|

Rehn–Meidner Model

The Rehn–Meidner model is an economic and wage policy model developed in 1951 by two economists at the research department of the Swedish Trade Union Confederation (LO), Gösta Rehn and Rudolf Meidner. The four main goals to be achieved were: * Low inflation * Full employment * High growth * Income equality Overview The model is based upon an interaction between Keynesian fiscal economics, real wage growth, active labour market policies and state intervention. The purpose was to create a positive spiral as part of the business cycle, in accordance with Keynesian theory, as the creation of an expansive welfare state and public investment meant to maintain domestic demand over economic cycles ensured security, safety and stability to labour, capital, business and consumers. This, in turn, helped to ensure low inflation, by helping to prevent wage-price spirals and thereby strengthened trade unions in demanding rising real wages in line with productivity growth, which, combi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gösta Rehn

Lars Gösta Rehn (1913 – 1 December 1996) was a Swedish economist. Life Rehn studied at the University of Stockholm and its Social Research Institute (''Socialinstitutet''). He started to work as an economist for the Swedish Trade Union Confederation in 1930, being this his full-time employment since 1943. In 1952-58 he worked with labour market policy questions for two committees at government level. In 1959-62, Rehn was employed by the Ministry of Finance as responsible for the Government's economic forecasts and analyzes of the effects of fiscal policy. In 1962 he became head of the Department of Labour and Social Affairs at the OECD in Paris. In 1973-79 he was director of the Institute for Social Research at Stockholm University Stockholm University ( sv, Stockholms universitet) is a public research university in Stockholm, Sweden, founded as a college in 1878, with university status since 1960. With over 33,000 students at four different faculties: law, humaniti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automation

Automation describes a wide range of technologies that reduce human intervention in processes, namely by predetermining decision criteria, subprocess relationships, and related actions, as well as embodying those predeterminations in machines. Automation has been achieved by various means including mechanical, hydraulic, pneumatic, electrical, electronic devices, and computers, usually in combination. Complicated systems, such as modern factories, airplanes, and ships typically use combinations of all of these techniques. The benefit of automation includes labor savings, reducing waste, savings in electricity costs, savings in material costs, and improvements to quality, accuracy, and precision. Automation includes the use of various equipment and control systems such as machinery, processes in factories, boilers, and heat-treating ovens, switching on telephone networks, steering, and stabilization of ships, aircraft, and other applications and vehicles with reduced hu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deindustrialization

Deindustrialization is a process of social and economic change caused by the removal or reduction of productive capacity, industrial capacity or activity in a country or region, especially of heavy industry or manufacturing industry. There are different interpretations of what deindustrialization is. Many associate Deindustrialization by country#United States, American deindustrialization with the mass closing of automaker plants in the now so-called "Rust Belt" between 1980 and 1990. The US Federal Reserve raised interest and exchange rates beginning in 1979, and continuing until 1984, which automatically caused import prices to fall. Japan was rapidly expanding productivity during this time, and this decimated the US machine tool sector. A second wave of deindustrialization occurred between 2001 and 2009, culminating in the automotive industry crisis of 2008–2010, automaker bailout of GM and Chrysler. Research has pointed to investment in patents rather than in new capi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Evasion

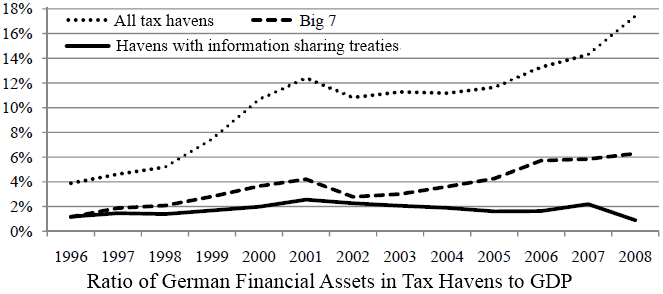

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability, and it includes dishonest tax reporting, declaring less income, profits or gains than the amounts actually earned, overstating deductions, using bribes against authorities in countries with high corruption rates and hiding money in secret locations. Tax evasion is an activity commonly associated with the informal economy. One measure of the extent of tax evasion (the "tax gap") is the amount of unreported income, which is the difference between the amount of income that should be reported to the tax authorities and the actual amount reported. In contrast, tax avoidance is the legal use of tax laws to reduce one's tax burden. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance, as they de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Flight

Capital flight, in economics, occurs when assets or money rapidly flow out of a country, due to an event of economic consequence or as the result of a political event such as regime change or economic globalization. Such events could be an increase in taxes on capital or capital holders or the government of the country defaulting on its debt that disturbs investors and causes them to lower their valuation of the assets in that country, or otherwise to lose confidence in its economic strength. This leads to a disappearance of wealth, and is usually accompanied by a sharp drop in the exchange rate of the affected country—depreciation in a variable exchange rate regime, or a forced devaluation in a fixed exchange rate regime. This fall is particularly damaging when the capital belongs to the people of the affected country because not only are the citizens now burdened by the loss in the economy and devaluation of their currency but their assets have lost much of their nominal v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Speculative Attacks

In economics, a speculative attack is a precipitous selling of untrustworthy assets by previously inactive speculators and the corresponding acquisition of some valuable assets (currencies, gold). The first model of a speculative attack was contained in a 1975 discussion paper on the gold market by Stephen Salant and Dale Henderson at the Federal Reserve Board. Paul Krugman, who visited the Board as a graduate student intern, soon adapted their mechanism to explain speculative attacks in the foreign exchange market.Paul Krugman (1979), 'A model of balance-of-payments crises'. ''Journal of Money, Credit, and Banking'' 11, pp. 311-25. There are now many hundreds of journal articles on financial speculative attacks, which are typically grouped into three categories: first, second, and third generation models. Salant has continued to explore real speculative attacks in a series of six articles. How it works A speculative attack in the foreign exchange market is the massive and sudde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Controls

Capital controls are residency-based measures such as transaction taxes, other limits, or outright prohibitions that a nation's government can use to regulate flows from capital markets into and out of the country's capital account. These measures may be economy-wide, sector-specific (usually the financial sector), or industry specific (e.g. "strategic" industries). They may apply to all flows, or may differentiate by type or duration of the flow (debt, equity, or direct investment, and short-term vs. medium- and long-term). Types of capital control include exchange controls that prevent or limit the buying and selling of a national currency at the market rate, caps on the allowed volume for the international sale or purchase of various financial assets, transaction taxes such as the proposed Tobin tax on currency exchanges, minimum stay requirements, requirements for mandatory approval, or even limits on the amount of money a private citizen is allowed to remove from the country ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Flows

In economics, capital goods or capital are "those durable produced goods that are in turn used as productive inputs for further production" of goods and services. At the macroeconomic level, "the nation's capital stock includes buildings, equipment, software, and inventories during a given year." A typical example is the machinery used in factories. Capital can be increased by the use of the factors of production, which however excludes certain durable goods like homes and personal automobiles that are not used in the production of saleable goods and services. Adam Smith defined capital as "that part of man's stock which he expects to afford him revenue". In economic models, capital is an input in the production function. The total physical capital at any given moment in time is referred to as the capital stock (not to be confused with the capital stock of a business entity). Capital goods, real capital, or capital assets are already-produced, durable goods or any non-fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro. The exchange rate is also regarded as the value of one country's currency in relation to another currency. For example, an interbank exchange rate of 114 Japanese yen to the United States dollar means that ¥114 will be exchanged for or that will be exchanged for ¥114. In this case it is said that the price of a dollar in relation to yen is ¥114, or equivalently that the price of a yen in relation to dollars is $1/114. Each country determines the exchange rate regime that will apply to its currency. For example, a currency may be floating, pegged (fixed), or a hybrid. Governments can impose certain limits and controls on exchange rates. Countries can also have a strong or weak currency. There is no agreement in the ec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currencies

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound Sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$)) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance - i.e. legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term "curren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bretton Woods System

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold (or 0.88867 gram fine gold per dollar). It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits. Preparing to rebuild the inte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Golden Age Of Capitalism

Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. Central characteristics of capitalism include capital accumulation, competitive markets, price system, private property, property rights recognition, voluntary exchange, and wage labor. In a market economy, decision-making and investments are determined by owners of wealth, property, or ability to maneuver capital or production ability in capital and financial markets—whereas prices and the distribution of goods and services are mainly determined by competition in goods and services markets. Economists, historians, political economists and sociologists have adopted different perspectives in their analyses of capitalism and have recognized various forms of it in practice. These include ''laissez-faire'' or free-market capitalism, anarcho-capitalism, state capitalism and welfare capitalism. Different forms of capitalism feature varying degrees of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)