|

National Securities Depository Limited

National Securities Depository Limited (NSDL) is an Indian central securities depository, based in Mumbai. It was established in August 1996 as the first electronic securities depository in India with national coverage. It was established based on a suggestion by a national institution responsible for the economic development of India. It's demat accounts now hold assets worth $4 trillion. NSDL provides services to investors, stock brokers, custodians, issuer companies, Saving account current account Business corresponding etc. through its nationwide network of Depository Participants or DPs and digital platforms. History Although India had a vibrant capital market which is more than a century old, the paper-based settlement of trades caused substantial problems such as bad delivery and delayed transfer of title. The promulgation of the Depositories ordinance in 1995 paved the way for the establishment of National Securities Depository Limited (NSDL), the first depository in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Securities Depository

A central securities depository (CSD) is a specialized financial organization holding securities like shares, either in certificated or uncertificated ( dematerialized) form, allowing ownership to be easily transferred through a book entry rather than by a transfer of physical certificates. This allows brokers and financial companies to hold their securities at one location where they can be available for clearing and settlement. This is usually done electronically, making it much faster and easier than was traditionally the case where physical certificates had to be exchanged after a trade had been completed. In some cases these organizations also carry out centralized comparison, and transaction processing such as clearing and settlement of securities transfers, securities pledges, and securities freezes. Scope A CSD can be national or international in nature, and may be for a specific type of security, such as government bonds. Domestic central securities depository Many c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mumbai

Mumbai (, ; also known as Bombay — the official name until 1995) is the capital city of the Indian state of Maharashtra and the ''de facto'' financial centre of India. According to the United Nations, as of 2018, Mumbai is the second-most populous city in India after Delhi and the eighth-most populous city in the world with a population of roughly 20 million (2 crore). As per the Indian government population census of 2011, Mumbai was the most populous city in India with an estimated city proper population of 12.5 million (1.25 crore) living under the Brihanmumbai Municipal Corporation. Mumbai is the centre of the Mumbai Metropolitan Region, the sixth most populous metropolitan area in the world with a population of over 23 million (2.3 crore). Mumbai lies on the Konkan coast on the west coast of India and has a deep natural harbour. In 2008, Mumbai was named an alpha world city. It has the highest number of millionaires and billionaires among all cities i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maharashtra

Maharashtra (; , abbr. MH or Maha) is a states and union territories of India, state in the western India, western peninsular region of India occupying a substantial portion of the Deccan Plateau. Maharashtra is the List of states and union territories of India by population, second-most populous state in India and the second-most populous country subdivision globally. It was formed on 1 May 1960 by splitting the bilingual Bombay State, which had existed since 1956, into majority Marathi language, Marathi-speaking Maharashtra and Gujarati language, Gujarati-speaking Gujarat. Maharashtra is home to the Marathi people, the predominant ethno-linguistic group, who speak the Marathi language, Marathi language, the official language of the state. The state is divided into 6 Divisions of Maharashtra, divisions and 36 List of districts of Maharashtra, districts, with the state capital being Mumbai, the List of million-plus urban agglomerations in India, most populous urban area in India ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

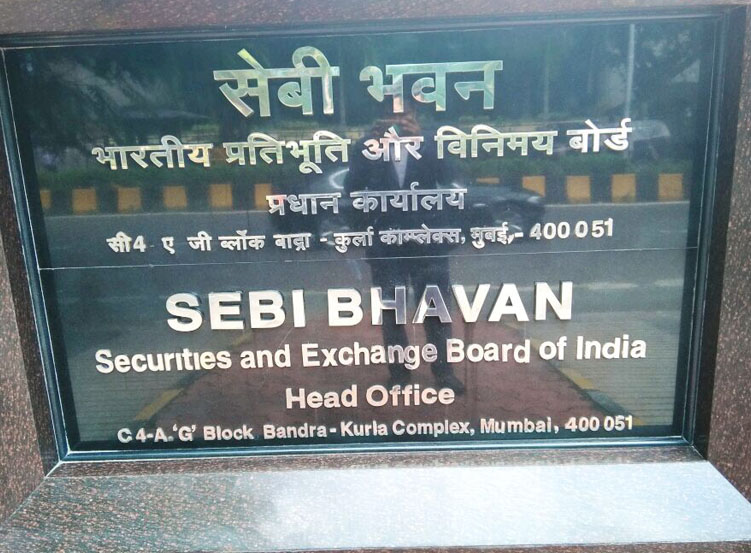

Securities And Exchange Board Of India

The Securities and Exchange Board of India (SEBI) is the regulatory body for securities and commodity market in India under the ownership of Ministry of Finance within the Government of India. It was established on 12 April 1988 as an executive body and was given statutory powers on 30 January 1992 through the SEBI Act, 1992. History Securities and Exchange Board of India (SEBI) was first established in 1988 as a non-statutory body for regulating the securities market. It became an autonomous body on 30 January 1992 and was accorded statutory powers with the passing of the SEBI Act 1992 by the Indian Parliament. SEBI has its headquarters at the business district of Bandra Kurla Complex in Mumbai and has Northern, Eastern, Southern and Western Regional Offices in New Delhi, Kolkata, Chennai, and Ahmedabad respectively. It has opened local offices at Jaipur and Bangalore and has also opened offices at Guwahati, Bhubaneshwar, Patna, Kochi and Chandigarh in Financial Year 2013 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ministry Of Finance (India)

The Ministry of Finance (IAST: ''Vitta Maṃtrālaya'') is a ministry within the Government of India concerned with the economy of India, serving as the Treasury of India. In particular, it concerns itself with taxation, financial legislation, financial institutions, capital markets, centre and state finances, and the Union Budget. The Ministry of Finance is the apex controlling authority of ''four'' central civil services namely Indian Revenue Service, Indian Audit and Accounts Service, Indian Economic Service and Indian Civil Accounts Service. It is also the apex controlling authority of one of the central commerce services namely Indian Cost and Management Accounts Service History R. K. Shanmukham Chetty was the first Finance Minister of independent India. He presented the first budget of independent India on 26 November 1947. Department of Economic Affairs The Department of Economic Affairs is the nodal agency of the Union Government to formulate and monitor country's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of India

The Government of India (ISO: ; often abbreviated as GoI), known as the Union Government or Central Government but often simply as the Centre, is the national government of the Republic of India, a federal democracy located in South Asia, consisting of 28 union states and eight union territories. Under the Constitution, there are three primary branches of government: the legislative, the executive and the judiciary, whose powers are vested in a bicameral Parliament, President, aided by the Council of Ministers, and the Supreme Court respectively. Through judicial evolution, the Parliament has lost its sovereignty as its amendments to the Constitution are subject to judicial intervention. Judicial appointments in India are unique in that the executive or legislature have negligible say. Etymology and history The Government of India Act 1833, passed by the British parliament, is the first such act of law with the epithet "Government of India". Basic structure The gover ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Financial regulators like Securities and Exchange Board of India (SEBI), Bank of England (BoE) and the U.S. Securities and Exchange Commission (SEC) oversee capital markets to protect investors against fraud, among other duties. Transactions on capital markets are generally managed by entities within the financial sector or the treasury departments of governments and corporations, but some can be accessed directly by the public. As an example, in the United States, any American citizen with an internet connection can create an account with TreasuryDirect and use it to buy bonds in the primary market, though sales to individu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dematerialization (securities)

In finance and financial law, dematerialization refers to the substitution of paper-form securities by book-entry securities. This is a form of indirect holding system where an intermediary, such as a broker or central securities depository, or the issuer itself (e.g., French system) holds a record of the ownership of shares usually in electronic format. The dematerialization of securities such as stocks has been a major trend since the late 1960s, with the result that by 2010 the majority of global securities were held in dematerialized form. History Although the phenomenon is ancient, since book-entry systems for recording securities have been noted from civilisations as early as Assyria in 2000 BC, it gained new prominence with the advent of computer technology in the late 20th century. Even during the period when paper certificates were popular, book-entry systems continued since many small firms could not afford printing secured paper-form securities. These book-entry sec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demat Account

A demat account is an Indian term for a dematerialized account that holds financial securities (equity or debt) digitally and to trade shares in the share market. In India, demat accounts are maintained by two depository organizations: the National Securities Depository Limited and the Central Depository Services Limited. A depository participant (DP), such as a bank, acts as an intermediary between the investor and the depository. In India, a DP is described as an agent of the depository. The relationship between the DPs and the depository is governed by an agreement made between the two under the Depositories Act. The demat account number is quoted for all transactions to enable electronic settlements of trades to take place. Access to the dematerialized account requires an internet password and a transaction password which allows the transfers or purchases of securities. A security is a tradable financial asset; the term commonly refers to any form of a financial instrument, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Depository Participant

In India, a Depository Participant (DP) is described as an Agent of the depository. They are the intermediaries between the depository and the investors. The relationship between the DPs and the depository is governed by an agreement made between the two under the Depositories Act. In a strictly legal sense, a DP is an entity who is registered as such with SEBI under the sub section 1A of Section 12 of the SEBI Act. As per the provisions of this Act, a DP can offer depository-related services only after obtaining a certificate of registration from SEBI. As of 2012, there were 288 DPs of NSDL and 563 DPs of CDSL registered with SEBI. SEBI (D&P) Regulations, 1996 prescribe a minimum net worth of Rs. 50 lakh for stockbrokers, R&T agents and non-banking finance companies (NBFC), for granting them a certificate of registration to act as DPs. If a stockbroker seeks to act as a DP in more than one depository, he should comply with the specified net worth criterion separately for each such ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Securities Depositories Of India

Central is an adjective usually referring to being in the center of some place or (mathematical) object. Central may also refer to: Directions and generalised locations * Central Africa, a region in the centre of Africa continent, also known as Middle Africa * Central America, a region in the centre of America continent * Central Asia, a region in the centre of Eurasian continent * Central Australia, a region of the Australian continent * Central Belt, an area in the centre of Scotland * Central Europe, a region of the European continent * Central London, the centre of London * Central Region (other) * Central United States, a region of the United States of America Specific locations Countries * Central African Republic, a country in Africa States and provinces * Blue Nile (state) or Central, a state in Sudan * Central Department, Paraguay * Central Province (Kenya) * Central Province (Papua New Guinea) * Central Province (Solomon Islands) * Central Province, Sri Lank ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Based In Mumbai

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assess ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |