|

Pre-qualification Questionnaires

In general, to pre-qualify is about passing or meeting an initial criteria or requirements before getting other opportunities opened up to such a person. Pre-qualification is a process whereby a loan officer takes information from a borrower and makes a tentative assessment of how much the lending institution is willing to lend them. Basic process The borrower is typically asked for their social security number or another identifier, together with proof of their employment, income, and assets, which is weighed against the monthly payments being made on their current debts. This provides a general picture of their creditworthiness. Based on this initial information, a maximum loan amount will be determined according to a standard Debt-to-income ratio (DTI). Final approval of the loan will require a credit report from a credit bureau Mortgage In a mortgage context, pre-qualification denotes a process that has not yet been underwritten by the lending institution. Typically, subprime ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Underwritten

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liability arising from such guarantee. An underwriting arrangement may be created in a number of situations including insurance, issues of security in a public offering, and bank lending, among others. The person or institution that agrees to sell a minimum number of securities of the company for commission is called the underwriter. History The term "underwriting" derives from the Lloyd's of London insurance market. Financial backers (or risk takers), who would accept some of the risk on a given venture (historically a sea voyage with associated risks of shipwreck) in exchange for a premium, would literally write their names under the risk information that was written on a Lloyd's slip created for this purpose. Securities underwriting In th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subprime

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subprime borrowers were defined as having FICO scores below 600, although this threshold has varied over time. These loans are characterized by higher interest rates, poor quality collateral, and less favorable terms in order to compensate for higher credit risk. Many subprime loans were packaged into mortgage-backed securities (MBS) and ultimately defaulted, contributing to the financial crisis of 2007–2008.Lemke, Lins and Picard, ''Mortgage-Backed Securities'', Chapter 3 (Thomson West, 2013 ed.). Defining subprime risk The term ''subprime'' refers to the credit quality of particular borrowers, who have weakened credit histories and a greater risk of loan default than prime borrowers. As people become economically active, records are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

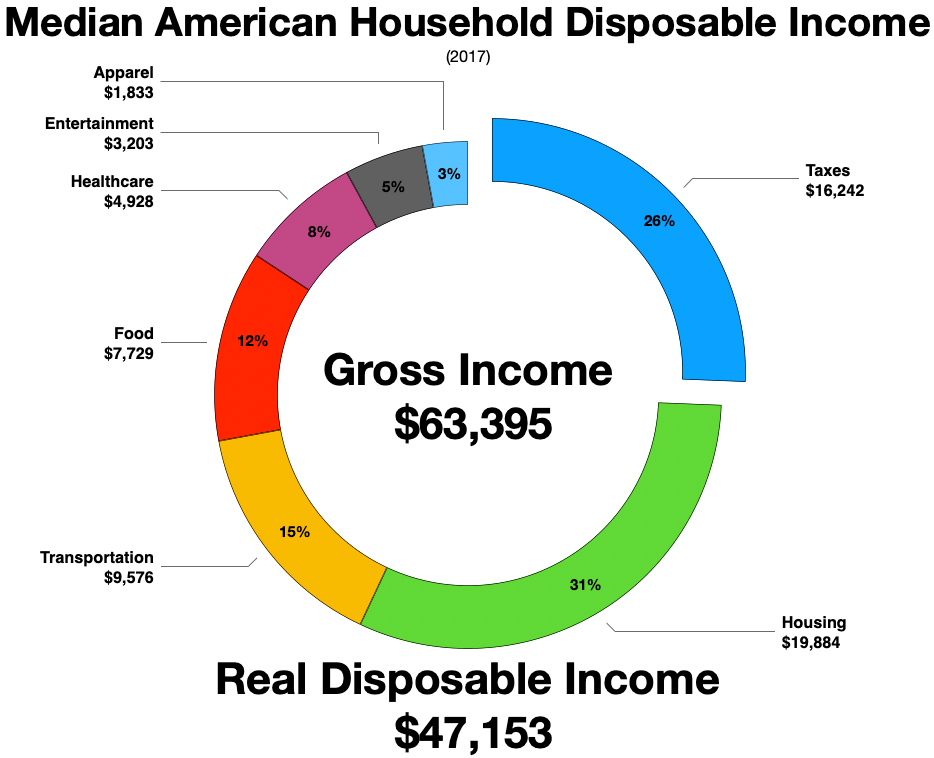

Gross Disposable Income

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income. Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents’ living and care arrangements. The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%. For the purposes of calculating the amount of income subject to garnishments, United States' federal law defin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Line Of Credit

A line of credit is a credit facility extended by a bank or other financial institution to a government, business or individual customer that enables the customer to draw on the facility when the customer needs funds. A line of credit takes several forms, such as an overdraft limit, demand loan, special purpose, export packing credit, term loan, discounting, purchase of commercial bills, traditional revolving credit card account, etc. It is effectively a source of funds that can readily be tapped at the borrower's discretion. Interest In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distin ... is paid only on money actually withdrawn. Lines of credit can be secured by collateral, or may be unsecured. Lines of credit are often extended by banks, financial institutions and other license ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan-to-value Ratio

The loan-to-value (LTV) ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. In Real estate, the term is commonly used by banks and building societies to represent the ratio of the first mortgage line as a percentage of the total appraised value of real property. For instance, if someone borrows to purchase a house worth , the LTV ratio is or , or 87%. The remaining 13% represent the lender's haircut, adding up to 100% and being covered from the borrower's equity. The higher the LTV ratio, the riskier the loan is for a lender. The valuation of a property is typically determined by an appraiser, but a better measure is an arms-length transaction between a willing buyer and a willing seller. Typically, banks will utilize the lesser of the appraised value and purchase price if the purchase is "recent" (within 1–2 years). Risk Loan to value is one of the key risk factors that lenders assess when qualifying borrowers fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Score

A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bureaus. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers and to mitigate losses due to bad debt. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits. Lenders also use credit scores to determine which customers are likely to bring in the most revenue. Credit scoring is not limited to banks. Other organizations, such as mobile phone companies, insurance companies, landlords, and government departments employ the same techniques. Digital finance companies such as online lenders also use alternative data sources to calculate the creditworthiness of borrowers. By country Australia In Australia, cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash-out

Cash out refinancing (in the case of real property) occurs when a loan is taken out on property already owned, and the loan amount is above and beyond the cost of transaction, payoff of existing liens, and related expenses. Definition Strictly speaking, all refinancing of debt is "cash-out," when funds retrieved are utilized for anything other than repaying an existing loan. In the case of common usage of the term, cash out refinancing occurs when equity is liquidated from a property above and beyond sum of the payoff of existing loans held in lien on the property, loan fees, costs associated with the loan, taxes, insurance, tax reserves, insurance reserves, and in the past any other non-lien debt held in the name of the owner being paid by loan proceeds. Example of cash out refinancing A homeowner who owes $80,000 on a home valued at $200,000 has $120,000 in equity. This equity can be liquidated with a cash-out refinance loan providing the loan is larger than $80,000. The total ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, and the term ''bankruptcy'' is therefore not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian ''banca rotta'', literally meaning "broken bank". The term is often described as having originated in renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment so that the public could see that the banker, the owner of the bench, was no longer in a condition to continue his business, although some dismiss this as a false etymology. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan. Formally, a mortgage lender (mortgagee), or other lienholder, obtains a termination of a mortgage borrower (mortgagor)'s equitable right of redemption, either by court order or by operation of law (after following a specific statutory procedure). Usually a lender obtains a security interest from a borrower who mortgages or pledges an asset like a house to secure the loan. If the borrower defaults and the lender tries to repossess the property, courts of equity can grant the borrower the equitable right of redemption if the borrower repays the debt. While this equitable right exists, it is a cloud on title and the lender cannot be sure that they can repossess the property. Therefore, through the process of foreclosure, the lender seeks to immediatel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form W-2

Form W-2 (officially, the "Wage and Tax Statement") is an Internal Revenue Service (IRS) tax form used in the United States to report wages paid to employees and the taxes withheld from them. Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship. An employer must mail out the Form W-2 to employees on or before January 31. This deadline gives these taxpayers about 2 months to prepare their returns before the April 15 income tax due date. The form is also used to report FICA taxes to the Social Security Administration. The Form W-2, along with Form W-3, generally must be filed by the employer with the Social Security Administration by the end of February. Relevant amounts on Form W-2 are reported by the Social Security Administration to the Internal Revenue Service. In territories, the W-2 is issued with a two letter code indicating which territory, such as W-2GU for Guam. If corrections a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)