|

Stocks For The Long Run

''Stocks for the Long Run'' is a book on investing by Jeremy Siegel. Its first edition was released in 1994. Its fifth edition was released on January 7, 2014. According to Pablo Galarza of ''Money'', "His 1994 book ''Stocks for the Long Run'' sealed the conventional wisdom that most of us should be in the stock market." James K. Glassman, a financial columnist for The Washington Post, called it one of the 10 best investment books of all time. Overview Siegel is a professor of finance at the Wharton School of the University of Pennsylvania and a contributor to financial publications like ''The Wall Street Journal'', ''Barron's'', ''The New York Times'', and the ''Financial Times''. The book takes a long-term view of the financial markets, starting in 1802, mainly in the United States (but with some comparisons to other financial markets as well). Siegel takes an empirical perspective in answering investing questions. Even though the book has been termed "the buy and hold Bible ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jeremy Siegel

Jeremy James Siegel (born November 14, 1945) is the Russell E. Palmer Professor of Finance at the Wharton School of the University of Pennsylvania in Philadelphia, Pennsylvania. Siegel comments extensively on the economy and financial markets. He appears regularly on networks including CNN, CNBC and NPR, and writes regular columns for Kiplinger's Personal Finance and Yahoo! Finance. Siegel's paradox is named after him. Biography Siegel was born into a family of Jews in Chicago, Illinois, and graduated from Highland Park High School. He majored in mathematics and economics as an undergraduate at Columbia University, graduating in 1967, and obtained a Ph.D. from MIT in 1971. At MIT he studied under Paul Samuelson and Robert Solow, both Nobel Prize winners. He taught at the University of Chicago for four years before moving to the Wharton School of the University of Pennsylvania. As of 2007, Siegel was advisor to WisdomTree Investments, a sponsor of exchange-traded funds; he owne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value At Risk

Value at risk (VaR) is a measure of the risk of loss for investments. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses. For a given portfolio, time horizon, and probability ''p'', the ''p'' VaR can be defined informally as the maximum possible loss during that time after excluding all worse outcomes whose combined probability is at most ''p''. This assumes mark-to-market pricing, and no trading in the portfolio. For example, if a portfolio of stocks has a one-day 95% VaR of $1 million, that means that there is a 0.05 probability that the portfolio will fall in value by more than $1 million over a one-day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day out of 20 days (because of 5% proba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Asset Pricing Model

In finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a well-diversified portfolio. The model takes into account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset. CAPM assumes a particular form of utility functions (in which only first and second moments matter, that is risk is measured by variance, for example a quadratic utility) or alternatively asset returns whose probability distributions are completely described by the first two moments (for example, the normal distribution) and zero transaction costs (necessary for diversification to get rid of all idiosyncratic risk). Under these conditions, CAPM shows that the cost of eq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Finance Topics

The following outline is provided as an overview of and topical guide to finance: Finance – addresses the ways in which individuals and organizations raise and allocate monetary resources over time, taking into account the risks entailed in their projects. Overview The term finance may incorporate any of the following: * The study of money and other assets * The management and control of those assets * Profiling and managing project risks Fundamental financial concepts * Finance ** Arbitrage ** Capital (economics) ** Capital asset pricing model ** Cash flow ** Cash flow matching ** Debt *** Default *** Consumer debt *** Debt consolidation *** Debt settlement *** Credit counseling *** Bankruptcy *** Debt diet *** Debt-snowball method *** Debt of developing countries **Asset types *** Real Estate *** Securities *** Commodities *** Futures *** Cash ** Discounted cash flow ** Financial capital *** Funding ** Entrepreneur *** Entrepreneurship ** Fixed income analys ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Picking

In financial markets, stock valuation is the method of calculating theoretical values of companies and their stocks. The main use of these methods is to predict future market prices, or more generally, potential market prices, and thus to profit from price movement – stocks that are judged '' undervalued'' (with respect to their theoretical value) are bought, while stocks that are judged ''overvalued'' are sold, in the expectation that undervalued stocks will overall rise in value, while overvalued stocks will generally decrease in value. In the view of fundamental analysis, stock valuation based on fundamentals aims to give an estimate of the intrinsic value of a stock, based on predictions of the future cash flows and profitability of the business. Fundamental analysis may be replaced or augmented by market criteria – what the market will pay for the stock, disregarding intrinsic value. These can be combined as "predictions of future cash flows/profits (fundamental)", togeth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Frederick Macaulay

Frederick Robertson Macaulay (August 12, 1882 – March 1970) was a Canadian economist of the Institutionalist School. He is known for introducing the concept of bond duration. Macaulay's contributions also include a mammoth empirical study of the time series behavior of interest rates published in 1938 and a study of short selling on the New York Stock Exchange (Macaulay and Durand, 1951). The term "Macaulay duration" is named after him. Macaulay was born in Montreal to a family influential in Montreal business; his father, Thomas Bassett Macaulay, was a well-known actuary He obtained his bachelor's and master's degrees from the |

Cyclically Adjusted Price-to-earnings Ratio

The cyclically adjusted price-to-earnings ratio, commonly known as CAPE, Shiller P/E, or P/E 10 ratio, is a valuation measure usually applied to the US S&P 500 equity market. It is defined as price divided by the average of ten years of earnings (moving average), adjusted for inflation. As such, it is principally used to assess likely future returns from equities over timescales of 10 to 20 years, with higher than average CAPE values implying lower than average long-term annual average returns. The ratio was invented by American economist Robert Shiller. The ratio is used to gauge whether a stock, or group of stocks, is undervalued or overvalued by comparing its current market price to its inflation-adjusted historical earnings record. It is a variant of the more popular price to earning ratio and is calculated by dividing the current price of a stock by its average inflation-adjusted earnings over the last 10 years. Using average earnings over the last decade helps to smooth ou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irrational Exuberance (book)

''Irrational Exuberance'' is a book by American economist Robert J. Shiller of Yale University, published March 2000. The book examines economic bubbles in the 1990s and early 2000s, and is named after Federal Reserve Chairman Alan Greenspan's famed 1996 comment about "irrational exuberance" warning of such a possible bubble. Overview Published at the height of the dot-com boom, the text put forth several arguments demonstrating how the stock markets were overvalued at the time, and likely to offer poor return on investment based on analysis of the cyclically adjusted price-to-earnings ratio which Shiller co-developed in the late 1980s. By happenstance, the dot-com bubble peaked the month of the book's publication, then collapsed by over 80% in the next two years. The second edition of ''Irrational Exuberance'' was published in 2005 and was updated to cover the housing bubble. Shiller wrote that the real estate bubble might soon burst, and he supported his claim by showing that me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

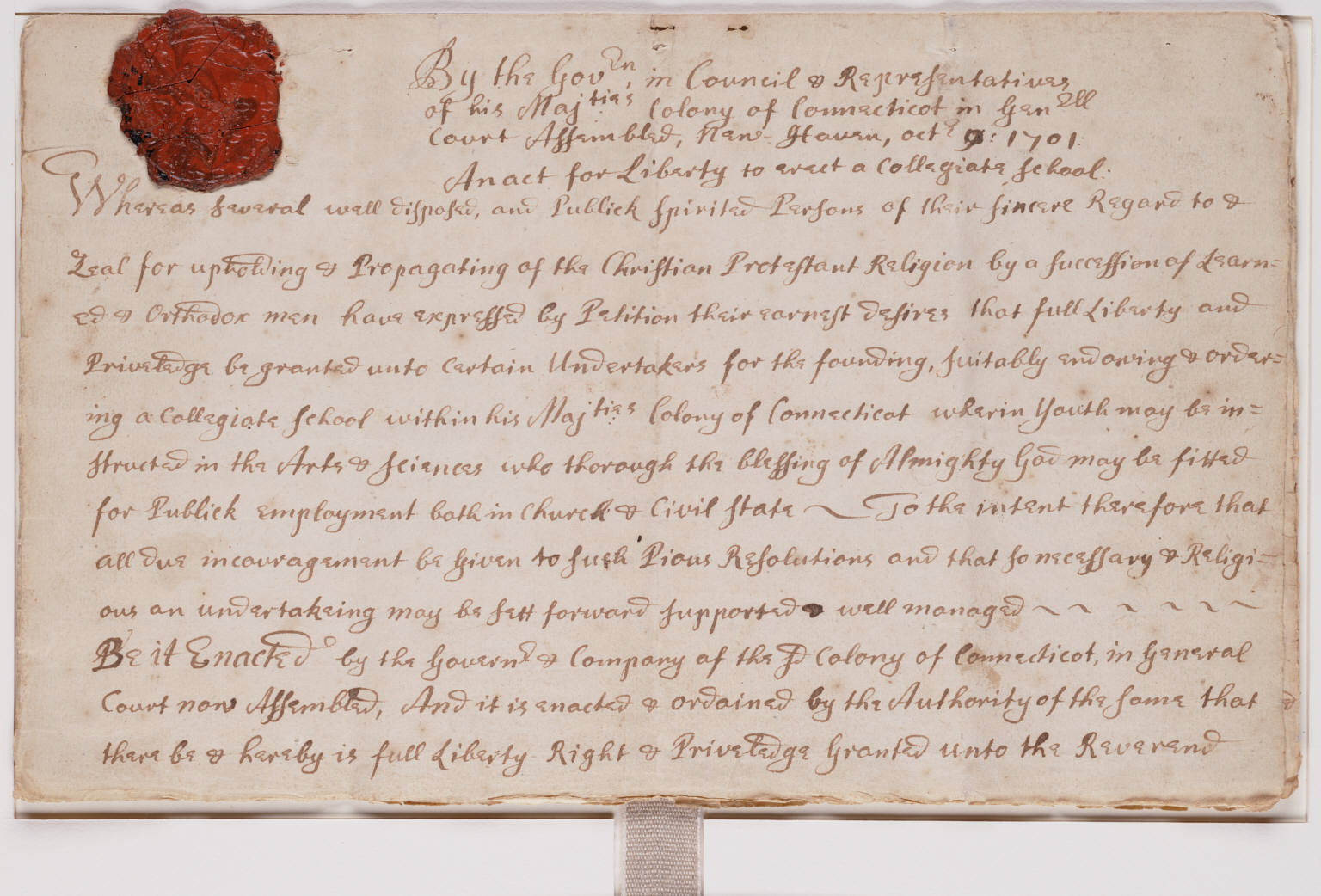

Yale University

Yale University is a private research university in New Haven, Connecticut. Established in 1701 as the Collegiate School, it is the third-oldest institution of higher education in the United States and among the most prestigious in the world. It is a member of the Ivy League. Chartered by the Connecticut Colony, the Collegiate School was established in 1701 by clergy to educate Congregational ministers before moving to New Haven in 1716. Originally restricted to theology and sacred languages, the curriculum began to incorporate humanities and sciences by the time of the American Revolution. In the 19th century, the college expanded into graduate and professional instruction, awarding the first PhD in the United States in 1861 and organizing as a university in 1887. Yale's faculty and student populations grew after 1890 with rapid expansion of the physical campus and scientific research. Yale is organized into fourteen constituent schools: the original undergraduate col ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert Shiller

Robert James Shiller (born March 29, 1946) is an American economist, academic, and author. As of 2019, he serves as a Sterling Professor of Economics at Yale University and is a fellow at the Yale School of Management's International Center for Finance. Shiller has been a research associate of the National Bureau of Economic Research (NBER) since 1980, was vice president of the American Economic Association in 2005, its president-elect for 2016, and president of the Eastern Economic Association for 2006–2007. He is also the co‑founder and chief economist of the investment management firm MacroMarkets LLC. Shiller was ranked by the ''IDEAS'' RePEc publications monitor in 2008 as among the 100 most influential economists of the world; and was still on the list in 2019. Eugene Fama, Lars Peter Hansen and Shiller jointly received the 2013 Nobel Memorial Prize in Economic Sciences, "for their empirical analysis of asset prices".* Background Shiller was born in Detroit, Michi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. The international standard definition of risk for common understanding in different applications is “effect of uncertainty on objectives”. The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas (business, economics, environment, finance, information technology, health, insurance, safety, security etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and generic guidelines on managing risks faced by organizations. Definitions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |