|

Open-high-low-close Chart

An open-high-low-close chart (also OHLC) is a type of chart typically used to illustrate movements in the price of a financial instrument over time. Each vertical line on the chart shows the price range (the highest and lowest prices) over one unit of time, e.g., one day or one hour. Tick marks project from each side of the line indicating the opening price (e.g., for a daily bar chart this would be the starting price for that day) on the left, and the closing price for that time period on the right. The bars may be shown in different hues depending on whether prices rose or fell in that period. The Japanese candlestick chart and OHLC charts show exactly the same data, i.e., the opening, high, low, and closing prices during a particular time frame.Rockefeller, Barbara (Feb. 6 2014). ''Technical Analysis for Dummies'', 3rd Edition. Wiley Publishing, Inc. Day traders, who by default have to watch the price movements on a chart, prefer to use the Japanese candlesticks, because they ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bollinger Bands Example, 2 Stddevs

Bollinger () is a French Champagne house, a producer of sparkling wines from the Champagne region. They produce several labels of Champagne under the Bollinger name, including the vintage ''Vieilles Vignes Françaises, Grande Année'' and ''R.D.'' as well as the non-vintage Special Cuvée. Founded in 1829 in Aÿ by Hennequin de Villermont, Paul Renaudin and Jacques Bollinger, the house continues to be run by members of the Bollinger family. In Britain, Bollinger Champagnes are affectionately known as "Bolly". History Bollinger has roots in the Champagne region dating back to 1585 when the Hennequins, one of the Bollinger founding families, owned land in Cramant. Before the Bollinger house was founded, in the 18th century the Villermont family practised wine making, though not under their family name. In 1750, Villermont settled in the location 16 rue Jules Lobet, which would eventually become the head office for Bollinger. In 1803 Jacques Joseph Placide Bollinger was born in El ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chart

A chart (sometimes known as a graph) is a graphical representation for data visualization, in which "the data is represented by symbols, such as bars in a bar chart, lines in a line chart, or slices in a pie chart". A chart can represent tabular numeric data, functions or some kinds of quality structure and provides different info. The term "chart" as a graphical representation of data has multiple meanings: * A data chart is a type of diagram or graph, that organizes and represents a set of numerical or qualitative data. * Maps that are adorned with extra information (map surround) for a specific purpose are often known as charts, such as a nautical chart or aeronautical chart, typically spread over several map sheets. * Other domain-specific constructs are sometimes called charts, such as the chord chart in music notation or a record chart for album popularity. Charts are often used to ease understanding of large quantities of data and the relationships between parts of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Instrument

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership interest in an entity or a contractual right to receive or deliver in the form of currency (forex); debt ( bonds, loans); equity ( shares); or derivatives ( options, futures, forwards). International Accounting Standards IAS 32 and 39 define a financial instrument as "any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity". Financial instruments may be categorized by "asset class" depending on whether they are equity-based (reflecting ownership of the issuing entity) or debt-based (reflecting a loan the investor has made to the issuing entity). If the instrument is debt it can be further categorized into short-term (less than one year) or long-term. Foreign exchange instruments and transactions are neither debt- nor equity-based and bel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hatch Mark

Hatch marks (also called hash marks or tick marks) are a form of mathematical notation. They are used in three ways as: * Unit and value marks — as on a ruler or number line * Congruence notation in geometry — as on a geometric figure * Graphed points — as on a graph Hatch marks are frequently used as an abbreviation of some common units of measurement. In regard to distance, a single hatch mark indicates feet, and two hatch marks indicate inches. In regard to time, a single hatch mark indicates minutes, and two hatch marks indicate seconds. In geometry and trigonometry, such marks are used following an elevated circle to indicate degrees, minutes, and seconds — ( ° ) ( ′ ) ( ″ ). Hatch marks can probably be traced to hatching in art works, where the pattern of the hatch marks represents a unique tone or hue. Different patterns indicate different tones. Unit and value marks Unit-and-value hatch marks are short vertical l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japanese Candlestick Chart

A candlestick chart (also called Japanese candlestick chart or K-line) is a style of financial chart used to describe price movements of a security, derivative, or currency. It is similar to a bar chart in that each candlestick represents all four important pieces of information for that day: open and close in the thick body; high and low in the “candle wick”. Being densely packed with information, it tends to represent trading patterns over short periods of time, often a few days or a few trading sessions. Candlestick charts are most often used in technical analysis In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the sam ... of equity and currency price patterns. They are used by traders to determine possible price movement based on past patterns, and who use the opening price, cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa duri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Line Chart

A line chart or line graph or curve chart is a type of chart which displays information as a series of data points called 'markers' connected by straight line segments. It is a basic type of chart common in many fields. It is similar to a scatter plot except that the measurement points are ordered (typically by their x-axis value) and joined with straight line segments. A line chart is often used to visualize a trend in data over intervals of time – a time series – thus the line is often drawn chronologically. In these cases they are known as run charts. History Some of the earliest known line charts are generally credited to Francis Hauksbee, Nicolaus Samuel Cruquius, Johann Heinrich Lambert and William Playfair. Example In the experimental sciences, data collected from experiments are often visualized by a graph. For example, if one collects data on the speed of an object at certain points in time, one can visualize the data in a data table such as the following: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moving Average

In statistics, a moving average (rolling average or running average) is a calculation to analyze data points by creating a series of averages of different subsets of the full data set. It is also called a moving mean (MM) or rolling mean and is a type of finite impulse response filter. Variations include: simple, cumulative, or weighted forms (described below). Given a series of numbers and a fixed subset size, the first element of the moving average is obtained by taking the average of the initial fixed subset of the number series. Then the subset is modified by "shifting forward"; that is, excluding the first number of the series and including the next value in the subset. A moving average is commonly used with time series data to smooth out short-term fluctuations and highlight longer-term trends or cycles. The threshold between short-term and long-term depends on the application, and the parameters of the moving average will be set accordingly. It is also used in economics ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

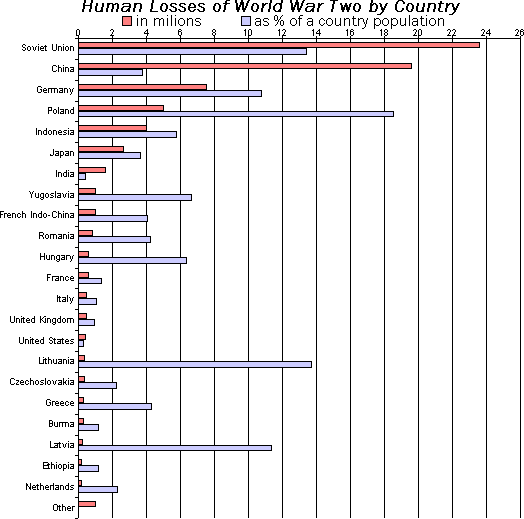

Column Chart

A bar chart or bar graph is a chart or graph that presents categorical data with rectangular bars with heights or lengths proportional to the values that they represent. The bars can be plotted vertically or horizontally. A vertical bar chart is sometimes called a column chart. A bar graph shows comparisons among discrete categories. One axis of the chart shows the specific categories being compared, and the other axis represents a measured value. Some bar graphs present bars clustered in groups of more than one, showing the values of more than one measured variable. History Many sources consider William Playfair (1759-1824) to have invented the bar chart and the ''Exports and Imports of Scotland to and from different parts for one Year from Christmas 1780 to Christmas 1781'' graph from his ''The Commercial and Political Atlas'' to be the first bar chart in history. Diagrams of the velocity of a constantly accelerating object against time published in ''The Latitude of Forms'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trading Volume

In capital markets, volume, or trading volume, is the amount (total number) of a security (or a given set of securities, or an entire market) that was traded during a given period of time. In the context of a single stock trading on a stock exchange, the volume is commonly reported as the number of shares that changed hands during a given day. The transactions are measured on stocks, bonds, options contracts, futures contracts and commodities. The average volume of a security over a longer period of time is the total amount traded in that period, divided by the length of the period. Therefore, the unit of measurement for average volume is shares per unit of time, typically per trading day. Significance Trading volume is usually higher when the price of a security is changing. News about a company's financial status, products, or plans, whether positive or negative, will usually result in a temporary increase in the trade volume of its stock. Shifts in trade volume can make ob ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa duri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |