|

Nostro

''Nostro'' and ''vostro'' (from Italian, ''nostro'' and ''vostro''; English, 'ours' and 'yours') are accounting terms used to distinguish an account held for another entity from an account another entity holds. The entities in question are usually banks. The terms ''nostro'' and ''vostro'' are used, mainly by banks, when one bank keeps money at another bank (in a correspondent account often called a nostro or vostro account). Both banks need to keep records of how much money is being kept by one bank on behalf of the other. In order to distinguish between the two sets of records of the same balance and set of transactions, banks refer to the accounts as ''nostro'' and ''vostro''. Speaking from the point of view of the bank whose money is being held at another bank: * A ''nostro'' is our account of ''our'' money (in which country you are staying), held by the ''other bank'' or "Foreign Bank". * A ''vostro'' is our account of ''other bank'' ''/'' "Foreign Bank's" money, held by '' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Correspondent Account

A correspondent account is an account (often called a nostro or vostro account) established by a banking institution to receive deposits from, make payments on behalf of, or handle other financial transactions for another financial institution. Correspondent accounts are established through bilateral agreements between the two banks. Application Commonly, correspondent accounts are the accounts of foreign banks that require the ability to pay and receive the domestic currency. A bank will typically require correspondent accounts for holding currencies outside of jurisdictions where it has a branch or affiliate. This is because most central bank settlement systems do not register deposits or transfer funds to banks not doing business in their countries. With few exceptions, the actual funds held in any foreign currency account (whether for a bank or for its customer) are held in the bank's correspondent account in that currency's home country. Even where a bank has branches or aff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double-entry Bookkeeping System

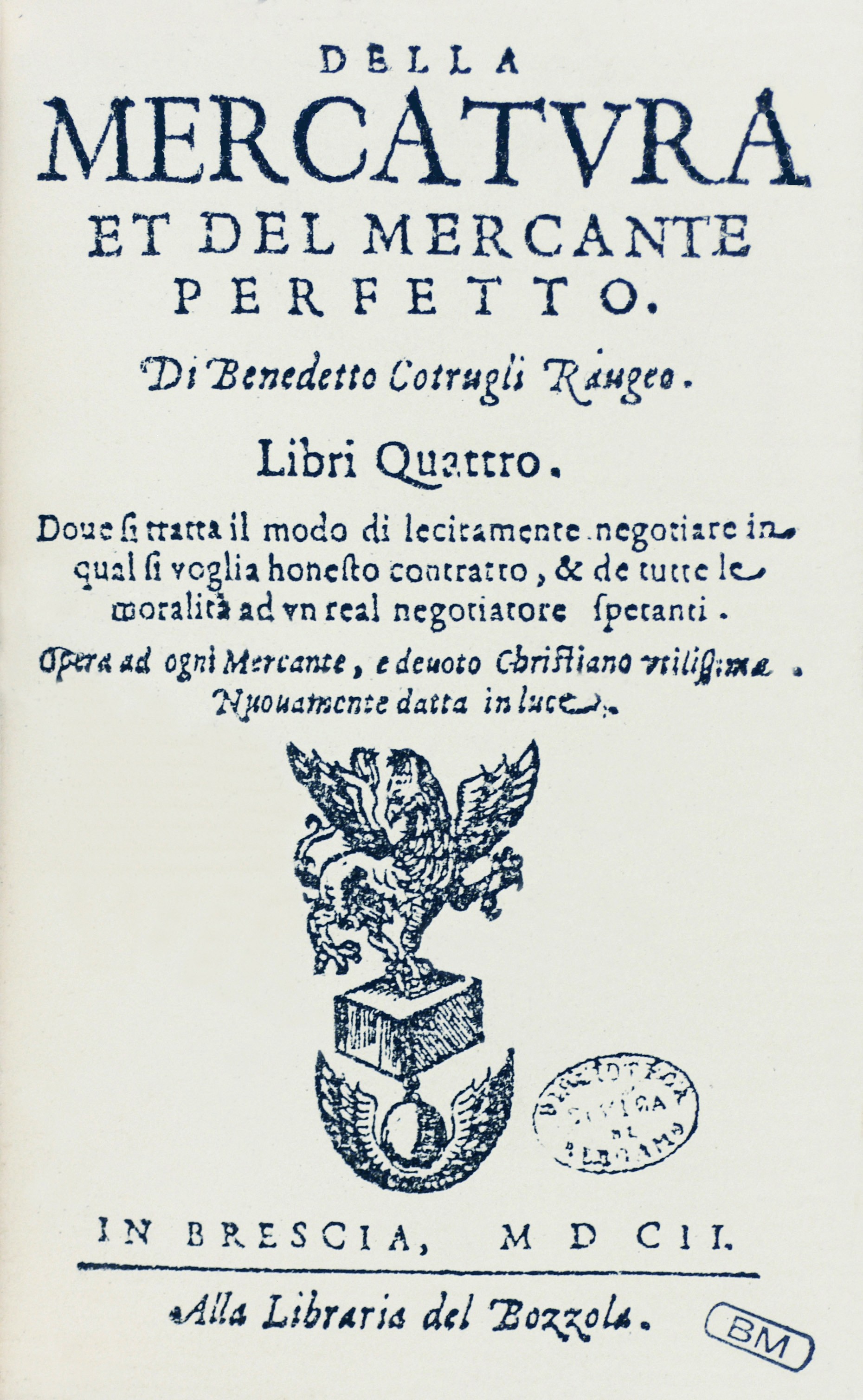

Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system has two equal and corresponding sides known as debit and credit. A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. The purpose of double-entry bookkeeping is to allow the detection of financial errors and fraud. For example, if a business takes out a bank loan for $10,000, recording the transaction would require a debit of $10,000 to an asset account called "Cash", as well as a credit of $10,000 to a liability account called "Notes Payable". The basic entry to record this transaction in a general ledger will look like this: Double-entry bookkeeping is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Correspondent Account

A correspondent account is an account (often called a nostro or vostro account) established by a banking institution to receive deposits from, make payments on behalf of, or handle other financial transactions for another financial institution. Correspondent accounts are established through bilateral agreements between the two banks. Application Commonly, correspondent accounts are the accounts of foreign banks that require the ability to pay and receive the domestic currency. A bank will typically require correspondent accounts for holding currencies outside of jurisdictions where it has a branch or affiliate. This is because most central bank settlement systems do not register deposits or transfer funds to banks not doing business in their countries. With few exceptions, the actual funds held in any foreign currency account (whether for a bank or for its customer) are held in the bank's correspondent account in that currency's home country. Even where a bank has branches or aff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Italian Language

Italian (''italiano'' or ) is a Romance language of the Indo-European language family that evolved from the Vulgar Latin of the Roman Empire. Together with Sardinian, Italian is the least divergent language from Latin. Spoken by about 85 million people (2022), Italian is an official language in Italy, Switzerland (Ticino and the Grisons), San Marino, and Vatican City. It has an official minority status in western Istria (Croatia and Slovenia). Italian is also spoken by large immigrant and expatriate communities in the Americas and Australia.Ethnologue report for language code:ita (Italy) – Gordon, Raymond G., Jr. (ed.), 2005. Ethnologue: Languages of the World, Fifteenth edition. Dallas, Tex.: SIL International. Online version Itali ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Settlement

A bureau de change (plural bureaux de change, both ) (British English) or currency exchange (American English) is a business where people can exchange one currency for another. Nomenclature Although originally French, the term "bureau de change" is widely used throughout Europe and French-speaking Canada, where it is common to find a sign saying "exchange" or "change". Since the adoption of the euro, many exchange offices have started incorporating its logotype prominently on their signage. In the United States and English-speaking Canada the business is described as "currency exchange" and sometimes "money exchange", sometimes with various additions such as "foreign", "desk", "office", "counter", "service", etc.; for example, "foreign currency exchange office". Location A bureau de change is often located at a bank, at a travel agent, airport, main railway station or large stores—namely, anywhere there is likely to be a market for people needing to convert currency. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Home Accounting Unit

A home, or domicile, is a space used as a permanent or semi-permanent residence for one or many humans, and sometimes various companion animals. It is a fully or semi sheltered space and can have both interior and exterior aspects to it. Homes provide sheltered spaces, for instance rooms, where domestic activity can be performed such as sleeping, preparing food, eating and hygiene as well as providing spaces for work and leisure such as remote working, studying and playing. Physical forms of homes can be static such as a house or an apartment, mobile such as a houseboat, trailer or yurt or digital such as virtual space. The aspect of ‘home’ can be considered across scales; from the micro scale showcasing the most intimate spaces of the individual dwelling and direct surrounding area to the macro scale of the geographic area such as town, village, city, country or planet. The concept of ‘home’ has been researched and theorized across disciplines – topics ranging ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Funds Transfer

Electronic funds transfer (EFT) is the electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems, without the direct intervention of bank staff. According to the United States Electronic Fund Transfer Act of 1978 it is "a funds transfer initiated through an electronic terminal, telephone, computer (including on-line banking) or magnetic tape for the purpose of ordering, instructing, or authorizing a financial institution to debit or credit a consumer's account". EFT transactions are known by a number of names across countries and different payment systems. For example, in the United States, they may be referred to as "electronic checks" or "e-checks". In the United Kingdom, the term "bank transfer" and "bank payment" are used, in Canada, " e-transfer" is used, while in several other European countries " giro transfer" is the common term. Types EFTs include, but ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clearing Account

A clearing account is usually a temporary account containing costs or amounts that are to be transferred to another account. An example is the income summary account containing revenue and expense amounts to be transferred to retained earnings The retained earnings (also known as plowback) of a corporation is the accumulated net income of the corporation that is retained by the corporation at a particular point of time, such as at the end of the reporting period. At the end of that peri ... at the close of a fiscal period. Other example of clearing account is excise clearing account. References Accounting terminology {{business-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |