|

Regret (decision Theory)

In decision theory, regret aversion (or anticipated regret) describes how the human emotional response of regret can influence decision-making under uncertainty. When individuals make choices without complete information, they often experience regret if they later discover that a different choice would have produced a better outcome. This regret can be quantified as the difference in value between the actual decision made and what would have been the optimal decision in hindsight. Unlike traditional models that consider regret as merely a post-decision emotional response, the theory of regret aversion proposes that decision-makers actively anticipate potential future regret and incorporate this anticipation into their current decision-making process. This anticipation can lead individuals to make choices specifically designed to minimize the possibility of experiencing regret later, even if those choices are not optimal from a purely probabilistic expected-value perspective. Regre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Decision Theory

Decision theory or the theory of rational choice is a branch of probability theory, probability, economics, and analytic philosophy that uses expected utility and probabilities, probability to model how individuals would behave Rationality, rationally under uncertainty. It differs from the Cognitive science, cognitive and Behavioural sciences, behavioral sciences in that it is mainly Prescriptive economics, prescriptive and concerned with identifying optimal decision, optimal decisions for a rational agent, rather than Descriptive economics, describing how people actually make decisions. Despite this, the field is important to the study of real human behavior by Social science, social scientists, as it lays the foundations to Mathematical model, mathematically model and analyze individuals in fields such as sociology, economics, criminology, cognitive science, moral philosophy and political science. History The roots of decision theory lie in probability theory, developed by Blai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transitive Relation

In mathematics, a binary relation on a set (mathematics), set is transitive if, for all elements , , in , whenever relates to and to , then also relates to . Every partial order and every equivalence relation is transitive. For example, less than and equality (mathematics), equality among real numbers are both transitive: If and then ; and if and then . Definition A homogeneous relation on the set is a ''transitive relation'' if, :for all , if and , then . Or in terms of first-order logic: :\forall a,b,c \in X: (aRb \wedge bRc) \Rightarrow aRc, where is the infix notation for . Examples As a non-mathematical example, the relation "is an ancestor of" is transitive. For example, if Amy is an ancestor of Becky, and Becky is an ancestor of Carrie, then Amy is also an ancestor of Carrie. On the other hand, "is the birth mother of" is not a transitive relation, because if Alice is the birth mother of Brenda, and Brenda is the birth mother of Claire, then it does ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ordinal Measurement

Level of measurement or scale of measure is a classification that describes the nature of information within the values assigned to variables. Psychologist Stanley Smith Stevens developed the best-known classification with four levels, or scales, of measurement: nominal, ordinal, interval, and ratio. This framework of distinguishing levels of measurement originated in psychology and has since had a complex history, being adopted and extended in some disciplines and by some scholars, and criticized or rejected by others. Other classifications include those by Mosteller and Tukey, and by Chrisman. Stevens's typology Overview Stevens proposed his typology in a 1946 ''Science'' article titled "On the theory of scales of measurement". In that article, Stevens claimed that all measurement in science was conducted using four different types of scales that he called "nominal", "ordinal", "interval", and "ratio", unifying both " qualitative" (which are described by his "nominal" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prediction

A prediction (Latin ''præ-'', "before," and ''dictum'', "something said") or forecast is a statement about a future event or about future data. Predictions are often, but not always, based upon experience or knowledge of forecasters. There is no universal agreement about the exact difference between "prediction" and " estimation"; different authors and disciplines ascribe different connotations. Future events are necessarily uncertain, so guaranteed accurate information about the future is impossible. Prediction can be useful to assist in making plans about possible developments. Opinion In a non-statistical sense, the term "prediction" is often used to refer to an informed guess or opinion. A prediction of this kind might be informed by a predicting person's abductive reasoning, inductive reasoning, deductive reasoning, and experience; and may be useful—if the predicting person is a knowledgeable person in the field. The Delphi method is a technique for elicitin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

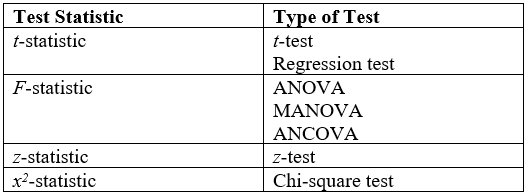

Hypothesis Testing

A statistical hypothesis test is a method of statistical inference used to decide whether the data provide sufficient evidence to reject a particular hypothesis. A statistical hypothesis test typically involves a calculation of a test statistic. Then a decision is made, either by comparing the test statistic to a critical value or equivalently by evaluating a ''p''-value computed from the test statistic. Roughly 100 specialized statistical tests are in use and noteworthy. History While hypothesis testing was popularized early in the 20th century, early forms were used in the 1700s. The first use is credited to John Arbuthnot (1710), followed by Pierre-Simon Laplace (1770s), in analyzing the human sex ratio at birth; see . Choice of null hypothesis Paul Meehl has argued that the epistemological importance of the choice of null hypothesis has gone largely unacknowledged. When the null hypothesis is predicted by theory, a more precise experiment will be a more severe test of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leonard Savage

Leonard Jimmie Savage (born Leonard Ogashevitz; 1917 – 1971) was an American mathematician and statistician. Economist Milton Friedman said Savage was "one of the few people I have met whom I would unhesitatingly call a genius." Education and career Savage was born and grew up in Detroit. He studied at Wayne State University in Detroit before transferring to University of Michigan, where he first majored in chemical engineering, then switched to mathematics, graduating in 1938 with a bachelor's degree. He continued at the University of Michigan with a PhD on differential geometry in 1941 under the supervision of Sumner Byron Myers. Savage subsequently worked at the Institute for Advanced Study in Princeton, New Jersey, the University of Chicago, the University of Michigan, Yale University, and the Statistical Research Group at Columbia University. Though his thesis advisor was Sumner Myers, he also credited Milton Friedman and W. Allen Wallis as statistical mentors. Durin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minimax

Minimax (sometimes Minmax, MM or saddle point) is a decision rule used in artificial intelligence, decision theory, combinatorial game theory, statistics, and philosophy for ''minimizing'' the possible loss function, loss for a Worst-case scenario, worst case (''max''imum loss) scenario. When dealing with gains, it is referred to as "maximin" – to maximize the minimum gain. Originally formulated for several-player zero-sum game theory, covering both the cases where players take alternate moves and those where they make simultaneous moves, it has also been extended to more complex games and to general decision-making in the presence of uncertainty. Game theory In general games The maximin value is the highest value that the player can be sure to get without knowing the actions of the other players; equivalently, it is the lowest value the other players can force the player to receive when they know the player's action. Its formal definition is: :\underline = \max_ \min_ W ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disposition Effect

The disposition effect is an anomaly discovered in behavioral finance. It relates to the tendency of investors to sell assets that have increased in value, while keeping assets that have dropped in value. Hersh Shefrin and Meir Statman identified and named the effect in their 1985 paper, which found that people dislike losing significantly more than they enjoy winning. The disposition effect has been described as one of the foremost vigorous actualities around individual investors because investors will hold stocks that have lost value yet sell stocks that have gained value." In 1979, Daniel Kahneman and Amos Tversky traced the cause of the disposition effect to the so-called "prospect theory". The prospect theory proposes that when an individual is presented with two equal choices, one having possible gains and the other with possible losses, the individual is more likely to opt for the former choice even though both would yield the same economic result. The disposition effect ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Economic Review

The ''American Economic Review'' is a monthly peer-reviewed academic journal first published by the American Economic Association in 1911. The current editor-in-chief is Erzo FP Luttmer, a professor of economics at Dartmouth College. The journal is based in Pittsburgh. It is one of the " top five" journals in economics. In 2004, the ''American Economic Review'' began requiring "data and code sufficient to permit replication" of a paper's results, which is then posted on the journal's website. Exceptions are made for proprietary data. Until 2017, the May issue of the ''American Economic Review'', titled the ''Papers and Proceedings'' issue, featured the papers presented at the American Economic Association's annual meeting that January. After being selected for presentation, the papers in the ''Papers and Proceedings'' issue did not undergo a formal process of peer review. Starting in 2018, papers presented at the annual meetings have been published in a separate journal, '' AEA Pap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First Price Auction

A first-price sealed-bid auction (FPSBA) is a common type of auction. It is also known as blind auction. In this type of auction, all bidders simultaneously submit sealed bids so that no bidder knows the bid of any other participant. The highest bidder pays the price that was submitted. Strategic analysis In a FPSBA, each bidder is characterized by their monetary valuation of the item for sale. Suppose Alice is a bidder and her valuation is a. Then, if Alice is rational: *She will never bid more than a, because bidding more than a can only make her lose net value. *If she bids exactly a, then she will not lose but also not gain any positive value. *If she bids less than a, then she ''may'' have some positive gain, but the exact gain depends on the bids of the others. Alice would like to bid the smallest amount that can make her win the item, as long as this amount is less than a. For example, if there is another bidder Bob and he bids y and y [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Allais Paradox

The Allais paradox is a choice problem designed by to show an inconsistency of actual observed choices with the predictions of expected utility theory. The Allais paradox demonstrates that individuals rarely make rational decisions consistently when required to do so immediately. The independence axiom of expected utility theory, which requires that the preferences of an individual should not change when altering two lotteries by equal proportions, was proven to be violated by the paradox. Statement of the problem The Allais paradox arises when comparing participants' choices in two different experiments, each of which consists of a choice between two gambles, A and B. The payoffs for each gamble in each experiment are as follows: Several studies involving hypothetical and small monetary payoffs, and recently involving health outcomes, have supported the assertion that when presented with a choice between 1A and 1B, most people would choose 1A. Likewise, when presented with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |