|

National Cooperative Bank

The National Cooperative Bank is a congressionally chartered cooperative bank in the United States created by the National Consumer Cooperative Bank Act of 1978 (Pub.L. 95-351). National Cooperative offers banking products and services to cooperatives, their members and social organizations nationwide. The bank was created to address the financial needs of an underserved market. NCB is an advocate for America's cooperatives and their members, placing special emphasis on serving the needs of communities that are economically challenged. NCB has focused on community revitalization. The employment of the cooperative model in the development of business contains access to affordable health care and affordable housing. Capital Impact Partners was the non-profit community development financial institution A community development financial institution (US) or community development finance institution (UK) - abbreviated in both cases to CDFI - is a financial institution that provides cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Charter

A congressional charter is a law passed by the United States Congress that states the mission, authority, and activities of a group. Congress issued federal charters from 1791 until 1992 under Title 36 of the United States Code. The first charter issued by Congress was for the First Bank of the United States. The relationship between Congress and an organization so recognized is largely symbolic, and is intended to lend the organization the legitimacy of being officially sanctioned by the U.S. government. Congress does not oversee or supervise organizations it has so chartered, aside from receiving a yearly financial statement. Background Until the District of Columbia was granted the ability to issue corporate charters in the late 1800s, corporations operating in the District required a congressional charter. With few exceptions, most corporations since created by Congress are not federally chartered but are simply created as District of Columbia corporations. Some charters c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

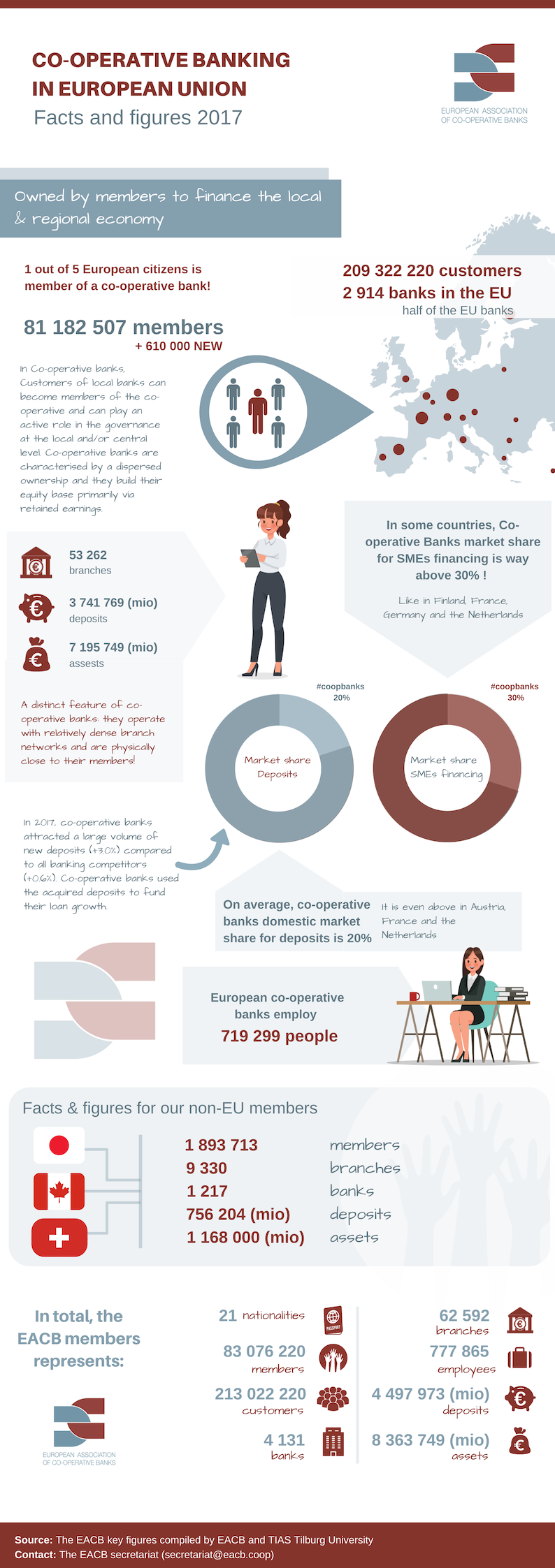

Cooperative Bank

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world. Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, building societies and cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses. A 2013 report by ILO concluded that cooperative banks outperformed their competitors during the financial crisis of 2007–2008. The cooperative banking sector had 20% market share of the European banking sector, but accounted for only 7% of all the write-downs and losses between the third quarter of 2007 and first quarter of 2011. Cooperative banks were also over-represented in lending to small and medium-sized businesses in all of the 10 countries included in the report. Credit unions in the US had five times lower failure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Impact Partners

Capital Impact Partners, or simply Capital Impact, is a congressionally chartered, District of Columbia nonprofit and certified community development financial institution that provides credit and financial services to underserved markets and populations in the United States. S&P Global issued Capital Impact its first rating in 2017. Capital Impact was created in 1982 as the nonprofit arm of the National Cooperative Bank as part of the National Consumer Cooperative Bank Act. Capital Impact became independently certified as its own financial institution by the U.S. Department of the Treasury's Community Development Financial Institutions Fund in 2011. The company's president and CEO is Ellis Carr, the chief lending officer is Diane Borradaile, the chief financial officer is Natalie Gunn, and Amy Sue Leavens is the chief legal counsel. From 1994 until 2016, Terry Simonette served as president and CEO of Capital Impact until Ellis Carr was named as his replacement. The company is am ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Community Development Financial Institution

A community development financial institution (US) or community development finance institution (UK) - abbreviated in both cases to CDFI - is a financial institution that provides credit and financial services to underserved markets and populations, primarily in the USA but also in the UK. A CDFI may be a community development bank, a community development credit union (CDCU), a community development loan fund (CDLF), a community development venture capital fund (CDVC), a microenterprise development loan fund, or a community development corporation. CDFIs are certified by the Community Development Financial Institutions Fund (CDFI Fund) at the U.S. Department of the Treasury, which provides funds to CDFIs through a variety of programs. The CDFI Fund and the legal concept of CDFIs were established by the ''Riegle Community Development and Regulatory Improvement Act of 1994.'' Broadly speaking, a CDFI is defined as a financial institution that: has a primary mission of community deve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Of The United States

Banking in the United States began by the 1780s along with the History of United States, country's founding and has developed into highly influential and complex system of banking and financial services. Anchored by New York City and Wall Street, it is centered on various financial services namely private banking, asset management, and Deposit insurance, deposit security. The beginnings of the banking industry can be traced to 1780 when the Bank of Pennsylvania was founded to fund the American Revolutionary War. After merchants in the Thirteen Colonies needed a currency as a medium of exchange, the Bank of North America was opened to facilitate more advanced financial transactions. As of 2018, the List of largest banks in the United States, largest banks in the United States were JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Goldman Sachs. It is estimated that banking assets were equal to 56 percent of the Economy of the United States, U.S. economy. As of Septemb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cooperative Banks In The United States

A cooperative (also known as co-operative, co-op, or coop) is "an autonomy, autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democratically-controlled wiktionary:Enterprise, enterprise".Statement on the Cooperative Identity. ''International Cooperative Alliance.'' Cooperatives are democratically controlled by their members, with each member having one vote in electing the board of directors. Cooperatives may include: * businesses owned and managed by the people who consume their goods and/or services (a consumer cooperative) * businesses where producers pool their output for their common benefit (a producer cooperative) * organizations managed by the people who work there (a worker c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1978

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Companies Established In 1978

American(s) may refer to: * American, something of, from, or related to the United States of America, commonly known as the "United States" or "America" ** Americans, citizens and nationals of the United States of America ** American ancestry, people who self-identify their ancestry as "American" ** American English, the set of varieties of the English language native to the United States ** Native Americans in the United States, indigenous peoples of the United States * American, something of, from, or related to the Americas, also known as "America" ** Indigenous peoples of the Americas * American (word), for analysis and history of the meanings in various contexts Organizations * American Airlines, U.S.-based airline headquartered in Fort Worth, Texas * American Athletic Conference, an American college athletic conference * American Recordings (record label), a record label previously known as Def American * American University, in Washington, D.C. Sports teams Soccer * B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |