|

Participatory Note

A participatory note, commonly known as a P-note or PN, is an instrument issued by a registered foreign institutional investor (FII) to an overseas investor who wishes to invest in Indian stock markets without registering themselves with the market regulator, the Securities and Exchange Board of India (SEBI). SEBI permitted foreign institutional investors to register and participate in the Indian stock market in 1992. These notes are a unique Indian invention started in 2000 by SEBI to enable foreign corporates and high networth investors enter the Indian market without having to go through the process of registering as Foreign Institutional Investor (FII). Investing through P-notes is very simple, and hence very popular amongst foreign institutional investors. The absolute value of P-notes investments rose to a record of in October 2007. However, mainly due to SEBI's strengthening of the regulatory framework for P-notes, their investments fell to a record low of . The amount of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investor

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, REITs, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Although institutional investors appear to be more sophisticated than retail investors, it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses of investment manageme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

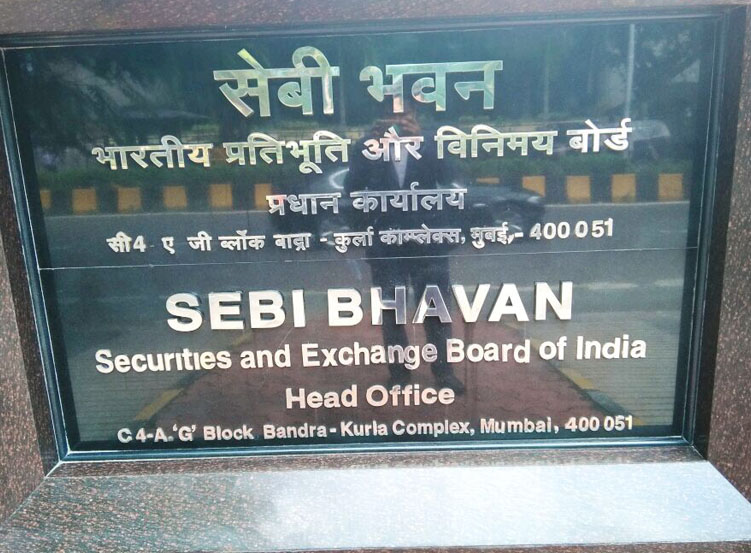

Securities And Exchange Board Of India

The Securities and Exchange Board of India (SEBI) is the regulatory body for securities and commodity market in India under the ownership of Ministry of Finance within the Government of India. It was established on 12 April 1988 as an executive body and was given statutory powers on 30 January 1992 through the SEBI Act, 1992. History Securities and Exchange Board of India (SEBI) was first established in 1988 as a non-statutory body for regulating the securities market. It became an autonomous body on 30 January 1992 and was accorded statutory powers with the passing of the SEBI Act 1992 by the Indian Parliament. SEBI has its headquarters at the business district of Bandra Kurla Complex in Mumbai and has Northern, Eastern, Southern and Western Regional Offices in New Delhi, Kolkata, Chennai, and Ahmedabad respectively. It has opened local offices at Jaipur and Bangalore and has also opened offices at Guwahati, Bhubaneshwar, Patna, Kochi and Chandigarh in Financial Year 2013� ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Investment is usually made with an investment strategy in mind. Size of the market The total market capitalization of all publicly traded securities worldwide rose from US$2.5 trillion in 1980 to US$93.7 trillion at the end of 2020. , there are 60 stock exchanges in the world. Of these, there are 16 exchanges with a market capitalization of $1 trillion or more, and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, these 16 exchanges are all in North America, Europe, or Asia. By country, the largest stock markets as of January 2022 are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Institutional Investor

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, REITs, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Although institutional investors appear to be more sophisticated than retail investors, it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses of investment managemen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hawala

Hawala or hewala ( ar, حِوالة , meaning ''transfer'' or sometimes ''trust''), also known as in Persian, and or in Somali, is a popular and informal value transfer system based on the performance and honour of a huge network of money brokers (known as ''hawaladars''). They operate outside of, or parallel to, traditional banking, financial channels and remittance systems. The system requires a minimum of two hawaladars that take care of the "transaction" without the movement of cash or telegraphic transfer. While hawaladars are spread throughout the world, they are primarily located in the Middle East, North Africa, the Horn of Africa and the Indian subcontinent. Hawala follows Islamic traditions but its use is not limited to Muslims. Origins The hawala system originated in India. Hawala as a legal concept came to be described as early as 1327, according to Schramm and Taube, though the actual practice has existed since the 8th century between Indian, Arab and Musl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BSE SENSEX

The BSE SENSEX (also known as the S&P Bombay Stock Exchange Sensitive Index or simply SENSEX) is a free-float market-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange. The 30 constituent companies which are some of the largest and most actively traded stocks, are representative of various industrial sectors of the Indian economy. Published since 1 January 1986, the S&P BSE SENSEX is regarded as the pulse of the domestic stock markets in India. The base value of the SENSEX was taken as ''100'' on 1 April 1979 and its base year as ''1978–79''. On 25 July 2001 BSE launched DOLLEX-30, a dollar-linked version of the SENSEX. Etymology The term Sensex was coined by Deepak Mohoni, a stock market analyst in 1989. BSE Sensitive Index then was at about 750 points. it is a portmanteau of the words Sensitive and Index. Calculation The BSE has some reviews and modifies its composition to be sure it reflects current m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subramanian Swamy

Subramanian Swamy (born 15 September 1939) is an Indian politician, economist and statistician. Before joining politics, he was a professor of Mathematical Economics at the Indian Institute of Technology, Delhi. He is known for his Hindu nationalist views. Swamy was a member of the Planning Commission of India and was a Cabinet Minister in the Chandra Shekhar government. Between 1994 and 1996, Swamy was Chairman of the Commission on Labour Standards and International Trade under former Prime Minister P. V. Narasimha Rao. Swamy was a long-time member of the Janata Party, serving as its president until 2013 when he joined the Bharatiya Janata Party (BJP). He has written on foreign affairs of India dealing largely with China, Pakistan and Israel. He was nominated to Rajya Sabha on 26 April 2016. Family and education Subramanian Swamy was born on 15 September 1939, in Mylapore, Chennai, Tamil Nadu, India, to a family which hailed originally from Madurai in Tamil Nadu. H ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of India

The Government of India ( ISO: ; often abbreviated as GoI), known as the Union Government or Central Government but often simply as the Centre, is the national government of the Republic of India, a federal democracy located in South Asia, consisting of 28 union states and eight union territories. Under the Constitution, there are three primary branches of government: the legislative, the executive and the judiciary, whose powers are vested in a bicameral Parliament, President, aided by the Council of Ministers, and the Supreme Court respectively. Through judicial evolution, the Parliament has lost its sovereignty as its amendments to the Constitution are subject to judicial intervention. Judicial appointments in India are unique in that the executive or legislature have negligible say. Etymology and history The Government of India Act 1833, passed by the British parliament, is the first such act of law with the epithet "Government of India". Basic structure The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

White Paper

A white paper is a report or guide that informs readers concisely about a complex issue and presents the issuing body's philosophy on the matter. It is meant to help readers understand an issue, solve a problem, or make a decision. A white paper is the first document researchers should read to better understand a core concept or idea. The term originated in the 1920s to mean a type of position paper or industry report published by some department of the UK government. Since the 1990s, this type of document has proliferated in business. Today, a business-to-business (B2B) white paper is closer to a marketing presentation, a form of content meant to persuade customers and partners and promote a certain product or viewpoint. That makes B2B white papers a type of grey literature. In government The term ''white paper'' originated with the British government and many point to the Churchill White Paper of 1922 as the earliest well-known example under this name. Gertrude Bell ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indian Black Money

In India, black money is funds earned on the black market, on which income and other taxes have not been paid. Also, the unaccounted money that is concealed from the tax administrator is called ''black money''. The black money is accumulated by the criminals, smugglers, and tax-evaders. Around ₹22,000 crores are supposed to have been accumulated by the criminals for vested interests, though writ petitions in the supreme court estimate this to be even larger, at ₹900 lakh crores. The total amount of black money deposited in foreign banks by Indians is unknown. Some reports claim a total of US $10.6 – $11.4 trillions is held illegally in Switzerland. Other reports, including those reported by the Swiss Bankers Association and the Government of Switzerland, claim these reports are false and fabricated, and the total amount held in all Swiss bank accounts by citizens of India is about 2 billion. In February 2012, the director of India's Central Bureau of Investigation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Money

A black market, underground economy, or shadow economy is a clandestine market or series of transactions that has some aspect of illegality or is characterized by noncompliance with an institutional set of rules. If the rule defines the set of goods and services whose production and distribution is prohibited by law, non-compliance with the rule constitutes a black market trade since the transaction itself is illegal. Parties engaging in the production or distribution of prohibited goods and services are members of the . Examples include the illegal drug trade, prostitution (where prohibited), illegal currency transactions, and human trafficking. Violations of the tax code involving income tax evasion in the . Because tax evasion or participation in a black market activity is illegal, participants attempt to hide their behavior from the government or regulatory authority. Cash is the preferred medium of exchange in illegal transactions since cash transactions are less-easi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Round-tripping (finance)

Round-tripping, also known as round-trip transactions or "Lazy Susans", is defined by ''The Wall Street Journal'' as a form of barter that involves a company selling "an unused asset to another company, while at the same time agreeing to buy back the same or similar assets at about the same price." Swapping assets on a round-trip produces no net economic substance, but may be fraudulently reported as a series of productive sales and beneficial purchases on the books of the companies involved, violating the substance over form accounting principle. The companies appear to be growing and very ''busy'', but the round-tripping ''business'' does not generate profits. Growth is an attractive factor to speculative investors, even if profits are lacking; such investment benefits companies and motivates them to undertake the illusory growth of round-tripping. They played a crucial part in temporarily inflating the market capitalization of energy traders such as Enron, CMS Energy, Reliant ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |