|

South African Futures Exchange - SAFEX

The South African Futures Exchange (Safex) is the futures exchange subsidiary of JSE Limited, the Johannesburg-based exchange. It consists of two divisions; a financial markets division for trading of equity derivatives and an agricultural markets division (AMD) for trading of agricultural derivatives. Safex was formed in 1990 as an independent exchange and experienced steady growth over the following decade. In 1995 a separate agricultural markets division was formed for trading of agricultural derivatives. The exchange continued to make steady progress despite intensifying competition from international derivative exchanges and over-the-counter alternatives. By 1997 Safex reserves have grown sufficiently to allow a significant reduction in the fees it levies per future or options contract. Consequently, all fees were reduced by 50 per cent that year and in the changes on allocated trades were removed. In 2001 the exchange was acquired by the JSE Securities Exchange, with t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company or daughter company is a company owned or controlled by another company, which is called the parent company or holding company. Two or more subsidiaries that either belong to the same parent company or having a same management being substantially controlled by same entity/group are called sister companies. The subsidiary can be a company (usually with limited liability) and may be a government- or state-owned enterprise. They are a common feature of modern business life, and most multinational corporations organize their operations in this way. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, or Citigroup; as well as more focused companies such as IBM, Xerox, and Microsoft. These, and others, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries. Details Subsidiaries are separate, distinct legal entities f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

JSE Limited

JSE Limited (previously the JSE Securities Exchange and the Johannesburg Stock Exchange) is the largest stock exchange in Africa. It is located in Sandton, Johannesburg, South Africa, after it moved from downtown Johannesburg in 2000. In 2003 the JSE had an estimated 473 listed companies and a market capitalisation of US$182.6 billion (€158 billion), as well as an average monthly traded value of US$6.399 billion (€5.5 billion). As of March 2022, the market capitalisation of the JSE was at US$1.36 trillion. History The discovery of gold on the Witwatersrand in 1886 led to many mining and financial companies opening and a need soon arose for a stock exchange. The first share transactions on the Rand took place in a rustic canvas tent, with trade taking place on Sundays, as this was the only day when mining was not allowed, owing to a strictly enforced regulation prohibiting the entry of African workers to the gold reefs. The ''Johannesburg Exchange & Chambers Company'' was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Exchange

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Over-the-counter (finance)

Over-the-counter (OTC) or off-exchange trading or pink sheet trading is done directly between two parties, without the supervision of an exchange (organized market), exchange. It is contrasted with exchange trading, which occurs via exchanges. A stock exchange has the benefit of facilitating liquidity, providing transparency, and maintaining the current market price. In an OTC trade, the price is not necessarily publicly disclosed. OTC trading, as well as exchange trading, occurs with commodities, financial instruments (including stocks), and derivative (finance), derivatives of such products. Products traded traditional stock exchanges, and other regulated bourse platforms, must be well standardized. This means that exchanged deliverables match a narrow range of quantity, quality, and identity which is defined by the exchange and identical to all transactions of that product. This is necessary for there to be transparency in stock exchange-based equities trading. The OTC ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Board (South Africa)

The Financial Services Board (FSB) was the government of South Africa's financial regulatory agency responsible for the non-banking financial services industry in South Africa from 1990 to 2018. It was an independent body which had a mandate to supervise and regulate the non-bank financial services industry in the public interest. This included the regulation of the biggest stock exchange in Africa the Johannesburg Stock Exchange. From 1 April 2018 the FSB was split into prudential and market conduct regulators. History The FSB was established in 1991 based on recommendations by the Van der Horst Committee to create an independent body to supervise and regulate the non-banking financial services industry. A number of additional acts later expanded and increased the role of the FSB. These included; In September 2004, the Financial Advisory and Intermediary Services Act (FAIS) expanded the mandate of the FSB to include aspects of market conduct in the banking industry. Financial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

