|

Net Foreign Assets

In economics, the concept of net foreign assets relates to balance of payments identity. The net foreign asset (NFA) position of a country is the value of the assets that country owns abroad, minus the value of the domestic assets owned by foreigners. The net foreign asset position of a country reflects the indebtedness of that country. The traditional balance of payments identity Traditional balance-of-payments accounting is that the change in the net foreign asset position equals the current account balance. In other words, if a country runs a $700 billion current account deficit, it has to borrow exactly $700 billion from abroad to finance the deficit and therefore, the country's net foreign asset position falls by $700 billion. \begin \mbox & = \mbox \\ \end The augmented balance of payments identity The traditional balance of payments identity does not take into account changes in asset prices and exchange rates. For example, the value of external assets or liabiliti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is the social science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on glossary of economics, these elements. Other broad distinctions within economics include those between positive economics, desc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balance Of Payments

In international economics, the balance of payments (also known as balance of international payments and abbreviated BOP or BoP) of a country is the difference between all money flowing into the country in a particular period of time (e.g., a quarter or a year) and the outflow of money to the rest of the world. These financial transactions are made by individuals, firms and government bodies to compare receipts and payments arising out of trade of goods and services. The balance of payments consists of two components: the current account and the capital account. The current account reflects a country's net income, while the capital account reflects the net change in ownership of national assets. History Until the early 19th century, international trade was heavily regulated and accounted for a relatively small portion compared with national output. In the Middle Ages, European trade was typically regulated at municipal level in the interests of security for local industry an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Current Account (balance Of Payments)

In economics, a country's current account records the value of exports and imports of both goods and services and international transfers of capital. It is one of the two components of its balance of payments, the other being the capital account (also known as the financial account). Current account measures the nation's earnings and spendings abroad and it consists of the balance of trade, net ''primary income'' or ''factor income'' (earnings on foreign investments minus payments made to foreign investors) and net unilateral transfers, that have taken place over a given period of time. The current account balance is one of two major measures of a country's foreign trade (the other being the net capital outflow). A current account surplus indicates that the value of a country's net foreign assets (i.e. assets less liabilities) grew over the period in question, and a current account deficit indicates that it shrank. Both government and private payments are included in the calcula ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Valuation Effects

In economics, valuation effects of a country are the changes in the value of assets held abroad, minus the changes in the value of domestic assets held by foreign investors. The traditional balance of payment identity ignores valuation effects, only recognizes that changes in the net foreign assets (NFA) are fully captured by the current account. The new balance of payment identity, however, considers the role of asset price changes and valuation effects. Changes in the NFA equal the current account plus valuation effects. \begin \mbox & = \mbox +\mbox \\ \end Valuation effects and the U.S. current account deficits Valuation effects have been increasingly important for the U.S. in the last two decades, given a dramatic, sharp rise in international cross-country portfolio holdings. For the U.S., valuation effects are partly compensating its current account deficits and therefore mitigating the decline of its net foreign assets In economics, the concept of net foreign assets re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

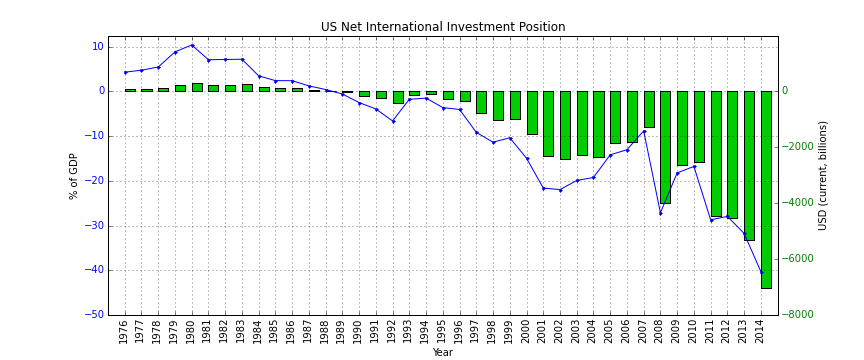

Net International Investment Position

__FORCETOC__ The net international investment position (NIIP) is the difference in the external financial assets and liabilities of a country. External debt of a country includes government debt and private debt. External assets publicly and privately held by a country's legal residents are also taken into account when calculating NIIP.Ministry of Economic and Finance of ArgentinInternational Investment Position Methodologypage.1 Commodities and currencies tend to follow a cyclical pattern of significant valuation changes, which is also reflected in NIIP. The International investment position (IIP) of a country is a financial statement of the value and composition of its external financial assets and liabilities. A positive NIIP value indicates that a nation is a creditor nation, while a negative value indicates that it is a ''debtor nation''. History The US was the world's largest creditor until the 1960s. However, over the last few decades, the US has become the world's largest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Macroeconomics

International finance (also referred to as international monetary economics or international macroeconomics) is the branch of financial economics broadly concerned with monetary and macroeconomic interrelations between two or more countries. International finance examines the dynamics of the global financial system, international monetary systems, balance of payments, exchange rates, foreign direct investment, and how these topics relate to international trade. Sometimes referred to as multinational finance, international finance is additionally concerned with matters of international financial management. Investors and multinational corporations must assess and manage international risks such as political risk and foreign exchange risk, including transaction exposure, economic exposure, and translation exposure. Some examples of key concepts within international finance are the Mundell–Fleming model, the optimum currency area theory, purchasing power parity, interest rate parit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |