|

Queensland Deposit Bank

The Bank of Queensland (branded BOQ) is an Australian retail bank with headquarters in Brisbane, Queensland. The bank is one of the oldest financial institutions in Queensland, having begun as a building society. It now has 163 branches throughout Australia, including 53 corporate branches and 103 "owner managed" branches. In 2021, customer satisfaction with BOQ was rated at 82.9% by Roy Morgan Research. In 2007 customer satisfaction levels were placed at 88%. The bank does not currently have any board directors who are based in Queensland. History A Bank of Queensland was established in 1863. It collapsed in 1866 closing its doors in the severe financial depression known as the Panic of 1866. Another bank took the same name in 1917 but disappeared into the National Bank in 1922. The current Bank of Queensland was established in 1874 as The Brisbane Permanent Benefit Building and Investment Society. It was incorporated in 1887. It amalgamated with City and Suburban Building ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc), i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Virgin Money Australia

Virgin Money Australia is an Australian financial services company owned by Bank of Queensland, and has 150,000 customers. History Foundation In 2003, Virgin Money was launched in Australia with the launch of Virgin Money credit cards. Virgin Money Australia initially launched in partnership with Macquarie Bank, followed by Westpac under a five-year agreement. At the time of Virgin Money's launch in Australia the group company that combined the UK and Australian operations was co-owned by Virgin Group and HHG Group. In 2004 100% ownership of that UK/Australia group company was acquired by Virgin Group for AU$219 million. First products It added superannuation (2005) and home loans (2008) to their product suite. The card was Australia's first no annual fee credit card. The card was marketed as a cheaper option to most other credit cards with up to 55 interest-free days and an interest rate of 12.99% (April 2007). Customers were entitled to offers through the credit card's ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New South Wales

) , nickname = , image_map = New South Wales in Australia.svg , map_caption = Location of New South Wales in AustraliaCoordinates: , subdivision_type = Country , subdivision_name = Australia , established_title = Before federation , established_date = Colony of New South Wales , established_title2 = Establishment , established_date2 = 26 January 1788 , established_title3 = Responsible government , established_date3 = 6 June 1856 , established_title4 = Federation , established_date4 = 1 January 1901 , named_for = Wales , demonym = , capital = Sydney , largest_city = capital , coordinates = , admin_center = 128 local government areas , admin_center_type = Administration , leader_title1 = Monarch , leader_name1 = Charles III , leader_title2 = Governor , leader_name2 = Margaret Beazley , leader_title3 = Premier , leader_name3 = Dominic Perrottet (Liberal) , national_representation = Parliament of Australia , national_representation_type1 = Senat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UFJ Bank

UFJ, which stands for the United Financial of Japan, is used in the former companies of UFJ Bank, UFJ Group, and UFJ Holdings. These related institutions disappeared after the merger of The Bank of Tokyo-Mitsubishi and UFJ Bank in 2005. UFJ Bank itself was established by the merger in 2002 of the Sanwa Bank, Tokai Bank, and Toyo Trust and Banking. See also * Mitsubishi UFJ Financial Group * MUFG Bank is the largest bank in Japan. It was established on January 1, 2006, following the merger of the Bank of Tokyo-Mitsubishi, Ltd. and UFJ Bank Ltd. MUFG is one of the three so-called Japanese "megabanks" (along with SMBC and Mizuho). As such, ... Banks of Japan Mitsubishi UFJ Financial Group {{Japan-company-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of Hawaii

The Bank of Hawaii Corporation ( haw, Panakō o Hawaii; abbreviated BOH) is a regional commercial bank headquartered in Honolulu, Hawaii. It is Hawaii's second oldest bank and its largest locally owned bank in that the majority of the voting stockholders reside within the state. Bank of Hawaii has the most accounts, customers, branches, and ATMs of any financial institution in the state (although BancWest's First Hawaiian Bank holds a greater number of dollars in deposits). The bank consists of four business segments: retail banking, commercial banking, investment services, and treasury. The bank is currently headed by chairman, president and chief executive officer, Peter S. Ho. Beginnings In 1893, Charles Montague Cooke (1849–1909) with his brother-in-law Joseph Ballard Atherton and business partner Peter Cushman Jones founded Bank of Hawaii. In 1897, it was chartered in the Republic of Hawaii by Interior Minister James A. King. A decade after its founding, in 1903, the ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company or daughter company is a company owned or controlled by another company, which is called the parent company or holding company. Two or more subsidiaries that either belong to the same parent company or having a same management being substantially controlled by same entity/group are called sister companies. The subsidiary can be a company (usually with limited liability) and may be a government- or state-owned enterprise. They are a common feature of modern business life, and most multinational corporations organize their operations in this way. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, or Citigroup; as well as more focused companies such as IBM, Xerox, and Microsoft. These, and others, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries. Details Subsidiaries are separate, distinct legal entities f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Stock Exchange

Australian Securities Exchange Ltd or ASX, is an Australian public company that operates Australia's primary securities exchange, the Australian Securities Exchange (sometimes referred to outside of Australia as, or confused within Australia as, The Sydney Stock Exchange, a separate entity). The ASX was formed on 1 April 1987, through incorporation under legislation of the Australian Parliament as an amalgamation of the six state securities exchanges, and merged with the Sydney Futures Exchange in 2006. Today, ASX has an average daily turnover of A$4.685 billion and a market capitalisation of around A$1.6 trillion, making it one of the world's top 20 listed exchange groups. ASX Clear is the clearing house for all shares, structured products, warrants and ASX Equity Derivatives. Overview ASX Group is a market operator, clearing house and payments system facilitator. It also oversees compliance with its operating rules, promotes standards of corporate governance amo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Bank Of Australasia

The National Bank of Australasia was a bank based in Melbourne. It was established in 1858, and in 1982 merged with the Commercial Banking Company of Sydney to form National Australia Bank. History In 1858, Alexander Gibb, a Melbourne gentleman, enlisted Andrew Cruickshank, a local merchant and pastoralist, to raise the capital to establish National Bank of Australasia with headquarters in Melbourne. The legal work establishing the bank was performed by a predecessor of King & Wood Mallesons. Cruickshank became its first chairman while Gibb left after being passed over for the position of General Manager. The bank opened its first branch in South Australia the same year. Expansion to other Australian states followed, with branches opening in Tasmania (1859), Western Australia (1866), New South Wales (1885) and finally Queensland (1920). An early branch established in Mauritius (1859) closed within a year, but a London branch (1864) was established to handle financing and payme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of Queensland (1917–1922)

The Bank of Queensland was a bank in Queensland, Australia. It flourished between 1917 and 1922. It was created by the January 1917 merger of the Royal Bank of Queensland with the Bank of North Queensland. The National Bank was not well represented in Queensland and, intending to expand itself into a truly national institution, bought the Bank of Queensland for cash on 9 January 1922 "for a price corresponding with the actual assets of £520,000". Their offer was accepted by the former shareholders immediately after it was approved by the National Bank's shareholders. Other trading banks named Bank of Queensland ;1863—1866 A Bank of Queensland had been established in London and opened for business in Brisbane on 13 August 1863 in the renovated premises of the former Joint Stock Bank. Caught by the fall-out from the July 1866 collapse of the major London discount house Overend, Gurney and Company Overend, Gurney & Company was a London wholesale discount bank, known as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1866

The Panic of 1866 was an international financial downturn that accompanied the failure of Overend, Gurney and Company in London, and the ''corso forzoso'' abandonment of the silver standard in Italy. In Britain, the economic impacts are held partially responsible for public agitation for political reform in the months leading up to the 1867 Reform Act. The crisis led to a sharp rise in unemployment to 8% and a subsequent fall in wages across the country. Similar to the "knife and fork" motives of Chartism in the late 1830s and 1840s, the financial pressure on the British working class led to rising support for greater representation of the people. Groups such as the Reform League saw rapid increases in membership and the organisation spearheaded multiple demonstrations against the political establishment such as the Hyde Park riot of 1866. Ultimately the popular pressure that arose from the banking crisis and the recession that followed can be held partly responsible for the en ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

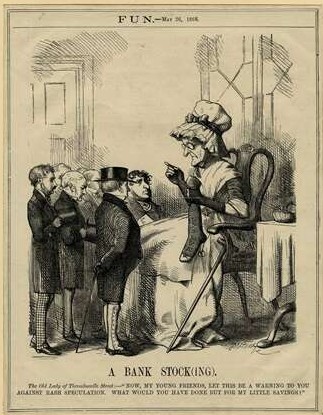

Bank Of Queensland (1863–1866)

The Bank of Queensland was a bank in Queensland, Australia. Established in London it opened for business in Brisbane on 13 August 1863 in the renovated premises of the former Joint Stock Bank. There had been just four (trading) banks established in Queensland by late 1862 but all from other Australian colonies, branches of New South Wales Bank, Union Bank of Australia, Australian Joint Stock Bank and the Bank of Australasia. Branches of the Bank of Queensland were shortly opened at Ipswich, Dalby and Rockhampton as well as at Toowoomba and elsewhere. In the midst of the July 1866 collapse of the major London discount house Overend, Gurney and Company the London board of the Bank of Queensland took the opportunity to announce that a major portion of their bank's capital had been lost by poorly chosen advances made on securities of sheep and cattle stations,The London directors seemed to fail to understand the advances were on livestock and wool to be sold in England but it might ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Roy Morgan Research

Roy Morgan, formerly known as Roy Morgan Research, is an independent Australian social and political market research and public opinion statistics company headquartered in Melbourne, Victoria. It operates nationally as Roy Morgan and internationally as Roy Morgan International. The Morgan Poll, a political poll that tracks voting intentions, is its most well-known product in Australia. Foundation The company was founded in by Roy Morgan (1908–1985) in 1941; its Executive Chairman today is his son, Gary Morgan; CEO is Michele Levine. Commercial performance The company has annual turnover of more than A$40 million, and along with the head office in Melbourne, also has offices in Sydney, Perth and Brisbane as well as offices of Roy Morgan International in Auckland, London, New York City, Princeton and Jakarta. The results are published on their website and by media sources (newspapers, magazines, television, radio, the Internet and online subscription services such as ''Crike ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |