|

Paul Tudor Jones

Paul Tudor Jones II (born September 28, 1954) is an American billionaire hedge fund manager, conservationist and philanthropist. In 1980, he founded his hedge fund, Tudor Investment Corporation, an asset management firm headquartered in Stamford, Connecticut. Eight years later he founded the Robin Hood Foundation, which focuses on poverty reduction. As of April 2022, his net worth was estimated at US$7.3 billion. Early life and education Jones was born in Memphis, Tennessee. Paul Tudor Jones II's father John Paul "Jack" Jones practiced transportation law from an office located next door to ''The Daily News'', a publication his family has owned and operated since 1886 and where Jack Jones was the publisher for 34 years. His half-brother is Peter Schutt. Jones graduated from Presbyterian Day School, an all-boys elementary school, before attending Memphis University School for high school. Jones then went on to the University of Virginia where he was a welterweight boxing champion. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Memphis, Tennessee

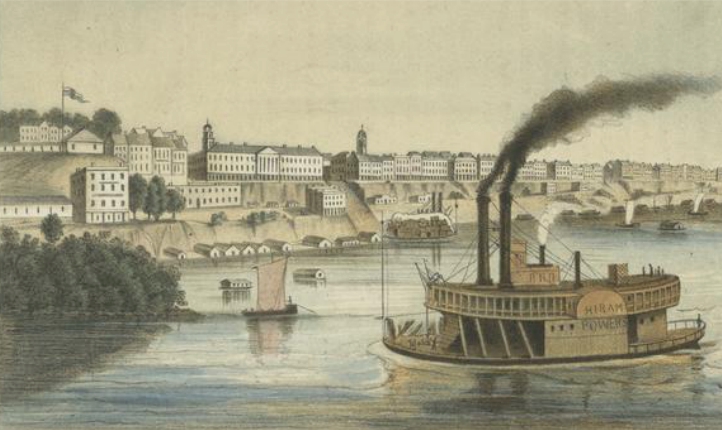

Memphis is a city in the U.S. state of Tennessee. It is the seat of Shelby County in the southwest part of the state; it is situated along the Mississippi River. With a population of 633,104 at the 2020 U.S. census, Memphis is the second-most populous city in Tennessee, after Nashville. Memphis is the fifth-most populous city in the Southeast, the nation's 28th-largest overall, as well as the largest city bordering the Mississippi River. The Memphis metropolitan area includes West Tennessee and the greater Mid-South region, which includes portions of neighboring Arkansas, Mississippi and the Missouri Bootheel. One of the more historic and culturally significant cities of the Southern United States, Memphis has a wide variety of landscapes and distinct neighborhoods. The first European explorer to visit the area of present-day Memphis was Spanish conquistador Hernando de Soto in 1541. The high Chickasaw Bluffs protecting the location from the waters of the Mississipp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chief Executive Officer

A chief executive officer (CEO), also known as a central executive officer (CEO), chief administrator officer (CAO) or just chief executive (CE), is one of a number of corporate executives charged with the management of an organization especially an independent legal entity such as a company or nonprofit institution. CEOs find roles in a range of organizations, including public and private corporations, non-profit organizations and even some government organizations (notably state-owned enterprises). The CEO of a corporation or company typically reports to the board of directors and is charged with maximizing the value of the business, which may include maximizing the share price, market share, revenues or another element. In the non-profit and government sector, CEOs typically aim at achieving outcomes related to the organization's mission, usually provided by legislation. CEOs are also frequently assigned the role of main manager of the organization and the highest-ranking offic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Louis Dreyfus Company

Louis Dreyfus Company B.V. (LDC), also called the Louis-Dreyfus Group, is a French merchant firm that is involved in agriculture, food processing, international shipping, and finance. The company owns and manages hedge funds, ocean vessels, develops and operates telecommunications infrastructures, and it is also involved in real estate development, management and ownership. Along with Archer Daniels Midland, Bunge, and Cargill, the Louis-Dreyfus Group is one of the four "ABCD" companies that dominate world agricultural commodity trading. The company makes up about 10% of the world's agricultural product trade flows, and it is the world's largest cotton and rice trader. It is also regarded by many as the second-largest player in the world's sugar market. LDC Metals expanded to become the world's third biggest trader of copper, zinc and lead concentrate, behind only Glencore and Trafigura. Louis Dreyfus Company has its head office in Rotterdam, Netherlands. The company's parent, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities Exchange Act Of 1934

The Securities Exchange Act of 1934 (also called the Exchange Act, '34 Act, or 1934 Act) (, codified at et seq.) is a law governing the secondary trading of securities (stocks, bonds, and debentures) in the United States of America. A landmark of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law. Companies raise billions of dollars by issuing securities in what is known as the primary market. Contrasted with the Securities Act of 1933, which regulates these original issues, the Securities Exchange Act of 1934 regulates the secondary trading of those securities between persons often unrelated to the issuer, frequently through brokers or dealers. Trillions of dollars are made and lost each year through t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Uptick Rule

The uptick rule is a trading restriction that states that short selling a stock is allowed only on an uptick. For the rule to be satisfied, the short must be either at a price above the last traded price of the security, or at the last traded price when the most recent movement between traded prices was upward (i.e. the security has traded below the last-traded price more recently than above that price). The U.S. Securities and Exchange Commission (SEC) defined the rule, and summarized it:"''Rule 10a-1(a)(1)'' provided that, subject to certain exceptions, a listed security may be sold short (A) at a price above the price at which the immediately preceding sale was effected (plus tick), or (B) at the last sale price if it is higher than the last different price (zero-plus tick). Short sales were not permitted on minus ticks or zero-minus ticks, subject to narrow exceptions." The rule went into effect in 1938 and was removed when ''Rule 201 Regulation SHO'' became effective in 2007. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Board Of Trade

The New York Board of Trade (NYBOT, renamed ICE Futures US in September, 2007), is a physical commodity futures exchange located in New York City. It is a wholly owned subsidiary of Intercontinental Exchange (ICE). History It originated in 1870 as the New York Cotton Exchange (NYCE). In 1998, the New York Board of Trade became the parent company of the New York Cotton Exchange and the Coffee, Sugar and Cocoa Exchange (CSCE). Both now function as divisions of NYBOT. NYBOT agreed to become a unit of ICE in September 2006. The New York Board of Trade was a private company founded by Tom Green and Alfredo Williams. The floor of the NYBOT is regulated by the Commodity Futures Trading Commission, an independent agency of the United States government. On February 26, 2003, NYBOT signed a historic lease agreement with the New York Mercantile Exchange (NYMEX) to move into its World Financial Center headquarters and trading facility after the NYBOT's original headquarters and trading ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peter Borish

Peter F. Borish is chairman and CEO of Computer Trading Corporation (CTC), an investment and advisory firm whose largest consulting client is CIBC. He is also a partner in Adam Hoffman's natural gas options trading team at Torsion Technologies, LLC. Borish is an advisor to Norbury Partners, a recently launched minority-owned discretionary global macro hedge fund. Previously, through CTC, Borish was chief strategist of Quad Group and its affiliated companies. In his role, Borish was engaged in recruiting new talent for Quad and working with the founding partners on business strategy. In addition, he helped traders develop a methodology to enhance their performance by serving as a trading coach. Borish is chairman and CEO of Computer Trading Corporation (CTC), and a current investor and advisor to ValueStream Ventures. He was also a founding investor in Charitybuzz. Borish formerly worked at the Federal Reserve Bank of New York, was founding partner and second-in-command at Tud ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodities Corporation

Commodities Corporation (frequently referred to as "CC") was a financial services company, based in Princeton, New Jersey that traded actively across various commodities. The firm was noted as one of the leading commodity and futures trading firms. CC is credited for launching the careers of many notable hedge fund investors and for its influence on global macro investing. The company was acquired in 1997 and operates as a subsidiary of Goldman Sachs. History The company was founded by Helmut Weymar and Amos Hostetter Sr. and with $2.5 million of capital in 1969 from a group of investors that included Nabisco. Weymar, who was a childhood friend of Hostetter's son Amos Jr., had studied commodities at MIT. As a result of his PhD thesis work on cocoa, Weymar took a job, working for Nabisco in 1965. Hostetter had been Weymar's mentor, and began trading stocks and commodities in the 1930s working for Hayden Stone. Hostetter's simple principles for trading are still widely circula ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth (in terms of number of employees, annual revenue, scale of operations, etc). Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the firms they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology or biotechnology. The typical venture capital investment occurs after an initial "seed funding" round. The first ro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emerging Markets

An emerging market (or an emerging country or an emerging economy) is a market that has some characteristics of a developed market, but does not fully meet its standards. This includes markets that may become developed markets in the future or were in the past. The term "frontier market" is used for developing countries with smaller, riskier, or more illiquid capital markets than "emerging". As of 2006, the economies of China and India are considered to be the largest emerging markets. According to ''The Economist'', many people find the term outdated, but no new term has gained traction. Emerging market hedge fund capital reached a record new level in the first quarter of 2011 of $121 billion. The 10 largest emerging and developing economies by either nominal or PPP-adjusted GDP are 4 of the 5 BRICS countries (Brazil, Russia, India and China) along with Indonesia, Iran, South Korea, Mexico, Saudi Arabia, Taiwan and Turkey. When countries "graduate" from their emerging status, they ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Global Macro

Global macro is an investment strategy based on the interpretation and prediction of large-scale events related to national economies, history, and international relations. The strategy typically employs forecasts and analysis of interest rate trends, international trade and payments, political changes, government policies, inter-government relations, and other broad systemic factors. Other definitions A noted example of what is now called a Global Macro strategy was George Soros' profitable sale of the pound sterling in 1992 prior to the European Rate Mechanism debacle., Foreword by Niall Ferguson In the 2010 Opalesque Roundtable discussion of global macro, hedge fund manager John Burbank discussed the increasing importance and shift of private and institutional investors toward more global macro strategies. Burbank defined global macro as "having a reason to be long or short something that is bigger than a fundamental stock view". DoubleLine has characterized macro as a "go anyw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |