|

Separation Property (finance)

A separation property is a crucial element of modern portfolio theory that gives a portfolio manager the ability to separate the process of satisfying investing clients' assets into two separate parts. The first part is the determination of the "optimum risky portfolio". This portfolio is the same for all clients. In one version, it has the highest Sharpe ratio. See mutual fund separation theorem for a discussion of other possibilities. It is the construction of a universal portfolio that is kept separate from the individual needs of each client. The second part is tailoring the use of that portfolio to the risk-aversive needs of each individual client. This is achieved through simulation of a given risk-return range by allocating the client's total investments partly to that universal portfolio and partly to the risk-free asset. See also * Markowitz model #Choosing the best portfolio - an expansion of the above *Mutual fund separation theorem - relating to the construction of op ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Portfolio Theory

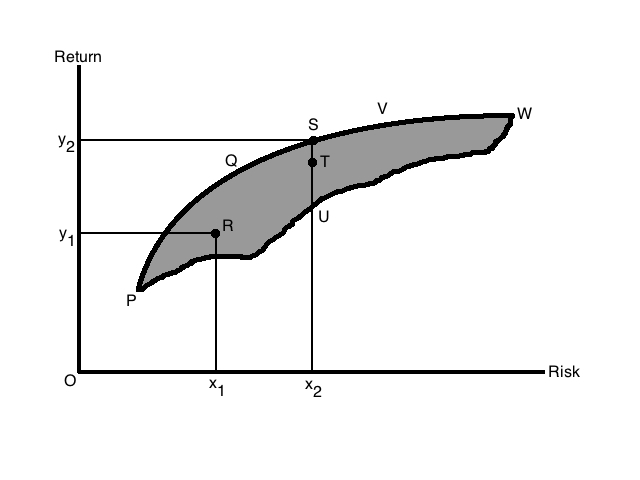

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of Diversification (finance), diversification in investing, the idea that owning different kinds of financial assets is less risky than owning only one type. Its key insight is that an asset's risk and return should not be assessed by itself, but by how it contributes to a portfolio's overall risk and return. The variance of return (or its transformation, the standard deviation) is used as a measure of risk, because it is tractable when assets are combined into portfolios. Often, the historical variance and covariance of returns is used as a proxy for the forward-looking versions of these quantities, but other, more sophisticated methods are available. Economist Harry Markowitz introduced MPT in a 1952 paper, for which he was later awarded a Nobel Memorial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio (finance)

In finance, a portfolio is a collection of investments. Definition The term "portfolio" refers to any combination of financial assets such as stocks, bonds and cash. Portfolios may be held by individual investors or managed by financial professionals, hedge funds, banks and other financial institutions. It is a generally accepted principle that a portfolio is designed according to the investor's risk tolerance, time frame and investment objectives. The monetary value of each asset may influence the risk/reward ratio of the portfolio. When determining asset allocation, the aim is to maximise the expected return and minimise the risk. This is an example of a multi-objective optimization problem: many efficient solutions are available and the preferred solution must be selected by considering a tradeoff between risk and return. In particular, a portfolio A is dominated by another portfolio A' if A' has a greater expected gain and a lesser risk than A. If no portfolio dominates A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

McGraw Hill

McGraw Hill is an American education science company that provides educational content, software, and services for students and educators across various levels—from K-12 to higher education and professional settings. They produce textbooks, digital learning tools, and adaptive technology to enhance learning experiences and outcomes. It is one of the "big three" educational publishers along with Houghton Mifflin Harcourt and Pearson Education. McGraw Hill also publishes reference and trade publications for the medical, business, and engineering professions. Formerly a division of The McGraw Hill Companies (later renamed McGraw Hill Financial, now S&P Global), McGraw Hill Education was divested and acquired by Apollo Global Management in March 2013 for $2.4 billion in cash. McGraw Hill was sold in 2021 to Platinum Equity for $4.5 billion. History McGraw Hill was founded in 1888, when James H. McGraw, co-founder of McGraw Hill, purchased the ''American Journal of Railwa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sharpe Ratio

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) measures the performance of an investment such as a security or portfolio compared to a risk-free asset, after adjusting for its risk. It is defined as the difference between the returns of the investment and the risk-free return, divided by the standard deviation of the investment returns. It represents the additional amount of return that an investor receives per unit of increase in risk. It was named after William F. Sharpe, who developed it in 1966. Definition Since its revision by the original author, William Sharpe, in 1994, the '' ex-ante'' Sharpe ratio is defined as: : S_a = \frac = \frac, where R_a is the asset return, R_b is the risk-free return (such as a U.S. Treasury security). E _a-R_b/math> is the expected value of the excess of the asset return over the benchmark return, and is the standard deviation of the asset excess return. The t-sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund Separation Theorem

In Modern portfolio theory, portfolio theory, a mutual fund separation theorem, mutual fund theorem, or separation theorem is a theorem stating that, under certain conditions, any investor's optimal portfolio can be constructed by holding each of certain mutual funds in appropriate ratios, where the number of mutual funds is smaller than the number of individual assets in the portfolio. Here a mutual fund refers to any specified benchmark portfolio of the available assets. There are two advantages of having a mutual fund theorem. First, if the relevant conditions are met, it may be easier (or lower in transactions costs) for an investor to purchase a smaller number of mutual funds than to purchase a larger number of assets individually. Second, from a theoretical and empirical standpoint, if it can be assumed that the relevant conditions are indeed satisfied, then Capital asset pricing model, implications for the functioning of asset markets can be derived and tested. Portfolio se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Portfolio

Market portfolio is an investment portfolio that theoretically consisting of a weighted sum of every asset in the market, with weights in the proportions that they exist in the market, with the necessary assumption that these assets are infinitely divisible. The concept is related to asset allocation and has been critiqued by some economists. In practice index providers and exchange-traded funds (ETF) providers create proxies of a market portfolio using securities that are available on securities exchanges in proportion of their weighting. Critiques Richard Roll's critique states that this is only a theoretical concept, as to create a market portfolio for investment purposes in practice would necessarily include every single possible available asset, including real estate, precious metals, stamp collections, jewelry, and anything with any worth, as the theoretical market being referred to would be the world market. There is some question of whether what is used for the mar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Markowitz Model

In finance, the Markowitz model ─ put forward by Harry Markowitz in 1952 ─ is a portfolio optimization model; it assists in the selection of the most efficient portfolio by analyzing various possible portfolios of the given securities. Here, by choosing securities that do not 'move' exactly together, the HM model shows investors how to reduce their risk. The HM model is also called mean-variance model due to the fact that it is based on expected returns (mean) and the standard deviation (variance) of the various portfolios. It is foundational to Modern portfolio theory. Assumptions Markowitz made the following assumptions while developing the HM model: # Risk of a portfolio is based on the variability of returns from said portfolio. # An investor is risk averse. # An investor prefers to increase consumption. # The investor's utility function is concave and increasing, due to their risk aversion and consumption preference. # Analysis is based on single period model of invest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund Separation Theorem

In Modern portfolio theory, portfolio theory, a mutual fund separation theorem, mutual fund theorem, or separation theorem is a theorem stating that, under certain conditions, any investor's optimal portfolio can be constructed by holding each of certain mutual funds in appropriate ratios, where the number of mutual funds is smaller than the number of individual assets in the portfolio. Here a mutual fund refers to any specified benchmark portfolio of the available assets. There are two advantages of having a mutual fund theorem. First, if the relevant conditions are met, it may be easier (or lower in transactions costs) for an investor to purchase a smaller number of mutual funds than to purchase a larger number of assets individually. Second, from a theoretical and empirical standpoint, if it can be assumed that the relevant conditions are indeed satisfied, then Capital asset pricing model, implications for the functioning of asset markets can be derived and tested. Portfolio se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Optimal Portfolio

Portfolio optimization is the process of selecting an optimal portfolio (asset distribution), out of a set of considered portfolios, according to some objective. The objective typically maximizes factors such as expected return, and minimizes costs like financial risk, resulting in a multi-objective optimization problem. Factors being considered may range from tangible (such as assets, liabilities, earnings or other fundamentals) to intangible (such as selective divestment). Modern portfolio theory Modern portfolio theory was introduced in a 1952 doctoral thesis by Harry Markowitz, where the Markowitz model was first defined. The model assumes that an investor aims to maximize a portfolio's expected return contingent on a prescribed amount of risk. Portfolios that meet this criterion, i.e., maximize the expected return given a prescribed amount of risk, are known as efficient portfolios. By definition, any other portfolio yielding a higher amount of expected return must also hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fisher Separation Theorem

In Economics, the Fisher separation theorem asserts that the primary objective of a corporation will be the maximization of its present value, regardless of the preferences of its shareholders. The theorem, therefore, separates management's "productive opportunities" from the entrepreneur's "market opportunities". It was proposed by—and is named after—the economist Irving Fisher. The theorem has its "clearest and most famous expositionin the ''Theory of Interest'' (1930); particularly in the "second approximation to the theory of interest"II:VI. {{Ref improve section, date=January 2011 The Fisher separation theorem states that: * the firm's Corporate_finance#The_investment_decision, investment decision is independent of the consumption preferences of the owner; * the investment decision is independent of the financing decision. * the value of a capital project (investment) is independent of the mix of methods – equity, debt, and/or cash – used to finance the project. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value.SeCorporate Finance: First Principles Aswath Damodaran, New York University's Stern School of Business Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding Project#Corporate finance, projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and Current liability, cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |