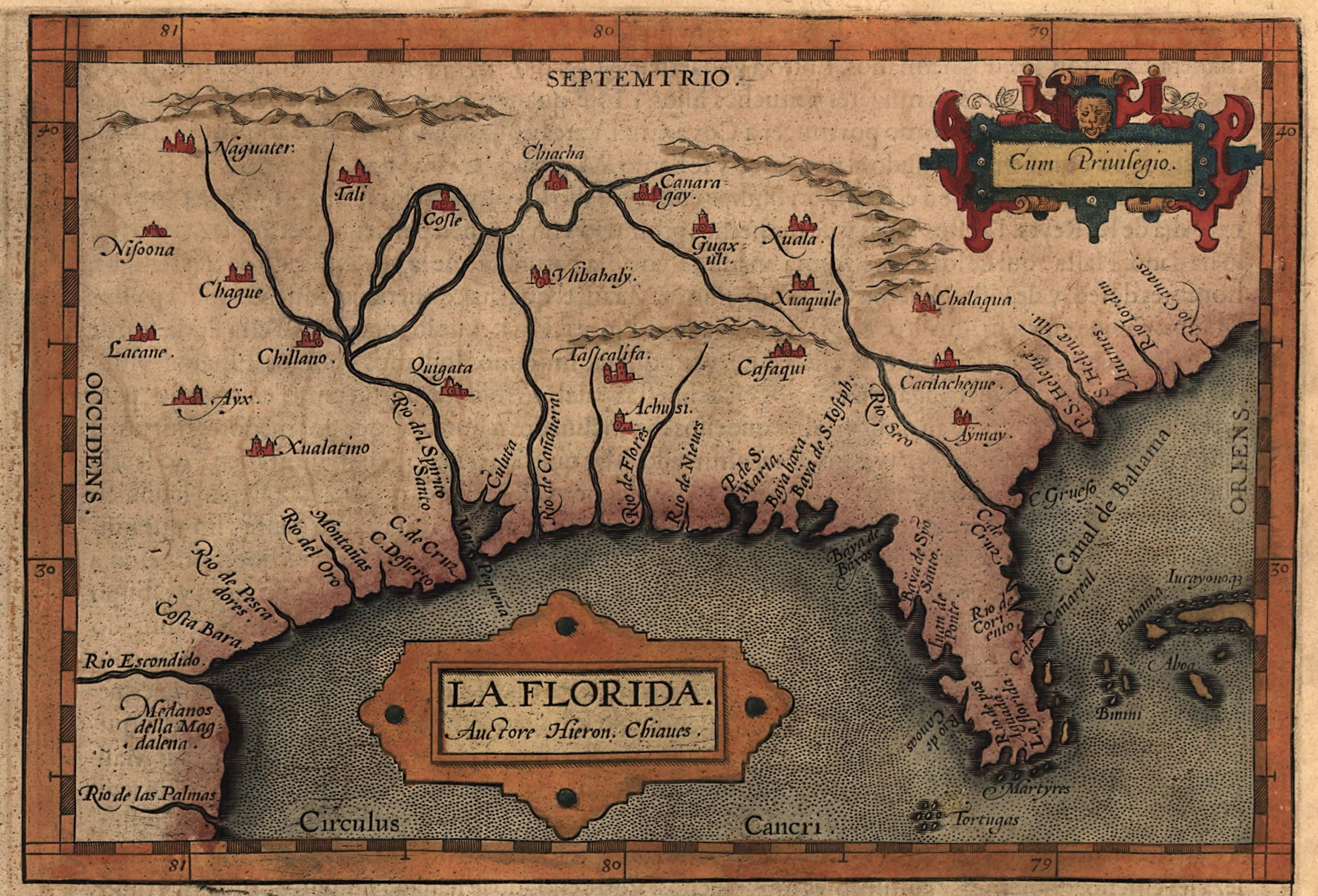

Florida

Florida is a state located in the Southeastern region of the United States. Florida is bordered to the west by the Gulf of Mexico, to the northwest by Alabama, to the north by Georgia, to the east by the Bahamas and Atlantic Ocean, and to the south by the Straits of Florida and Cuba; it is the only state that borders both the Gulf of Mexico and the Atlantic Ocean. Spanning , Florida ranks 22nd in area among the 50 states, and with a population of over 21 million, it is the third-most populous. The state capital is Tallahassee, and the most populous city is Jacksonville. The Miami metropolitan area, with a population of almost 6.2 million, is the most populous urban area in Florida and the ninth-most populous in the United States; other urban conurbations with over one million people are Tampa Bay, Orlando, and Jacksonville. Various Native American groups have inhabited Florida for at least 14,000 years. In 1513, Spanish explorer Juan Ponce de León became the first k ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |