|

Raymond Goldsmith

Raymond W. Goldsmith (Dec 23, 1904 – July 12, 1988, Hamden, Connecticut) was an American economist specialising in historical data on national income, saving, financial intermediation, and financial assets and liabilities. Goldsmith was born in Brussels to a family of Jewish ancestry, and grew up in Frankfurt. After finishing secondary school, he worked in a bank for a year that include the German hyperinflation of 1923. He then studied at the Berlin Handelshochschule and obtained a Ph.D. from the University of Berlin in 1928. From then until he left for the USA in 1934, he was employed by the German statistical office and the Institut fur Finanzwesen, working on studies of the banking and economic systems of Latin America and elsewhere. He was a fellow at the Brookings Institution, 1930–31, and a postdoc at the London School of Economics, 1933-34. Between 1934 and 1951, he worked in various capacities at the Securities and Exchange Commission and the War Production Board. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hamden, Connecticut

Hamden is a town in New Haven County, Connecticut, United States. The town's nickname is "The Land of the Sleeping Giant". The population was 61,169 at the 2020 census. History The peaceful tribe of Quinnipiacs were the first residents of the land that is now Hamden, they had great regard awe and veneration for the Blue Hills Sleeping Giant Mountain. amden was purchased by William Christopher Reilly and the Reverend John Davenport in 1638 from the local Quinnipiac Native American tribe. It was settled by Puritans as part of the town of New Haven. It remained a part of New Haven until 1786 when 1,400 local residents incorporated the area as a separate town, naming it after the English statesman John Hampden. Largely developed as a nodal collection of village-like settlements (which remain distinct today), including Mount Carmel (home to Quinnipiac University), Whitneyville, Spring Glen, West Woods, and Highwood, Hamden has a long-standing industrial history. In 1798, four ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fellow Of The American Statistical Association

Like many other academic professional societies, the American Statistical Association (ASA) uses the title of Fellow of the American Statistical Association as its highest honorary grade of membership. The number of new fellows per year is limited to one third of one percent of the membership of the ASA. , the people that have been named as Fellows are listed below. Fellows 1914 * John Lee Coulter * Miles Menander Dawson * Frank H. Dixon * David Parks Fackler * Henry Walcott Farnam * Charles Ferris Gettemy * Franklin Henry Giddings * Henry J. Harris * Edward M. Hartwell * Joseph A. Hill * George K. Holmes * William Chamberlin Hunt * John Koren * Thomas Bassett Macaulay * S. N. D. North * Warren M. Persons * Edward B. Phelps * LeGrand Powers * William Sidney Rossiter * Charles H. Verrill * Cressy L. Wilbur * S. Herbert Wolfe * Allyn Abbott Young 1916 * Victor S. Clark * Frederick Stephen Crum * Louis Israel Dublin * Walter Sherman Gifford * James Waterman Glover * Roy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Review Of Income And Wealth

The ''Review of Income and Wealth'' is a peer-reviewed academic journal published by Wiley-Blackwell on behalf of the International Association for Research in Income and Wealth. It was established in 1951 and published annually until 1966, when it became a quarterly. Its aim is to provide a venue for research on income and wealth in terms of national and international, economic and social accounting. Its scope includes research on the "development of concepts and definitions for measurement and analysis", the development and "integration of systems of economic and social statistics", and "related methodological problems", and also more applied areas such as international comparisons and the use of economic and social accounting for "budgeting and policy analysis" in different economies. The editors of the ''Review'' are Conchita D'Ambrosio (University of Luxembourg), Robert J. Hill (University of Graz), and Stephan Klasen (University of Göttingen), and its previous editors ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Selma Fine Goldsmith

Selma Evelyn Fine Goldsmith (1912–1962) was an American economic statistician who accurately estimated the personal income distribution of Americans.. Life Selma Fine was born in New York City on January 17, 1912, and attended Morris High School in The Bronx. She graduated in 1932 from Cornell University and completed her doctorate in 1936 from Harvard University with a dissertation on 17th- and 18th-century British business cycles. Fine began working for the United States Department of Agriculture and then for the National Resources Planning Board, where she began working on income tax data. During this time she married Yale economist Raymond W. Goldsmith. They had three children. Her major publications on income data were produced later, in the 1950s. She died of cancer on April 15, 1962. Personal life Fine was married to Raymond W. Goldsmith, Professor of Economics at Yale University. Recognition Goldsmith won the Distinguished Service Award of the Department of Comm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Journal Of Roman Studies

The Society for the Promotion of Roman Studies (The Roman Society) was founded in 1910 as the sister society to the Society for the Promotion of Hellenic Studies. The Society is the leading organisation in the United Kingdom for those interested in the study of Rome and the Roman Empire. Its scope covers Roman history, archaeology, literature and art. History of the society The society was founded at a public meeting in 1910, chaired by Frederic Kenyon, Director of the British Museum, and sponsored by Percy Gardner, George Macmillan, John Penoyre, Francis Haverfield, J. S. Reid, A. H. Smith, G. F. Hill , and G. H. Hallam. The Society's Memorandum and Articles of Association described its major aims as "...to promote Roman studies by creating a library, publishing a journal, and supporting the British School at Rome." The first issue of the ''Journal of Roman Studies'' was published in 1911. Early contributors included Francis Haverfield, Eugénie Strong, Albert Van Buren, Eliz ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peter Temin

Peter Temin (; born 17 December 1937) is an economist and economic historian, currently Gray Professor Emeritus of Economics, MIT and former head of the Economics Department. Education Temin graduated from Swarthmore College in 1959 before earning his Ph.D. at MIT in 1964. Beginning in the 1960s and early 1970s he published on American economic history in the 19th century, including ''The Jacksonian Economy'' (1969) and ''Causal Factors in American Economic Growth in the Nineteenth Century'' (1975), as well as ''Reckoning with Slavery'' (1976), which was an examination of the slave economy and its effects. His papers of the 1960s would reflect intense empirical study as part of his working method, including composition of iron and steel products, which would later be part of his analysis of industrial development. He continued his study of 19th century industrialization with ''Engines of Enterprise''. Influence Two of Temin's most cited conclusions in this area are on the relati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Angus Maddison

Angus Maddison (6 December 1926 – 24 April 2010) was a distinguished British economist specialising in quantitative macro economic history, including the measurement and analysis of economic growth and development. Maddison lectured at several universities over the course of his career, including the University of St. Andrews in Scotland and Harvard University. In 1978, Maddison was appointed Historical Professor in the Faculty of Economics at the University of Groningen (RUG). He retired in 1996 and became Emeritus Professor. Maddison is particularly known for documenting economic performance over long periods of time and across major countries in every continent of the world. Early life and OEEC/OECD Born in Newcastle-on-Tyne, England, Maddison was educated at Darlington Grammar School and subsequently attended Selwyn College, Cambridge, as an undergraduate. After attending McGill University and Johns Hopkins University as a graduate student, he decided not to pursue a P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Roman GDP

The study of the Roman economy, which is, the economies of the ancient city-state of Rome and its empire during the Republican and Imperial periods remains highly speculative. There are no surviving records of business and government accounts, such as detailed reports of tax revenues, and few literary sources regarding economic activity. Instead, the study of this ancient economy is today mainly based on the surviving archeological and literary evidence that allow researchers to form conjectures based on comparisons with other more recent pre-industrial economies. During the early centuries of the Roman Republic, it is conjectured that the economy was largely agrarian and centered on the trading of commodities such as grain and wine.Garnsey, Peter, et al. The Roman Empire: Economy, Society and Culture. 2nd ed., University of California Press, 2015, www.jstor.org/stable/10.1525/j.ctt9qh25h. Financial markets were established through such trade, and financial institutions, which ext ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tangible Asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetaryThere are different methods of assessing the monetary value of the assets recorded on the Balance Sheet. In some cases, the ''Historical Cost'' is used; such that the value of the asset when it was bought in the past is used as the monetary value. In other instances, the present fair market value of the asset is used to determine the value shown on the balance sheet. value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. Assets can be grouped into two major classes: tangible assets and intangible assets. Tangible assets contain various subclasses, incl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

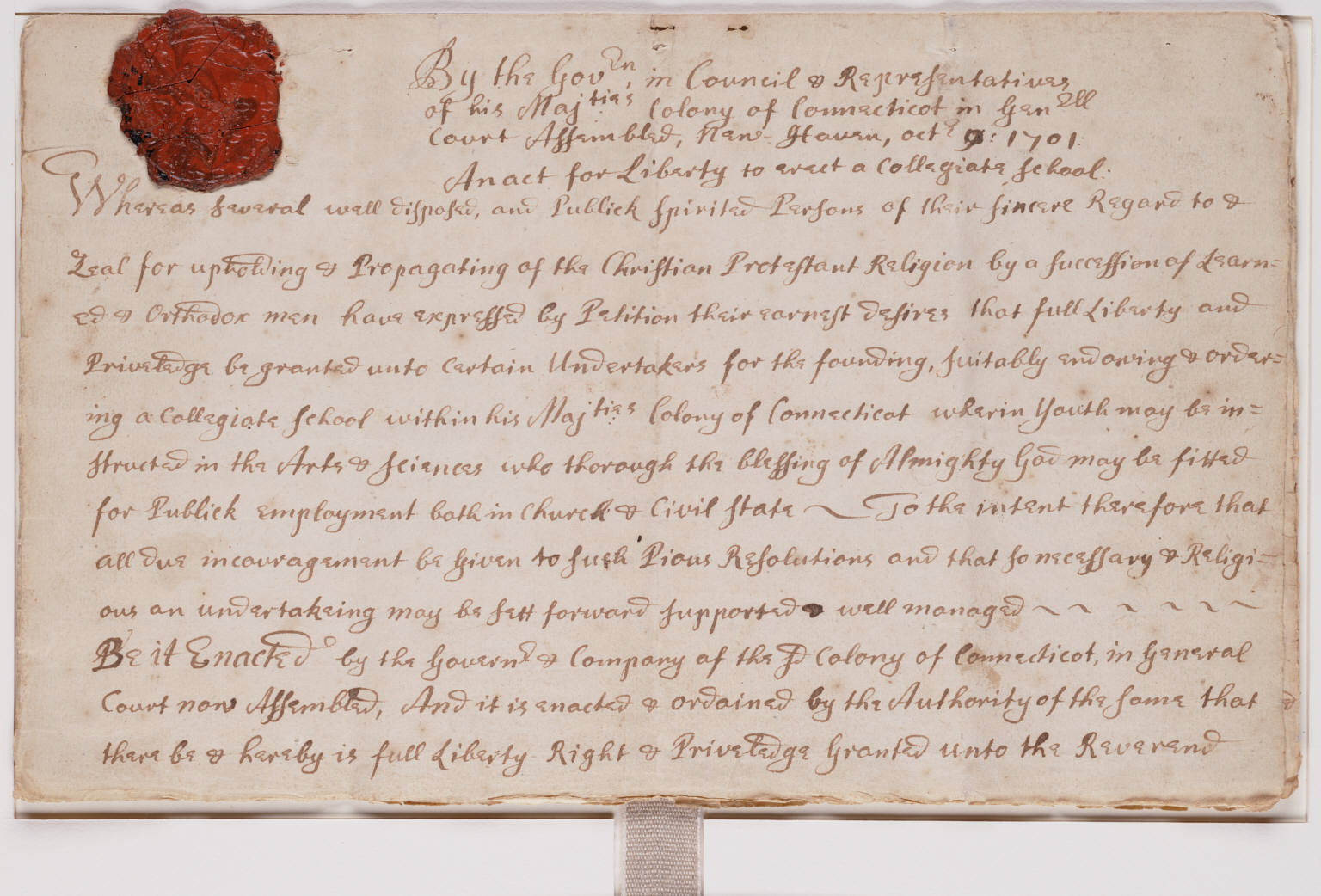

Yale University

Yale University is a private research university in New Haven, Connecticut. Established in 1701 as the Collegiate School, it is the third-oldest institution of higher education in the United States and among the most prestigious in the world. It is a member of the Ivy League. Chartered by the Connecticut Colony, the Collegiate School was established in 1701 by clergy to educate Congregational ministers before moving to New Haven in 1716. Originally restricted to theology and sacred languages, the curriculum began to incorporate humanities and sciences by the time of the American Revolution. In the 19th century, the college expanded into graduate and professional instruction, awarding the first PhD in the United States in 1861 and organizing as a university in 1887. Yale's faculty and student populations grew after 1890 with rapid expansion of the physical campus and scientific research. Yale is organized into fourteen constituent schools: the original undergraduate col ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Permanent Income Hypothesis

The permanent income hypothesis (PIH) is a model in the field of economics to explain the formation of consumption patterns. It suggests consumption patterns are formed from future expectations and consumption smoothing. The theory was developed by Milton Friedman and published in his ''A Theory of Consumption Function'', published in 1957 and subsequently formalized by Robert Hall in a rational expectations model. Originally applied to consumption and income, the process of future expectations is thought to influence other phenomena. In its simplest form, the hypothesis states changes in permanent income (human capital, property, assets), rather than changes in temporary income (unexpected income), are what drive changes in consumption. The formation of consumption patterns opposite to predictions was an outstanding problem faced by the Keynesian orthodoxy. Friedman's predictions of consumption smoothing, where people spread out transitory changes in income over time, departe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Cycle Hypothesis

In economics, the life-cycle hypothesis (LCH) is a model that strives to explain the consumption patterns of individuals. Background The hypothesis Implications Saving and wealth when income and population are stable The effect of population growth The effect of productivity growth Theory and evidence Elderly dissaving is also influenced by the present factors that materially prevent them form the possibility of spending their previous savings. One of them is the loss of the driving license. An extended survey held in 1998, 2000, and 2002 among the U.S. retired citizens highlighted that "about 90% of the trips among people older than age 65 are in a private vehicle" and that driving cessation was highly correlated (46% to 63%, Tobit regression) to a reduction in spending on non basic needs such as trips, tickets, and dinings out. It is also relevant to distinguish elderly poor people in two basic tipologies: people who are poor on income, or those who are poor in terms of b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |