|

Pengrowth

Pengrowth Energy Corporation was a Canadian oil and natural gas company based in Calgary, Alberta. Established in 1988 by Calgary entrepreneur James S Kinnear, it was one of the largest of the Canadian royalty trusts ("Canroys"), with a market capitalization of US$4.12 billion at the end of 2007. Its assets were approximately evenly distributed between oil and natural gas. Pengrowth's assets are in the Western Canada sedimentary basin, a geologic region which has a long history of productivity in crude oil and natural gas. In addition to the properties in western Canada, the company had assets in the Atlantic Ocean off of Nova Scotia. Pengrowth produced petroleum ranging from heavy crude oil to light oil, natural gas liquids, and natural gas. Proved reserves in 2006 were reported to be of oil equivalent (boe) with an additional of probable reserves. Average daily production in 2006 was (bpd) with a projected amount of 86,000 to 87,000 for 2007; figures verifying these tota ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

James S Kinnear

James S. Kinnear (born December 31, 1947) is a Canadian entrepreneur and philanthropist. Kinnear was born in Toronto, Ontario, and grew up in Montreal and Toronto. Career Kinnear graduated from the University of Toronto in 1969 with a Bachelor of Science degree and worked in the securities business in Toronto, London and Montreal until 1980. In 1979 he was awarded the Chartered Financial Analyst (CFA) designation. He subsequently moved to Calgary, Alberta where he established Kinnear Financial Consulting Limited in 1980 and then Pengrowth Management Limited in 1982. Pengrowth Management Limited, a private company, initially initiated investments in oil and gas properties on behalf of pension fund clients. In December 1988, Pengrowth Management Limited launched Pengrowth Gas Income Fund (the name was later changed to Pengrowth Energy Trust) with an initial public offering of $12.5million, a new investment vehicle which permitted individual investors to be involved with oil and gas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scotiabank Saddledome

Scotiabank Saddledome is a multi-use indoor arena in Calgary, Alberta, Canada. Located in Stampede Park in the southeast end of downtown Calgary, the Saddledome was built in 1983 to replace the Stampede Corral as the home of the Calgary Flames of the National Hockey League, and to host ice hockey and figure skating at the 1988 Winter Olympics. The facility also hosts concerts, conferences and other sporting championships, and events for the Calgary Exhibition and Stampede. It underwent a major renovation in 1994–95 and sold its naming rights, during which its original name of Olympic Saddledome was changed to Canadian Airlines Saddledome. The facility was given the name Pengrowth Saddledome in 2000, after Pengrowth Management Ltd. signed a ten-year agreement. It adopted its current name in October 2010 as Scotiabank signed on as title sponsor. The Saddledome is owned by the City of Calgary, who leases it to the Saddledome Foundation, a non-profit organization, to oversee its ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royalty Trust

A royalty trust is a type of corporation, mostly in the United States or Canada, usually involved in oil and gas production or mining. However, unlike most corporations, its profits are not taxed at the corporate level provided a certain high percentage (e.g. 90%) of profits are distributed to shareholders as dividends. The dividends are then taxed as personal income. This system, similar to real estate investment trusts, effectively avoids the double taxation of corporate income. Texas oilman T. Boone Pickens is often credited with creating the first royalty trust in 1979; however Marine Petroleum Trust (Marps) was created in 1956, twenty three years earlier. Characteristics of royalty trusts Royalty trusts typically own oil or natural gas wells, the mineral rights of wells, or mineral rights on other types of properties. An outside company must perform the actual operation of the oil or gas field, or mine, and the trust itself, in the United States, may have no employees. Shar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royalty Trust

A royalty trust is a type of corporation, mostly in the United States or Canada, usually involved in oil and gas production or mining. However, unlike most corporations, its profits are not taxed at the corporate level provided a certain high percentage (e.g. 90%) of profits are distributed to shareholders as dividends. The dividends are then taxed as personal income. This system, similar to real estate investment trusts, effectively avoids the double taxation of corporate income. Texas oilman T. Boone Pickens is often credited with creating the first royalty trust in 1979; however Marine Petroleum Trust (Marps) was created in 1956, twenty three years earlier. Characteristics of royalty trusts Royalty trusts typically own oil or natural gas wells, the mineral rights of wells, or mineral rights on other types of properties. An outside company must perform the actual operation of the oil or gas field, or mine, and the trust itself, in the United States, may have no employees. Shar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Calgary Flames

The Calgary Flames are a professional ice hockey team based in Calgary. The Flames compete in the National Hockey League (NHL) as a member of the Pacific Division (NHL), Pacific Division in the Western Conference (NHL), Western Conference, and are the third major professional ice hockey team to represent the city of Calgary, following the Calgary Tigers (1921–1927) and Calgary Cowboys (1975–1977). The Flames are one of two NHL franchises based in Alberta, the other being the Edmonton Oilers. The cities' proximity has led to a rivalry known as the "Battle of Alberta". The team was founded in 1972–73 NHL season, 1972 in Atlanta as the Atlanta Flames before Relocation of professional sports teams, relocating to Calgary in 1980–81 NHL season, 1980. The Flames played their first three seasons in Calgary at the Stampede Corral before moving into the Scotiabank Saddledome (originally the Olympic Saddledome) in 1983–84 Calgary Flames season, 1983. In 1985–86 Calgary Flames ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Western Canada Sedimentary Basin

The Western Canadian Sedimentary Basin (WCSB) underlies of Western Canada including southwestern Manitoba, southern Saskatchewan, Alberta, northeastern British Columbia and the southwest corner of the Northwest Territories. This vast sedimentary basin consists of a massive wedge of sedimentary rock extending from the Rocky Mountains in the west to the Canadian Shield in the east. This wedge is about thick under the Rocky Mountains, but thins to zero at its eastern margins. The WCSB contains one of the world's largest reserves of petroleum and natural gas and supplies much of the North American market, producing more than per day of gas in 2000. It also has huge reserves of coal. Of the provinces and territories within the WCSB, Alberta has most of the oil and gas reserves and almost all of the oil sands. Conventional oil The WCSB is considered a mature area for exploration of petroleum and recent development has tended toward natural gas and oil sands rather than conventiona ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Depreciation (economics)

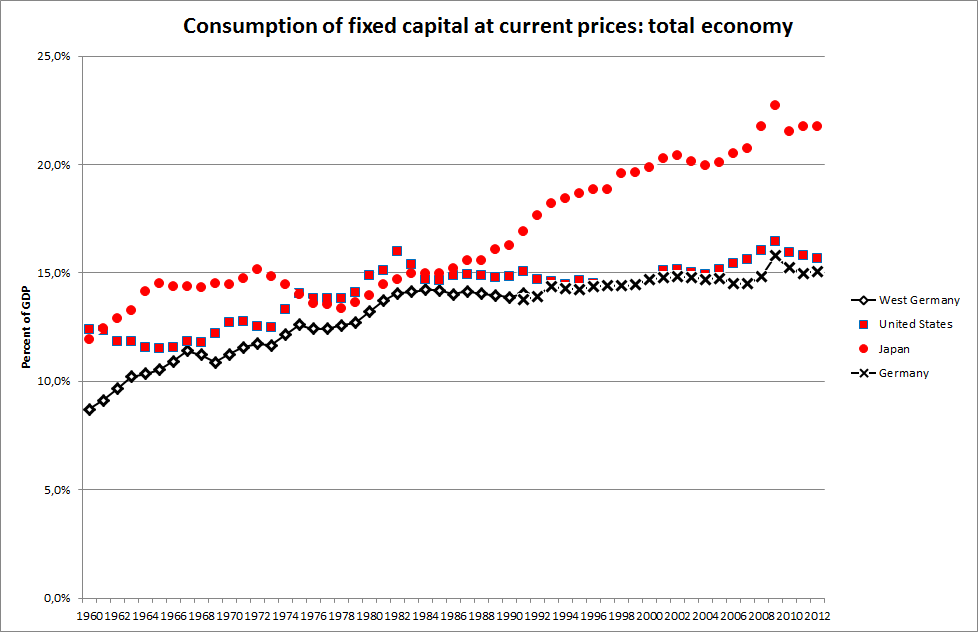

In economics, depreciation is the gradual decrease in the economic value of the capital stock of a firm, nation or other entity, either through physical depreciation, obsolescence or changes in the demand for the services of the capital in question. If the capital stock is K_t in one period t, gross (total) investment spending on newly produced capital is I_t and depreciation is D_t, the capital stock in the next period, K_, is K_t + I_t - D_t. The net increment to the capital stock is the difference between gross investment and depreciation, and is called net investment. Models In economics, the value of a capital asset may be modeled as the present value of the flow of services the asset will generate in future, appropriately adjusted for uncertainty. Economic depreciation over a given period is the reduction in the remaining value of future goods and services. Under certain circumstances, such as an unanticipated increase in the price of the services generated by an asset or a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corporate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flow-through Entity

A flow-through entity (FTE) is a legal entity where income "flows through" to investors or owners; that is, the income of the entity is treated as the income of the investors or owners. Flow-through entities are also known as pass-through entities or fiscally-transparent entities. Common types of FTEs are general partnerships, limited partnerships and limited liability partnerships. In the United States, additional types of FTE include S corporations, income trusts and limited liability companies. Most countries require an FTE (or its owners) to file an annual return reporting the shares of income allocated to owners, and to provide each owner with a statement of allocated income to enable owners to report their shares of income on their own tax returns. In the United States, the statement of allocated income is known as a K-1 (or Schedule K-1). Depending on the local tax regulations, this structure can avoid dividend tax and double taxation because only owners or investors are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" comes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share (finance)

In finance, financial markets, a share is a unit of Equity (finance), equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an enterprise. The owner of shares in a company is a shareholder (or stockholder) of the corporation. A share is an indivisible unit of capital, expressing the ownership relationship between the company and the shareholder. The denominated value of a share is its face value, and the total of the face value of issued shares represent the capital of a company, which may not reflect the market value of those shares. The income received from the ownership of shares is a dividend. There are different types of shares such as equity shares, preference shares, deferred shares, redeemable shares, bonus shares, right shares, and employee stock option plan shares. Valuation Shares are valued according to the various principle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Proven Reserves

Proven reserves (also called measured reserves, 1P, and reserves) is a measure of fossil fuel energy reserves, such as oil reserves, natural gas reserves, and coal reserves. It is defined as the " antity of energy sources estimated with reasonable certainty, from the analysis of geologic and engineering data, to be recoverable from well established or known reservoirs with the existing equipment and under the existing operating conditions." A reserve is considered proven if it is probable that at least 90% of the resource is recoverable by economically profitable means. Operating conditions are taken into account when determining if a reserve is classified as proven. Operating conditions include operational break-even price, regulatory and contractual approvals, without which the reserve cannot be classified as proven. Price changes therefore can have a large impact on the classification of proven reserves. Regulatory and contractual conditions may change, and also affect the am ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)