|

Procyclical And Countercyclical

Procyclical and countercyclical variables are variables that fluctuate in a way that is positively or negatively correlated with business cycle fluctuations in gross domestic product (GDP). The scope of the concept may differ between the context of macroeconomic theory and that of economic policy–making. The concept is often encountered in the context of a government's approach to spending and taxation. A 'procyclical fiscal policy' can be summarised simply as governments choosing to increase government spending and reduce taxes during an economic expansion, but reduce spending and increase taxes during a recession. A 'countercyclical' fiscal policy takes the opposite approach: reducing spending and raising taxes during a boom period, and increasing spending and cutting taxes during a recession. Business cycle theory Procyclical In business cycle theory and finance, any economic quantity that is positively correlated with the overall state of the economy is said to be procyc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics'' such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numerous sources of busine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basel II Accord

Basel II is the second of the Basel Accords, which are recommendations on banking laws and regulations issued by the Basel Committee on Banking Supervision. It is now extended and partially superseded by Basel III. The Basel II Accord was published in June 2004. It was a new framework for international banking standards, superseding the Basel I framework, to determine the minimum capital that banks should hold to guard against the financial and operational risks. The regulations aimed to ensure that the more significant the risk a bank is exposed to, the greater the amount of capital the bank needs to hold to safeguard its solvency and overall economic stability. Basel II attempted to accomplish this by establishing risk and capital management requirements to ensure that a bank has adequate capital for the risk the bank exposes itself to through its lending, investment and trading activities. One focus was to maintain sufficient consistency of regulations so to limit competi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Classical Macroeconomics

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of rigorous foundations based on microeconomics, especially rational expectations. New classical macroeconomics strives to provide neoclassical microeconomic foundations for macroeconomic analysis. This is in contrast with its rival new Keynesian school that uses microfoundations such as price stickiness and imperfect competition to generate macroeconomic models similar to earlier, Keynesian ones. History Classical economics is the term used for the first modern school of economics. The publication of Adam Smith's ''The Wealth of Nations'' in 1776 is considered to be the birth of the school. Perhaps the central idea behind it is on the ability of the market to be self-correcting as well as being the most superior institution in allocating resources. The c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progressive Taxation

A progressive tax is a tax in which the tax rate increases as the taxable amount increases.Sommerfeld, Ray M., Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson (1992), ''Concepts of Taxation'', Dryden Press: Fort Worth, TX The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate.Hyman, David M. (1990) ''Public Finance: A Contemporary Application of Theory to Policy'', 3rd, Dryden Press: Chicago, ILJames, Simon (1998) ''A Dictionary of Taxation'', Edgar Elgar Publishing Limited: Northampton, MA The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower wikt:ability to pay, ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Policy

In economics and political science, fiscal policy is the use of government revenue collection ( taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation (which is considered "healthy" at the level in the range 2%–3%) and to increase employment. Additionally, it is designed to try t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

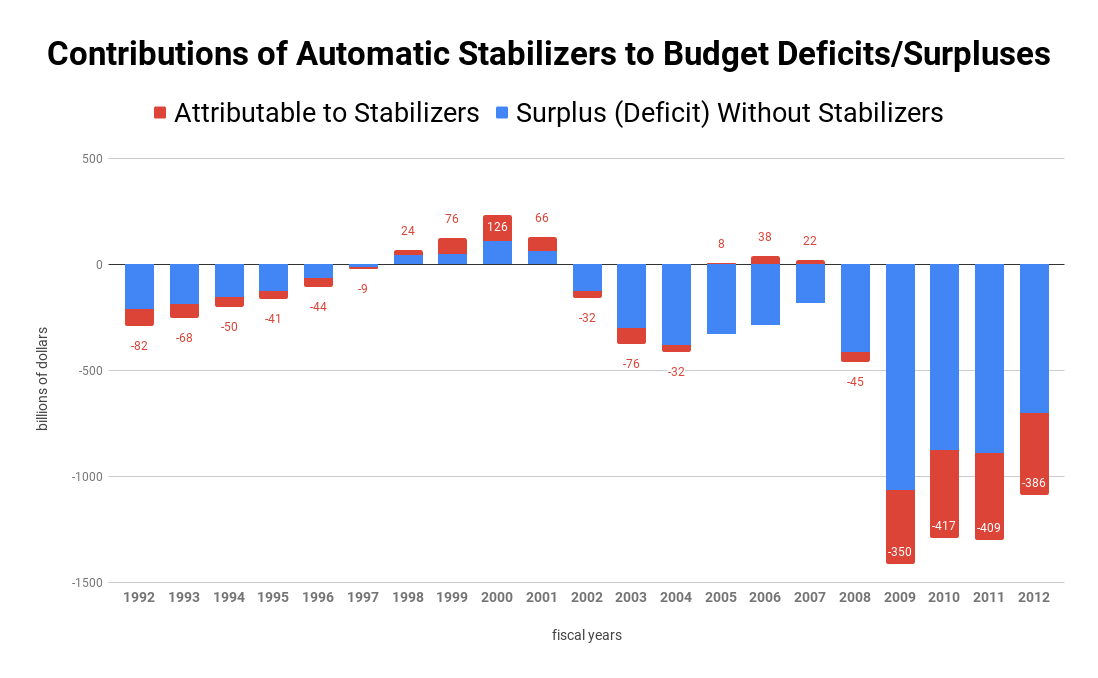

Automatic Stabilizer

In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and welfare spending, that act to damp out fluctuations in real GDP. The size of the government budget deficit tends to increase when a country enters a recession, which tends to keep national income higher by maintaining aggregate demand. There may also be a multiplier effect. This effect happens automatically depending on GDP and household income, without any explicit policy action by the government, and acts to reduce the severity of recessions. Similarly, the budget deficit tends to decrease during booms, which pulls back on aggregate demand. Therefore, automatic stabilizers tend to reduce the size of the fluctuations in a country's GDP. Induced taxes Tax revenues generally depend on household income and the pace of economic activity. Household incomes fall and the economy slows down during a recession, and government tax revenues fall as well. Thi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian Economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes – a recession, when demand is low, or inflation, when demand is high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between government and central bank. In particular, fiscal policy actions (taken by the government) and monetary policy actio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics'' such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numerous sources of busine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fair Value

In accounting and in most schools of economic thought, fair value is a rational and unbiased estimate of the potential market price of a good, service, or asset. The derivation takes into account such objective factors as the costs associated with production or replacement, market conditions and matters of supply and demand. Subjective factors may also be considered such as the risk characteristics, the cost of and return on capital, and individually perceived utility. Economic understanding Vs market price There are two schools of thought about the relation between the market price and fair value in any form of market, but especially with regard to tradable assets: * The efficient-market hypothesis asserts that, in a well organized, reasonably transparent market, the market price is generally equal to or close to the fair value, as investors react quickly to incorporate new information about relative scarcity, utility, or potential returns in their bids; see also Rationa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Financial Intermediation

A journal, from the Old French ''journal'' (meaning "daily"), may refer to: * Bullet journal, a method of personal organization *Diary, a record of what happened over the course of a day or other period *Daybook, also known as a general journal, a daily record of financial transactions *Logbook, a record of events important to the operation of a vehicle, facility, or otherwise * Record (other) * Transaction log, a chronological record of data processing *Travel journal In publishing, ''journal'' can refer to various periodicals or serials: *Academic journal, an academic or scholarly periodical **Scientific journal, an academic journal focusing on science **Medical journal, an academic journal focusing on medicine **Law review, a professional journal focusing on legal interpretation * Magazine, non-academic or scholarly periodicals in general **Trade magazine, a magazine of interest to those of a particular profession or trade **Literary magazine, a magazine devoted to lit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Crunch

A credit crunch (also known as a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates changes. Credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises). Causes A credit crunch is often caused by a sustained period of careless and inappropriate lending which results in losses for lending institutions and investor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Adequacy Ratio

Capital Adequacy Ratio (CAR) is also known as ''Capital to Risk (Weighted) Assets Ratio'' (CRAR), is the ratio of a bank's capital to its risk. National regulators track a bank's CAR to ensure that it can absorb a reasonable amount of loss and complies with statutory Capital requirements. It is a measure of a bank's capital. It is expressed as a percentage of a bank's risk-weighted credit exposures. The enforcement of regulated levels of this ratio is intended to protect depositors and promote stability and efficiency of financial systems around the world. Two types of capital are measured: tier one capital, which can absorb losses without a bank being required to cease trading, and tier two capital, which can absorb losses in the event of a winding-up and so provides a lesser degree of protection to depositors. Formula Capital adequacy ratios (CARs) are a measure of the amount of a bank's core capital expressed as a percentage of its risk-weighted asset. Capital adequacy rati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |