|

Paper Wealth

Paper wealth means wealth as measured by monetary value, as reflected in price of assets – how much money one's assets could be sold for. Paper wealth is contrasted with real wealth, which refers to one's actual physical assets. For example, if one owns a house and its assessed value increases (relative to the general price level, i.e., assuming no inflation) then one's paper wealth has increased – the asset has increased in value, meaning it could in principle be sold in exchange for a larger quantity of money, but one's real wealth is unchanged – the real asset is still the same house. It is said that one has "gotten richer ''on paper''," meaning "as an accounting matter": numbers on a balance sheet have changed, but the physical world has not. The term "paper wealth" is frequently used in popular discussions of wealth, and in some critiques of capitalism, finance, and certain economic theories, but is little-used in mainstream economics, which instead generally identifie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth (economics)

Wealth is the abundance of Value (economics), valuable financial assets or property, physical possessions which can be converted into a form that can be used for financial transaction, transactions. This includes the core meaning as held in the originating Old English word , which is from an Indo-European languages, Indo-European word stem. The modern concept of wealth is of significance in all areas of economics, and clearly so for economic growth, growth economics and development economics, yet the meaning of wealth is context-dependent. An individual possessing a substantial net worth is known as ''wealthy''. Net worth is defined as the current value of one's assets less liabilities (excluding the principal in trust accounts). At the most general level, economists may define wealth as "the total of anything of value" that captures both the subjective nature of the idea and the idea that it is not a fixed or static concept. Various definitions and concepts of wealth have been a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

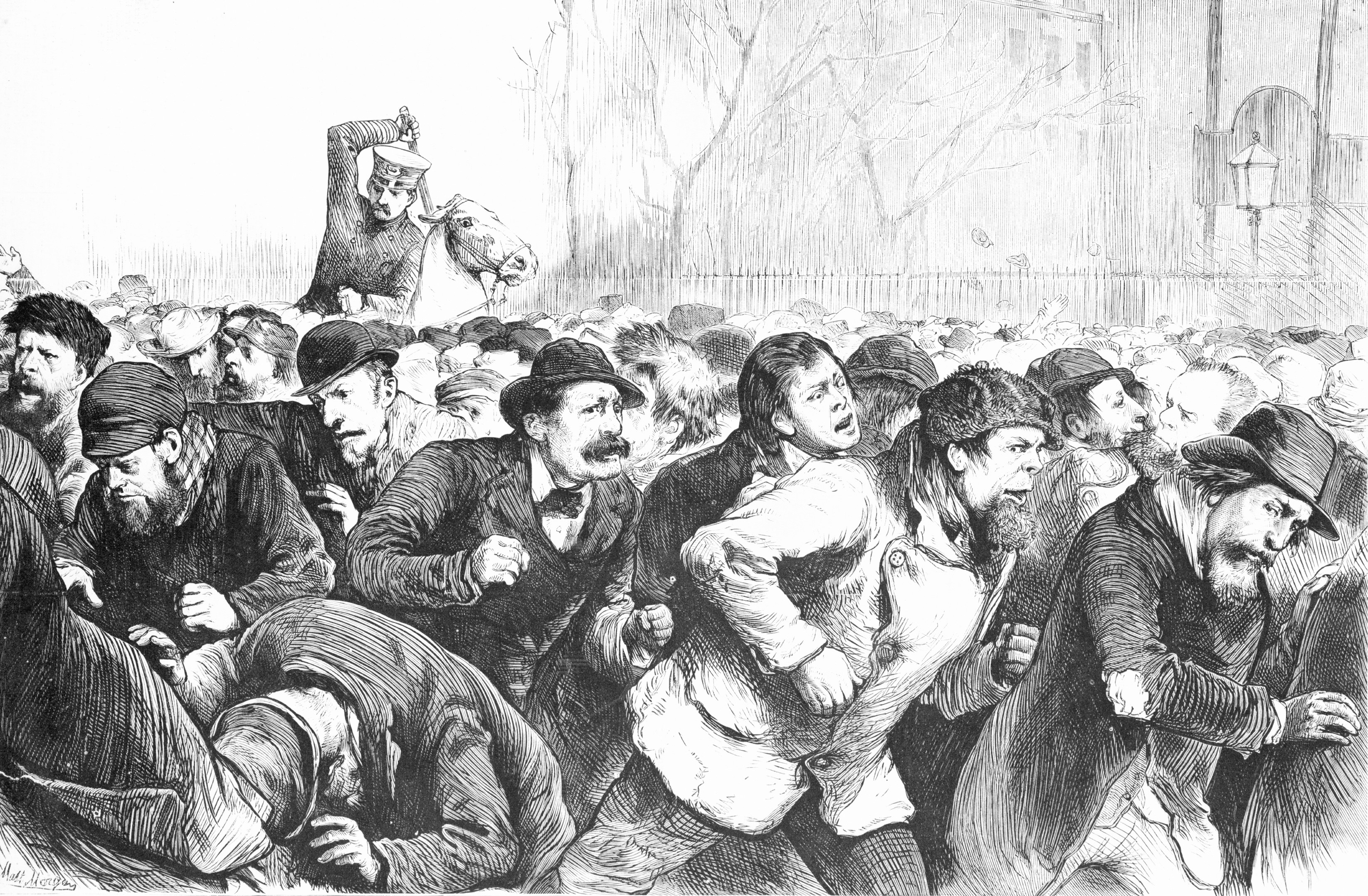

Stock Market Crash

A stock market crash is a sudden dramatic decline of stock In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ... prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often follow speculation and economic bubbles. A stock market crash is a social phenomenon where external economic events combine with crowd psychology in a positive feedback loop where selling by some market participants drives more market participants to sell. Generally speaking, crashes usually occur under the following conditions: a prolonged period of rising stock prices (a Market trend#Market terminology, bull market) and excessive economic optimism, a market where price–earnings ratios exce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Depression (economics)

An economic depression is a period of carried long-term economical downturn that is result of lowered economic activity in one major or more national economies. Economic depression maybe related to one specific country were there is some economic crisis that has worsened but most often reflexes historically the American Great Depression and similar economic status that may be recognized as existing at some country, several countries or even in many countries. It is often understood in economics that economic crisis and the following recession that maybe named economic depression are part of economic cycles where slowdown of economy follows the economic growth and vice versa. It is a result of more severe economic problems or a ''downturn'' than the economic recession, recession itself, which is a slowdown in economic activity over the course of the normal business cycle of growing economy. Economic depressions maybe also characterized by their length or duration, and maybe showing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

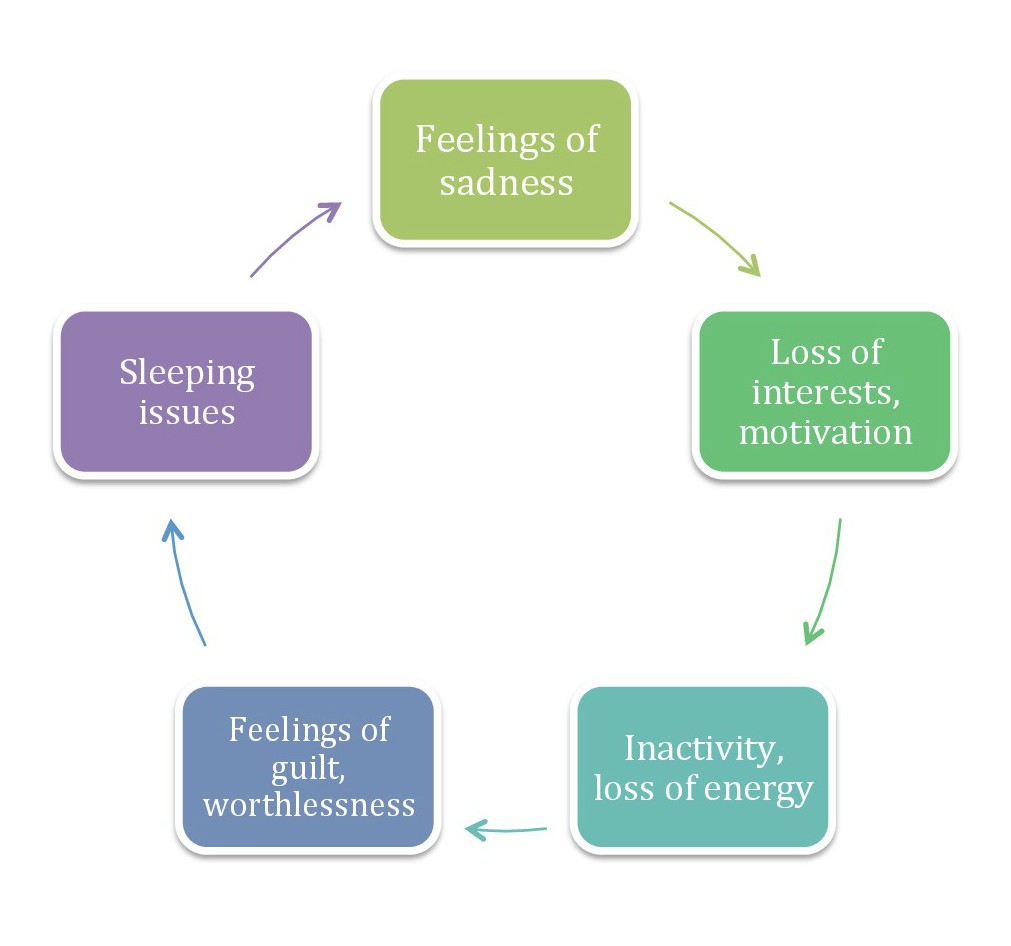

Vicious Cycle

A vicious circle (or cycle) is a complex chain of events that reinforces itself through a feedback loop, with detrimental results. It is a system with no tendency toward equilibrium (social, economic, ecological, etc.), at least in the short run. Each iteration of the cycle reinforces the previous one, in an example of positive feedback. A vicious circle will continue in the direction of its momentum until an external factor intervenes to break the cycle. A well-known example of a vicious circle in economics is hyperinflation. A virtuous circle is an equivalent system with a favorable outcome. Examples Vicious circles in the subprime mortgage crisis The contemporary subprime mortgage crisis is a complex group of vicious circles, both in its genesis and in its manifold outcomes, most notably the late 2000s recession. A specific example is the circle related to housing. As housing prices decline, more homeowners go " underwater", when the market value of a home drops below ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Procyclical

Procyclical and countercyclical variables are variables that fluctuate in a way that is positively or negatively correlated with business cycle fluctuations in gross domestic product (GDP). The scope of the concept may differ between the context of macroeconomic theory and that of economic policy–making. The concept is often encountered in the context of a government's approach to spending and taxation. A 'procyclical fiscal policy' can be summarised simply as governments choosing to increase government spending and reduce taxes during an economic expansion, but reduce spending and increase taxes during a recession. A 'countercyclical' fiscal policy takes the opposite approach: reducing spending and raising taxes during a boom period, and increasing spending and cutting taxes during a recession. Business cycle theory Procyclical In business cycle theory and finance, any economic quantity that is positively correlated with the overall state of the economy is said to be procyc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Effect

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption as measured by their preferences subject to limitations on their expenditures, by maximizing utility subject to a consumer budget constraint. Factors influencing consumers' evaluation of the utility of goods: income level, cultural factors, product information and physio-psychological factors. Consumption is separated from production, logically, because two different economic agents are involved. In the first case consumption is by the primary individual, individual tastes or preferences determine the amount of pleasure people derive from the goods and services they consume.; in the second case, a producer might make something that he would not consume himself. Therefore, different motivations and abilities are involved. The models that make up consumer theory are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth Effect

The wealth effect is the change in spending that accompanies a change in perceived wealth. Usually the wealth effect is positive: spending changes in the same direction as perceived wealth. Effect on individuals Changes in a consumer's wealth cause changes in the amounts and distribution of his or her consumption. People typically spend more overall when one of two things is true: when people ''actually are'' richer, objectively, or when people ''perceive themselves'' to be richer—for example, the assessed value of their home increases, or a stock they own goes up in price. Demand for some goods (called inferior goods) decreases with increasing wealth. For example, consider consumption of cheap fast food versus steak. As someone becomes wealthier, their demand for cheap fast food is likely to decrease, and their demand for more expensive steak may increase. Consumption may be tied to relative wealth. Particularly when supply is highly inelastic, or when the seller is a monopo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Cycle

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics'' such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numerous sources of business ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distressed Sale , a similar technique used on apparel

{{disambiguation ...

Distress may refer to: * Distress (medicine), an aversive state in which a person shows maladaptive behaviors * Mental distress (or psychological distress) * Distress, or distraint, the act of seizing goods to compel payment * ''Distress'' (novel), a novel by Greg Egan * ''Distress'' (1946 film), a 1946 French film * ''Distress'' (1929 film), a 1929 French silent film * Distress signal, an recognized means for obtaining help * Distressed inventory, goods or materials whose potential to be sold at a normal cost has passed * Distressing, the process of making an object appear aged ** Stone washing Stone washing is a textile manufacturing process used to give a newly manufactured cloth garment a worn-in (or worn-out) appearance. Stone-washing also helps to increase the softness and flexibility of otherwise stiff and rigid fabrics such as ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark To Market

Mark-to-market (MTM or M2M) or fair value accounting is accounting for the "fair value" of an asset or liability based on the current market price, or the price for similar assets and liabilities, or based on another objectively assessed "fair" value. Fair value accounting has been a part of Generally Accepted Accounting Principles (GAAP) in the United States since the early 1990s, and is now regarded as the "gold standard" in some circles. Failure to use it is viewed as the cause of the Orange County Bankruptcy, even though its use is considered to be one of the reasons for the Enron scandal and the eventual bankruptcy of the company, as well as the closure of the accounting firm Arthur Andersen. Mark-to-market accounting can change values on the balance sheet as market conditions change. In contrast, historical cost accounting, based on the past transactions, is simpler, more stable, and easier to perform, but does not represent current market value. It summarizes past tra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Value

Market value or OMV (Open Market Valuation) is the price at which an asset would trade in a competitive auction setting. Market value is often used interchangeably with ''open market value'', ''fair value'' or ''fair market value'', although these terms have distinct definitions in different standards, and differ in some circumstances. Definition International Valuation Standards defines market value as "the estimated amount for which a property should exchange on the date of valuation between a willing buyer and a willing seller in an arm’s-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion". Market value is a concept distinct from market price, which is "the price at which one can transact", while market value is "the true underlying value" according to theoretical standards. The concept is most commonly invoked in inefficient markets or disequilibrium situations where prevailing market prices are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |