|

Overdraft

An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. In these situations the account is said to be "overdrawn". In the economic system, if there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply. By analogy, overdrafting of an aquifer refers to extraction of water faster than it will be replenished. History in finance The first overdraft facility was set up in 1728 by the Royal Bank of Scotland. The merchant William Hogg was having problems in balancing his books and was able to come to an agreement with the newly established bank that allowed him to withdraw money from his empty account to pay his debts before he received h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overdrafting

Overdrafting is the process of extracting groundwater beyond the equilibrium yield of an aquifer. Groundwater is one of the largest sources of fresh water and is found underground. The primary cause of groundwater depletion is the excessive pumping of groundwater up from underground aquifers. Insufficient recharge can lead to depletion, reducing the usefulness of the aquifer for humans. Depletion can also have impacts on the environment around the aquifer, such as soil compression and land subsidence, local climatic change, soil chemistry changes, and other deterioration of the local environment. There are two sets of yields: safe yield and sustainable yield. Safe yield is the amount of groundwater that can be withdrawn over a period of time without exceeding the long-term recharge rate or affecting the aquifer integrity. Sustainable yield is the amount of water extraction that can be sustained indefinitely without negative hydrological impacts, taking into account both recha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Halifax (United Kingdom Bank)

Halifax (previously known as Halifax Building Society and colloquially known as The Halifax) is a British banking brand operating as a trading division of Bank of Scotland, itself a wholly owned subsidiary of Lloyds Banking Group. It is named after the town of Halifax, West Yorkshire, where it was founded as a building society in 1853. By 1913 it had developed into the UK's largest building society and continued to grow and prosper and maintained this position within the UK until 1997 when it Demutualization#Building societies, demutualised. In 1996, it became Halifax plc, a public limited company which was a constituent of the FTSE 100 Index. In 2001, Halifax plc merged with The Governor and Company of the Bank of Scotland, forming HBOS. In 2006, the HBOS Group Reorganisation Act 2006 legally transferred the assets and liabilities of the Halifax chain to Bank of Scotland. That bank, originally established by act of parliament, became a standard Public limited company, plc, wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lloyds Banking Group

Lloyds Banking Group plc is a British financial institution formed through the acquisition of HBOS by Lloyds TSB in 2009. It is one of the UK's largest financial services organisations, with 30 million customers and 65,000 employees. Lloyds Bank was founded in 1765 but the wider Group's heritage extends over 320 years, dating back to the founding of the Bank of Scotland by the Parliament of Scotland in 1695. The Group's headquarters are located at 25 Gresham Street in the City of London, while its registered office is on The Mound in Edinburgh. It also operates office sites in Birmingham, Bristol, West Yorkshire and Glasgow. The Group also has overseas operations in the US and Europe. Its headquarters for business in the European Union is in Berlin, Germany. The business operates under a number of distinct brands, including Lloyds Bank, Halifax, Bank of Scotland and Scottish Widows. Former Chief Executive António Horta-Osório told ''The Banker'', "We will keep the d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

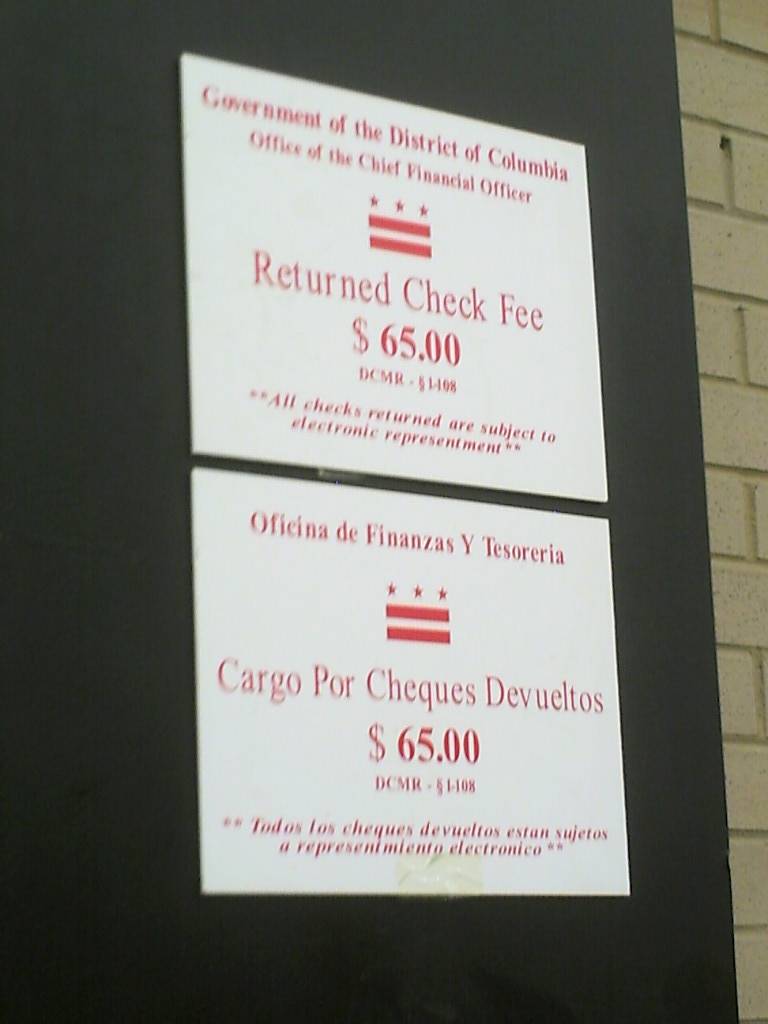

Bank Charges

A bank fee or a bank charge includes charges and fees made by a bank to their customers exclusive of interest payments. In common parlance, the term often relates to charges in respect of personal current accounts or checking account. These charges may take many forms such as monthly charges for the provision of an account, specific transaction charges such as withdrawal and transfer fees, ATM usage fees, debit card fees for doing a card transactions above a preset limit per month, credit card fees, loan establishment fees, early termination fees, and minimum account balance fees. They also include overdraft fees or non-sufficient funds (NSF) fees for exceeding authorized overdraft limits, or making payments (or attempting to make payments) where no authorized overdraft exists. History A banks main source of income is interest charges on lending but bank fees have been a minor but important part of a banks income since the early days of banking. Bank fees were initially des ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aquifer

An aquifer is an underground layer of water-bearing material, consisting of permeability (Earth sciences), permeable or fractured rock, or of unconsolidated materials (gravel, sand, or silt). Aquifers vary greatly in their characteristics. The study of water flow in aquifers and the characterization of aquifers is called ''hydrogeology''. Related concepts include aquitard, a bed (geology), bed of low permeability along an aquifer, and aquiclude (or ''aquifuge''), a solid and impermeable region underlying or overlying an aquifer, the pressure of which could lead to the formation of a confined aquifer. Aquifers can be classified as saturated versus unsaturated; aquifers versus aquitards; confined versus unconfined; isotropic versus anisotropic; porous, karst, or fractured; and transboundary aquifer. Groundwater from aquifers can be sustainably harvested by humans through the use of qanats leading to a well. This groundwater is a major source of fresh water for many regions, althoug ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Charge

A bank fee or a bank charge includes charges and fees made by a bank to their customers exclusive of interest payments. In common parlance, the term often relates to charges in respect of personal current accounts or checking account. These charges may take many forms such as monthly charges for the provision of an account, specific transaction charges such as withdrawal and transfer fees, ATM usage fees, debit card fees for doing a card transactions above a preset limit per month, credit card fees, loan establishment fees, early termination fees, and minimum account balance fees. They also include overdraft fees or non-sufficient funds (NSF) fees for exceeding authorized overdraft limits, or making payments (or attempting to make payments) where no authorized overdraft exists. History A banks main source of income is interest charges on lending but bank fees have been a minor but important part of a banks income since the early days of banking. Bank fees were initially des ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debit Card

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. Debit cards are similar to a credit card, but the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase. Some debit cards carry a Stored-value card, stored value with which a payment is made (prepaid cards), but most relay a message to the cardholder's bank to withdraw funds from the cardholder's designated bank account. In some cases, the payment card number is assigned exclusively for use on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-sufficient Funds

A dishonoured cheque (US spelling: dishonored check) is a cheque that the bank on which it is drawn declines to pay ("honour"). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the most common, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF cheque may be referred to as a bad cheque, dishonoured cheque, bounced cheque, cold cheque, rubber cheque, returned item, or hot cheque. Lost or bounced cheques result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed "Present again", by which time the funds should have cleared. When more than one cheque is presented fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Authorization Hold

Authorization hold (also card authorization, preauthorization, or preauth) is a service offered by credit and debit card providers whereby the provider puts a hold of the amount approved by the cardholder, reducing the balance of available funds until the merchant clears the transaction (also called settlement), after the transaction is completed or aborted, or because the hold expires. In the case of debit cards, authorization holds can fall off the account, thus rendering the balance available again, anywhere from one to eight business days after the transaction date, depending on the bank's policy. In the case of credit cards, holds may last as long as thirty days, depending on the issuing bank. Transactions may be withdrawn but in most cases, especially with smaller banks, will not show up as a deposit on the cardholder's bank statement but will instead be directly added to the available balance automatically due to it only being a “temporary charge”. The usual reason fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regulation CC

The Expedited Funds Availability Act (EFA or EFAA) was enacted in 1987 by the United States Congress for the purpose of standardizing hold periods on deposits made to commercial banks and to regulate institutions' use of deposit holds. It is also referred to as Regulation CC or Reg CC, after the Federal Reserve regulation that implements the act. The law is codified in Title 12, Chapter 41 of the US Code and Title 12, Part 229 of the Code of Federal Regulations. Disclosure Financial institutions must disclose their hold policies to all account holders, and make the policy available in written form upon request by any customer. It must also be provided at the time of opening of all new accounts. Additional disclosures are required on deposit slips, at automated teller machines, and when the policy is changed in any way. Types of hold Regulation CC stipulates four types of holds that a bank may place on a check deposit at its discretion. Each has its own qualifications and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |