|

Overlapping Generations Model

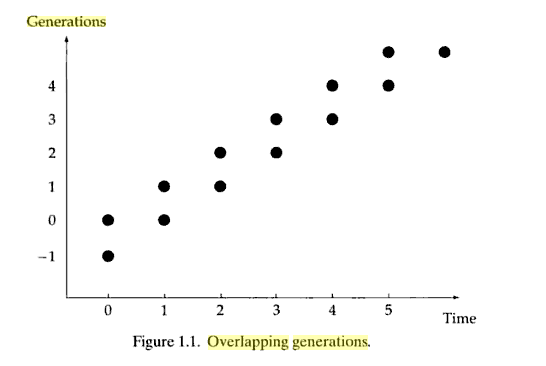

The overlapping generations (OLG) model is one of the dominating frameworks of analysis in the study of macroeconomic dynamics and economic growth. In contrast, to the Ramsey–Cass–Koopmans neoclassical growth model in which individuals are infinitely-lived, in the OLG model individuals live a finite length of time, long enough to overlap with at least one period of another agent's life. The OLG model is the natural framework for the study of: (a) the life-cycle behavior (investment in human capital, work and saving for retirement), (b) the implications of the allocation of resources across the generations, such as Social Security, on the income per capita in the long-run, (c) the determinants of economic growth in the course of human history, and (d) the factors that triggered the fertility transition. History The construction of the OLG model was inspired by Irving Fisher's monograph ''The Theory of Interest''.: It was first formulated in 1947, in the context of a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomic

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism." Macroeconomists study topics such as GDP (Gross Domestic Product), unemployment (including unemployment rates), national income, price indices, output, consumption, inflation, saving, investment, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The United Nations Sustainable Development Goal 17 has a target to enha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David De La Croix

David de la Croix (; born 22 April 1964) is a Belgian scholar and author in the field of economic growth and demographic economics. He is professor at the University of Louvain (UCLouvain). Contributions David de la Croix and his co-authors Raouf Boucekkine and Omar Licandro developed a unified framework encompassing longevity, education and economic growth. The basic link is that a longer life expectancy justifies a greater investment in education (this is called the Ben Porath mechanism in the related literature), which in turn fosters economic growth by promoting human capital accumulation. The resulting model has been taken to several sets of demographic data pertaining to the 17th and 18th centuries, providing evidence on the role of demographics in the Industrial Revolution. This conclusion is reinforced by the work with Omar Licandro on famous people, which provides a broad picture of the evolution of the longevity of the elite over the last centuries, using a database ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Over Saving

Over may refer to: Places *Over, Cambridgeshire, England *Over, Cheshire, England * Over, South Gloucestershire, England *Over, Tewkesbury, near Gloucester, England **Over Bridge * Over, Seevetal, Germany Music Albums * ''Over'' (album), by Peter Hammill, 1977 * ''Over'' (EP), by Jarboe and Telecognac, 2000 Songs * "Over" (Blake Shelton song) * "Over" (Drake song) * "Over" (Evans Blue song) * "Over" (Fayray song) * "OVER" (Hey! Say! JUMP song) * "Over" (High and Mighty Color song) * "Over" (Lindsay Lohan song) * "Over" (Portishead song) *"Over", by A Perfect Circle from '' Mer de Noms'' *"Over", by Embrace from ''If You've Never Been'' *"Over", by Jimmy Eat World from '' Stay on My Side Tonight'' *"Over", by Zarif from '' Box of Secrets'' *"Over", a commonly used unofficial title for a studio outtake by Cardiacs included on ''Toy World'' Other uses *Over, a term in radio radiotelephony procedure *Over, a professional wrestling term *Over (cricket), a division of play in the s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Necessary And Sufficient Condition

In logic and mathematics, necessity and sufficiency are terms used to describe a conditional or implicational relationship between two statements. For example, in the conditional statement: "If then ", is necessary for , because the truth of is guaranteed by the truth of (equivalently, it is impossible to have without ). Similarly, is sufficient for , because being true always implies that is true, but not being true does not always imply that is not true. In general, a necessary condition is one that must be present in order for another condition to occur, while a sufficient condition is one that produces the said condition. The assertion that a statement is a "necessary ''and'' sufficient" condition of another means that the former statement is true if and only if the latter is true. That is, the two statements must be either simultaneously true, or simultaneously false. In ordinary English (also natural language) "necessary" and "sufficient" indicate relations betw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pareto Efficiency

Pareto efficiency or Pareto optimality is a situation where no action or allocation is available that makes one individual better off without making another worse off. The concept is named after Vilfredo Pareto (1848–1923), Italian civil engineer and economist, who used the concept in his studies of economic efficiency and income distribution. The following three concepts are closely related: * Given an initial situation, a Pareto improvement is a new situation where some agents will gain, and no agents will lose. * A situation is called Pareto-dominated if there exists a possible Pareto improvement. * A situation is called Pareto-optimal or Pareto-efficient if no change could lead to improved satisfaction for some agent without some other agent losing or, equivalently, if there is no scope for further Pareto improvement. The Pareto front (also called Pareto frontier or Pareto set) is the set of all Pareto-efficient situations. Pareto originally used the word "optimal" for t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fundamental Theorems Of Welfare Economics

There are two fundamental theorems of welfare economics. The first states that in economic equilibrium, a set of complete markets, with complete information, and in perfect competition, will be Pareto optimal (in the sense that no further exchange would make one person better off without making another worse off). The requirements for perfect competition are these: # There are no externalities and each actor has perfect information. # Firms and consumers take prices as given (no economic actor or group of actors has market power). The theorem is sometimes seen as an analytical confirmation of Adam Smith's "invisible hand" principle, namely that ''competitive markets ensure an efficient allocation of resources''. However, there is no guarantee that the Pareto optimal market outcome is socially desirable, as there are many possible Pareto efficient allocations of resources differing in their desirability (e.g. one person may own everything and everyone else nothing). The second th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malthusian Trap

Malthusianism is the idea that population growth is potentially exponential while the growth of the food supply or other resources is linear, which eventually reduces living standards to the point of triggering a population die off. This event, called a Malthusian catastrophe (also known as a Malthusian trap, population trap, Malthusian check, Malthusian crisis, Malthusian spectre, or Malthusian crunch) occurs when population growth outpaces agricultural production, causing famine or war, resulting in poverty and depopulation. Such a catastrophe inevitably has the effect of forcing the population to "correct" back to a lower, more easily sustainable level (quite rapidly, due to the potential severity and unpredictable results of the mitigating factors involved, as compared to the relatively slow time scales and well-understood processes governing unchecked growth or growth affected by preventive checks). Malthusianism has been linked to a variety of political and social movements ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gender Wage Gap

The gender pay gap or gender wage gap is the average difference between the remuneration for men and women who are working. Women are generally found to be paid less than men. There are two distinct numbers regarding the pay gap: non-adjusted versus adjusted pay gap. The latter typically takes into account differences in hours worked, occupations chosen, education and job experience. In the United States, for example, the non-adjusted average woman's annual salary is 79% of the average man's salary, compared to 95% for the adjusted average salary. The reasons link to legal, social and economic factors, and extend beyond "equal pay for equal work". The social factors include topics such as discrimination based on gender, the motherhood penalty vs. fatherhood bonus, parental leave, and gender norms. Additionally, the consequences of the gender pay gap surpass individual grievances, leading to reduced economic output, lower pensions for women, and fewer learning opportunities. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OLG Model - Diamond in economics

{{disambig ...

The acronym OLG may refer to: * ''Oberlandesgericht'', a higher regional court of appeals in Germany * Online gaming * Ontario Lottery and Gaming Corporation, a Canadian provincial government agency which operates lottery games and casinos. * Our Lady of Guadalupe * Overlapping gene in genomes * Overlapping generations in population genetics * Overlapping generations model The overlapping generations (OLG) model is one of the dominating frameworks of analysis in the study of macroeconomic dynamics and economic growth. In contrast, to the Ramsey–Cass–Koopmans neoclassical growth model in which individuals are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convergence Hypothesis

The idea of convergence in economics (also sometimes known as the catch-up effect) is the hypothesis that poorer economies' per capita incomes will tend to grow at faster rates than richer economies, and in the Solow-Swan growth model, economic growth is driven by the accumulation of physical capital until this optimum level of capital per worker, which is the "steady state" is reached, where output, consumption and capital are constant. The model predicts more rapid growth when the level of physical capital per capita is low, something often referred to as “catch up” growth. As a result, all economies should eventually converge in terms of per capita income. Developing countries have the potential to grow at a faster rate than developed countries because diminishing returns (in particular, to capital) are not as strong as in capital-rich countries. Furthermore, poorer countries can replicate the production methods, technologies, and institutions of developed countries. In ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |