|

Singapore Swop Offer Rate (SOR)

Singapore Dollar Swap Offer Rate (SOR) is an implied interest rate, determined by examining the Foreign exchange spot, spot and Forward exchange rate, forward Exchange Rate, foreign exchange rate between the United States dollar, US dollar (USD) and Singapore dollar, Singapore dollar (SGD) and the appropriate US dollar interest rate for the term of the forward. It reflects the cost of borrowing SGD synthetically by borrowing USD and subsequently "swapping" to SGD by using an Foreign exchange swap, FX Swap. It is an alternative to SIBOR, Singapore Interbank Offered Rate (SIBOR) which is a measure of the interbank money market rates. As of December 2018, SOR is measured and published periods of overnight, 1 month, 3 month, and 6 month. Like SIBOR, SOR is set by the Association of Banks in Singapore, and is also publicly available. Below are the rates for 5 December 2018 published bABS Co. Residential property loans in Singapore are no longer pegged to SOR as banks have withdra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Spot

A foreign exchange spot transaction, also known as FX spot, is an agreement between two parties to buy one currency against selling another currency at an agreed price for settlement on the spot date. The exchange rate at which the transaction is done is called the spot exchange rate. As of 2010, the average daily turnover of global FX spot transactions reached nearly US$1.5 trillion, counting 37.4% of all foreign exchange transactions. FX spot transactions increased by 38% to US$2.0 trillion from April 2010 to April 2013. Settlement date The standard settlement timeframe for foreign exchange spot transactions is T+2; i.e., two business days from the trade date. Notable exceptions are USD/CAD, USD/TRY, USD/PHP, USD/ RUB, and offshore USD/ KZT and offshore USD/ COP and USD/ PKR currency pairs, which settle at T+1. Majority of SME FX payments are made through Spot FX, partially because businesses aren't aware of alternatives. Execution methods Common methods of executing a s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward Exchange Rate

The forward exchange rate (also referred to as forward rate or forward price) is the exchange rate at which a bank agrees to exchange one currency for another at a future date when it enters into a forward contract with an investor. Multinational corporations, banks, and other financial institutions enter into forward contracts to take advantage of the forward rate for hedging purposes. The forward exchange rate is determined by a parity relationship among the spot exchange rate and differences in interest rates between two countries, which reflects an economic equilibrium in the foreign exchange market under which arbitrage opportunities are eliminated. When in equilibrium, and when interest rates vary across two countries, the parity condition implies that the forward rate includes a premium or discount reflecting the interest rate differential. Forward exchange rates have important theoretical implications for forecasting future spot exchange rates. Financial economists hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro. The exchange rate is also regarded as the value of one country's currency in relation to another currency. For example, an interbank exchange rate of 114 Japanese yen to the United States dollar means that ¥114 will be exchanged for or that will be exchanged for ¥114. In this case it is said that the price of a dollar in relation to yen is ¥114, or equivalently that the price of a yen in relation to dollars is $1/114. Each country determines the exchange rate regime that will apply to its currency. For example, a currency may be floating, pegged (fixed), or a hybrid. Governments can impose certain limits and controls on exchange rates. Countries can also have a strong or weak currency. There is no agreement in the econ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color. The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank. The U.S. dollar was originally defined under a bimetallic standard of (0.7735 troy ounces) fine silver or, from 1837, fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Singapore Dollar

The Singapore dollar (sign: S$; code: SGD) is the official currency of the Republic of Singapore. It is divided into 100 cents. It is normally abbreviated with the dollar sign $, or S$ to distinguish it from other dollar-denominated currencies. The Monetary Authority of Singapore (MAS) issues the banknotes and coins of the Singapore dollar. As of 2019, the Singapore dollar is the 13th-most traded currency in the world by value. Apart from its use in Singapore, the Singapore dollar is also accepted as customary tender in Brunei according to the Currency Interchangeability Agreement between the Monetary Authority of Singapore and the Autoriti Monetari Brunei Darussalam (Monetary Authority of Brunei Darussalam). Likewise, the Brunei dollar is also customarily accepted in Singapore. History The Spanish-American silver dollar brought over by the Manila galleons was in wide circulation in Asia and the Americas from the 16th to 19th centuries. From 1845 to 1939 the Straits Sett ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Swap

In finance, a foreign exchange swap, forex swap, or FX swap is a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates (normally spot to forward) and may use foreign exchange derivatives. An FX swap allows sums of a certain currency to be used to fund charges designated in another currency without acquiring foreign exchange risk. It permits companies that have funds in different currencies to manage them efficiently. Structure A foreign exchange swap has two legs - a spot transaction and a forward transaction - that are executed simultaneously for the same quantity, and therefore offset each other. Forward foreign exchange transactions occur if both companies have a currency the other needs. It prevents negative foreign exchange risk for either party. Foreign exchange spot transactions are similar to forward foreign exchange transactions in terms of how they are agreed upon; however, they are planned for a specific date ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SIBOR

SIBOR stands for Singapore Interbank Offered Rate '''' 25 July 2012 and is a daily based on the at which s offer to lend ''unsecured'' funds to other banks in the wholesale |

Association Of Banks In Singapore

Association may refer to: *Club (organization), an association of two or more people united by a common interest or goal *Trade association, an organization founded and funded by businesses that operate in a specific industry *Voluntary association, a body formed by individuals to accomplish a purpose, usually as volunteers Association in various fields of study *Association (archaeology), the close relationship between objects or contexts. *Association (astronomy), combined or co-added group of astronomical exposures * Association (chemistry) *Association (ecology), a type of ecological community *Genetic association, when one or more genotypes within a population co-occur * Association (object-oriented programming), defines a relationship between classes of objects *Association (psychology), a connection between two or more concepts in the mind or imagination *Association (statistics), a statistical relationship between two variables *File association, associates a file with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of squ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Industry Of Singapore

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property (" foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

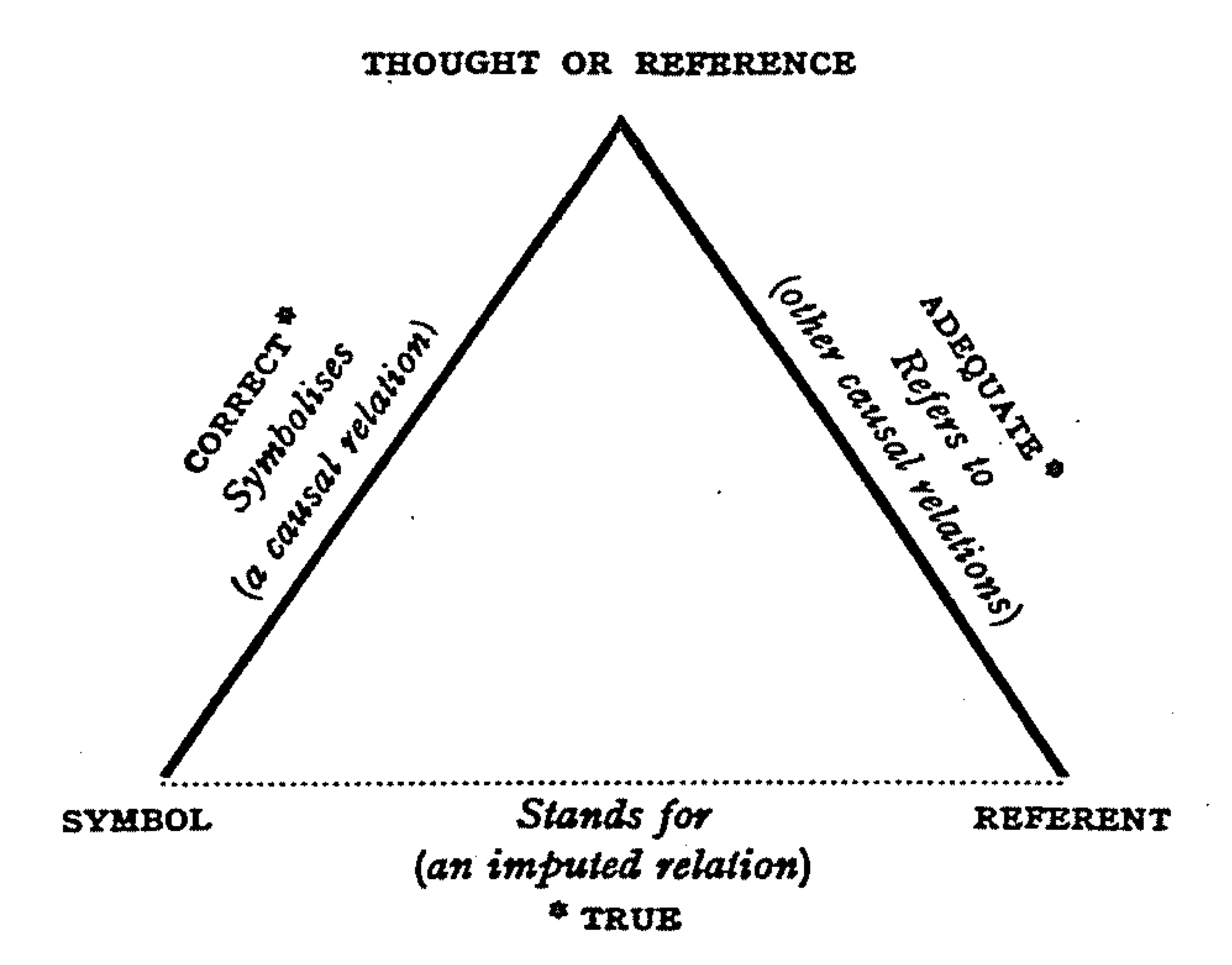

Reference Rates

Reference is a relationship between objects in which one object designates, or acts as a means by which to connect to or link to, another object. The first object in this relation is said to ''refer to'' the second object. It is called a '' name'' for the second object. The second object, the one to which the first object refers, is called the '' referent'' of the first object. A name is usually a phrase or expression, or some other symbolic representation. Its referent may be anything – a material object, a person, an event, an activity, or an abstract concept. References can take on many forms, including: a thought, a sensory perception that is audible (onomatopoeia), visual (text), olfactory, or tactile, emotional state, relationship with other, spacetime coordinate, symbolic or alpha-numeric, a physical object or an energy projection. In some cases, methods are used that intentionally hide the reference from some observers, as in cryptography. References feature in many ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)