|

Petroleum Royalties (Relief) Act 1983

The Petroleum Royalties (Relief) Act 1983 (c. 59) is an Act of the Parliament of the United Kingdom which exempted certain petroleum licence holders of new offshore oil and gas fields from the payment of petroleum royalties or the delivery of petroleum. Background In the Budget statement in 1983 the Chancellor of the Exchequer announced changes to the taxation in the oil industry. He noted that Government had a responsibility to compare the likely returns from future development both to the Government and to the industry, and had to ensure that the country obtained the appropriate benefit. The demarcation line between the direct benefit to the nation and the benefit to the oil and gas industry work was such that, after the Budget measures and taxation proposals and the measures in this Act the nation would obtain the majority of the benefit. Petroleum revenue tax was 75 per cent, and corporation tax was 52 per cent. The measures in this Act meant that benefit from other dis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Act Of Parliament

Acts of Parliament, sometimes referred to as primary legislation, are texts of law passed by the Legislature, legislative body of a jurisdiction (often a parliament or council). In most countries with a parliamentary system of government, acts of parliament begin as a Bill (law), bill, which the legislature votes on. Depending on the structure of government, this text may then be subject to assent or approval from the Executive (government), executive branch. Bills A draft act of parliament is known as a Bill (proposed law), bill. In other words, a bill is a proposed law that needs to be discussed in the parliament before it can become a law. In territories with a Westminster system, most bills that have any possibility of becoming law are introduced into parliament by the government. This will usually happen following the publication of a "white paper", setting out the issues and the way in which the proposed new law is intended to deal with them. A bill may also be introduced in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Parliament Of The United Kingdom

The Parliament of the United Kingdom is the supreme legislative body of the United Kingdom, the Crown Dependencies and the British Overseas Territories. It meets at the Palace of Westminster, London. It alone possesses legislative supremacy and thereby ultimate power over all other political bodies in the UK and the overseas territories. Parliament is bicameral but has three parts, consisting of the sovereign ( King-in-Parliament), the House of Lords, and the House of Commons (the primary chamber). In theory, power is officially vested in the King-in-Parliament. However, the Crown normally acts on the advice of the prime minister, and the powers of the House of Lords are limited to only delaying legislation; thus power is ''de facto'' vested in the House of Commons. The House of Commons is an elected chamber with elections to 650 single-member constituencies held at least every five years under the first-past-the-post system. By constitutional convention, all governme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

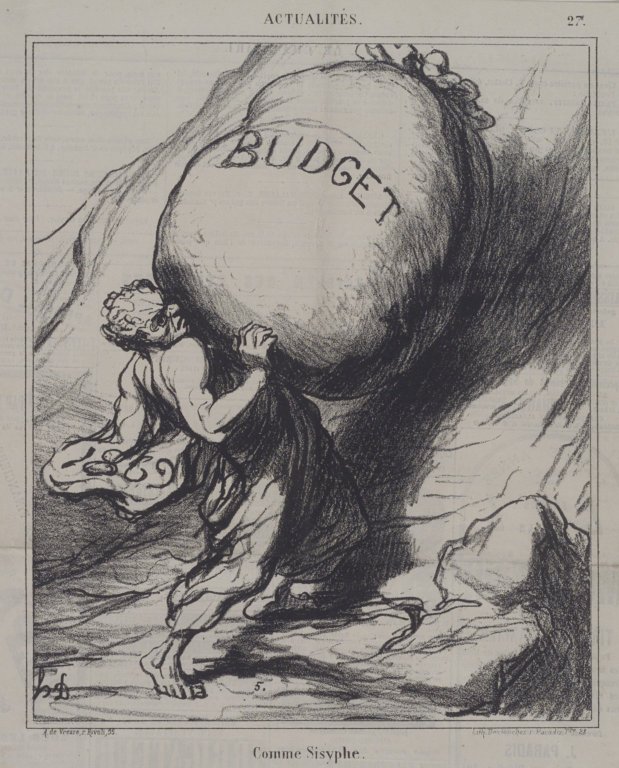

Budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budget, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chancellor Of The Exchequer

The chancellor of the Exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and head of His Majesty's Treasury. As one of the four Great Offices of State, the Chancellor is a high-ranking member of the British Cabinet. Responsible for all economic and financial matters, the role is equivalent to that of a finance minister in other countries. The chancellor is now always Second Lord of the Treasury as one of at least six lords commissioners of the Treasury, responsible for executing the office of the Treasurer of the Exchequer the others are the prime minister and Commons government whips. In the 18th and early 19th centuries, it was common for the prime minister also to serve as Chancellor of the Exchequer if he sat in the Commons; the last Chancellor who was simultaneously prime minister and Chancellor of the Exchequer was Stanley Baldwin in 1923. Formerly, in cases when the chancellorship was vacant, the L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corporate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

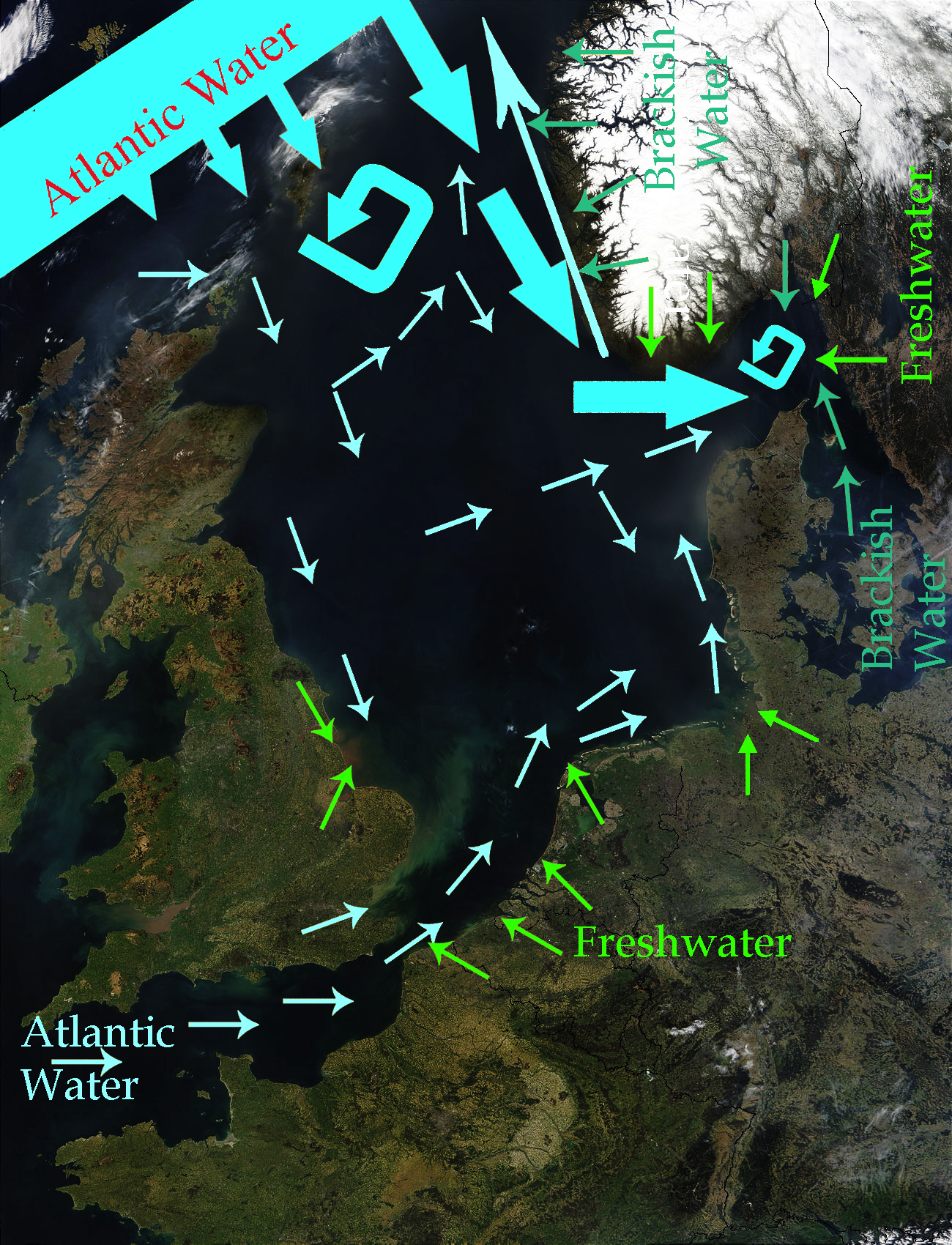

North Sea

The North Sea lies between Great Britain, Norway, Denmark, Germany, the Netherlands and Belgium. An epeiric sea on the European continental shelf, it connects to the Atlantic Ocean through the English Channel in the south and the Norwegian Sea in the north. It is more than long and wide, covering . It hosts key north European shipping lanes and is a major fishery. The coast is a popular destination for recreation and tourism in bordering countries, and a rich source of energy resources, including wind and wave power. The North Sea has featured prominently in geopolitical and military affairs, particularly in Northern Europe, from the Middle Ages to the modern era. It was also important globally through the power northern Europeans projected worldwide during much of the Middle Ages and into the modern era. The North Sea was the centre of the Vikings' rise. The Hanseatic League, the Dutch Republic, and the British each sought to gain command of the North Sea and access t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Advance Petroleum Revenue Tax Act 1986

The Advance Petroleum Revenue Tax Act 1986 (c. 68) is an Act of the Parliament of the United Kingdom which provided for the repayment of advance petroleum revenue tax (APRT) to a participator in an oil field where the net profit period has not been reached. Background The Advance Petroleum Revenue Tax Act implemented the proposal announced by the Chancellor of the Exchequer in the Autumn Statement to accelerate, on a targeted basis, the arrangements for the repayment of advance petroleum revenue tax due to oil companies. Text was copied from this source, which is licensed under th Open Parliament Licence v3.0 © Parliamentary Copyright. The fall in world oil prices in 1986 had a serious impact on the economics of North Sea development, resulting in cutbacks in activity. Companies involved in North Sea activity had reassessed their plans to take low oil prices into account, but some of them faced the more immediate problems caused by a shortage of the cash available to go ahe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royal Assent

Royal assent is the method by which a monarch formally approves an act of the legislature, either directly or through an official acting on the monarch's behalf. In some jurisdictions, royal assent is equivalent to promulgation, while in others that is a separate step. Under a modern constitutional monarchy, royal assent is considered little more than a formality. Even in nations such as the United Kingdom, Norway, the Netherlands, Liechtenstein and Monaco which still, in theory, permit their monarch to withhold assent to laws, the monarch almost never does so, except in a dire political emergency or on advice of government. While the power to veto by withholding royal assent was once exercised often by European monarchs, such an occurrence has been very rare since the eighteenth century. Royal assent is typically associated with elaborate ceremony. In the United Kingdom the Sovereign may appear personally in the House of Lords or may appoint Lords Commissioners, who announce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Petroleum Royalties (Relief) And Continental Shelf Act 1989

The Petroleum Royalties (Relief) and Continental Shelf Act 1989 (c. 1) is an Act of the Parliament of the United Kingdom which abolished petroleum royalties for gas fields in the southern basin of the North Sea and onshore, and enacted an agreement with the Republic of Ireland on the extent of the continental shelf. Background The Act had two purposes, firstly to end royalties for new fields in the southern basin of the North Sea as well as onshore. This implemented a commitment made by the Government in the 1988 Budget statement. Secondly, it implemented the agreement that the United Kingdom Government had reached with the Republic of Ireland on the determination of the continental shelf. The Government's policy was to keep the North Sea fiscal regime under review and to make changes where appropriate to ensure that the right climate existed for further exploration and development. There were a number of significant gas prospects in the southern basin of the North Sea which w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Petroleum Act 1998

The Petroleum Act 1998 is an Act of the Parliament of the United Kingdom which consolidated arrangements for the licensing, operation and abandonment of offshore installations and pipelines. As a consolidation Act, it did not change the substantive law, although certain Acts were amended and repealed. Background This was a consolidation Act which brought together a number of enactments on petroleum. It dealt with rights and licences to search for and get petroleum; the application of criminal and civil law to offshore activities; authorisations for submarine pipelines; and the decommissioning of offshore installations and pipelines. The main Acts which were to be consolidated were the Petroleum (Production) Act 1934; the Petroleum and Submarine Pipelines Act 1975; the Oil and Gas (Enterprise) Act 1982; and the Petroleum Act 1987, Parts I and II. The Act vested all rights to the UK’s petroleum resources in the Crown; a right first established by the Petroleum Production Act ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

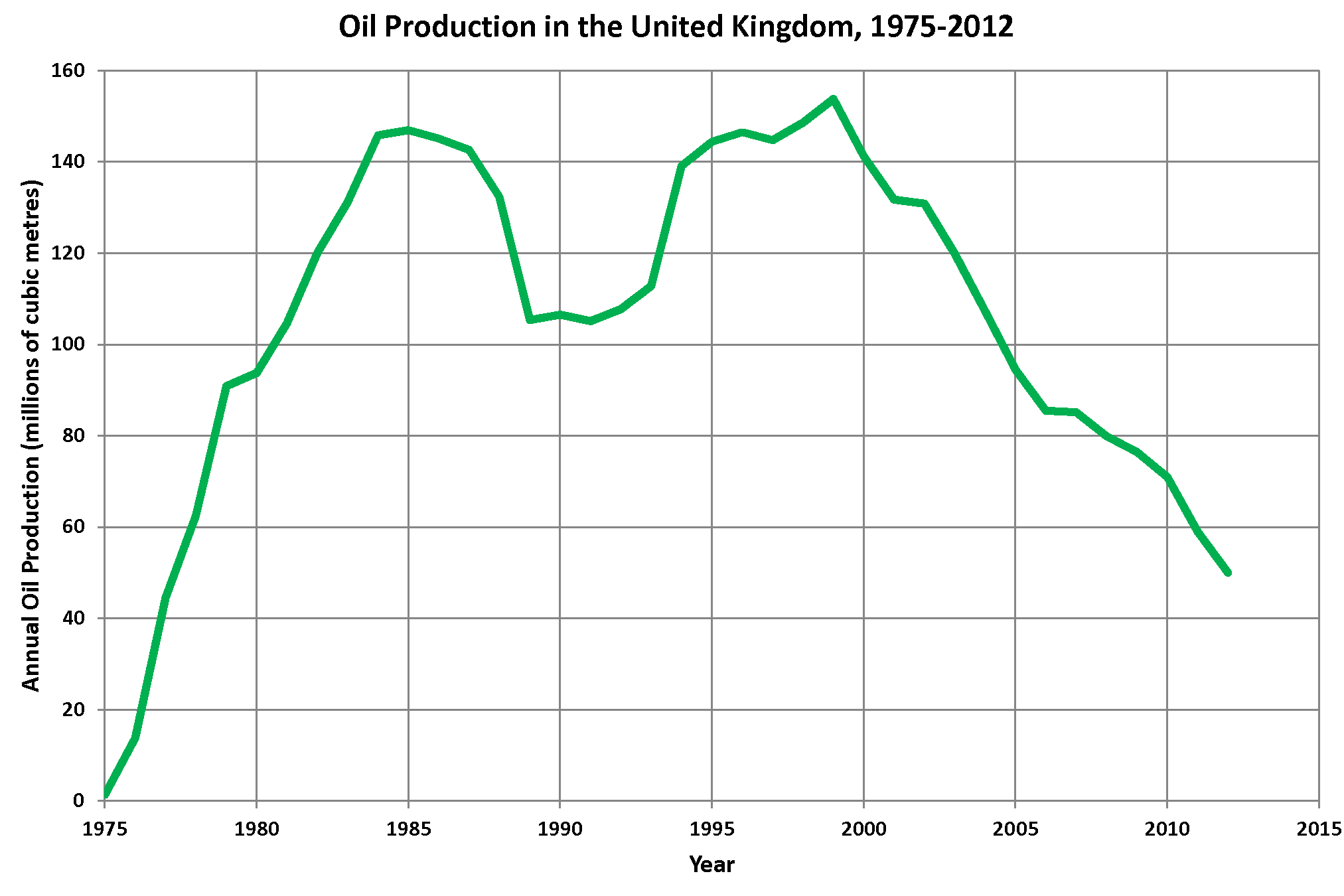

Oil And Gas Industry In The United Kingdom

The oil and gas industry plays a central role in the economy of the United Kingdom. Oil and gas account for more than three-quarters of the UK's total primary energy needs. Oil provides 97 per cent of the fuel for transport, and gas is a key fuel for heating and electricity generation. Transport, heating and electricity each account for about one-third of the UK's primary energy needs. Oil and gas are also major feedstocks for the petrochemicals industries producing pharmaceuticals, plastics, cosmetics and domestic appliances. Although UK Continental Shelf production peaked in 1999, in 2016 the sector produced 62,906,000 cubic metres of oil and gas, meeting more than half of the UK's oil and gas needs. There could be up to 3.18 billion cubic metres of oil and gas still to recover from the UK's offshore fields. In 2017, capital investment in the UK offshore oil and gas industry was £5.6 billion. Since 1970 the industry has paid almost £330 billion in production tax. About 280,000 j ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)