|

Refunding Certificate

The Refunding Certificate was a type of interest-bearing banknote that the United States Treasury issued in 1879. They issued it only in the $10 denomination, depicting Benjamin Franklin. Their issuance reflects the end of a coin-hoarding period that began during the American Civil War, and represented a return to public confidence in paper money. When the Treasury issued the bonds, silver coins were in wide circulation and gold coins were just beginning to appear at banks nationwide. The Treasury paid out in notes, the majority— (or 98.5%)—in the fourth quarter of 1879, as long lines of people gathered at Post Office branches and Treasury offices. The Refunding Certificate originally promised to pay 4% annual interest in perpetuity. The obligation on these notes reads: :''"This certifies that the sum of Ten Dollars has been deposited with the Treasurer of the United States under Act of February 26th, 1879 convertible with accrued interest at 4 per cent per annum into 4 p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest

In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit or reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs. For example, a customer would usually pay interest to borrow from a bank, so they pay the bank an amount which is more than the amount they borrowed; or a customer may earn interest on their savings, and so they may withdraw more than they originally deposited. In the case of savings, the customer is the lender, and the bank plays the role of the borrower. Interest diff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banknote

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable instrument, negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand. Banknotes were originally issued by commercial banks, which were legally required to Redemption value, redeem the notes for legal tender (usually gold or silver coin) when presented to the chief cashier of the originating bank. These commercial banknotes only traded at face value in the market served by the issuing bank. Commercial banknotes have primarily been replaced by national banknotes issued by central banks or monetary authority, monetary authorities. National banknotes are often – but not always – legal tender, meaning that courts of law are required to recognize them as satisfactory payment of money debts. Historically, banks sought to ensure that they could always pay customers in coins when they presented banknotes for payment. This p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and coins, while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes. The departm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

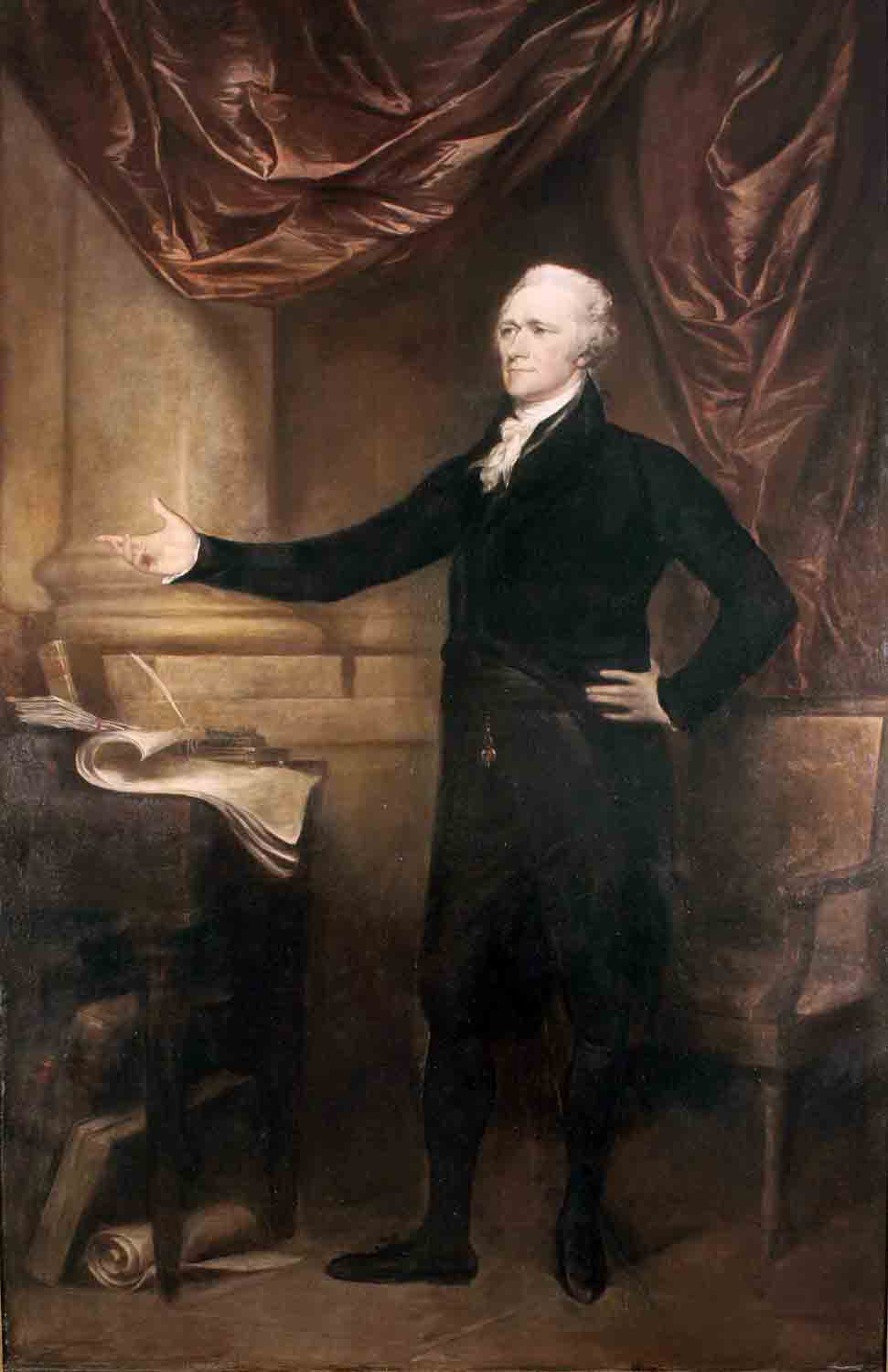

United States Ten-dollar Bill

The United States ten-dollar bill ($10) is a Denomination (currency), denomination of U.S. currency. The obverse of the bill features the portrait of Alexander Hamilton, who served as the first U.S. Secretary of the Treasury. The Obverse and reverse, reverse features the U.S. Treasury Building. All $10 bills issued today are Federal Reserve Notes. As of December 2018, the average life of a $10 bill in Circulation (currency), circulation is 5.3 years before it is replaced due to wear. Ten-dollar bills are delivered by Federal Reserve Banks in yellow straps. The source of the portrait on the $10 bill is John Trumbull's 1805 painting of Hamilton that belongs to the portrait collection of New York City Hall. The $10 bill is unique in that it is the only denomination in circulation in which the portrait faces to the left. It also features one of two non-presidents on currently issued U.S. bills, the other being Benjamin Franklin on the United States one hundred-dollar bill, $100 bill. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benjamin Franklin

Benjamin Franklin ( April 17, 1790) was an American polymath who was active as a writer, scientist, inventor, statesman, diplomat, printer, publisher, and political philosopher. Encyclopædia Britannica, Wood, 2021 Among the leading intellectuals of his time, Franklin was one of the Founding Fathers of the United States, a drafter and signer of the United States Declaration of Independence, and the first United States Postmaster General. As a scientist, he was a major figure in the American Enlightenment and the history of physics for his studies of electricity, and for charting and naming the current still known as the Gulf Stream. As an inventor, he is known for the lightning rod, bifocals, and the Franklin stove, among others. He founded many civic organizations, including the Library Company, Philadelphia's first fire department, and the University of Pennsylvania. Isaacson, 2004, p. Franklin earned the title of "The First American" for his early and indefa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Civil War

The American Civil War (April 12, 1861 – May 26, 1865; also known by other names) was a civil war in the United States. It was fought between the Union ("the North") and the Confederacy ("the South"), the latter formed by states that had seceded. The central cause of the war was the dispute over whether slavery would be permitted to expand into the western territories, leading to more slave states, or be prevented from doing so, which was widely believed would place slavery on a course of ultimate extinction. Decades of political controversy over slavery were brought to a head by the victory in the 1860 U.S. presidential election of Abraham Lincoln, who opposed slavery's expansion into the west. An initial seven southern slave states responded to Lincoln's victory by seceding from the United States and, in 1861, forming the Confederacy. The Confederacy seized U.S. forts and other federal assets within their borders. Led by Confederate President Jefferson Davis, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Silver

Silver is a chemical element with the Symbol (chemistry), symbol Ag (from the Latin ', derived from the Proto-Indo-European wikt:Reconstruction:Proto-Indo-European/h₂erǵ-, ''h₂erǵ'': "shiny" or "white") and atomic number 47. A soft, white, lustrous transition metal, it exhibits the highest electrical conductivity, thermal conductivity, and reflectivity of any metal. The metal is found in the Earth's crust in the pure, free elemental form ("native silver"), as an alloy with gold and other metals, and in minerals such as argentite and chlorargyrite. Most silver is produced as a byproduct of copper, gold, lead, and zinc Refining (metallurgy), refining. Silver has long been valued as a precious metal. Silver metal is used in many bullion coins, sometimes bimetallism, alongside gold: while it is more abundant than gold, it is much less abundant as a native metal. Its purity is typically measured on a per-mille basis; a 94%-pure alloy is described as "0.940 fine". As one of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile metal in a pure form. Chemically, gold is a transition metal and a group 11 element. It is one of the least reactive chemical elements and is solid under standard conditions. Gold often occurs in free elemental ( native state), as nuggets or grains, in rocks, veins, and alluvial deposits. It occurs in a solid solution series with the native element silver (as electrum), naturally alloyed with other metals like copper and palladium, and mineral inclusions such as within pyrite. Less commonly, it occurs in minerals as gold compounds, often with tellurium (gold tellurides). Gold is resistant to most acids, though it does dissolve in aqua regia (a mixture of nitric acid and hydrochloric acid), forming a soluble tetrachloroaurate anion. Gold is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perpetuity

A perpetuity is an annuity that has no end, or a stream of cash payments that continues forever. There are few actual perpetuities in existence. For example, the United Kingdom (UK) government issued them in the past; these were known as consols and were all finally redeemed in 2015. Real estate and preferred stock are among some types of investments that affect the results of a perpetuity, and prices can be established using techniques for valuing a perpetuity. Perpetuities are but one of the time value of money methods for valuing financial assets. Perpetuities are a form of ordinary annuities. The concept is closely linked to terminal value and terminal growth rate in valuation. Detailed description A perpetuity is an annuity in which the periodic payments begin on a fixed date and continue indefinitely. It is sometimes referred to as a perpetual annuity. Fixed coupon payments on permanently invested (irredeemable) sums of money are prime examples of perpetuities. Scholar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

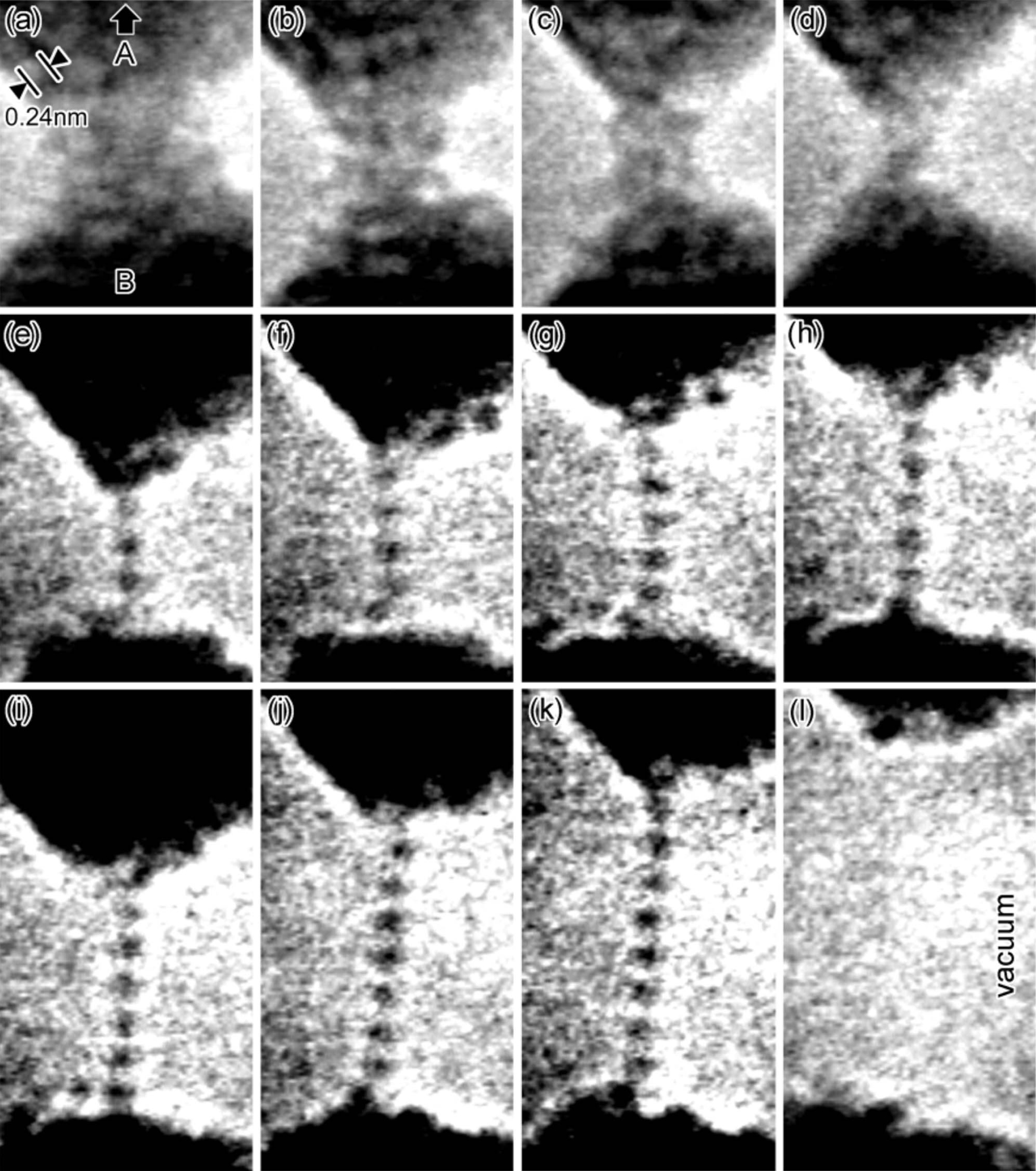

Fractional Currency (United States)

__NOTOC__ Fractional currency, also referred to as shinplasters, was introduced by the United States federal government following the outbreak of the Civil War. These low- denomination banknotes of the United States dollar were in use between 21 August 1862 and 15 February 1876, and issued in denominations of 3, 5, 10, 15, 25, and 50 cents across five issuing periods.Kravitz The complete type set below is part of the National Numismatic Collection, housed at the National Museum of American History, part of the Smithsonian Institution. History The Civil War economy catalyzed a shortage of United States coinage—gold and silver coins were hoarded given their intrinsic bullion value relative to irredeemable paper currency at the time.Anderson, p. 303.Reed, p. 298. In late 1861, to help finance the Civil War, the U.S. government borrowed gold coin from New York City banks in exchange for Seven-thirties treasury notesMitchell, 1903, pp. 27–32. and the New York banks sold them t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

-$0.50-Fr.1328.jpg)