|

Price Of Anarchy In Auctions

The Price of Anarchy (PoA) is a concept in game theory and mechanism design that measures how the social welfare of a system degrades due to selfish behavior of its agents. It has been studied extensively in various contexts, particularly in auctions. In an auction, there are one or more items and one or more agents with different valuations for the items. The items have to be divided among the agents. It is desired that the ''social welfare'' - the sum of values of all agents - be as high as possible. One approach to maximizing the social welfare is designing a truthful mechanism. In such a mechanism, each agent is incentivized to report his true valuations to the items. Then, the auctioneer can calculate and implement an allocation that maximizes the sum of values. An example to such a mechanism is the VCG auction. In practice, however, it is not always feasible to use truthful mechanisms. The VCG mechanism, for example, might be too complicated for the participants to under ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Of Anarchy

The Price of Anarchy (PoA) is a concept in economics and game theory that measures how the efficiency of a system degrades due to selfish behavior of its agents. It is a general notion that can be extended to diverse systems and notions of efficiency. For example, consider the system of transportation of a city and many agents trying to go from some initial location to a destination. Let efficiency in this case mean the average time for an agent to reach the destination. In the 'centralized' solution, a central authority can tell each agent which path to take in order to minimize the average travel time. In the 'decentralized' version, each agent chooses its own path. The Price of Anarchy measures the ratio between average travel time in the two cases. Usually the system is modeled as a game and the efficiency is some function of the outcomes (e.g. maximum delay in a network, congestion in a transportation system, social welfare in an auction, etc.). Different concepts of equilib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Submodular Set Function

In mathematics, a submodular set function (also known as a submodular function) is a set function whose value, informally, has the property that the difference in the incremental value of the function that a single element makes when added to an input set decreases as the size of the input set increases. Submodular functions have a natural diminishing returns property which makes them suitable for many applications, including approximation algorithms, game theory (as functions modeling user preferences) and electrical networks. Recently, submodular functions have also found immense utility in several real world problems in machine learning and artificial intelligence, including automatic summarization, multi-document summarization, feature selection, active learning, sensor placement, image collection summarization and many other domains. Definition If \Omega is a finite set, a submodular function is a set function f:2^\rightarrow \mathbb, where 2^\Omega denotes the power ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unit Demand

In economics, a unit demand agent is an agent who wants to buy a single item, which may be of one of different types. A typical example is a buyer who needs a new car. There are many different types of cars, but usually a buyer will choose only one of them, based on the quality and the price. If there are ''m'' different item-types, then a unit-demand valuation function is typically represented by ''m'' values v_1,\dots,v_m, with v_j representing the subjective value that the agent derives from item j. If the agent receives a set A of items, then his total utility is given by: :u(A)=\max_v_j since he enjoys the most valuable item from A and ignores the rest. Therefore, if the price of item j is p_j, then a unit-demand buyer will typically want to buy a single item – the item j for which the net utility v_j - p_j is maximized. Ordinal and cardinal definitions A unit-demand valuation is formally defined by: * For a preference relation: for every set B there is a subset A\subsete ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Additive Set Function

In mathematics, an additive set function is a function mapping sets to numbers, with the property that its value on a union of two disjoint sets equals the sum of its values on these sets, namely, \mu(A \cup B) = \mu(A) + \mu(B). If this additivity property holds for any two sets, then it also holds for any finite number of sets, namely, the function value on the union of ''k'' disjoint sets (where ''k'' is a finite number) equals the sum of its values on the sets. Therefore, an additive set function is also called a finitely-additive set function (the terms are equivalent). However, a finitely-additive set function might not have the additivity property for a union of an ''infinite'' number of sets. A σ-additive set function is a function that has the additivity property even for countably infinite many sets, that is, \mu\left(\bigcup_^\infty A_n\right) = \sum_^\infty \mu(A_n). Additivity and sigma-additivity are particularly important properties of measures. They are abstr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diminishing Returns

In economics, diminishing returns are the decrease in marginal (incremental) output of a production process as the amount of a single factor of production is incrementally increased, holding all other factors of production equal ( ceteris paribus). The law of diminishing returns (also known as the law of diminishing marginal productivity) states that in productive processes, increasing a factor of production by one unit, while holding all other production factors constant, will at some point return a lower unit of output per incremental unit of input. The law of diminishing returns does not cause a decrease in overall production capabilities, rather it defines a point on a production curve whereby producing an additional unit of output will result in a loss and is known as negative returns. Under diminishing returns, output remains positive, however productivity and efficiency decrease. The modern understanding of the law adds the dimension of holding other outputs equal, since ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

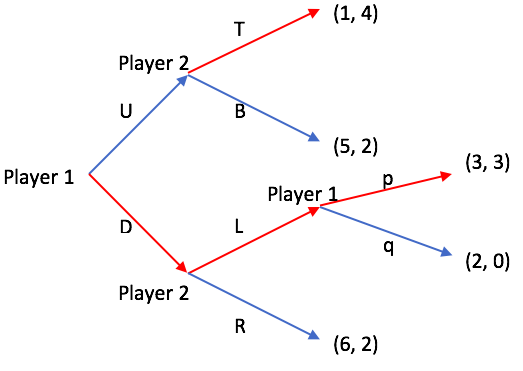

Subgame Perfect Equilibrium

In game theory, a subgame perfect equilibrium (or subgame perfect Nash equilibrium) is a refinement of a Nash equilibrium used in dynamic games. A strategy profile is a subgame perfect equilibrium if it represents a Nash equilibrium of every subgame of the original game. Informally, this means that at any point in the game, the players' behavior from that point onward should represent a Nash equilibrium of the continuation game (i.e. of the subgame), no matter what happened before. Every finite extensive game with perfect recall has a subgame perfect equilibrium. Perfect recall is a term introduced by Harold W. Kuhn in 1953 and ''"equivalent to the assertion that each player is allowed by the rules of the game to remember everything he knew at previous moves and all of his choices at those moves"''. A common method for determining subgame perfect equilibria in the case of a finite game is backward induction. Here one first considers the last actions of the game and determine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sequential Auction

A sequential auction is an auction in which several items are sold, one after the other, to the same group of potential buyers. In a ''sequential first-price auction'' (SAFP), each individual item is sold using a first price auction, while in a ''sequential second-price auction'' (SASP), each individual item is sold using a second price auction. A sequential auction differs from a combinatorial auction, in which many items are auctioned simultaneously and the agents can bid on bundles of items. A sequential auction is much simpler to implement and more common in practice. However, the bidders in each auction know that there are going to be future auctions, and this may affect their strategic considerations. Here are some examples. Example 1. There are two items for sale and two potential buyers: Alice and Bob, with the following valuations: * Alice values each item as 5, and both items as 10 (i.e., her valuation is additive). * Bob values each item as 4, and both items as 4 (i.e., ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross-substitute Valuations

In economics, gross substitutes (GS) is a class of utility functions on indivisible goods. An agent is said to ''have a GS valuation'' if, whenever the prices of some items increase and the prices of other items remain constant, the agent's demand for the items whose price remain constant weakly increases. An example is shown on the right. The table shows the valuations (in dollars) of Alice and Bob to the four possible subsets of the set of two items: . Alice's valuation is GS, but Bob's valuation is not GS. To see this, suppose that initially both apple and bread are priced at $6. Bob's optimal bundle is apple+bread, since it gives him a net value of $3. Now, the price of bread increases to $10. Now, Bob's optimal bundle is the empty bundle, since all other bundles give him negative net value. So Bob's demand to apple has decreased, although only the price of bread has increased. The GS condition was introduced by Kelso and Crawford in 1982 and was greatly publicized by Gul an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First Welfare Theorem

There are two fundamental theorems of welfare economics. The first states that in economic equilibrium, a set of complete markets, with complete information, and in perfect competition, will be Pareto optimal (in the sense that no further exchange would make one person better off without making another worse off). The requirements for perfect competition are these: # There are no externalities and each actor has perfect information. # Firms and consumers take prices as given (no economic actor or group of actors has market power). The theorem is sometimes seen as an analytical confirmation of Adam Smith's "invisible hand" principle, namely that ''competitive markets ensure an efficient allocation of resources''. However, there is no guarantee that the Pareto optimal market outcome is socially desirable, as there are many possible Pareto efficient allocations of resources differing in their desirability (e.g. one person may own everything and everyone else nothing). The second ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Walrasian Equilibrium

Competitive equilibrium (also called: Walrasian equilibrium) is a concept of economic equilibrium introduced by Kenneth Arrow and Gérard Debreu in 1951 appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated. Definitions A competitive equilibrium (CE) consists of two elements: * A price function P. It takes as argument a vector representing a bundle of commodities, and returns a positive real number that represents its price. Usually the price function is linear - it is represented as a vector of prices, a price for each commodity type. * An allocation m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First-price Sealed-bid Auction

A first-price sealed-bid auction (FPSBA) is a common type of auction. It is also known as blind auction. In this type of auction, all bidders simultaneously submit sealed bids so that no bidder knows the bid of any other participant. The highest bidder pays the price that was submitted. Strategic analysis In a FPSBA, each bidder is characterized by their monetary valuation of the item for sale. Suppose Alice is a bidder and her valuation is a. Then, if Alice is rational: *She will never bid more than a, because bidding more than a can only make her lose net value. *If she bids exactly a, then she will not lose but also not gain any positive value. *If she bids less than a, then she ''may'' have some positive gain, but the exact gain depends on the bids of the others. Alice would like to bid the smallest amount that can make her win the item, as long as this amount is less than a. For example, if there is another bidder Bob and he bids y and y [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Correlated Equilibrium

In game theory, a correlated equilibrium is a solution concept that is more general than the well known Nash equilibrium. It was first discussed by mathematician Robert Aumann in 1974. The idea is that each player chooses their action according to their private observation of the value of the same public signal. A strategy assigns an action to every possible observation a player can make. If no player would want to deviate from their strategy (assuming the others also don't deviate), the distribution from which the signals are drawn is called a correlated equilibrium. Formal definition An N-player strategic game \displaystyle (N,A_i,u_i) is characterized by an action set A_i and utility function u_i for each player i. When player i chooses strategy a_i \in A_i and the remaining players choose a strategy profile described by the N-1-tuple a_, then player i's utility is \displaystyle u_i(a_i,a_). A ''strategy modification'' for player i is a function \phi_i\colon A_i \to A_i. Tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |