|

Russell Indexes

Russell indexes are a family of global stock market indices from FTSE Russell that allow investors to track the performance of distinct market segments worldwide. Many investors use mutual funds or exchange-traded funds based on the FTSE Russell Indexes as a way of gaining exposure to certain portions of the U.S. stock market. Additionally, many investment managers use the Russell Indexes as benchmarking, benchmarks to measure their own performance. Russell's index design has led to more assets benchmarked to its U.S. index family than all other U.S. equity indexes combined. The best-known index of the series is the Russell 2000, which tracks US small-cap stocks and is made up of the bottom 2,000 stocks in the Russell 3000 index. History Seattle, Washington-based Russell's index began in 1984 when the firm launched its family of U.S. indices to measure U.S. market segments and hence better track the performance of investment managers. The resulting methodology produced the broad-m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Indices

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance. Two of the primary criteria of an index are that it is ''investable'' and ''transparent'': The methods of its construction are specified. Investors may be able to invest in a stock market index by buying an index fund, which is structured as either a mutual fund or an exchange-traded fund, and "track" an index. The difference between an index fund's performance and the index, if any, is called '' tracking error''. Types of indices by coverage Stock market indices may be classified and segmented by the set of underlying stocks included in the index, sometimes referred to as the "coverage". The underlying stocks are typically grouped together based on their underlying economics or underlying investor demand that the index is seekin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OTC Bulletin Board

The OTC (Over-The-Counter) Bulletin Board or OTCBB was a United States Financial quote, quotation medium operated by the Financial Industry Regulatory Authority (FINRA) for its subscribing members. FINRA closed the OTCBB on November 8, 2021. The board was used for many over-the-counter (finance), over-the-counter (OTC) Stock, equity security (finance), securities that were not listed on the NASDAQ or a national stock exchange, it had shrunk significantly as stock have migrated to the trading facilities of the OTC Markets Group. Broker-dealers who subscribed to the system, which was not electronic, were able to use the OTCBB to enter orders for OTC securities that qualified to be quoted. According to the U.S. Securities and Exchange Commission (SEC), "fraudsters often claim or imply that an OTCBB company is a Nasdaq company to mislead investors into thinking that the company is bigger than it is". FINRA, an "independent, not-for-profit organization authorized by U.S. Congress, Cong ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Russell Microcap Index

The Russell Microcap Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the Russell 2000 Index based on a combination of their market cap and current index membership and it also includes up to the next 1,000 stocks. , the weighted average market capitalization for a company in the index was $535 million; the median market cap was $228 million. The market cap of the largest company in the index was $3.6 billion. The index, which was launched on June 1, 2005, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. Its ticker symbol is ^RUMIC. Records In February 2021, during the everything bubble, a record 14 members of the index exceeded the market capitalization of the smallest member of the S&P 500 Index. Investing The Russell Microcap Index is tracked by the iShares Micro-Cap Exchange-traded fund, ETF (). Top 10 holdings *Mer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Russell Midcap Index

The Russell Midcap Index is a stock market index that measures performance of the 800 smallest companies (approximately 27% of total capitalization) in the Russell 1000 Index. , the stocks of the Russell Midcap Index had a weighted average market capitalization of approximately $22.64 billion, median market capitalization of $9.91 billion, and the market capitalization of the largest company is $54.74 billion. The index, which was launched on November 1, 1991, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. Its ticker symbol is ^RMCC. Investing The Russell Midcap Index is tracked by an ETF, iShares Russell Mid-Cap (). Top 10 holdings As of June 30, 2019 *ServiceNow () *Analog Devices () *Fidelity National Information Services () *Edwards Lifesciences () *Sempra Energy () *Roper Technologies () * Worldpay, Inc. () *Fiserv () *Ross Stores () *Dollar General () See also *S&P 400 *Russell Investments *Russell 2000 Index *Russell 1000 Index The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Russell Top 50 Index

The Russell Top 50 Index also known as the Russell Top 50 Mega Cap is a stock market index that measures the performance of the largest companies in the Russell 3000 Index. It includes approximately 50 of the largest securities based on a combination of their market cap and current index membership and represents approximately 40% of the total market capitalization of the Russell 3000. The index, which was launched on January 1, 2005, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. Its ticker symbol is ^RU50. Investing Prior to January 27, 2016, the index was tracked by an exchange-traded fund, the Guggenheim Russell Top 50 Mega Cap ETF (). The ETF switched to the S&P 500 Top 50 Index. Top 10 holdings *Apple Inc. () * Microsoft Corp () * Amazon.com () *Meta Platforms () * Alphabet Inc Cl A () *Alphabet Inc Cl C () * Berkshire Hathaway Inc () *Johnson & Johnson () *Procter & Gamble The Procter & Gamble Company (P&G) is an American multina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Russell Top 200 Index

The Russell Top 200 Index measures the performance of the 200 largest companies (63% of total market capitalization) in the Russell 1000 Index, with a weighted average market capitalization of $186 billion. The median capitalization is $48 billion; the smallest company in the index has an approximate capitalization of $14 billion. The index, which was launched on September 1, 1992, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. Its ticker symbol is ^RT200. Investing The Russell Top 200 Index is tracked by an exchange-traded fund, iShares Russell Top 200 Index (). Top 10 holdings As of December 31, 2016 *Apple Inc. () *Microsoft Corp () * Exxon Mobil Corp () *Johnson & Johnson () * JPMorgan Chase & Co () *Berkshire Hathaway Inc () *Amazon.com () *General Electric () *AT&T () *Meta Platforms () See also *Russell Investments *Russell 2000 Index *Russell 1000 Index *Russell Top 50 Index The Russell Top 50 Index also known as the Russell Top 50 Me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Russell 1000 Index

The Russell 1000 Index is a U.S. stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index. , the stocks of the Russell 1000 Index had a weighted average market capitalization of $1.013 trillion and a median market capitalization of $15.7 billion. , components ranged in market capitalization from $1.8 billion to $1.4 trillion. The index, which was launched on January 1, 1984, is maintained by FTSE Russell, a subsidiary of the United Kingdom-based London Stock Exchange Group. The ticker symbol is typically RUI, .RUI or ^RUI. There are several exchange-traded funds and mutual funds that track the index. Record values Annual returns Top sectors by weight *Technology * Consumer Discretionary * Industrials * Financials *Health Care Top 10 holdings *Apple - *Nvidia - *Microsoft - *Amazon - * Meta - * Tesla - *Alphabet (Class A) - *Broadcom - *Alphabet (Class C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Russell 2500 Index

The Russell 2500 Index measures the performance of the 2,500 smallest companies (19% of total capitalization) in the Russell 3000 Index, with a weighted average market capitalization of approximately $4.3 billion, median capitalization of $1.2 billion and market capitalization of the largest company of $18.7 billion. The index, which was launched on June 1, 1990, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. Its ticker symbol is ^R25I. Top 10 holdings *Huntington Bancshares () * Hologic () * Mid-America Apartments () * Quintiles IMS Holdings () * Alaska Air Group () *Idexx Laboratories () * Snap-on () * Arch Capital Group () * Lear Corporation () * E-Trade Financial () (as of December 31, 2016) Top sectors by weight *Financial Services *Producer Durables *Consumer Discretionary *Technology *Health Care See also *Russell Investments *Russell 2000 Index *Russell 1000 Index The Russell 1000 Index is a U.S. stock market index that tracks the highes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NASDAQ

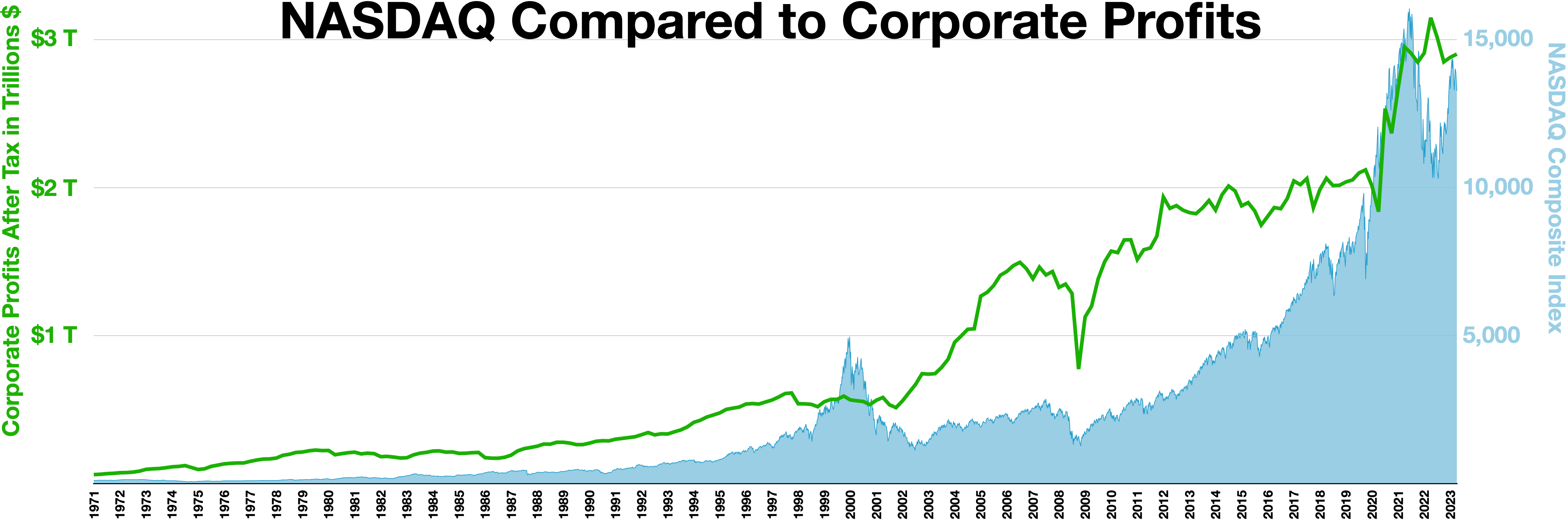

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock exchange in the world by market capitalization, exceeding $25 trillion in July 2024. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (ticker symbol ICE). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. According to a Gallup, Inc., Gallup poll conducted in 2022, approximately 58% of American adults reported having money invested in the stock market, either through individual stocks, mutual funds, or 401(k), retirement accounts. __FORCETOC__ History The earliest recorded organization of Security (finance), securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, secu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Impact

In financial markets, market impact is the effect that a market participant has when it buys or sells an asset. It is the extent to which the buying or selling moves the price against the buyer or seller, i.e., upward when buying and downward when selling. It is closely related to market liquidity; in many cases "liquidity" and "market impact" are synonymous. Especially for large investors, e.g., financial institutions, market impact is a key consideration before any decision to move money within or between financial markets. If the amount of money being moved is large (relative to the turnover of the asset(s) in question), then the market impact can be several percentage points and needs to be assessed alongside other transaction costs (costs of buying and selling). Market impact can arise because the price needs to move to tempt other investors to buy or sell assets (as counterparties), but also because professional investors may position themselves to profit from knowledge th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Index Fund

An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the performance of a specified basket of underlying investments. The main advantage of index funds for investors is they do not require much time to managethe investors will not need to spend time analyzing various stocks or stock portfolios. Most investors also find it difficult to beat the performance of the S&P 500 index; indeed passively managed funds, such as index funds, consistently outperform actively managed funds. Thus investors, academicians, and authors such as Warren Buffett, John C. Bogle, Jack Brennan, Paul Samuelson, Burton Malkiel, David Swensen, Benjamin Graham, Gene Fama, William J. Bernstein, and Andrew Tobias have long been strong proponents of index funds. * * * * * * * Siegel, J.J. (2019). Climbing Mount Everest: Paul Samuelson on Financial Theory and Practice. In: Cord, R., Anderson, R., Ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |