|

Stanbic Bank Uganda Limited

Stanbic Bank Uganda Limited (SBU) is a commercial bank in Uganda and is licensed by the Bank of Uganda, the national banking regulator. Overview SBU is the largest commercial bank in the country, by assets. As of 31 December 2021, the bank's total assets were valued at USh8.713 trillion (US$2.452 billion). At that time shareholders' equity was valued at USh1.483 trillion (US$417.5 million). In June 2018, Fitch Rating Agency gave Stanbic Bank Uganda a AAA rating with a Stable outlook. Group SBU is listed on the Uganda Securities Exchange (USE), where it trades under the symbol SBU. It offers a range of banking products including Internet banking, mobile money, SME lending, and debit and credit cards, among other products. SBU is a subsidiary of Stanbic Africa Holdings Limited, which is in turn owned by Standard Bank Group Limited. History The bank was founded in Uganda as the National Bank of India in 1906. After several name changes, it became Grindlays Bank. In 1991, Standa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc), i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internet Banking

Online banking, also known as internet banking, web banking or home banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution's website. The online banking system will typically connect to or be part of the core banking system operated by a bank to provide customers access to banking services in addition to or in place of traditional branch banking. Online banking significantly reduces the banks' operating cost by reducing reliance on a branch network and offers greater convenience to some customers by lessening the need to visit a branch bank as well as the convenience of being able to perform banking transactions even when branches are closed. Internet banking provides personal and corporate banking services offering features such as viewing account balances, obtaining statements, checking recent transactions, transferring money between accounts, and mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Bank Of South Africa

Standard Bank Group Limited is a major South African bank and financial services group. It is Africa's biggest lender by assets. The company's corporate headquarters, Standard Bank Centre, is situated in Simmonds Street, Johannesburg. History The bank now known as Standard Bank was formed in 1862 as a South African subsidiary of the British overseas bank Standard Bank, under the name The Standard Bank of South Africa. The bank's origins can be traced to 1862, when a group of businessmen led by the prominent South African politician John Paterson formed a bank in London, initially under the name Standard Bank of British South Africa. The bank started operations in 1863 in Port Elizabeth, South Africa, and soon after opening it merged with several other banks including the ''Commercial Bank of Port Elizabeth'', the Colesberg Bank, the British Kaffrarian Bank and the ''Fauresmith Bank''. It was prominent in financing and development of the diamond fields of Kimberley in 1867 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of Uganda

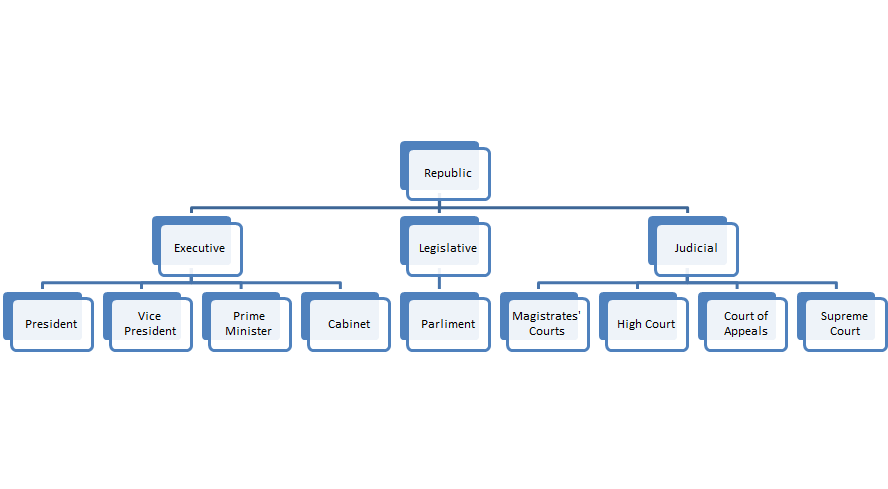

Uganda is a presidential republic in which the President of Uganda is the head of state and the prime minister is the head of government business. There is a multi-party system. Executive power is exercised by the government. Legislative power is given to both the government and the National Assembly. The system is based on a democratic parliamentary system with equal rights for all citizens over 18 years of age. Political culture In a measure ostensibly designed to reduce sectarian violence, political parties were restricted in their activities from 1986. In the non-party "Movement" system instituted by President Yoweri Museveni, political parties continued to exist but could not campaign in elections or field candidates directly (although electoral candidates could belong to political parties). A constitutional referendum canceled this 19-year ban on multi-party politics in July 2005. Presidential elections were held in February 2006. Museveni ran against several candidates, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Uganda Commercial Bank

Uganda Commercial Bank Ltd (UCB/UCBL) was a Ugandan government-owned bank, and the largest financial institution in the country. In 2001 the bank was privatised and merged into Stanbic Bank (Uganda) Limited. History Uganda Commercial Bank (UCB) was established by an Act of Parliament, "The Uganda Commercial Bank Act, 1965". The new bank was to replace the Uganda Credit and Savings Bank. The bank extended banking services to rural areas, and steadily expanded its branch network throughout the 1960s and 1970s. In 1971/72, following the nationalisation of foreign-owned businesses by the government of Idi Amin, the bank's branch network expanded rapidly when it took over most of the branches of foreign-owned banks - leaving Uganda Commercial Bank with nearly a monopoly in banking markets outside Kampala. The fall of Amin's government in 1979 brought a revival of foreign development assistance to Uganda, some of which was channelled through Uganda Commercial Bank, leading to an incre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Regulatory Authority Of Uganda

The Insurance Regulatory Authority of Uganda (IRAU) is a government agency mandated to "ensure the effective administration, supervision, regulation and control of the business of Insurance in Uganda". Location The headquarters of IRAU are located in the Legacy Towers Complex at 5 Kyaddondo Road on Nakasero Hill in the Kampala Central Division. The coordinates of the IRAU headquarters are 0°19'49.0"N, 32°34'41.0"E (Latitude:0.330278; Longitude:32.578056). In March 2018, construction began on Insurance Towers, a 13-floor skyscraper to house the headquarters of IRAU. The building is being built by Roko Construction Company Limited, at a cost of USh28.4 billion (approx. US$7.6 million). Completion is expected in September 2019. History The agency was created in 1997 by an Act of Parliament. This followed the liberalization and privatization policies of Uganda's government, which ended its direct provision of goods and services and the adoption the role of supervisor and regula ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bancassurance

Bancassurance is a relationship between a bank and an insurance company that is aimed at offering insurance products or insurance benefits to the bank's customers. In this partnership, bank staff and tellers become the point of sale and point of contact for the customer. Bank staff are advised and supported by the insurance company through wholesale product information, marketing campaigns and sales training. The bank and the insurance company share the commission. Insurance policies are processed and administered by the insurance company. This partnership arrangement can be profitable for both companies. Banks can earn additional revenue by selling the insurance products, while insurance companies are able to expand their customer base without having to expand their sales forces or pay commissions to insurance agents or brokers. Bancassurance has proved to be an effective distribution channel in a number of countries in Europe, Latin America, Asia, and Australia. Description ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Markets Authority (Uganda)

The Capital Markets Authority of Uganda (CMA) is a semi-autonomous government body responsible for the financial regulation of the capital markets industry in Uganda. Overview The CMA approves the offers of all securities to the public and licenses market professionals like broker-dealers, investment advisers, and fund managers. It licenses stock exchanges but has so far issued licences only to the Uganda Securities Exchange and ALTX East Africa Securities Exchange. Its overall objectives are market regulation and investor protection. Mandate *The development of all aspects of the capital markets with particular emphasis on the removal of impediments to, and the creation of incentives, for longer term investments in productive enterprises. *The creation, maintenance, and regulation, through implementation of a system in which market participants are self-regulatory to the maximum practicable extent, of a market in which securities can be issued and traded in an orderly, fair, an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Adviser

A financial adviser or financial advisor is a professional who provides financial services to clients based on their financial situation. In many countries, financial advisors must complete specific training and be registered with a regulatory body in order to provide advice. In the United States, a financial adviser carries a Series 7 and Series 66 or Series 65 qualification examination. According to the U.S. Financial Industry Regulatory Authority (FINRA), qualification designations and compliance issues must be reported for public view. Details of formal compliance issues can be found on thInvestment Adviser Public Disclosure(IAPD) website and details of non-formal issues can be found oOnesta FINRA specifies the following groups who may use the term ''financial advisor:'' brokers, investment advisers, private bankers, accountants, lawyers, insurance agents and financial planners. Financial advisors need to be able to take the full picture of the client's financial situation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stockbroker

A stockbroker is a regulated broker, broker-dealer, or registered investment adviser (in the United States) who may provide financial advisory and investment management services and execute transactions such as the purchase or sale of stocks and other investments to financial market participants in return for a commission, markup, or fee, which could be based on a flat rate, percentage of assets, or hourly rate. The term also refers to financial companies, offering such services. Examples of professional designations held by individuals in this field, which affects the types of investments they are permitted to sell and the services they provide include chartered financial consultants, certified financial planners or chartered financial analysts (in the United States and UK), chartered strategic wealth professionals (in Canada), chartered financial planners (in the UK). The Financial Industry Regulatory Authority provides an online tool designed to help understand professio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant Bank

A merchant bank is historically a bank dealing in commercial loans and investment. In modern British usage it is the same as an investment bank. Merchant banks were the first modern banks and evolved from medieval merchants who traded in commodities, particularly cloth merchants. Historically, merchant banks' purpose was to facilitate and/or finance production and trade of commodities, hence the name "merchant". Few banks today restrict their activities to such a narrow scope. In modern usage in the United States, the term additionally has taken on a more narrow meaning, and refers to a financial institution providing capital to companies in the form of share ownership instead of loans. A merchant bank also provides advice on corporate matters to the firms in which they invest. History Merchant banks were the first modern banks. They emerged in the Middle Ages from the Italian grain and cloth merchants community and started to develop in the 11th century during the large Eur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)