|

Revenue Management College (Chad)

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees. This definition is based on IAS 18. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, Company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, in the balance statement, revenue is a subsection of the Equity section and revenue increases equity, it is often referred to as the "top line" due to its position on the income statement at the very top. This is to be contrasted with the "bottom line" which denotes net income (gross revenues minus total expenses). In general usage, revenue is the total amount of income b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting

Accounting, also known as accountancy, is the measurement, processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the "language of business", measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used as synonyms. Accounting can be divided into several fields including financial accounting, management accounting, tax accounting and cost accounting. Financial accounting focuses on the reporting of an organization's financial information, including the preparation of financial statements, to the external users of the information, such as investors, regulators and suppliers; and management accounting focuses on the measurement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Accounting Practice

Publicly traded companies typically are subject to rigorous standards. Small and midsized businesses often follow more simplified standards, plus any specific disclosures required by their specific lenders and shareholders. Some firms operate on the cash method of accounting which can often be simple and straight forward. Larger firms most often operate on an accrual basis. Accrual basis is one of the fundamental accounting assumptions and if it is followed by the company while preparing the Financial statements then no further disclosure is required. Accounting standards prescribe in considerable detail what accruals must be made, how the financial statements are to be presented, and what additional disclosures are required. Some important elements that accounting standards cover include: identifying the exact entity which is reporting, discussing any "going concern" questions, specifying monetary units, and reporting time frames. Limitations The notable limitations of accounting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Digital Media

Digital media is any communication media that operate in conjunction with various encoded machine-readable data formats. Digital media can be created, viewed, distributed, modified, listened to, and preserved on a digital electronics device. ''Digital'' defines as any data represented by a series of digits, and ''media'' refers to methods of broadcasting or communicating this information. Together, ''digital media'' refers to mediums of digitized information broadcast through a screen and/or a speaker. This also includes text, audio, video, and graphics that are transmitted over the internet for viewing or listening to on the internet. Digital media platforms, such as YouTube, Vimeo, and Twitch, accounted for viewership rates of 27.9 billion hours in 2020. A contributing factor to its part in what is commonly referred to as ''the digital revolution'' can be attributed to the use of interconnectivity. Digital media Examples of digital media include software, digital images, d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Donations

A donation is a gift for charity, humanitarian aid, or to benefit a cause. A donation may take various forms, including money, alms, services, or goods such as clothing, toy A toy or plaything is an object that is used primarily to provide entertainment. Simple examples include toy blocks, board games, and dolls. Toys are often designed for use by children, although many are designed specifically for adults and pet ...s, food, or vehicles. A donation may satisfy medical needs such as blood or Organ transplant, organs for transplant. Charitable donations of goods or services are also called ''gifts in kind''. Donating statistics In the United States, in 2007, the Bureau of Labor Statistics found that American households in the lowest fifth in terms of wealth, gave on average a higher percentage of their incomes to charitable organizations than those households in the highest fifth. Charity Navigator writes that, according to Giving USA, Americans gave $298 billion in 2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sponsorships

Sponsoring something (or someone) is the act of supporting an event, activity, person, or organization financially or through the provision of products or services. The individual or group that provides the support, similar to a benefactor, is known as the sponsor. Definition Sponsorship is a cash and/or in-kind fee paid to a property (typically in sports, arts, entertainment or causes) in return for access to the exploitable commercial potential associated with that property. While the sponsoree (property being sponsored) may be nonprofit, unlike philanthropy, sponsorship is done with the expectation of a commercial return. While sponsorship can deliver increased awareness, brand building and propensity to purchase, it is different from advertising. Unlike advertising, sponsorship can not communicate specific product attributes. Nor can it stand alone, as sponsorship requires support elements. Theories A range of psychological and communications theories have been used to exp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fund Accounting

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law.Leon E. Hay (1980). ''Accounting for Governmental and Nonprofit Entities, Sixth edition'', page 5. Richard D. Irwin, Inc., Homewood, IL. It emphasizes accountability rather than profitability, and is used by Nonprofit organizations and by governments. In this method, a ''fund'' consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions. The label ''fund accounting'' has also been applied to investment accounting, portfolio accounting or securities accounting – all synonyms describing the process of accounting for a portfolio of investments such as securities, commodities and/or real estate held in an investment fund such as a mutual fund or hedge fund. Investment acc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mission Statement

A mission statement is a short statement of why an organization exists, what its overall goal is, the goal of its operations: what kind of product or service it provides, its primary customers or market, and its geographical region of operation. It may include a short statement of such fundamental matters as the organization's values or philosophies, a business's main competitive advantages, or a desired future state—the "vision". Historically it is associated with Christian religious groups; indeed, for many years, a missionary was assumed to be a person on a specifically religious mission. The word "mission" dates from 1598, originally of Jesuits sending ("missio", Latin for "act of sending") members abroad. A mission is not simply a description of an organization by an external party, but an expression, made by an organization's leaders, of their desires and intent for the organization. A mission statement aims to communicate the organisation's purpose and direction to it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-profit Organization

A nonprofit organization (NPO) or non-profit organisation, also known as a non-business entity, not-for-profit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in contrast with an entity that operates as a business aiming to generate a profit for its owners. A nonprofit is subject to the non-distribution constraint: any revenues that exceed expenses must be committed to the organization's purpose, not taken by private parties. An array of organizations are nonprofit, including some political organizations, schools, business associations, churches, social clubs, and consumer cooperatives. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may incorporate as a nonprofit entity without securing tax-exempt status. Key aspects of nonprofits are accountability, trustworthiness, honesty, and openness to eve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

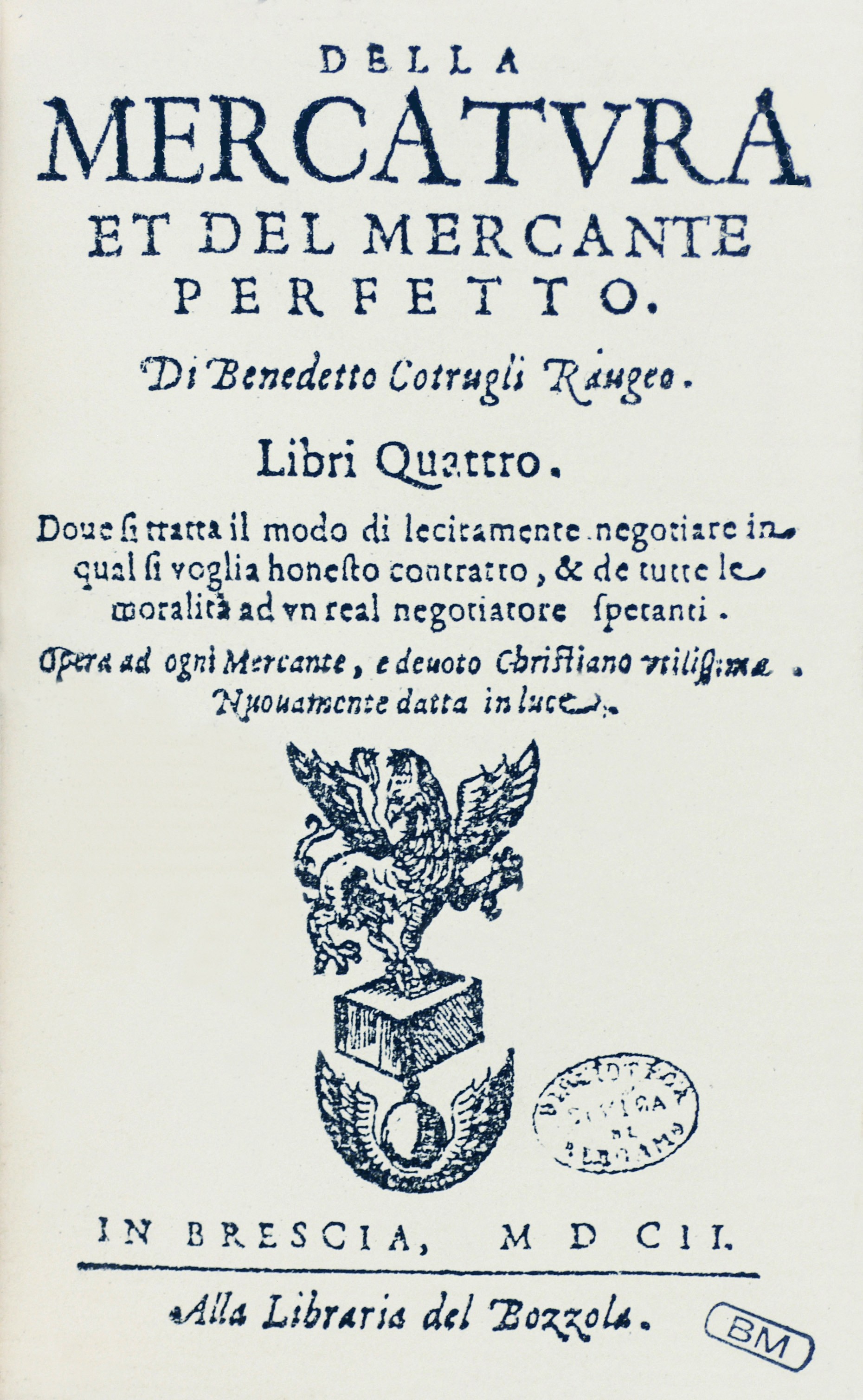

Double-entry Bookkeeping System

Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system has two equal and corresponding sides known as debit and credit. A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. The purpose of double-entry bookkeeping is to allow the detection of financial errors and fraud. For example, if a business takes out a bank loan for $10,000, recording the transaction would require a debit of $10,000 to an asset account called "Cash", as well as a credit of $10,000 to a liability account called "Notes Payable". The basic entry to record this transaction in a general ledger will look like this: Double-entry bookkeeping is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Financial Reporting Standards

International Financial Reporting Standards, commonly called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB). They constitute a standardised way of describing the company's financial performance and position so that company financial statements are understandable and comparable across international boundaries. They are particularly relevant for companies with shares or securities listed on a public stock exchange. IFRS have replaced many different national accounting standards around the world but have not replaced the separate accounting standards in the United States where U.S. GAAP is applied. History The International Accounting Standards Committee (IASC) was established in June 1973 by accountancy bodies representing ten countries. It devised and published International Accounting Standards (IAS), interpretations and a conceptual framework. These were looked to by many national accounting standard-set ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Generally Accepted Accounting Principles

Publicly traded companies typically are subject to rigorous standards. Small and midsized businesses often follow more simplified standards, plus any specific disclosures required by their specific lenders and shareholders. Some firms operate on the cash method of accounting which can often be simple and straight forward. Larger firms most often operate on an accrual basis. Accrual basis is one of the fundamental accounting assumptions and if it is followed by the company while preparing the Financial statements then no further disclosure is required. Accounting standards prescribe in considerable detail what accruals must be made, how the financial statements are to be presented, and what additional disclosures are required. Some important elements that accounting standards cover include: identifying the exact entity which is reporting, discussing any "going concern" questions, specifying monetary units, and reporting time frames. Limitations The notable limitations of accounting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)