|

Petrobourse

The Iranian Oil Bourse ( fa, بورس نفت ایران), International Oil Bourse, Iran Petroleum Exchange Kish Exchange or Oil Bourse in Kish (IOB; the official English language name is unclear) also known as Iran Crude Oil Exchange, is a commodity exchange, which opened its first phase on 17 February 2008. It was created by cooperation between Iranian ministries, the Iran Mercantile Exchange and other state and private institutions in 2005. The history of Iran Mercantile Exchange and its links with the "international trading floor of crude oil and petrochemical products in the Kish Island" (IOB) have been published. The IOB is intended as an oil bourse for petroleum, petrochemicals and gas in various currencies other than the United States dollar, primarily the euro and Iranian rial and a basket of other major (non-US) currencies. The geographical location is at the Persian Gulf island of Kish which is designated by Iran as a free trade zone.http://www.iran-daily.com/1383/2199/ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

West Texas Intermediate

West Texas Intermediate (WTI) is a grade or mix of crude oil; the term is also used to refer to the spot price, the futures price, or assessed price for that oil. In colloquial usage, WTI usually refers to the WTI Crude Oil futures contract traded on the New York Mercantile Exchange (NYMEX). The WTI oil grade is also known as Texas light sweet, oil produced from any location can be considered WTI if the oil meets the required qualifications. Spot and futures prices of WTI are used as a benchmark in oil pricing. This grade is described as light crude oil because of its low density and sweet because of its low sulfur content. The price of WTI is often included in news reports on oil prices, alongside the price of Brent crude from the North Sea. Other important oil markers include the Dubai crude, Oman crude, Urals oil, and the OPEC reference basket. WTI is lighter and sweeter, containing less sulfur than Brent, and considerably lighter and sweeter than Dubai or Oman. WTI crud ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brent Crude

Brent Crude may refer to any or all of the components of the Brent Complex, a physically and financially traded oil market based around the North Sea of Northwest Europe; colloquially, Brent Crude usually refers to the price of the ICE (Intercontinental Exchange) Brent Crude Oil futures contract or the contract itself. The original Brent Crude referred to a trading classification of sweet light crude oil first extracted from the Brent oilfield in the North Sea in 1976. As production from the Brent oilfield declined to zero in 2021, crude oil blends from other oil fields have been added to the trade classification. The current Brent blend consists of crude oil produced from the Forties (added 2002), Oseberg (added 2002), Ekofisk (added 2007), and Troll (added 2018) oil fields (also known as the BFOET Quotation). The Brent Crude oil marker is also known as Brent Blend, London Brent and Brent petroleum. This grade is described as light because of its relatively low density, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Maker

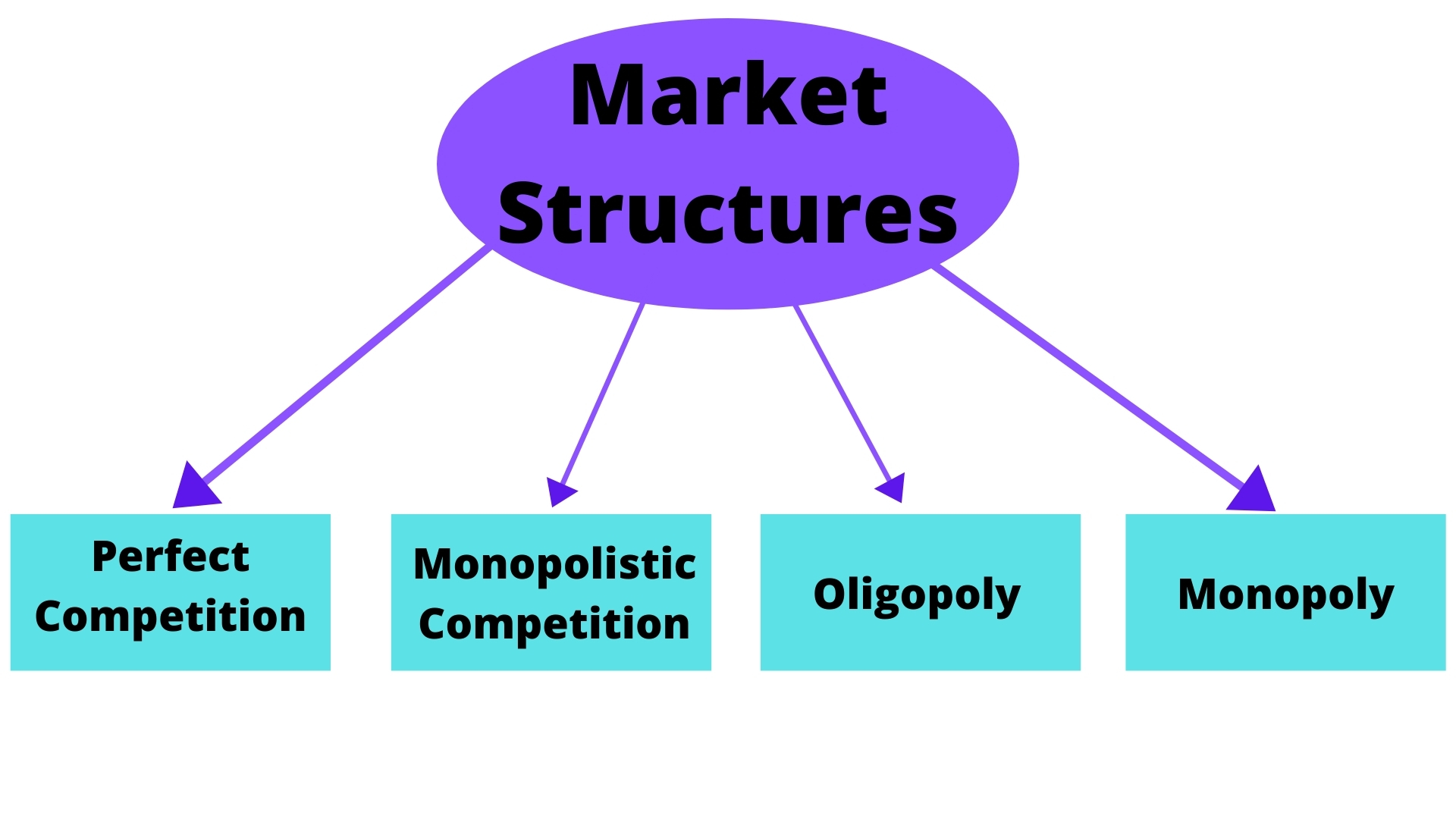

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue.Syverson, C. (2019). Macroeconomics and Market Power. The Journal of Economic Perspectives, 33(3), 23-43. https://doi.org/10.1257/jep.33.3.23 This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. Such propensities contradict perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are consequently referred to as 'price takers', whereas market participants that exhibit market power are referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contracts

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract with a m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |