|

Optimal Tax

Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. The social welfare function used is typically a function of individuals' utilities, most commonly some form of utilitarian function, so the tax system is chosen to maximise the aggregate of individual utilities. Tax revenue is required to fund the provision of public goods and other government services, as well as for redistribution from rich to poor individuals. However, most taxes distort individual behavior, because the activity that is taxed becomes relatively less desirable; for instance, taxes on labour income reduce the incentive to work. The optimization problem involves minimizing the distortions caused by taxation, while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes (where individuals cannot change their behaviour to redu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Welfare Function

In welfare economics, a social welfare function is a function that ranks social states (alternative complete descriptions of the society) as less desirable, more desirable, or indifferent for every possible pair of social states. Inputs of the function include any variables considered to affect the economic welfare of a society. In using welfare measures of persons in the society as inputs, the social welfare function is individualistic in form. One use of a social welfare function is to represent prospective patterns of collective choice as to alternative social states. The social welfare function provides the government with a simple guideline for achieving the optimal distribution of income. The social welfare function is analogous to the consumer theory of indifference-curve– budget constraint tangency for an individual, except that the social welfare function is a mapping of individual preferences or judgments of everyone in the society as to collective choices, which ap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Horizontal Equity

Equity, or economic equality, is the concept or idea of fairness in economics, particularly in regard to taxation or welfare economics. More specifically, it may refer to a movement that strives to provide equal life chances regardless of identity, to provide all citizens with a basic and equal minimum of income, goods, and services or to increase funds and commitment for redistribution. Overview According to Peter Corning, there are three distinct categories of substantive fairness (equality, equity, and reciprocity) that must be combined and balanced in order to achieve a truly fair society. Inequality and inequities have significantly increased in recent decades. Equity is based on the idea of moral equality. Equity looks at the distribution of capital, goods, and access to services throughout an economy and is often measured using tools such as the Gini index. Equity may be distinguished from economic efficiency in overall evaluation of social welfare. Although 'equity' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joel Slemrod

Joel Brian Slemrod (born July 14, 1951) is an American economist and academic, currently serving as a professor of economics at the University of Michigan and the Paul W. McCracken Collegiate Professor of Business Economics and Public Policy at the Stephen M. Ross School of Business at the University of Michigan. Education He earned a Bachelor of Arts degree from Princeton University in 1973 and a Ph.D. in economics from Harvard University in 1980. Career Slemrod has served on the faculty of the University of Michigan since 1987, and does research on taxation, with a focus on taxation of personal income. He is co-author of ''Taxing Ourselves: A Citizen's Guide to the Great Debate over Tax Reform'' and the editor of Does Atlas Shrug? The Economic Consequences of Taxing the Rich. Slemrod also serves as Director of the Office of Tax Policy Research, which is a research center at the University of Michigan on matters of tax policy. In 2001, Slemrod shared an Ig Nobel Prize with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP ( Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 1948, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flat Tax

A flat tax (short for flat-rate tax) is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressive due to exemptions, or regressive in case of a maximum taxable amount. There are various tax systems that are labeled "flat tax" even though they are significantly different. The defining characteristic is the existence of only one tax rate other than zero, as opposed to multiple non-zero rates that vary depending on the amount subject to taxation. A flat tax system is usually discussed in the context of an income tax, where progressivity is common, but it may also apply to taxes on consumption, property or transfers. Unlike progressive taxes, which include complex and numerous exceptions left to the tax collectors’ discretion, the flat tax is clear cut. In combination with the low rate, its simplicity considerably reduces the stimul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gregory Mankiw

Nicholas Gregory Mankiw (; born February 3, 1958) is an American macroeconomist who is currently the Robert M. Beren Professor of Economics at Harvard University. Mankiw is best known in academia for his work on New Keynesian economics. Mankiw has written widely on economics and economic policy. , the RePEc overall ranking based on academic publications, citations, and related metrics put him as the 45th most influential economist in the world, out of nearly 50,000 registered authors. He was the 11th most cited economist and the 9th most productive research economist as measured by the h-index. In addition, Mankiw is the author of several best-selling textbooks, writes a popular blog,For Greg Mankiw's blog, see and has since 2007 written approximately monthly for the Sunday business section of ''The New York Times.'' According to the Open Syllabus Project, Mankiw is the most frequently-cited author on college syllabi for economics courses. Mankiw is a conservative and has been ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David Bradford (economist)

David Frantz Bradford (January 8, 1939 – February 22, 2005) was a prominent American economist and professor of economics and public affairs in the Woodrow Wilson School at Princeton University.• Eric Quinones Christopher Lehmann-Haupt (February 22, 2005)David Bradford, Princeton economist and tax expert, dies,"''News at Princeton''.• Christopher Lehmann-Haupt (February 24, 2005)"David Bradford, 66, Economist Who Advocated Tax Reform, Dies,"''New York Times''. Bradford was born in Cambridge, Massachusetts. After his graduation from Amherst College in 1960, Bradford studied at MIT and Harvard (M.S., Applied Mathematics, 1962). In 1966 he earned his doctorate in economics from Stanford University. He was awarded the degree of Doctor of Humane Letters by Amherst College in 1985. From 1991 to 1993, he served as a member of the President's Council of Economic Advisors (George H. W. Bush). He had previously served as Deputy Assistant Secretary for Tax Policy in the United States ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William J

William is a male given name of Germanic origin.Hanks, Hardcastle and Hodges, ''Oxford Dictionary of First Names'', Oxford University Press, 2nd edition, , p. 276. It became very popular in the English language after the Norman conquest of England in 1066,All Things William"Meaning & Origin of the Name"/ref> and remained so throughout the Middle Ages and into the modern era. It is sometimes abbreviated "Wm." Shortened familiar versions in English include Will, Wills, Willy, Willie, Bill, and Billy. A common Irish form is Liam. Scottish diminutives include Wull, Willie or Wullie (as in Oor Wullie or the play ''Douglas''). Female forms are Willa, Willemina, Wilma and Wilhelmina. Etymology William is related to the given name ''Wilhelm'' (cf. Proto-Germanic ᚹᛁᛚᛃᚨᚺᛖᛚᛗᚨᛉ, ''*Wiljahelmaz'' > German ''Wilhelm'' and Old Norse ᚢᛁᛚᛋᛅᚼᛅᛚᛘᛅᛋ, ''Vilhjálmr''). By regular sound changes, the native, inherited English form of the name shoul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

James Mirrlees

Sir James Alexander Mirrlees (5 July 1936 – 29 August 2018) was a British economist and winner of the 1996 Nobel Memorial Prize in Economic Sciences. He was knighted in the 1997 Birthday Honours. Early life and education Born in Minnigaff, Kirkcudbrightshire, Mirrlees was educated at Douglas Ewart High School, then at the University of Edinburgh ( MA in Mathematics and Natural Philosophy in 1957) and Trinity College, Cambridge (Mathematical Tripos and PhD in 1963 with thesis title ''Optimum Planning for a Dynamic Economy'', supervised by Richard Stone). He was a very active student debater. A contemporary, Quentin Skinner, has suggested that Mirrlees was a member of the Cambridge Apostles along with fellow Nobel Laureate Amartya Sen during the period. Economics Between 1968 and 1976, Mirrlees was a visiting professor at the Massachusetts Institute of Technology three times. He was also a visiting professor at the University of California, Berkeley (1986) and Yale Univers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peter Diamond

Peter Arthur Diamond (born , 1940) is an American economist known for his analysis of U.S. Social Security In the United States, Social Security is the commonly used term for the Federal government of the United States, federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration ( ... policy and his work as an advisor to the Advisory Council on Social Security in the late 1980s and 1990s. He was awarded the Nobel Memorial Prize in Economic Sciences in 2010, along with Dale T. Mortensen and Christopher A. Pissarides. He is an List of Institute Professors, Institute Professor at the Massachusetts Institute of Technology. On June 6, 2011, he withdrew his nomination to serve on the Federal Reserve's board of governors, citing intractable Republican Party (United States), Republican opposition for 14 months. Early life and education Diamond was born to a American Jews, Jewish family in New York City. His gra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Elasticity Of Demand

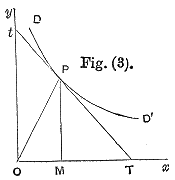

A good's price elasticity of demand (E_d, PED) is a measure of how sensitive the quantity demanded is to its price. When the price rises, quantity demanded falls for almost any good, but it falls more for some than for others. The price elasticity gives the percentage change in quantity demanded when there is a one percent increase in price, holding everything else constant. If the elasticity is −2, that means a one percent price rise leads to a two percent decline in quantity demanded. Other elasticities measure how the quantity demanded changes with other variables (e.g. the income elasticity of demand for consumer income changes). Price elasticities are negative except in special cases. If a good is said to have an elasticity of 2, it almost always means that the good has an elasticity of −2 according to the formal definition. The phrase "more elastic" means that a good's elasticity has greater magnitude, ignoring the sign. Veblen and Giffen goods are two classes of good ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Elasticity Of Supply

The price elasticity of supply (PES or Es) is a measure used in economics to show the responsiveness, or elasticity, of the quantity supplied of a good or service to a change in its price. The elasticity is represented in numerical form, and is defined as the percentage change in the quantity supplied divided by the percentage change in price. When the elasticity is less than one, the supply of the good can be described as ''inelastic''; when it is greater than one, the supply can be described as ''elastic''.Png, Ivan (1999). pp. 129–32. An elasticity of zero indicates that quantity supplied does not respond to a price change: the good is "fixed" in supply. Such goods often have no labor component or are not produced, limiting the short run prospects of expansion. If the elasticity is exactly one, the good is said to be ''unit-elastic''. The quantity of goods supplied can, in the short term, be different from the amount produced, as manufacturers will have stocks which they ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |