|

Qualified Domestic Institutional Investor

Qualified Domestic Institutional Investor (), also known as QDII, is a scheme relating to the capital market set up to allow financial institutions to invest in offshore markets such as securities and bonds. Similar to QFII (Qualified Foreign Institutional Investor), it is a transitional arrangement which provides limited opportunities for domestic investors to access foreign markets at a stage where a country/territory's currency is not traded or floated completely freely and where capital is not able to move completely freely in and out of the country. QDII in China In People's Republic of China, QDII allows investors to invest in foreign securities markets via certain fund management institutions, insurance companies, securities companies and other assets management institutions which have been approved by China Securities Regulatory Commission ("CSRC"). On 13 April 2006, the Chinese government announced the QDII scheme, allowing Chinese institutions and residents to entrust C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Financial regulators like Securities and Exchange Board of India (SEBI), Bank of England (BoE) and the U.S. Securities and Exchange Commission (SEC) oversee capital markets to protect investors against fraud, among other duties. Transactions on capital markets are generally managed by entities within the financial sector or the treasury departments of governments and corporations, but some can be accessed directly by the public. As an example, in the United States, any American citizen with an internet connection can create an account with TreasuryDirect and use it to buy bonds in the primary market, though sales to individu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Offshore Investment

Offshore investment is the keeping of money in a jurisdiction other than one's country of residence. Offshore jurisdictions are used to pay less tax in many countries by large and small-scale investors. Poorly regulated offshore domiciles have served historically as havens for tax evasion, money laundering, or to conceal or protect illegally acquired money from law enforcement in the investor's country. However, the modern, well-regulated offshore centres allow legitimate investors to take advantage of higher rates of return or lower rates of tax on that return offered by operating via such domiciles. The advantage to offshore investment is that such operations are both legal and less costly than those offered in the investor's country—or "onshore". Locations favored by investors for low rates of tax are known as offshore financial centers or (sometimes) tax havens. Payment of less tax is the driving force behind most 'offshore' activity. Due to the use of offshore centers, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In China

China's banking sector had () in assets at the end of 2020. The "big four/five" state-owned commercial banks are the Bank of China, the China Construction Bank, the Industrial and Commercial Bank of China, and the Agricultural Bank of China, all of which are among the largest banks in the world . The Bank of Communications is sometimes included. Other notable big and also the largest banks in the world are China Merchants Bank and Ping An Bank. History Chinese financial institutions conducted all major banking functions, including the acceptance of deposits, the making of loans, issuing notes, money exchange, and long-distance remittance of money by the Song Dynasty (960-1279). In 1024, the first paper currency was issued by the state in Sichuan. The two major types of indigenous Chinese financial institutions, () and (), more often cooperated than competed in China's financial market. Due to structural weaknesses of traditional Chinese law, Chinese financial instituti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chinese Financial System

The People's Republic of China has an upper middle income developing mixed socialist market economy that incorporates economic planning through industrial policies and strategic five-year plans. —Xu, Chenggang. "The Fundamental Institutions of China’s Reforms and Development." Journal of Economic Literature, vol. 49, no. 4, American Economic Association, 2011, pp. 1076–151, . —Nee, Victor, and Sonja Opper. "Political Capital in a Market Economy." Social Forces, vol. 88, no. 5, Oxford University Press, 2010, pp. 2105–32, . —Shue Tuck Wong & Sun Sheng Han (1998) Whither China's Market Economy? The Case of Lijin Zhen, Geographical Review, 88:1, 29-46, —Gregory C. Chow (2005) The Role of Planning in China's Market Economy, Journal of Chinese Economic and Business Studies, 3:3, 193-203, —HUA, HUANG. "The Market Economy in China." Security Dialogue, vol. 24, no. 2, Sage Publications, Ltd., 1993, pp. 175–79, . —Chow, Gregory C. "Development of a More Market- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of China

The China, People's Republic of China has an upper middle income Developing country, developing Mixed economy, mixed socialist market economy that incorporates economic planning through Industrial policy, industrial policies and strategic Five-year plans of China, five-year plans. —Xu, Chenggang. "The Fundamental Institutions of China’s Reforms and Development." Journal of Economic Literature, vol. 49, no. 4, American Economic Association, 2011, pp. 1076–151, . —Nee, Victor, and Sonja Opper. "Political Capital in a Market Economy." Social Forces, vol. 88, no. 5, Oxford University Press, 2010, pp. 2105–32, . —Shue Tuck Wong & Sun Sheng Han (1998) Whither China's Market Economy? The Case of Lijin Zhen, Geographical Review, 88:1, 29-46, —Gregory C. Chow (2005) The Role of Planning in China's Market Economy, Journal of Chinese Economic and Business Studies, 3:3, 193-203, —HUA, HUANG. "The Market Economy in China." Security Dialogue, vol. 24, no. 2, Sage Publications ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Administration Of Foreign Exchange

The State Administration of Foreign Exchange (SAFE) of the People's Republic of China is an administrative agency under the State Council tasked with drafting rules and regulations governing foreign exchange market activities, and managing the state foreign-exchange reserves, which at the end of December 2016 stood at $3.01 trillion for the People's Bank of China. The current director is Pan Gongsheng. Role SAFE's existence and role were initially closely guarded secrets, its subsidiaries were minor, but the funds under management have increased significantly in recent years. They were responsible for running SAFE's portfolio across the various time zones, replicating the investments of head office in Beijing.Jamil AnderliniChina investment arm emerges from shadows, ''Financial Times'', 5 January 2008 SAFE created and controlled the Central Huijin Investment, but in September 2007, it ceded control to the newly formed sovereign wealth fund, China Investment Corporation. With ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Qualified Foreign Institutional Investor

The Qualified Foreign Institutional Investor () program, one of the first efforts to internationalize the RMB, represents China's effort to allow, on a selective basis, global institutional investors to invest in its RMB denominated capital market. Once licensed, foreign investors are permitted to buy RMB-denominated "A shares" in China's mainland Shanghai and Shenzhen stock exchanges. Thus foreign investors benefit from an opportunity to invest onshore, which is otherwise often insulated from the rest of the world, and subject to capital controls governing the movement of assets in-and-out of the country. Development The program has been in operation for over a decade, and quotas allocating RMB under licenses have expanded steadily. By the end of April 2011, 103 licensed QFII investors had been granted a combined quota of $20.7 billion to invest in China's capital markets under the QFII program, UBS AG currently holds the greatest single share of quota. Foreign access to China ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South China Morning Post

The ''South China Morning Post'' (''SCMP''), with its Sunday edition, the ''Sunday Morning Post'', is a Hong Kong-based English-language newspaper owned by Alibaba Group. Founded in 1903 by Tse Tsan-tai and Alfred Cunningham, it has remained Hong Kong's newspaper of record since British colonial rule. Editor-in-chief Tammy Tam succeeded Wang Xiangwei in 2016. The ''SCMP'' prints paper editions in Hong Kong and operates an online news website. The newspaper's circulation has been relatively stable for years—the average daily circulation stood at 100,000 in 2016. In a 2019 survey by the Chinese University of Hong Kong, the ''SCMP'' was regarded relatively as the most credible paid newspaper in Hong Kong. The ''SCMP'' was owned by Rupert Murdoch's News Corporation from 1986 until it was acquired by Malaysian real estate tycoon Robert Kuok in 1993. On 5 April 2016, Alibaba Group acquired the media properties of the SCMP Group, including the ''SCMP''. In January 2017, former D ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MarketWatch

MarketWatch is a website that provides financial information, business news, analysis, and stock market data. Along with ''The Wall Street Journal'' and ''Barron's'', it is a subsidiary of Dow Jones & Company, a property of News Corp. History The company was conceived as DBC Online by Data Broadcasting Corp. in the fall of 1995. The marketwatch.com domain name was registered on July 30, 1997. The website launched on October 30, 1997, as a 50/50 joint venture between DBC and CBS News run by Larry Kramer and with Thom Calandra as editor-in-chief. In 1999, the company hired David Callaway and in 2003, Callaway became editor-in-chief. In January 1999, during the dot-com bubble, the company became a public company via an initial public offering. After pricing at $17 per share, the stock traded as high as $130 per share on its first day of trading, giving it a market capitalization of over $1 billion despite only $7 million in annual revenues. In June 2000, the company formed a j ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China ( abbr. Hong Kong SAR or HKSAR), is a city and special administrative region of China on the eastern Pearl River Delta in South China. With 7.5 million residents of various nationalities in a territory, Hong Kong is one of the most densely populated places in the world. Hong Kong is also a major global financial centre and one of the most developed cities in the world. Hong Kong was established as a colony of the British Empire after the Qing Empire ceded Hong Kong Island from Xin'an County at the end of the First Opium War in 1841 then again in 1842.. The colony expanded to the Kowloon Peninsula in 1860 after the Second Opium War and was further extended when Britain obtained a 99-year lease of the New Territories in 1898... British Hong Kong was occupied by Imperial Japan from 1941 to 1945 during World War II; British administration resume ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Renminbi

The renminbi (; symbol: ÂĄ; ISO code: CNY; abbreviation: RMB) is the official currency of the People's Republic of China and one of the world's most traded currencies, ranking as the fifth most traded currency in the world as of April 2022. The yuan ( or ) is the basic unit of the renminbi, but the word is also used to refer to the Chinese currency generally, especially in international contexts. One yuan is divided into 10 jiao (), and the jiao is further subdivided into 10 fen (). The renminbi is issued by the People's Bank of China, the monetary authority of China. Valuation Until 2005, the value of the renminbi was pegged to the US dollar. As China pursued its transition from central planning to a market economy and increased its participation in foreign trade, the renminbi was devalued to increase the competitiveness of Chinese industry. It has previously been claimed that the renminbi's official exchange rate was undervalued by as much as 37.5% against its purchas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

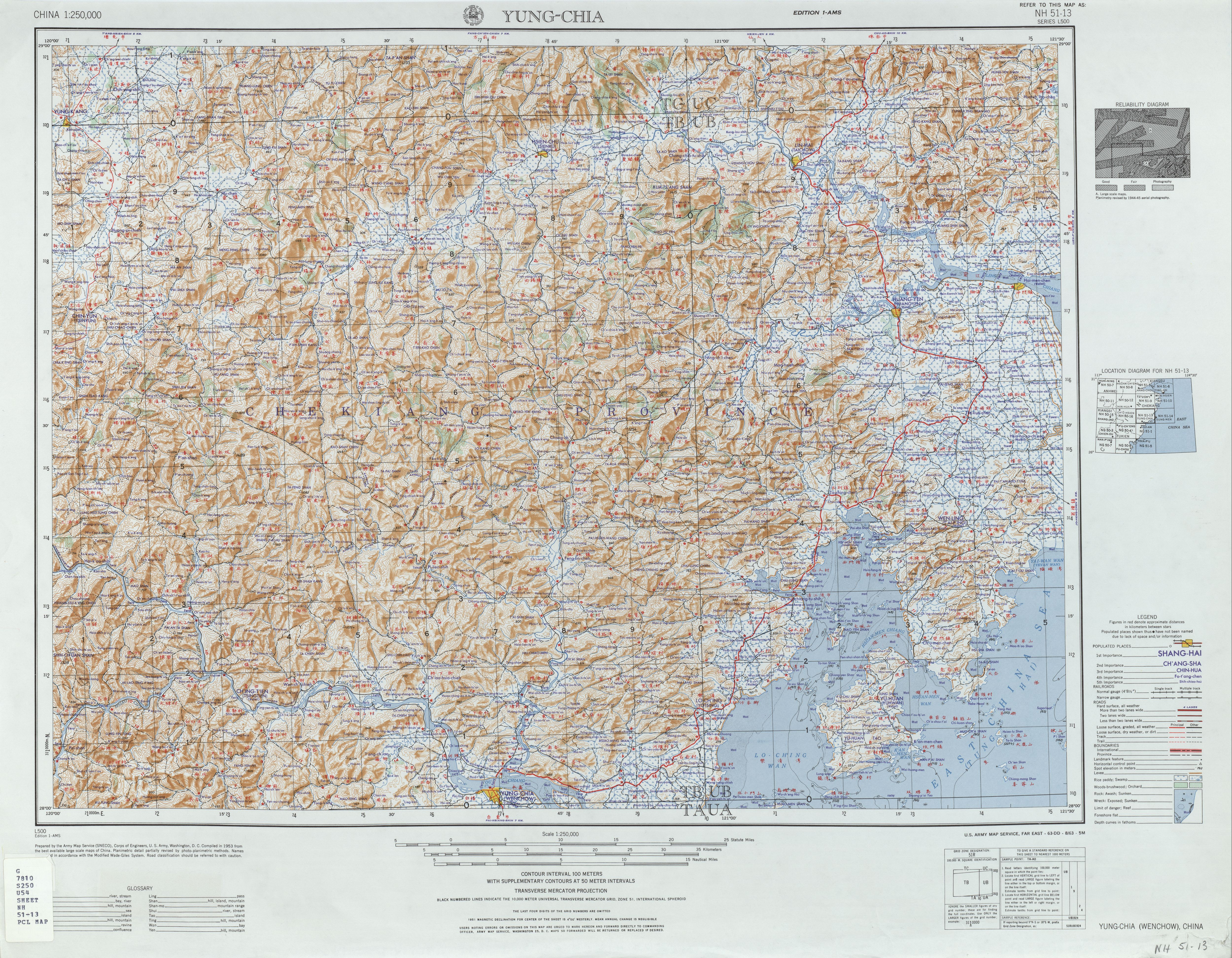

Wenzhou

Wenzhou (pronounced ; Wenzhounese: Yuziou ”y33–11 tÉ•iɤu33–32 ), historically known as Wenchow is a prefecture-level city in southeastern Zhejiang province in the People's Republic of China. Wenzhou is located at the extreme south east of Zhejiang Province with its borders connecting to Lishui on the west, Taizhou on the north, and Fujian to the south. It is surrounded by mountains, the East China Sea, and 436 islands, while its lowlands are almost entirely along its East China Sea coast, which is nearly in length. Most of Wenzhou's area is mountainous as almost 76 percent of its surface area is classified as mountains and hills. It is said that Wenzhou has 7/10 mountains, 1/10 water, and 2/10 farmland. At the time of the 2010 Chinese census, 3,039,500 people lived in Wenzhou's urban area; the area under its jurisdiction (which includes three satellite cities and six counties) held a population of 9,122,100 of which 31.16% are non-local residents from outside of Wenz ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |