|

Non-contestable Market

In economics, the theory of contestable markets, associated primarily with its 1982 proponent William J. Baumol, held that there are markets served by a small number of firms that are nevertheless characterized by competitive equilibrium (and therefore desirable welfare outcomes) because of the existence of potential short-term entrants.Brock, 1983. p.1055. Theory A perfectly contestable market has three main features: # No entry or exit barriers # No sunk costs # Access to the same level of technology (to incumbent firms and new entrants) A perfectly contestable market is not possible in real life. Instead, the degree of contestability of a market is talked about. The more contestable a market is, the closer it will be to a perfectly contestable market. Some economists argue that determining price and output is actually dependent not on the type of market structure (whether it is a monopoly or perfectly competitive market) but on the threat of competition.Critic Capital LLC" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is the social science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on glossary of economics, these elements. Other broad distinctions within economics include those between positive economics, desc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Power

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue.Syverson, C. (2019). Macroeconomics and Market Power. The Journal of Economic Perspectives, 33(3), 23-43. https://doi.org/10.1257/jep.33.3.23 This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. Such propensities contradict perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are consequently referred to as 'price takers', whereas market participants that exhibit market power are referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

George Stigler

George Joseph Stigler (; January 17, 1911 – December 1, 1991) was an American economist. He was the 1982 laureate in Nobel Memorial Prize in Economic Sciences and is considered a key leader of the Chicago school of economics. Early life and education Stigler was born in Seattle, Washington, the son of Elsie Elizabeth (Hungler) and Joseph Stigler. He was of German descent and spoke German in his childhood. He graduated from the University of Washington in 1931 with a BA and then spent a year at Northwestern University from which he obtained his MBA in 1932. It was during his studies at Northwestern that Stigler developed an interest in economics and decided on an academic career. Career After he received a tuition scholarship from the University of Chicago, Stigler enrolled there in 1933 to study economics and went on to earn his PhD in economics there in 1938. He taught at Iowa State College from 1936 to 1938. He spent much of World War II at Columbia University, performi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

A Dictionary Of Economics

A, or a, is the first letter and the first vowel of the Latin alphabet, used in the modern English alphabet, the alphabets of other western European languages and others worldwide. Its name in English is ''a'' (pronounced ), plural ''aes''. It is similar in shape to the Ancient Greek letter alpha, from which it derives. The uppercase version consists of the two slanting sides of a triangle, crossed in the middle by a horizontal bar. The lowercase version can be written in two forms: the double-storey a and single-storey ɑ. The latter is commonly used in handwriting and fonts based on it, especially fonts intended to be read by children, and is also found in italic type. In English grammar, " a", and its variant " an", are indefinite articles. History The earliest certain ancestor of "A" is aleph (also written 'aleph), the first letter of the Phoenician alphabet, which consisted entirely of consonants (for that reason, it is also called an abjad to distinguis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William Baumol

William Jack Baumol (February 26, 1922 – May 4, 2017) was an American economist. He was a professor of economics at New York University, Academic Director of the Berkley Center for Entrepreneurship and Innovation, and Professor Emeritus at Princeton University. He was a prolific author of more than eighty books and several hundred journal articles. Baumol wrote extensively about labor market and other economic factors that affect the economy. He also made significant contributions to the theory of entrepreneurship and the history of economic thought. He is among the most influential economists in the world according to IDEAS/RePEc. He was elected a Fellow of the American Academy of Arts and Sciences in 1971, the American Philosophical Society in 1977, and the United States National Academy of Sciences in 1987. Baumol was considered a candidate for the Nobel Prize in Economics for 2003, and Thomson Reuters cited him as a potential recipient in 2014, but he died without receivin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

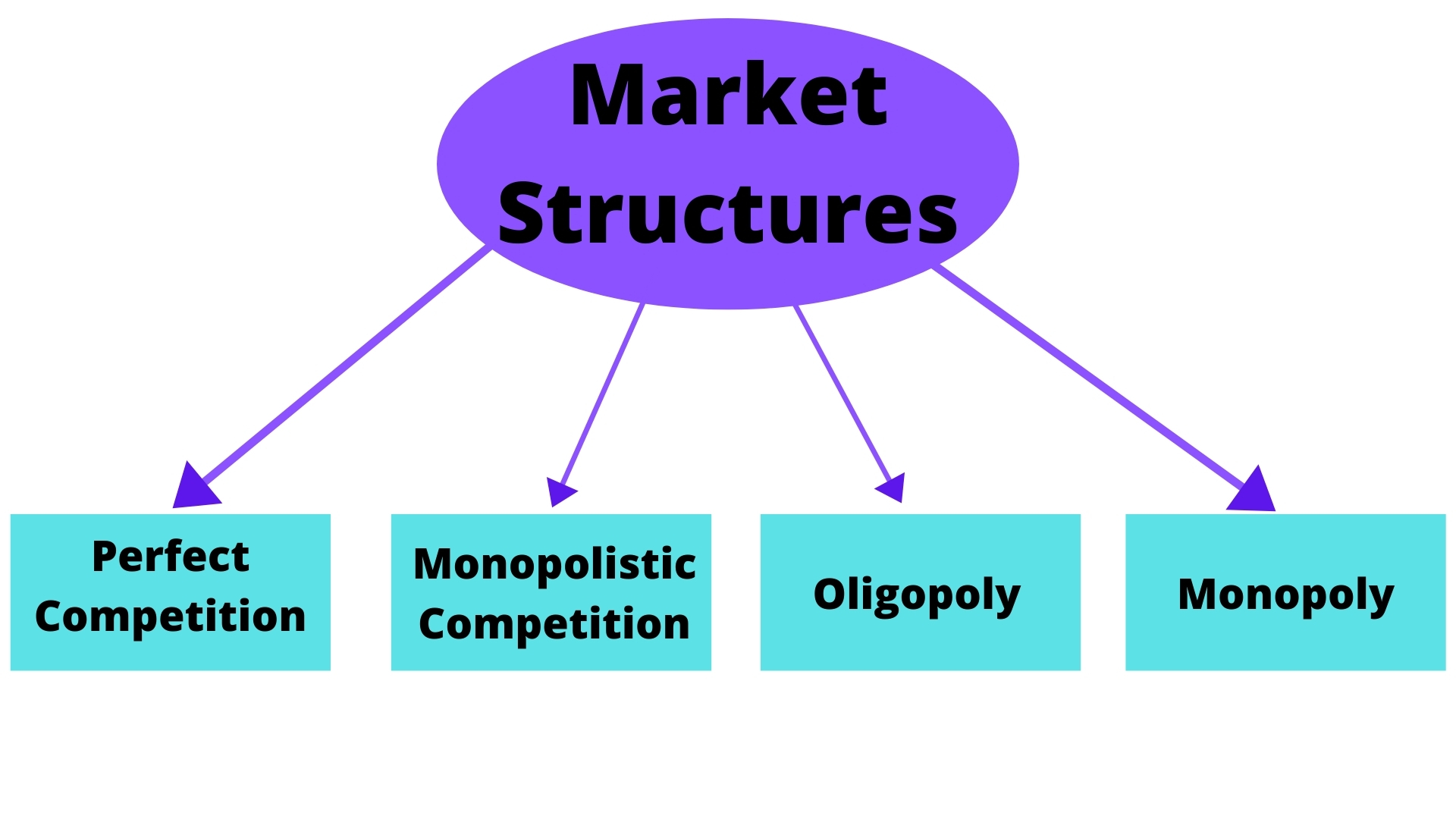

Perfect Competition

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In Economic model, theoretical models where conditions of perfect competition hold, it has been demonstrated that a Market (economics), market will reach an Economic equilibrium, equilibrium in which the quantity supplied for every Goods and services, product or service, including Workforce, labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum. Perfect competition provides both allocative efficiency and productive efficiency: * Such markets are ''allocatively efficient'', as output will always occur where marginal cost is equal to average revenue i.e. price (MC = AR). In perfect competition, any Profit maximization, profit-maximizing producer faces a market price equal to its marginal cost (P = MC). This implies that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopolistic Competition

Monopolistic competition is a type of imperfect competition such that there are many producers competing against each other, but selling products that are differentiated from one another (e.g. by branding or quality) and hence are not perfect substitutes. In monopolistic competition, a company takes the prices charged by its rivals as given and ignores the impact of its own prices on the prices of other companies. If this happens in the presence of a coercive government, monopolistic competition will fall into government-granted monopoly. Unlike perfect competition, the company maintains spare capacity. Models of monopolistic competition are often used to model industries. Textbook examples of industries with market structures similar to monopolistic competition include restaurants, cereals, clothing, shoes, and service industries in large cities. The "founding father" of the theory of monopolistic competition is Edward Hastings Chamberlin, who wrote a pioneering book on the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coercive Monopoly

In economics and business ethics, a coercive monopoly is a firm that is able to raise prices and make production decisions without the risk that competition will arise to draw away their customers. Greenspan, Alan''Antitrust'', in ''Capitalism:The Unknown Ideal'' by Ayn Rand. Als by Nathaniel Branden defines and discusses coercive monopoly. A coercive monopoly is not merely a sole supplier of a particular kind of good or service (a monopoly): It is a monopoly wherein there is no opportunity to compete with it because entry into the field is legally closed. It is a case of a non-contestable market. A coercive monopoly has few or no incentives to keep prices low and may deliberately price gouge consumers by curtailing production. Furthermore, this highlights that the law of supply and demand is negligible, as those in control behave independently from the market and set arbitrary production policies for their personal benefit Coercive monopolies, by definition, require either go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bertrand–Edgeworth Model

In microeconomics, the Bertrand–Edgeworth model of price-setting oligopoly looks at what happens when there is a homogeneous product (i.e. consumers want to buy from the cheapest seller) where there is a limit to the output of firms which are willing and able to sell at a particular price. This differs from the Bertrand competition model where it is assumed that firms are willing and able to meet all demand. The limit to output can be considered as a physical capacity constraint which is the same at all prices (as in Edgeworth's work), or to vary with price under other assumptions. History Joseph Louis François Bertrand (1822–1900) developed the model of Bertrand competition in oligopoly. This approach was based on the assumption that there are at least two firms producing a homogenous product with constant marginal cost (this could be constant at some positive value, or with zero marginal cost as in Cournot). Consumers buy from the cheapest seller. The Bertrand– Nash equi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oligopoly

An oligopoly (from Greek ὀλίγος, ''oligos'' "few" and πωλεῖν, ''polein'' "to sell") is a market structure in which a market or industry is dominated by a small number of large sellers or producers. Oligopolies often result from the desire to maximize profits, which can lead to collusion between companies. This reduces competition, increases prices for consumers, and lowers wages for employees. Many industries have been cited as oligopolistic, including civil aviation, electricity providers, the telecommunications sector, Rail freight markets, food processing, funeral services, sugar refining, beer making, pulp and paper making, and automobile manufacturing. Most countries have laws outlawing anti-competitive behavior. EU competition law prohibits anti-competitive practices such as price-fixing and manipulating market supply and trade among competitors. In the US, the United States Department of Justice Antitrust Division and the Federal Trade Commission are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competition Law

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust law (or just antitrust), anti-monopoly law, and trade practices law. The history of competition law reaches back to the Roman Empire. The business practices of market traders, guilds and governments have always been subject to scrutiny, and sometimes severe sanctions. Since the 20th century, competition law has become global. The two largest and most influential systems of competition regulation are United States antitrust law and European Union competition law. National and regional competition authorities across the world have formed international support and enforcement networks. Modern competition law has historically evolved on a national level to promote and maintain fair competition in markets principally within the territorial boun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William J

William is a male given name of Germanic origin.Hanks, Hardcastle and Hodges, ''Oxford Dictionary of First Names'', Oxford University Press, 2nd edition, , p. 276. It became very popular in the English language after the Norman conquest of England in 1066,All Things William"Meaning & Origin of the Name"/ref> and remained so throughout the Middle Ages and into the modern era. It is sometimes abbreviated "Wm." Shortened familiar versions in English include Will, Wills, Willy, Willie, Bill, and Billy. A common Irish form is Liam. Scottish diminutives include Wull, Willie or Wullie (as in Oor Wullie or the play ''Douglas''). Female forms are Willa, Willemina, Wilma and Wilhelmina. Etymology William is related to the given name ''Wilhelm'' (cf. Proto-Germanic ᚹᛁᛚᛃᚨᚺᛖᛚᛗᚨᛉ, ''*Wiljahelmaz'' > German ''Wilhelm'' and Old Norse ᚢᛁᛚᛋᛅᚼᛅᛚᛘᛅᛋ, ''Vilhjálmr''). By regular sound changes, the native, inherited English form of the name shoul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |