|

Payment Processor

A payment processor is a system that enables financial transactions, commonly employed by a merchant, to handle transactions with customers from various channels such as credit cards and debit cards or bank accounts. They are usually broken down into two types: front-end and back-end. Front-end processors have connections to various card associations and supply authorization and settlement services to the merchant banks' merchants. Back-end processors accept settlements from front-end processors and, via the Federal Reserve Bank for example, move the money from the issuing bank to the merchant bank. In an operation that will usually take a few seconds, the payment processor will both check the details received by forwarding them to the respective card's issuing bank or card association for verification, and also carry out a series of anti-fraud measures against the transaction. Additional parameters, including the card's country of issue and its previous payment history, are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant

A merchant is a person who trades in commodities produced by other people, especially one who trades with foreign countries. Historically, a merchant is anyone who is involved in business or trade. Merchants have operated for as long as industry, commerce, and trade have existed. In 16th-century Europe, two different terms for merchants emerged: referred to local traders (such as bakers and grocers) and ( nl, koopman) referred to merchants who operated on a global stage, importing and exporting goods over vast distances and offering added-value services such as credit and finance. The status of the merchant has varied during different periods of history and among different societies. In modern times, the term ''merchant'' has occasionally been used to refer to a businessperson or someone undertaking activities (commercial or industrial) for the purpose of generating profit, cash flow, sales, and revenue using a combination of human, financial, intellectual and physical capit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NetMarket

NetMarket is an online marketplace owned by Trilegiant that sells various goods ranging from electronics to jewelry. It was founded in 1994 by Dan Kohn and Roger Lee, both former London School of Economics students, and by Guy H. T. Haskin and Eiji Hirai from Swarthmore College. ''The New York Times'' has credited the company with performing the first secure retail transaction on the Internet. History NetMarket was initially conceived by Dan Kohn while he was studying at the London School of Economics after finishing an honors degree in economics from Swarthmore College. He recruited classmate and Yale graduate Roger Lee to become president of the company. The company's management team was rounded out by Guy H. T. Haskin and Eiji Hirai, both from Swarthmore and both hired for their technical skills. The firm's initial headquarters was a house in Nashua, New Hampshire. It started out selling goods such as CDs and books for various offline stores using non-digital payments. On Au ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Service Provider

A payment service provider (PSP) is a third-party company that assists businesses to accept electronic payments, such as credit cards and debit cards payments. PSPs act as intermediaries between those who make payments, i.e. consumers, and those who accept them, i.e. retailers. Some of the most renowned PSPs are: * Adyen * PayPal * Stripe Operation PSPs establish technical connections with acquiring banks and card networks, enabling merchants to accept different payment methods without the need to partner with a particular bank. They fully manage payment processing and external network relationships, making the merchant less dependent on banking institutions. PSP can also offer risk management services for card and bank based payments, transaction payment matching, reporting, fund remittance and fraud protection. Some PSPs provide services to process other next generation methods ( payment systems) including cash payments, wallets, prepaid cards or vouchers, and even pap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Point To Point Encryption

Point-to-point encryption (P2PE) is a standard established by the PCI Security Standards Council. Payment solutions that offer similar encryption but do not meet the P2PE standard are referred to as end-to-end encryption (E2EE) solutions. The objective of P2PE and E2EE is to provide a payment security solution that instantaneously converts confidential payment card (credit and debit card) data and information into indecipherable code at the time the card is swiped, in order to prevent hacking and fraud. It is designed to maximize the security of payment card transactions in an increasingly complex regulatory environment. The standard The P2PE Standard defines the requirements that a "solution" must meet in order to be accepted as a PCI-validated P2PE solution. A "solution" is a complete set of hardware, software, gateway, decryption, device handling, etc. Only "solutions" can be validated; individual pieces of hardware such as card readers cannot be validated. It is also a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Card Industry Data Security Standard

The Payment Card Industry Data Security Standard (PCI DSS) is an information security standard used to handle credit cards from major card brands. The standard is administered by the Payment Card Industry Security Standards Council and its use is mandated by the card brands. The standard was created to better control cardholder data and reduce credit card fraud. Validation of compliance is performed annually or quarterly, by a method suited to the volume of transactions handled: * Self-Assessment Questionnaire (SAQ) * Firm-specific Internal Security Assessor (ISA) * External Qualified Security Assessor (QSA) History Originally, the major card brands started five different security programs: * Visa's Cardholder Information Security Program * MasterCard's Site Data Protection *American Express's Data Security Operating Policy *Discover's Information Security and Compliance *JCB's Data Security Program The intentions of each were roughly similar: to create an additional level of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

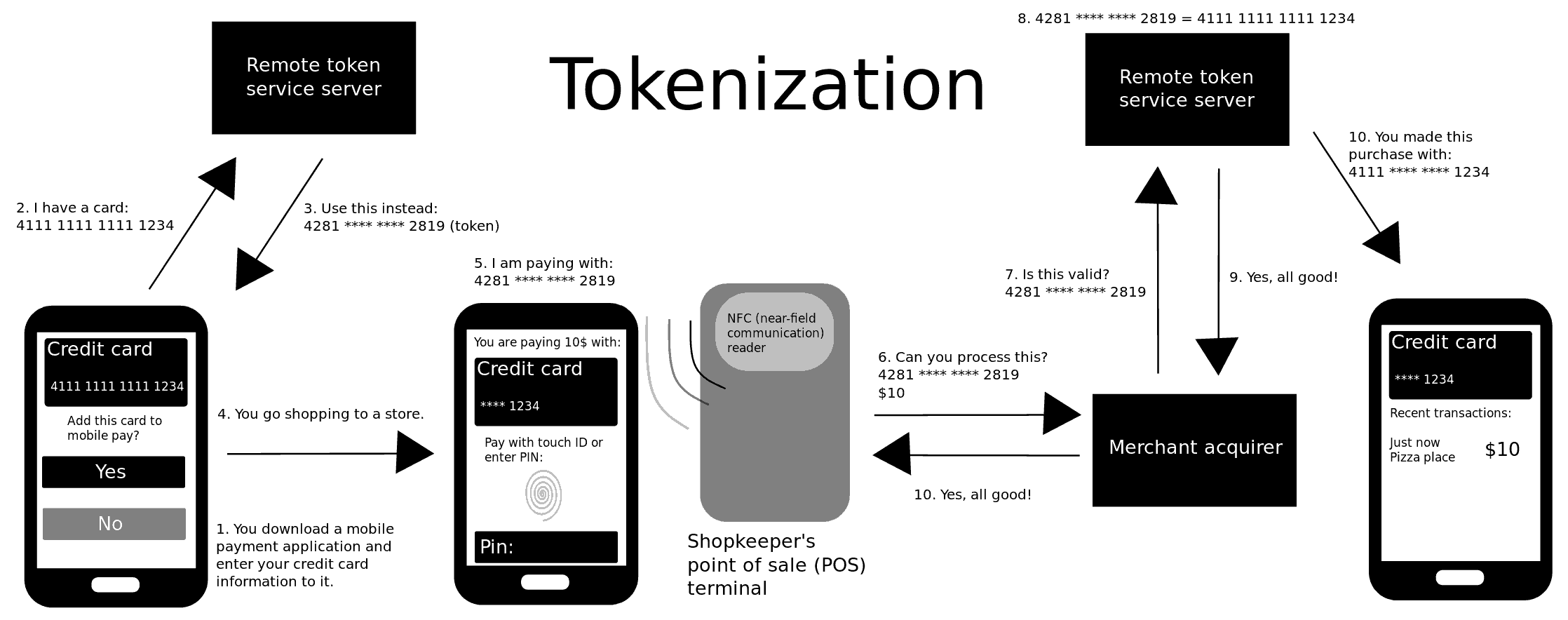

Tokenization (data Security)

Tokenization, when applied to data security, is the process of substituting a sensitive data element with a non-sensitive equivalent, referred to as a token, that has no intrinsic or exploitable meaning or value. The token is a reference (i.e. identifier) that maps back to the sensitive data through a tokenization system. The mapping from original data to a token uses methods that render tokens infeasible to reverse in the absence of the tokenization system, for example using tokens created from random numbers. A one-way cryptographic function is used to convert the original data into tokens, making it difficult to recreate the original data without obtaining entry to the tokenization system's resources. To deliver such services, the system maintains a vault database of tokens that are connected to the corresponding sensitive data. Protecting the system vault is vital to the system, and improved processes must be put in place to offer database integrity and physical security. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card Fraud

Credit card fraud is an inclusive term for fraud committed using a payment card, such as a credit card or debit card. The purpose may be to obtain goods or services or to make payment to another account, which is controlled by a criminal. The Payment Card Industry Data Security Standard (PCI DSS) is the data security standard created to help financial institutions process card payments securely and reduce card fraud. Credit card fraud can be authorised, where the genuine customer themselves processes payment to another account which is controlled by a criminal, or unauthorised, where the account holder does not provide authorisation for the payment to proceed and the transaction is carried out by a third party. In 2018, unauthorised financial fraud losses across payment cards and remote banking totalled £844.8 million in the United Kingdom. Whereas banks and card companies prevented £1.66 billion in unauthorised fraud in 2018. That is the equivalent to £2 in every £3 of atte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Software As A Service

Software as a service (SaaS ) is a software licensing and delivery model in which software is licensed on a subscription basis and is centrally hosted. SaaS is also known as "on-demand software" and Web-based/Web-hosted software. SaaS is considered to be part of cloud computing, along with infrastructure as a service (IaaS), platform as a service (PaaS), desktop as a service (DaaS), managed software as a service (MSaaS), mobile backend as a service (MBaaS), data center as a service (DCaaS), integration platform as a service (iPaaS), and information technology management as a service (ITMaaS). SaaS apps are typically accessed by users of a web browser (a thin client). SaaS became a common delivery model for many business applications, including office software, messaging software, payroll processing software, DBMS software, management software, CAD software, development software, gamification, virtualization, accounting, collaboration, customer relationship manage ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19 Pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identified in an outbreak in the Chinese city of Wuhan in December 2019. Attempts to contain it there failed, allowing the virus to spread to other areas of Asia and later COVID-19 pandemic by country and territory, worldwide. The World Health Organization (WHO) declared the outbreak a public health emergency of international concern on 30 January 2020, and a pandemic on 11 March 2020. As of , the pandemic had caused COVID-19 pandemic cases, more than cases and COVID-19 pandemic deaths, confirmed deaths, making it one of the deadliest pandemics in history, deadliest in history. COVID-19 symptoms range from Asymptomatic, undetectable to deadly, but most commonly include fever, Nocturnal cough, dry cough, and fatigue. Severe illness is more likely ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PayPal

PayPal Holdings, Inc. is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers, and serves as an electronic alternative to traditional paper methods such as checks and money orders. The company operates as a payment processor for online vendors, auction sites and many other commercial users, for which it charges a fee. Established in 1998 as Confinity, PayPal went public through an IPO in 2002. It became a wholly owned subsidiary of eBay later that year, valued at $1.5 billion. In 2015 eBay spun off PayPal to its shareholders, and PayPal became an independent company again. The company was ranked 143rd on the 2022 Fortune 500 of the largest United States corporations by revenue. History Early history PayPal was originally established by Max Levchin, Peter Thiel, and Luke Nosek in December 1998 as Confinity, a company that developed security software for hand-hel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Funds Transfer

Electronic funds transfer (EFT) is the electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems, without the direct intervention of bank staff. According to the United States Electronic Fund Transfer Act of 1978 it is "a funds transfer initiated through an electronic terminal, telephone, computer (including on-line banking) or magnetic tape for the purpose of ordering, instructing, or authorizing a financial institution to debit or credit a consumer's account". EFT transactions are known by a number of names across countries and different payment systems. For example, in the United States, they may be referred to as "electronic checks" or "e-checks". In the United Kingdom, the term "bank transfer" and "bank payment" are used, in Canada, " e-transfer" is used, while in several other European countries " giro transfer" is the common term. Types EFTs include, but ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit car ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |