|

Seven Bank

is a Japanese bank. It is a subsidiary of Seven & I Holdings Co., Ltd. (parent company of 7-Eleven Japan and Ito Yokado). Until October 11, 2005, it was , taking its initials from Ito Yokado. Conducting its business primarily through the Internet, IY Bank has automatic teller machines in 7-Eleven convenience stores and Ito Yokado general-merchandise stores in Japan, and on April 27, 2005, opened its first branch with live staff. Customers with accounts at certain banks can process transactions at IY terminals at no cost; IY collects a handling fee from customers at other banks. Seven Bank began accepting foreign-issued ATM and credit cards in June 2007. Cards with Visa, Plus, American Express, Discover, JCB, Diners Club or China UnionPay logos on them are all accepted to withdraw yen from the machines. In December 2009, Seven Bank discontinued ATM services for MasterCard, Maestro and Cirrus cards. Seven Bank said that from their perspective, a revision of the terms and conditi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc), i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

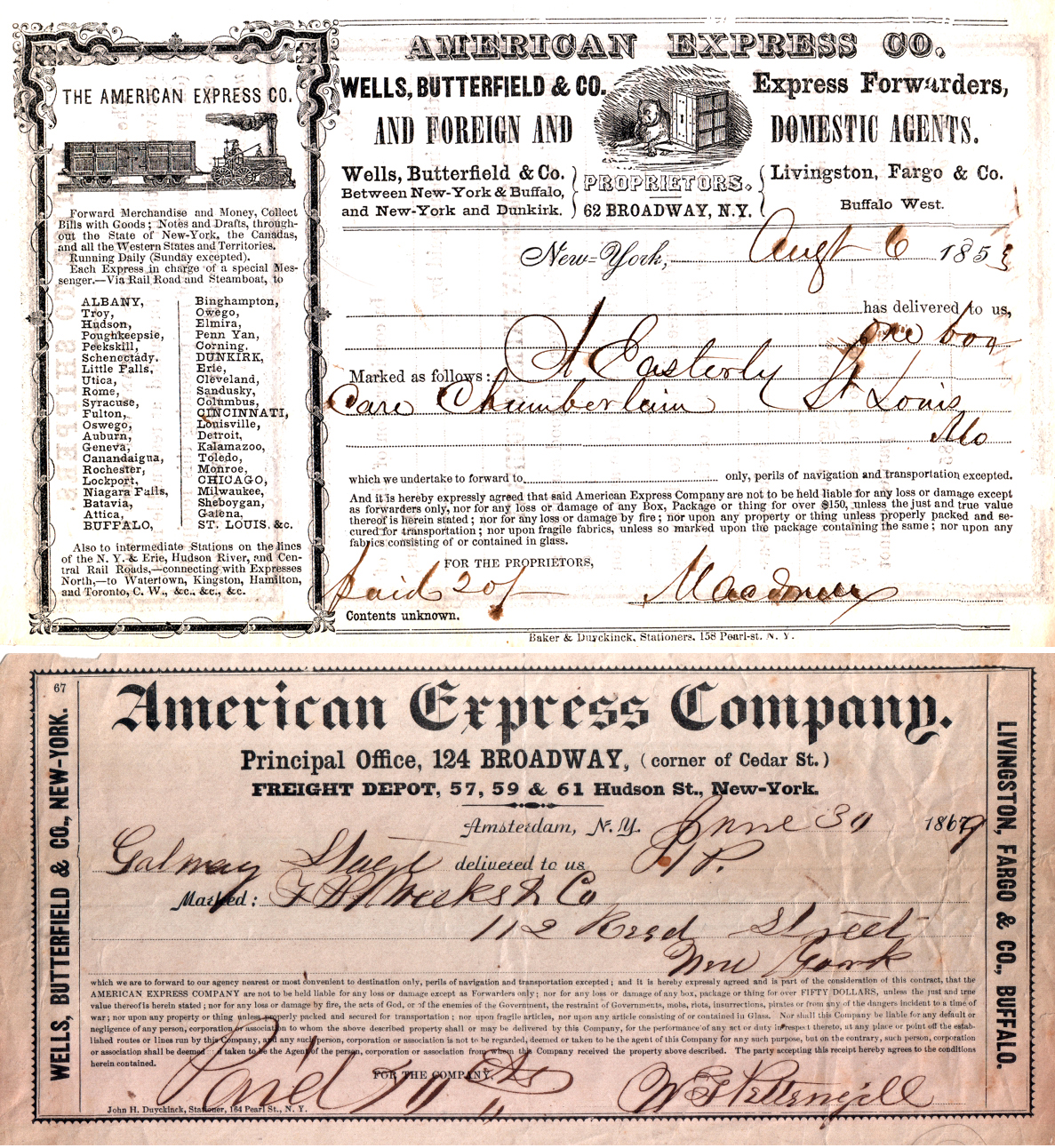

American Express

American Express Company (Amex) is an American multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the company had 121.7million cards in force, includ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 2001

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Seven & I Holdings

is a Japanese diversified retail group headquartered in Nibancho, Tokyo. Seven & I was founded in 1920 as Ito-Yokado, the Japanese chain of general merchandise and department stores. In 1991, Ito-Yokado acquired majority control of 7-Eleven, the American international chain of convenience stores. Seven & I was then established in 2005 as part of a corporate restructuring to serve as the holding company of 7-Eleven, Ito-Yokado, and its other business ventures. It was the fifteenth largest retailer in the world as of 2018. History The Ito-Yokado Japanese chain of grocery and clothing stores was founded in 1920. In the 1970s, Ito-Yokado became a Japanese franchisee of both the 7-Eleven international chain of convenience stores and the Denny's international chain of family restaurants. In 1990, the Southland Corporation, 7-Eleven's American parent company, filed for bankruptcy due to incurring debt, allowing Ito-Yokado to take over 70 percent of Southland in 1991. In 1999, Southlan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Western Union

The Western Union Company is an American multinational financial services company, headquartered in Denver, Colorado. Founded in 1851 as the New York and Mississippi Valley Printing Telegraph Company in Rochester, New York, the company changed its name to the Western Union Telegraph Company in 1856 after merging with several other telegraph companies. The company dominated the American telegraphy industry from the 1860s to the 1980s, pioneering technology such as telex and developing a range of telegraph-related services (including wire money transfer) in addition to its core business of transmitting and delivering telegram messages. After experiencing financial difficulties, Western Union began to move its business away from communications in the 1980s and increasingly focused on its money transfer services. The company ceased its communications operations completely in 2006, at which time The New York Times described it as "the world's largest money-transfer business" and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cirrus (interbank Network)

Mastercard Cirrus is a worldwide interbank network that provides cash to Mastercard cardholders. As a subsidiary of Mastercard Inc., it connects all Mastercard credit, debit and prepaid cards, as well as ATM cards issued by various banks worldwide bearing the Mastercard / Maestro logo. Founded in 1982, prior to its acquisition by Mastercard in 1987, Cirrus System, LLC was owned by Bank of Montreal, BayBanks Inc., First Interstate Bancorp, Mellon Bank, NBD Bancorp Inc. and Norwest Corp. By default, Mastercard, Maestro cards are linked to the Cirrus network, but very often all three logotypes will be shown. Canadian, American and Saudi Arabian ATMs use this network alongside their local networks and many banks have adopted Cirrus as their international interbank network alongside either a local network, the rival Plus ATM network owned by Visa, or both. In countries such as India and Bangladesh Bangladesh (}, ), officially the People's Republic of Bangladesh, is a coun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maestro (debit Card)

Mastercard Maestro is a brand of debit cards and prepaid cards owned by Mastercard that was introduced in 1991. Maestro is accepted at around fifteen million point of sale outlets in 93 countries. Starting July 1, 2023, Mastercard will phase out Maestro across Europe. European banks and other card issuers will be required to replace expired or lost Maestro cards with Debit Mastercard. Functionality Maestro debit cards are obtained from associate banks and are linked to the cardholder's savings account, current account or any of several other types of accounts, while prepaid cards do not require a bank account to operate. Maestro cards can be used at point of sale (POS) and ATMs. Payments are made by swiping cards through the payment terminal, insertion into a chip and PIN device or by a contactless reader. The payment is authorized by the card issuer to ensure that the cardholder has sufficient funds in their account to make the purchase. The cardholder then confirms the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

China UnionPay

UnionPay (), also known as China UnionPay () or by its abbreviation, CUP or UPI internationally, is a Chinese state-owned financial services corporation headquartered in Shanghai, China. It provides bank card services and a major card scheme in mainland China. Founded on 26 March 2002, China UnionPay is an association for China's banking card industry, operating under the approval of the People's Bank of China (PBOC, central bank of China). It is also an electronic funds transfer at point of sale (EFTPOS) network, and the only interbank network in China that links all the automatic teller machine (ATMs) of all banks throughout the country. UnionPay cards can be used in 180 countries and regions around the world. In 2015 the UnionPay overtook Visa and Mastercard in total value of payments made by customers and became the largest card payment processing organization (debit and credit cards combined) in the world surpassing the two. However, only 0.5% of this payment volume wa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diners Club

A diner is a small, inexpensive restaurant found across the United States, as well as in Canada and parts of Western Europe. Diners offer a wide range of foods, mostly American cuisine, a casual atmosphere, and, characteristically, a combination of booths served by a waitstaff and a long sit-down counter with direct service, in the smallest simply by a cook. Many diners have extended hours, and some along highways and areas with significant shift work stay open for 24 hours. Considered quintessentially American, many diners share an archetypal exterior form. Some of the earliest were converted rail cars, retaining their streamlined structure and interior fittings. From the 1920s to the 1940s, diners, by then commonly known as "lunch cars", were usually prefabricated in factories, like modern mobile homes, and delivered on site with only the utilities needing to be connected. As a result, many early diners were typically small and narrow to fit onto a rail car or truck. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japan Credit Bureau

, formerly Japan Credit Bureau, is a credit card company based in Tokyo, Japan. It is accepted at JCB merchants, and has strategic alliances with Discover Network merchants in the United States, UnionPay merchants in China, American Express merchants in Canada, and RuPay merchants in India. History Founded in 1961 as Japan Credit Bureau, JCB established itself in the Japanese credit card market when it purchased Osaka Credit Bureau in 1968. its cards are issued to 130 million customers in 23 countries. JCB also operates a network of membership airport lounges for holders of their Platinum Cards issued outside Japan. Since 1981, JCB has been expanding its business overseas. JCB cards are issued in 24 countries, in most countries JCB is affiliated with financial institutions to license them to issue JCB-branded cards. All international operations are conducted through its 100%-owned subsidiary, JCB International Credit Card Co., Ltd. In the United States, JCB is not a prim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discover Card

Discover is a credit card brand issued primarily in the United States. It was introduced by Sears in 1985. When launched, Discover did not charge an annual fee and offered a higher-than-normal credit limit, features that were disruptive to the existing credit card industry. A subsequent innovation was "Cashback Bonus" on purchases. Most cards with the Discover brand are issued by Discover Bank, formerly the Greenwood Trust Company. Discover transactions are processed through the Discover Network payment network. In 2005, Discover Financial Services acquired Pulse, an electronic funds transfer network, allowing it to market and issue debit and ATM cards. In February 2006, Discover Financial Services announced that it would begin offering Discover debit cards to other financial institutions, made possible by the acquisition of Pulse. Discover is the third largest credit card brand in the U.S. based on the number of cards in circulation, behind Visa and Mastercard, with 57 milli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)