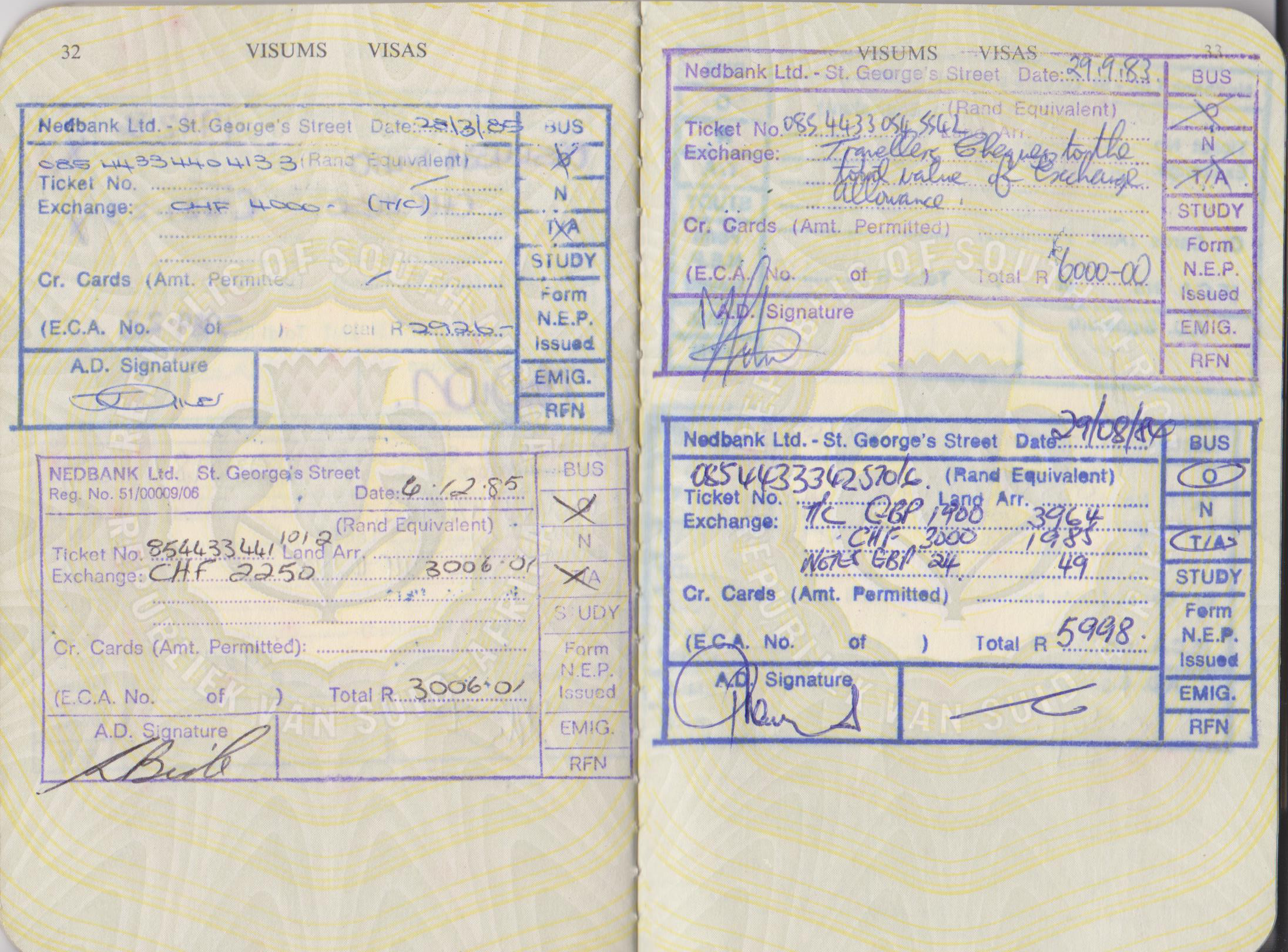

Financial Rand

The South African financial rand was the most visible part of a system of capital controls. Although the financial rand was abolished in March 1995, some capital controls remain in place. These capital controls are locally referred to as "exchange controls", although the system has since 1995 moved towards surveillance — recording and reporting to the authorities of foreign currency transactions — rather than control. Capital controls have been in place in South Africa in various guises on an uninterrupted basis since the outbreak of World War II, when Great Britain and its dominions implemented the Sterling area. Following the 1960 Sharpeville massacre, South Africa experienced significant outflows of foreign exchange on the capital account of the balance of payments and instituted an additional level of capital controls, known as the Blocked Rand system. This had the principal effect of blocking outflows of capital to the other countries in the Sterling Area, notably Brita ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

AltX

AltX is an alternative public equity exchange for small and medium-sized companies in South Africa South Africa, officially the Republic of South Africa (RSA), is the southernmost country in Africa. It is bounded to the south by of coastline that stretch along the South Atlantic and Indian Oceans; to the north by the neighbouring countri ... operated in parallel with and wholly owned by the JSE Securities Exchange. As of July 2008 the shares of just over 80 companies listed on AltX had a combined value of over R30-billion. History The exchange launched in October 2003 as a nursery for the JSE main board, replacing the failed venture capital and development capital boards established as sub-sets of the main board in the 1980s. It was intended to encourage entrepreneurship, especially among South Africa's emerging black middle class. Beige Holdings Limited and Insurance Outsourcing Managers' Holding Limited were the first companies to list, in January 2004. Sapa via SABCnew ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond Exchange Of South Africa

The Bond Exchange of South Africa (BESA) was a South African bond exchange based in Johannesburg. It was acquired by the JSE Limited in 2009, and rebranded as the JSE Debt Market. The entity, now through the JSE Limited, operates and regulates the debt securities and interest rate derivatives markets in South Africa. Prior to its acquisition it was constituted as a public company. History BESA was granted its exchange license in 1996 and over the next twelve years was responsible for the development of the bond market in South Africa. As an exchange, BESA was in the business of providing a range of platforms and services to address the needs of capital market participants, be it issuers, market makers, traders or investors. In December 2007, BESA converting from a mutual association to a public company. This was followed by a rights issue which was concluded in October 2008, injecting fresh capital into the business and introducing new strategic partners to the exchange. With d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Futures Exchanges

This is a list of notable futures exchanges. Those stock exchanges that also offer trading in futures contracts besides trading in securities are listed both here and the list of stock exchanges. Africa Kenya * Nairobi Securities Exchange (NEXT) Nigeria * Nigerian Stock Exchange (NSE) South Africa * South African Futures Exchange (SAFEX) Asia Eastern Asia China * China Financial Futures Exchange (CFFEX) * Dalian Commodity Exchange (DCE) * Shanghai Futures Exchange (SHFE) * Zhengzhou Commodity Exchange (ZCE) * Guangzhou Futures Exchange (GZFE) Hong Kong * Hong Kong Exchanges and Clearing (HKEx) ** Hong Kong Futures Exchange (HKFE) erged** Hong Kong Stock Exchange (HKSE) erged** London Metal Exchange (LME) * Hong Kong Mercantile Exchange (HKMEx, defunct) Japan * Japan Exchange Group (JPX) ** Osaka Exchange (OSE) ** Tokyo Commodity Exchange (TOCOM) * Osaka Dojima Commodity Exchange (ODEX) * Tokyo Financial Exchange (TFX) South Korea * Korea Exchange (KRX), forme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Stock Exchanges

This is a list of major stock exchanges. Those futures exchanges that also offer trading in securities besides trading in futures contracts are listed both here and in the list of futures exchanges. There are sixteen stock exchanges in the world that have a market capitalization of over US$1 trillion each. They are sometimes referred to as the "$1 Trillion Club". These exchanges accounted for 87% of global market capitalization in 2016. Some exchanges do include companies from outside the country where the exchange is located. Major stock exchanges Major stock exchange groups (the current top 21 by market capitalization) of issued shares of listed companies ("MIC" = market identifier code). * Note: "Δ" to UTC, as well as "Open (UTC)" and "Close (UTC)" columns contain valid data only for standard time in a given time zone. During daylight saving time period, the UTC times will be one hour less and Δs one hour more. **Applicable for non-closing auction session shares only. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of African Stock Exchanges

There are 29 exchanges in Africa, representing 38 nations' capital markets. 21 of the 29 stock exchanges in Africa are members of the African Securities Exchanges Association (ASEA). ASEA members are indicated below by an asterisk (*). The Egyptian Exchange (EGX), founded in 1883, is the oldest stock exchange in Africa. One of the oldest bourses (exchanges) on the continent is the Casablanca Stock Exchange of Morocco, founded in 1929 and the JSE Limited in 1887. Today the Casablanca stock exchange, in Morocco is the 3rd largest exchange in Africa, while Johannesburg Stock Exchange is the first, and the Nigerian Stock Exchange (NSE) is the second. There are several notable countries on the continent that do not have a stock exchange. The most notable is Ethiopia, although it does have a commodities exchange in Addis Ababa. In January 2021 a capital market bill was tabled to Ethiopian lawmakers that would establish a stock exchange through a public-private partnership. List Se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South African Institute Of Financial Markets

The following is a list of securities examinations and the organizations that offer them. Africa *The Securities Industry Training Institute East Africa (SITI) was conceptualized in 2008 to standardize and administer market education for the East African region. It is a joint effort involving the region's Central Depository & Settlement Corporation Ltd (CDSC) and the following exchanges: **Uganda Securities Exchange Ltd (USE) **Kenya's Nairobi Securities Exchange Ltd (NSE) **Tanzania's Dar-es-Salaam Stock Exchange Ltd (DSE) **the Rwanda Stock Exchange. *Ethiopia Institute of Financial Studies (EIFS) training program *Ghana Stock Exchange (GSE) Securities Courses * Namibia Stock Exchange (NSX) semi-annual Stock-brokering Exams *Nigerian Stock Exchange (NSE) offers a few certificate programs including: **Module 1: The role and responsibilities of compliance officers in the capital market **Module 2: Compliance risk based monitoring programmes **Module 3: Conduct of business obli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)