|

QIAIF

Qualifying Investor Alternative Investment Fund or QIAIF is a Central Bank of Ireland regulatory classification established in 2013 for Ireland's five tax-free legal structures for holding assets. The Irish Collective Asset-management Vehicle or ICAV is the most popular of the five Irish QIAIF structures, it is the main tax-free structure for foreign investors holding Irish assets. In 2018, the Central Bank of Ireland expanded the Loan Originating QIAIF or L–QIAIF regime which enables the five tax-free structures to be used for closed-end debt instruments. The L–QIAIF is Ireland's main debt–based BEPS tool as it overcomes the lack of confidentiality and tax secrecy of the Section 110 SPV. It is asserted that many assets in QIAIFs and LQIAIFs are Irish assets being shielded from Irish taxation. Irish QIAIFs and LQIAIFs can be integrated with Irish corporate base erosion and profit shifting ("BEPS") tax tools to create confidential routes out of the Irish tax system to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irish Section 110 Special Purpose Vehicle (SPV)

An Irish Section 110 special purpose vehicle (SPV) or section 110 company, is an Irish tax resident company, which qualifies under ''Section 110'' of the '' Irish Taxes Consolidation Act 1997'' (TCA) for a special tax regime that enables the SPV to attain "tax neutrality": i.e. the SPV pays no Irish taxes, VAT, or duties. Section 110 was created in 1997 to help International Financial Services Centre (IFSC) legal and accounting firms compete for the administration of global securitisation deals, and by 2017 was the largest structured finance vehicle in EU securitisation. Section 110 SPVs have made the IFSC the third largest global Shadow Banking OFC. While they pay no Irish tax, they contribute €100 million annually to the Irish economy in fees paid to IFSC legal and accounting firms. In June 2016, it was discovered that US distressed debt funds used Section 110 SPVs, structured by IFSC service firms, to avoid Irish taxes on €80 billion of Irish domestic investments. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Tax In The Republic Of Ireland

Ireland's Corporate Tax System is a central component of Ireland's economy. In 2016–17, foreign firms paid 80% of Irish corporate tax, employed 25% of the Irish labour force (paid 50% of Irish salary tax), and created 57% of Irish OECD non-farm value-add. As of 2017, 25 of the top 50 Irish firms were U.S.–controlled businesses, representing 70% of the revenue of the top 50 Irish firms. By 2018, Ireland had received the most U.S. in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven system. Ireland's "headline" corporation tax rate is 12.5%, however, foreign multinationals pay an aggregate of 2.2–4.5% on global profits "shifted" to Ireland, via Ireland's global network of bilateral tax treaties. These lower effective tax rates are achieved by a complex set of Irish base erosion and profit shifting ("BEPS") tools which handle the largest BEPS flows in the world (e.g. the Double Ir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank Of Ireland

The Central Bank of Ireland ( ga, Banc Ceannais na hÉireann) is Ireland's central bank, and as such part of the European System of Central Banks (ESCB). It is the country's financial services regulator for most categories of financial firms. It was the issuer of Irish pound banknotes and coinage until the introduction of the Euro currency, and now provides this service for the European Central Bank. The Central Bank of Ireland was founded on 1 February 1943, and since 1 January 1972 has been the banker of the Government of Ireland in accordance with the Central Bank Act 1971, which can be seen in legislative terms as completing the long transition from a currency board to a fully functional central bank. Its head office, the Central Bank of Ireland building, was located on Dame Street, Dublin from 1979 until 2017. Its offices at Iveagh Court and College Green also closed down at the same time. Since March 2017, its headquarters are located on North Wall Quay, where the pu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

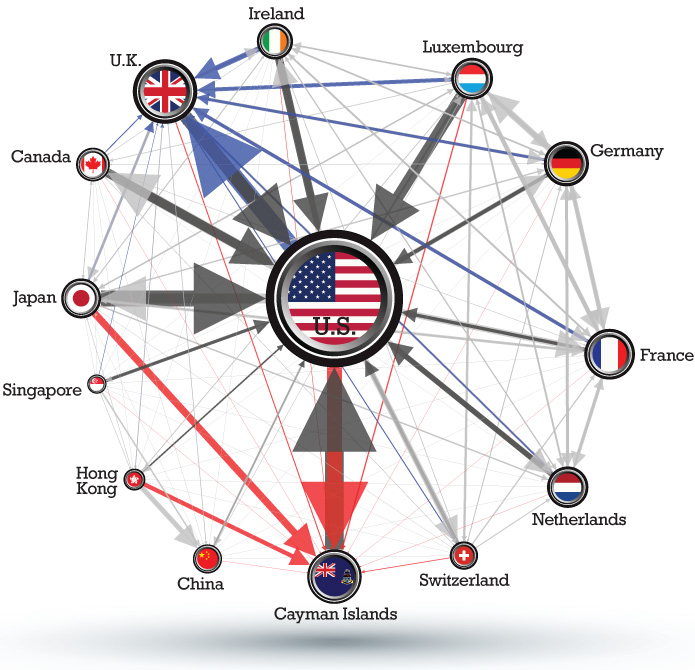

Corporate Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Financial Services Centre

The International Financial Services Centre (IFSC) is an area of central Dublin and part of the CBD established in the 1980s as an urban regeneration area and special economic zone (SEZ) on the derelict state-owned former port authority lands of the reclaimed North Wall and George's Dock areas of the Dublin Docklands. The term has become a metonym for the Irish financial services industry as well as being used as an address and still being classified as an SEZ. It officially began in 1987 as an SEZ on an docklands site in central Dublin, with EU approval to apply a 10% corporate tax rate for "designated financial services activities". Before the expiry of this EU approval in 2005, the Irish Government legislated to effectively have a national flat rate by reducing the overall Irish corporate tax rate from 32% to 12.5% which was finally introduced in 2003. An additional primary goal of the IFSC was to assist the urban renewal and development programme of the North Wall ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Offshore Financial Centre

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy." "Offshore" does not refer to the location of the OFC, since many Financial Stability Forum– IMF OFCs, such as Delaware, South Dakota, Singapore, Luxembourg and Hong Kong, are located "onshore", but to the fact that the largest users of the OFC are non-resident, i.e. "offshore". The IMF lists OFCs as a third class of financial centre, with international financial centres (IFCs), and regional financial centres (RFCs); there is overlap (e.g. Singapore is an RFC and an OFC). The Caribbean, including the Cayman Islands, the British Virgin Islands and Bermuda, has several major OFCs, facilitating many billions of dollars worth of trade and investment globally. During April–June 2000, the Financial Stability Forum–International Monetary Fund produced the first l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Common Contractual Fund

A common contractual fund (CCF) is a collective investment scheme structure in Ireland introduced by the European Communities UCITS Regulations, 2003. The CCF is an unincorporated body established by a management company under which the participants by contractual arrangements participate and share in the property of the fund as co-owners (specifically tenants in common). It is modelled on the Luxembourg Fonds commun de placement or ''FCP'' structure. Although the CCF could only be established as a UCITS when it was originally introduced in 2003, a non UCITS CCF can now be established pursuant to the ''Investment Funds, Companies and Miscellaneous Provisions Act 2005'', which was enacted in June 2005. Purpose for establishing a CCF structure in Ireland The majority of pension funds are entitled to favourable withholding tax treatment on investments. For instance, in the Netherlands, exempt Dutch pension funds qualify for a 0% withholding tax in the US in respect of dividend ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Matheson (law Firm)

Matheson (previously Matheson Ormsby Prentice), is an Irish law firm partnership based in the IFSC in Dublin, which specialises in multinational tax schemes (e.g. for clients in Ireland such as Microsoft, Google and Abbot), and tax structuring of special purpose vehicles (e.g. Section 110 securitisation SPVs). Matheson is estimated to be Ireland's largest corporate law firm. Matheson state in the International Tax Review that their tax department is: "significantly the largest tax practice group amongst Irish law firms". Development While Matheson's website traces their history back to 1825 and notes that their offices were burnt in the Irish Easter Rising of 1916, it wasn't until after the creation and initial development of Dublin's International Financial Services Centre (or IFSC) that Matheson emerged as a small but standalone law firm with 14 partners and over 50 solicitors (or lawyers) in 1991. It moved to its current IFSC offices, 70 Sir John Rogerson's Quay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dublin Office Sales Price Versus EU-28 (2016)

Dublin (; , or ) is the capital and largest city of Ireland. On a bay at the mouth of the River Liffey, it is in the province of Leinster, bordered on the south by the Dublin Mountains, a part of the Wicklow Mountains range. At the 2016 census it had a population of 1,173,179, while the preliminary results of the 2022 census recorded that County Dublin as a whole had a population of 1,450,701, and that the population of the Greater Dublin Area was over 2 million, or roughly 40% of the Republic of Ireland's total population. A settlement was established in the area by the Gaels during or before the 7th century, followed by the Vikings. As the Kingdom of Dublin grew, it became Ireland's principal settlement by the 12th century Anglo-Norman invasion of Ireland. The city expanded rapidly from the 17th century and was briefly the second largest in the British Empire and sixth largest in Western Europe after the Acts of Union in 1800. Following independence in 1922, Dublin becam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stephen Donnelly 2016

Stephen or Steven is a common English first name. It is particularly significant to Christians, as it belonged to Saint Stephen ( grc-gre, Στέφανος ), an early disciple and deacon who, according to the Book of Acts, was stoned to death; he is widely regarded as the first martyr (or "protomartyr") of the Christian Church. In English, Stephen is most commonly pronounced as ' (). The name, in both the forms Stephen and Steven, is often shortened to Steve or Stevie. The spelling as Stephen can also be pronounced which is from the Greek original version, Stephanos. In English, the female version of the name is Stephanie. Many surnames are derived from the first name, including Stephens, Stevens, Stephenson, and Stevenson, all of which mean "Stephen's (son)". In modern times the name has sometimes been given with intentionally non-standard spelling, such as Stevan or Stevon. A common variant of the name used in English is Stephan ; related names that have found some curre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dublin Office Sales Price, As A Multiple Of Cost Of Build, Versus EU-28 (2016)

Dublin (; , or ) is the capital and largest city of Ireland. On a bay at the mouth of the River Liffey, it is in the province of Leinster, bordered on the south by the Dublin Mountains, a part of the Wicklow Mountains range. At the 2016 census it had a population of 1,173,179, while the preliminary results of the 2022 census recorded that County Dublin as a whole had a population of 1,450,701, and that the population of the Greater Dublin Area was over 2 million, or roughly 40% of the Republic of Ireland's total population. A settlement was established in the area by the Gaels during or before the 7th century, followed by the Vikings. As the Kingdom of Dublin grew, it became Ireland's principal settlement by the 12th century Anglo-Norman invasion of Ireland. The city expanded rapidly from the 17th century and was briefly the second largest in the British Empire and sixth largest in Western Europe after the Acts of Union in 1800. Following independence in 1922, Dublin becam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)