|

Public Provident Fund

The Public Provident Fund (PPF) is a savings-cum-tax-saving instrument in India, introduced by the National Savings Institute of the Ministry of Finance in 1968. The main objective of the scheme is to mobilize small savings by offering an investment with reasonable returns combined with income tax benefits. The scheme is fully guaranteed by the Central Government. Balance in the PPF account is not subject to attachment under any order or decree of court under the Government Savings Banks Act, 1873. However Income Tax & other Government authorities can attach the account for recovering tax dues. The 2019 Public Provident Fund Scheme, introduced by the Government on 12 December 2019, resulted in the rescinding of the earlier 1968 Public Provident Fund Scheme. Eligibility Individuals who are residents of India are eligible to open their account under the Public Provident Fund, and are entitled to tax-free returns. Non resident Indians As of August 2018, according to the Indian ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

India

India, officially the Republic of India ( Hindi: ), is a country in South Asia. It is the seventh-largest country by area, the second-most populous country, and the most populous democracy in the world. Bounded by the Indian Ocean on the south, the Arabian Sea on the southwest, and the Bay of Bengal on the southeast, it shares land borders with Pakistan to the west; China, Nepal, and Bhutan to the north; and Bangladesh and Myanmar to the east. In the Indian Ocean, India is in the vicinity of Sri Lanka and the Maldives; its Andaman and Nicobar Islands share a maritime border with Thailand, Myanmar, and Indonesia. Modern humans arrived on the Indian subcontinent from Africa no later than 55,000 years ago., "Y-Chromosome and Mt-DNA data support the colonization of South Asia by modern humans originating in Africa. ... Coalescence dates for most non-European populations average to between 73–55 ka.", "Modern human beings—''Homo sapiens''—originated in Africa. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of India

The Government of India ( ISO: ; often abbreviated as GoI), known as the Union Government or Central Government but often simply as the Centre, is the national government of the Republic of India, a federal democracy located in South Asia, consisting of 28 union states and eight union territories. Under the Constitution, there are three primary branches of government: the legislative, the executive and the judiciary, whose powers are vested in a bicameral Parliament, President, aided by the Council of Ministers, and the Supreme Court respectively. Through judicial evolution, the Parliament has lost its sovereignty as its amendments to the Constitution are subject to judicial intervention. Judicial appointments in India are unique in that the executive or legislature have negligible say. Etymology and history The Government of India Act 1833, passed by the British parliament, is the first such act of law with the epithet "Government of India". Basic structure The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ministry Of Finance (India)

The Ministry of Finance ( IAST: ''Vitta Maṃtrālaya'') is a ministry within the Government of India concerned with the economy of India, serving as the Treasury of India. In particular, it concerns itself with taxation, financial legislation, financial institutions, capital markets, centre and state finances, and the Union Budget. The Ministry of Finance is the apex controlling authority of ''four'' central civil services namely Indian Revenue Service, Indian Audit and Accounts Service, Indian Economic Service and Indian Civil Accounts Service. It is also the apex controlling authority of one of the central commerce services namely Indian Cost and Management Accounts Service History R. K. Shanmukham Chetty was the first Finance Minister of independent India. He presented the first budget of independent India on 26 November 1947. Department of Economic Affairs The Department of Economic Affairs is the nodal agency of the Union Government to formulate and monitor coun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-Resident Indians

Overseas Indians ( IAST: ), officially Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs) are Indians who live outside of the Republic of India. According to the Government of India, ''Non-Resident Indians'' are citizens of India who are not living in the country, while the term ''People of Indian Origin'' are people of Indian birth or ancestry who are not citizens of India, but are citizens of other nations and may additionally have Overseas Citizenship of India (OCI), with those having the OCI status known as ''Overseas Citizens of India''. According to a Ministry of External Affairs report, there are 32 million NRIs and OCIs residing outside India and overseas Indians comprise the world's largest overseas diaspora. Every year 2.5 million (25 lakhs) Indians migrate overseas, which is the highest annual number of migrants in the world. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Income-tax Act, 1961

The Income-tax Act, 1961 is the charging statute of Income Tax in India. It provides for levy, administration, collection and recovery of Income Tax. The Government of India The Government of India ( ISO: ; often abbreviated as GoI), known as the Union Government or Central Government but often simply as the Centre, is the national government of the Republic of India, a federal democracy located in South Asia, ... brought a draft statute called the " Direct Taxes Code" intended to replace the Income Tax Act, 1961 and the Wealth Tax Act, 1957. However the bill was later scrapped. Amendments The Government of India presents finance bill (budget) every year in the month of February. The finance budget brings various amendments in Income-tax Act, 1961 including tax slabs rates. The amendments are generally applicable to the next following financial year beginning from 1 April unless otherwise specified. Such amendments become part of thincome tax actafter the approval ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ircon International

Ircon International, or Indian Railway Construction Limited (IRCON), is an Indian engineering & construction corporation, specialized in transport infrastructure. The public sector undertaking was established in 1976, by the Indian Railways under the Indian Companies Act 1956. IRCON was registered as the Indian Railway Construction International Limited, a wholly owned entity of the Indian Railways. Its primary charter was the construction of railway projects in India and abroad. Ircon has since diversified into other transport and infrastructure segments and with its expanded scope of operations around the world, the name was changed to Indian Railway International Ltd. in October 1995. The Ircon is well known for undertaking challenging infrastructure projects, especially in difficult terrains in India and abroad. Ircon has completed over 1650 major infrastructure projects in India and over 900 major projects across the globe in more than 31 countries. Area of business Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity-linked Savings Scheme

An Equity Linked Savings Scheme, popularly known as ELSS, is a type of diversified equity scheme which comes, with a lock-in period of three years, offered by mutual funds in India. They offer tax benefits under the Section 80C of Income Tax Act 1961. ELSSes can be invested using both SIP ( Systematic Investment Plan) and lump sums investment options. There is a three years lock-in period, and thus has better liquidity compared to other options like NSC and Public Provident Fund. Mutual funds are subjective to fluctuations in the market. There were many instances where the money you invested is the same or even lesser after 3 years in a mutual fund. See also * National Pension System (NPS) * Mutual fund * Income tax in India Income tax in India is governed by Entry 82 of the Union List of the Seventh Schedule to the Constitution of India, empowering the Government of India, central government to tax non-agricultural income; agricultural income is defined in Secti ... Refere ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Pension System

National Pension System Trust (NPS Trust) is a specialised division of Pension Fund Regulatory and Development Authority which is under the jurisdiction of Ministry of Finance of the Government of India. The National Pension System (NPS) is a voluntary defined contribution pension system in India. National Pension System, like PPF and EPF is an EEE (Exempt-Exempt-Exempt) instrument in India where the entire corpus escapes tax at maturity and entire pension withdrawal amount is tax-free. NPS started with the decision of the Government of India to stop defined benefit pensions for all its employees who joined after 1 April 2004. While the scheme was initially designed for government employees only, it was opened up for all citizens of India between the age of 18 and 65 in 2009, for OCI card holders and PIO's in October 2019. On 26 August 2021, PFRDA increased the entry age for the National Pension System (NPS) from 65 years to 70 years. As per the revised norms, any Indian C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

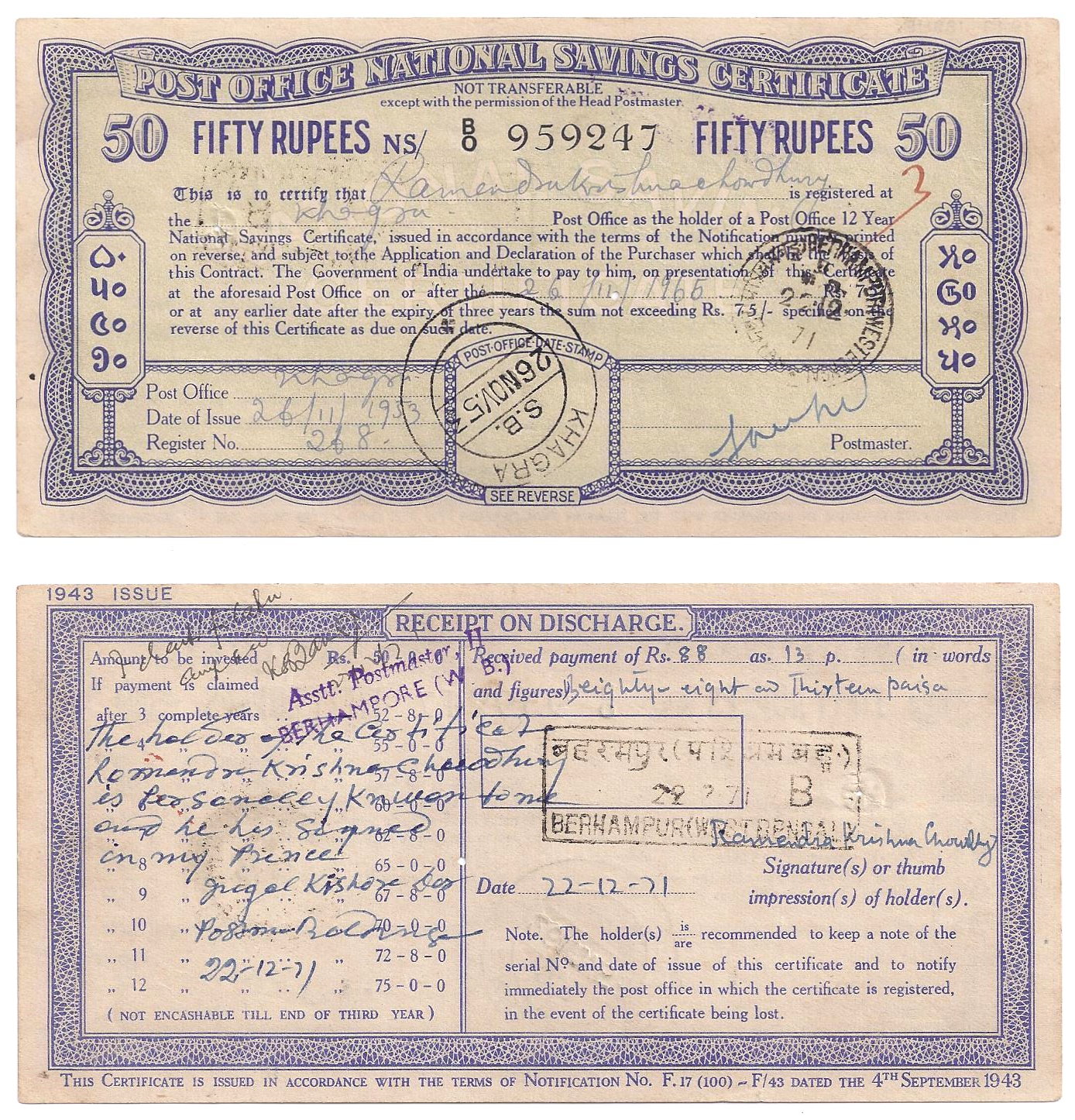

National Savings Certificates (India)

National Savings Certificates, popularly known as ''NSC'', is an Indian Government savings bond, primarily used for small savings and income tax saving investments in India. It is part of the postal savings system of India Post. These can be purchased from any Post Office in India by an adult (either in his/her own name or on behalf of a minor), a minor, a trust, and two adults jointly. These are issued for five and ten year maturity and can be pledged to banks as collateral for availing loans. The holder gets the tax benefit under Section 80C of Income Tax Act, 1961 The Income-tax Act, 1961 is the charging statute of Income Tax in India. It provides for levy, administration, collection and recovery of Income Tax. The Government of India brought a draft statute called the "Direct Taxes Code" intended to re .... Other similar government savings schemes in India include: Public Provident Fund (PPF), Post Office Fixed Deposit, Post Office Recurring Deposit, etc. The ce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retirement In India

VRS applies to employees who have completed 10 years of service or are above the age of 40 years. It applies to workers, executives of companies and/or to an authority of a co-operative society (except company/co-operative society directors). As per the rules, voluntary retirement scheme should result in an overall reduction in the existing strength of employees and the vacancy cannot be filled up. PSUs have to obtain prior approval of the government before offering voluntary retirement. Firms can frame different schemes, however, they must conform to the guidelines under section 2BA of the Income-Tax Rules. One of the pertinent rules clearly states that retiring employee must not be employed in another firm belonging to the same management. Retirement in India includes all the culture around retirement in India. Various organizations offer "voluntary retirement schemes" (VRS) as part of their strategy to have turnover of employees. Indian culture has a traditional concept that re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax-advantaged Savings Plans In India

Tax advantage refers to the economic bonus which applies to certain accounts or investments that are, by statute, tax-reduced, tax-deferred, or tax-free. Examples of tax-advantaged accounts and investments include retirement plans, education savings accounts, medical savings accounts, and government bonds. Governments establish tax advantages to encourage private individuals to contribute money when it is considered to be in the public interest. Benefits Tax advantages provide an incentive to engage in certain investments and accounts, functioning like a government subsidy. For example, individual retirement accounts are tax-advantaged since they are tax-deferred. By encouraging investment in these accounts, there is a reduced need for the government to support citizens later in life by spending money on welfare or other government expenses. Capital gains tax rate benefits may also spur investment. Types of tax-advantaged accounts and investments Retirement plans An examp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |