|

Quantitative Investment

Quantitative analysis is the use of mathematical and statistical methods in finance and investment management. Those working in the field are quantitative analysts (quants). Quants tend to specialize in specific areas which may include derivative structuring or pricing, risk management, investment management and other related finance occupations. The occupation is similar to those in industrial mathematics in other industries. The process usually consists of searching vast databases for patterns, such as correlations among liquid assets or price-movement patterns (trend following or mean reversion). Although the original quantitative analysts were "sell side quants" from market maker firms, concerned with derivatives pricing and risk management, the meaning of the term has expanded over time to include those individuals involved in almost any application of mathematical finance, including the buy side. Applied quantitative analysis is commonly associated with quantitative investm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified strike ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "has done more than any other contemporary economist to raise the level of scientific analysis in economic theory". "In a career that spanned seven decades, he transformed his field, influenced millions of students and turned MIT into an economics powerhouse" Economic historian Randall E. Parker has called him the "Father of Modern Economics", and ''The New York Times'' considers him to be the "foremost academic economist of the 20th century". Samuelson was likely the most influential economist of the latter half of the 20th century."Paul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Post-modern Portfolio Theory

Post-Modern Portfolio Theory (PMPT) is an extension of the traditional Modern Portfolio Theory (MPT), an application of mean-variance analysis (MVA). Both theories propose how rational investors can use diversification to optimize their portfolios. History Post-Modern Portfolio Theory was introduced in 1991 by software entrepreneurs Brian M. Rom and Kathleen Ferguson to differentiate the portfolio-construction software developed by their company, Investment Technologies, LLC, from those provided by the traditional modern portfolio theory. It first appeared in the literature in 1993 in an article by Rom and Ferguson in ''The Journal of Performance Measurement''. It combines the theoretical research of many authors and has expanded over several decades as academics at universities in many countries tested these theories to determine whether or not they had merit. The essential difference between PMPT and the modern portfolio theory of Markowitz and Sharpe (MPT) is that PMPT focuses on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability Theory

Probability theory is the branch of mathematics concerned with probability. Although there are several different probability interpretations, probability theory treats the concept in a rigorous mathematical manner by expressing it through a set of axioms. Typically these axioms formalise probability in terms of a probability space, which assigns a measure taking values between 0 and 1, termed the probability measure, to a set of outcomes called the sample space. Any specified subset of the sample space is called an event. Central subjects in probability theory include discrete and continuous random variables, probability distributions, and stochastic processes (which provide mathematical abstractions of non-deterministic or uncertain processes or measured quantities that may either be single occurrences or evolve over time in a random fashion). Although it is not possible to perfectly predict random events, much can be said about their behavior. Two major results in probability ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

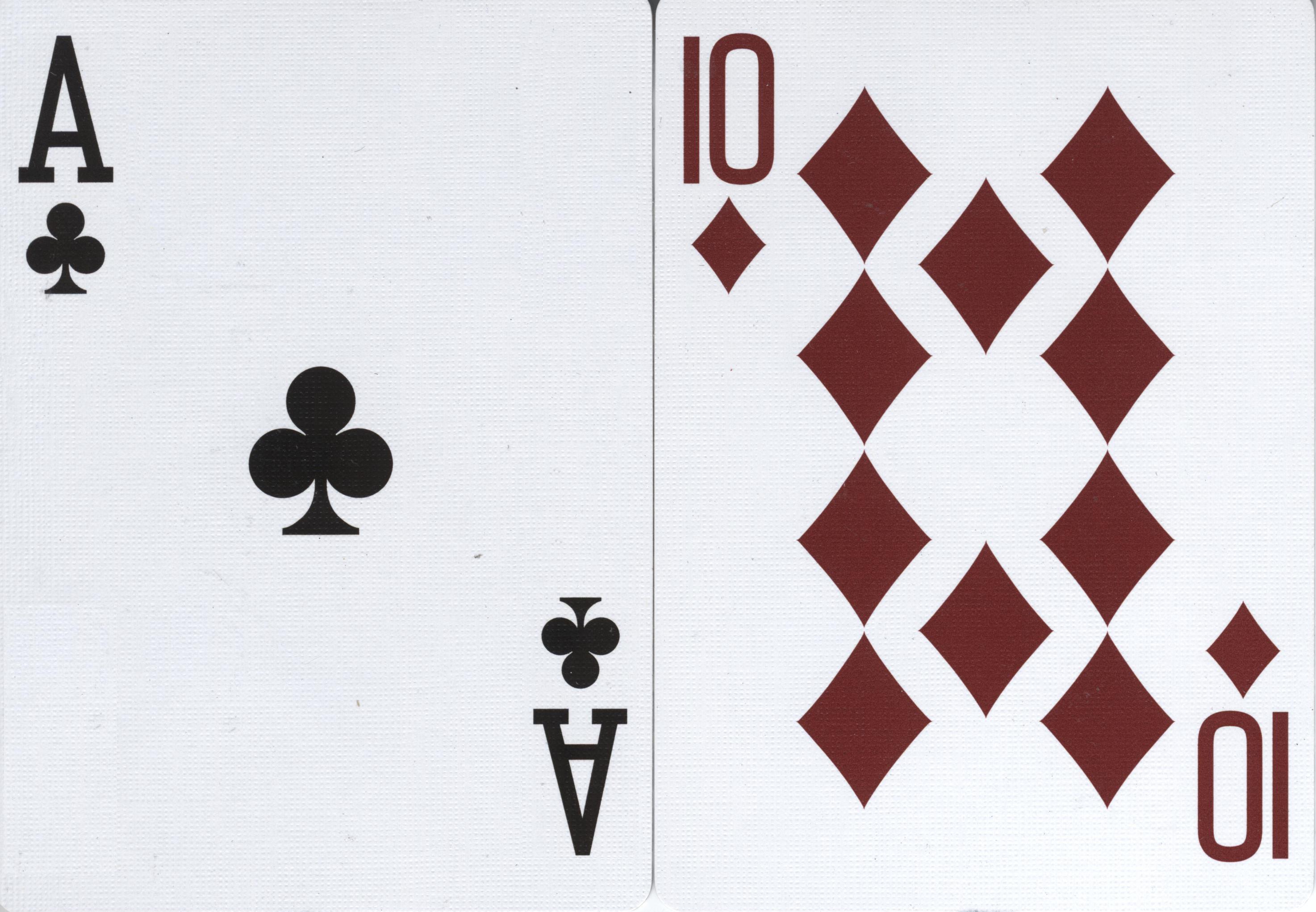

Card Counting

Card counting is a blackjack strategy used to determine whether the player or the dealer has an advantage on the next hand. Card counters are advantage players who try to overcome the casino house edge by keeping a running count of high and low valued cards dealt. They generally bet more when they have an advantage and less when the dealer has an advantage. They also change playing decisions based on the composition of the deck. Basics Card counting is based on statistical evidence that high cards (aces, 10s, and 9s) benefit the player, while low cards, (2s, 3s, 4s, 5s, 6s, and 7s) benefit the dealer. High cards benefit the player in the following ways: # They increase the player's probability of hitting a natural, which often pays out at 3 to 2 odds. # Doubling down increases expected value. The elevated ratio of tens and aces improves the probability that doubling down will succeed.Thorp (1966), pp. 24–27, pp. 41–47, pp. 98–99, pp. 102–103, p. 110, p. 115. # They pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Blackjack

Blackjack (formerly Black Jack and Vingt-Un) is a casino banking game. The most widely played casino banking game in the world, it uses decks of 52 cards and descends from a global family of casino banking games known as Twenty-One. This family of card games also includes the British game of Pontoon, the European game, Vingt-et-Un and the Russian game Ochko. Blackjack players do not compete against each other. The game is a comparing card game where each player competes against the dealer. History Blackjack's immediate precursor was the English version of '' twenty-one'' called ''Vingt-Un'', a game of unknown (but likely Spanish) provenance. The first written reference is found in a book by the Spanish author Miguel de Cervantes. Cervantes was a gambler, and the protagonists of his " Rinconete y Cortadillo", from ''Novelas Ejemplares'', are card cheats in Seville. They are proficient at cheating at ''veintiuna'' (Spanish for "twenty-one") and state that the object of the gam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

University Of California, Irvine

The University of California, Irvine (UCI or UC Irvine) is a public land-grant research university in Irvine, California. One of the ten campuses of the University of California system, UCI offers 87 undergraduate degrees and 129 graduate and professional degrees, and roughly 30,000 undergraduates and 6,000 graduate students are enrolled at UCI as of Fall 2019. The university is classified among " R1: Doctoral Universities – Very high research activity", and had $436.6 million in research and development expenditures in 2018. UCI became a member of the Association of American Universities in 1996. The university was rated as one of the "Public Ivies” in 1985 and 2001 surveys comparing publicly funded universities the authors claimed provide an education comparable to the Ivy League. The university also administers the UC Irvine Medical Center, a large teaching hospital in Orange, and its affiliated health sciences system; the University of California, Irvine, Arboretum; and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Mexico State University

New Mexico State University (NMSU or NM State) is a public land-grant research university based primarily in Las Cruces, New Mexico. Founded in 1888, it is the oldest public institution of higher education in New Mexico and one of the state's two flagship universities, along with the University of New Mexico. NMSU has extension and research centers across the state, including campuses in Alamogordo, Carlsbad, Doña Ana County, and Grants. Initially established as Las Cruces College, NM State was designated a land-grant college in 1898 and subsequently renamed New Mexico College of Agriculture and Mechanic Arts; it received its present name in 1960. NMSU had approximately 21,700 students enrolled as of Fall 2021 and a faculty-to-student ratio of roughly 1 to 16. NMSU offers 28 doctoral degree programs, 58 master's degree programs, and 96 baccalaureate majors. New Mexico State's athletic teams compete at the NCAA Division I level in the Western Athletic Conference except for foot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Edward O

Edward is an English given name A given name (also known as a forename or first name) is the part of a personal name quoted in that identifies a person, potentially with a middle name as well, and differentiates that person from the other members of a group (typically a fa .... It is derived from the Anglo-Saxon name ''Ēadweard'', composed of the elements '' ēad'' "wealth, fortune; prosperous" and ''wikt:weard#Old English, weard'' "guardian, protector”. History The name Edward was very popular in Anglo-Saxon England, but the rule of the House of Normandy, Norman and House of Plantagenet, Plantagenet dynasties had effectively ended its use amongst the upper classes. The popularity of the name was revived when Henry III of England, Henry III named his firstborn son, the future Edward I of England, Edward I, as part of his efforts to promote a cult around Edward the Confessor, for whom Henry had a deep admiration. Variant forms The name has been adopted in the Iberian P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantitative Investing

Quantitative analysis is the use of mathematical and statistical methods in finance and investment management. Those working in the field are quantitative analysts (quants). Quants tend to specialize in specific areas which may include derivative structuring or pricing, risk management, investment management and other related finance occupations. The occupation is similar to those in industrial mathematics in other industries. The process usually consists of searching vast databases for patterns, such as correlations among liquid assets or price-movement patterns (trend following or mean reversion). Although the original quantitative analysts were "sell side quants" from market maker firms, concerned with derivatives pricing and risk management, the meaning of the term has expanded over time to include those individuals involved in almost any application of mathematical finance, including the buy side. Applied quantitative analysis is commonly associated with quantitative investm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Itô Calculus

Itô calculus, named after Kiyosi Itô, extends the methods of calculus to stochastic processes such as Brownian motion (see Wiener process). It has important applications in mathematical finance and stochastic differential equations. The central concept is the Itô stochastic integral, a stochastic generalization of the Riemann–Stieltjes integral in analysis. The integrands and the integrators are now stochastic processes: :Y_t=\int_0^t H_s\,dX_s, where ''H'' is a locally square-integrable process adapted to the filtration generated by ''X'' , which is a Brownian motion or, more generally, a semimartingale. The result of the integration is then another stochastic process. Concretely, the integral from 0 to any particular ''t'' is a random variable, defined as a limit of a certain sequence of random variables. The paths of Brownian motion fail to satisfy the requirements to be able to apply the standard techniques of calculus. So with the integrand a stochastic process, the Itô ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |