|

Ronald E. Hermance Jr.

Hudson City Bancorp, Inc., based in Paramus, in the U.S. state of New Jersey, was a bank-holding company for Hudson City Savings Bank, its only subsidiary, then the largest savings bank in New Jersey and one of the oldest banks in the United States, with US$50 billion in assets. It is now a fully publicly held entity and a member S&P 500 stock market Index. In 2005, its US$3.93 billion secondary offering of common stock was the largest in United States banking history. At the time, it was also the seventh largest domestic public offering in United States history THACHER PROFFITT REPRESENTS HUDSON CITY BANCORP IN 7TH LARGEST DOMESTIC PUBLIC OFFERING IN HISTORY June 8, 2005, PRNewswire, Insurance Newscast, InsuranceBroadcasting.com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company or daughter company is a company owned or controlled by another company, which is called the parent company or holding company. Two or more subsidiaries that either belong to the same parent company or having a same management being substantially controlled by same entity/group are called sister companies. The subsidiary can be a company (usually with limited liability) and may be a government- or state-owned enterprise. They are a common feature of modern business life, and most multinational corporations organize their operations in this way. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, or Citigroup; as well as more focused companies such as IBM, Xerox, and Microsoft. These, and others, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries. Details Subsidiaries are separate, distinct legal entities f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

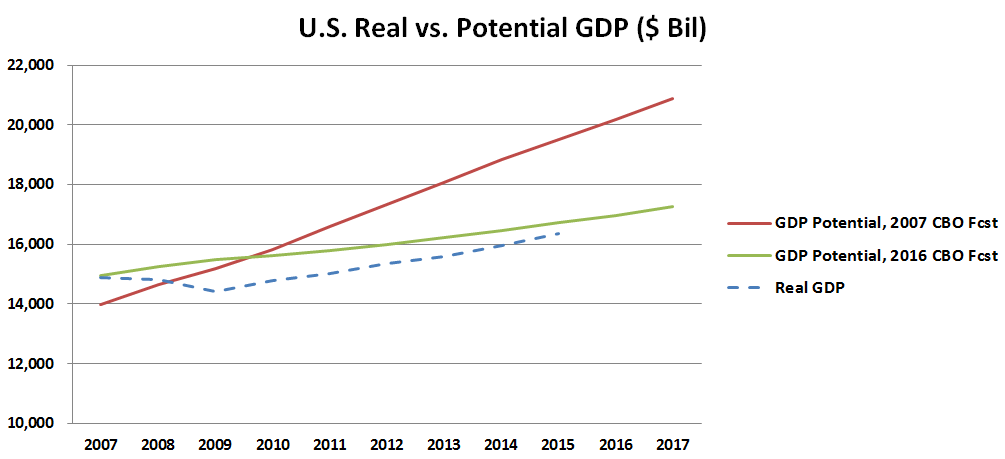

Economic Malaise

Economic stagnation is a prolonged period of slow economic growth (traditionally measured in terms of the GDP growth), usually accompanied by high unemployment. Under some definitions, "slow" means significantly slower than potential growth as estimated by macroeconomists, even though the growth rate may be nominally higher than in other countries not experiencing economic stagnation. Secular stagnation theory The term "secular stagnation" was originally coined by Alvin Hansen in 1938 to "describe what he feared was the fate of the American economy following the Great Depression of the early 1930s: a check to economic progress as investment opportunities were stunted by the closing of the frontier and the collapse of immigration". Warnings similar to secular stagnation theory have been issued after all deep recessions, but they usually turned out to be wrong because they underestimated the potential of existing technologies.Pagano and Sbracia (2014"The secular stagnation hypo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thacher Proffitt

Thacher Proffitt & Wood LLP was an American law firm headquartered in New York City. At its peak, the firm was made up of approximately 365 attorneys with offices in New York City; Washington, D.C.; Mexico City; White Plains, New York; and Summit, New Jersey. History The firm traced its founding back to 1848, when Benjamin Franklin Butler opened a legal practice with his son, William Allen Butler, at 29 Wall Street in New York City. The firm was headquartered in downtown Manhattan from 1848 until 2001, eventually occupying floors 38 through 40 of the 2 World Trade Center building prior to the building's destruction in the September 11 attacks. All of the firm's employees survived the attacks, and the firm temporarily relocated to midtown Manhattan before moving to 2 World Financial Center in September 2003. Thacher Proffitt was a market leader in the mortgage-backed securities (MBS) market, and in fact was instrumental in the creation of the residential MBS and commercial MBS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Home Loan Bank

The Federal Home Loan Banks (FHLBanks, or FHLBank System) are 11 U.S. government-sponsored banks that provide liquidity to the members of financial institutions to support housing finance and community investment. Overview The FHLBank System was chartered by Congress in 1932, during the Great Depression. It has a primary mission of providing member financial institutions with financial products/services which assist and enhance the financing of housing and community lending. The 11 FHLBanks are each structured as cooperatives owned and governed by their member financial institutions, which today include savings and loan associations (thrifts), commercial banks, credit unions and insurance companies. Each FHLBank is required to register at least one class of equity with the SEC, although their debt is not registered. A benefit of FHLBank membership is access to liquidity through secured loans, known as advances, which are funded by the FHLBanks in the capital markets from the is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Board Of Directors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit organization, or a government agency. The powers, duties, and responsibilities of a board of directors are determined by government regulations (including the jurisdiction's corporate law) and the organization's own constitution and by-laws. These authorities may specify the number of members of the board, how they are to be chosen, and how often they are to meet. In an organization with voting members, the board is accountable to, and may be subordinate to, the organization's full membership, which usually elect the members of the board. In a stock corporation, non-executive directors are elected by the shareholders, and the board has ultimate responsibility for the management of the corporation. In nations with codetermination (such as Germ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Daniel Gross (journalist)

Daniel Gross (born August 4, 1967) is an American financial and economic journalist. He was the executive editor of ''strategy+business'' magazine from 2015 to January 2020 and was named editor-in-chief in February 2020. Prior to joining ''strategy+business'', Gross was a columnist and the global business editor at the ''Daily Beast'' (2012–2014). Previously, he was the economics editor and cohost of ''The Daily Ticker'' at Yahoo Finance (2010–2012), a columnist and a senior editor at ''Newsweek'' (2007–2010), a columnist at ''Slate'' (2002–2010), a columnist at ''The New York Times'', and a reporter for the '' New Republic'' and ''Bloomberg News''. Gross wrote the "Contrary Indicator" column at ''Newsweek'', the "Moneybox" column at ''Slate'', and the "Economic View" column at ''The New York Times''. He also has written cover stories for ''New York'' and ''The New York Times Magazine'', and has contributed to ''Fortune'', ''Wired'', ''The Washington Post'', and ''The Bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. U.S. Congress, Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and bank regulation, regulating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and regulating banks, maintaining the stabili ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1990-1991 Recession

The early 1990s recession describes the period of economic downturn affecting much of the Western world in the early 1990s. The impacts of the recession contributed in part to the 1992 U.S. presidential election victory of Bill Clinton over incumbent president George H. W. Bush. The recession also included the resignation of Canadian prime minister Brian Mulroney, the reduction of active companies by 15% and unemployment up to nearly 20% in Finland, civil disturbances in the United Kingdom and the growth of discount stores in the United States and beyond. Primary factors believed to have led to the recession include the following: restrictive monetary policy enacted by central banks, primarily in response to inflation concerns, the loss of consumer and business confidence as a result of the 1990 oil price shock, the end of the Cold War and the subsequent decrease in defense spending, the savings and loan crisis and a slump in office construction resulting from overbuilding duri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long Island, New York

Long Island is a densely populated island in the southeastern region of the U.S. state of New York, part of the New York metropolitan area. With over 8 million people, Long Island is the most populous island in the United States and the 18th-most populous in the world. The island begins at New York Harbor approximately east of Manhattan Island and extends eastward about into the Atlantic Ocean and 23 miles wide at its most distant points. The island comprises four counties: Kings and Queens counties (the New York City boroughs of Brooklyn and Queens, respectively) and Nassau County share the western third of the island, while Suffolk County occupies the eastern two thirds of the island. More than half of New York City's residents (58.4%) lived on Long Island as of 2020, in Brooklyn and in Queens. Culturally, many people in the New York metropolitan area colloquially use the term "Long Island" (or "the Island") to refer exclusively to Nassau and Suffolk counties, and conv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chief Financial Officer

The chief financial officer (CFO) is an officer of a company or organization that is assigned the primary responsibility for managing the company's finances, including financial planning, management of financial risks, record-keeping, and financial reporting. In some sectors, the CFO is also responsible for analysis of data. Some CFOs have the title CFOO for chief financial and operating officer. In the majority of countries, finance directors (FD) typically report into the CFO and FD is the level before reaching CFO. The CFO typically reports to the chief executive officer (CEO) and the board of directors and may additionally have a seat on the board. The CFO supervises the finance unit and is the chief financial spokesperson for the organization. The CFO directly assists the chief operating officer (COO) on all business matters relating to budget management, cost–benefit analysis, forecasting needs, and securing of new funding. Qualification Most CFOs of large companies hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chief Operating Officer

A chief operating officer or chief operations officer, also called a COO, is one of the highest-ranking executive positions in an organization, composing part of the "C-suite". The COO is usually the second-in-command at the firm, especially if the highest-ranking executive is the chairperson and CEO. The COO is responsible for the daily operation of the company and its office building and routinely reports to the highest-ranking executive—usually the chief executive officer (CEO). Responsibilities and similar titles Unlike other C-suite positions, which tend to be defined according to commonly designated responsibilities across most companies, a COO's job tends to be defined in relation to the specific CEO with whom they work, given the close working relationship of these two individuals. The selection of a COO is similar in many ways to the selection of a vice president or chief of staff of the United States: power and responsibility structures vary in government and priva ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |