|

Negative Equity

Negative equity is a deficit of owner's equity, occurring when the value of an asset used to secure a loan is less than the outstanding balance on the loan. In the United States, assets (particularly real estate, whose loans are mortgages) with negative equity are often referred to as being "underwater", and loans and borrowers with negative equity are said to be "upside down". People and companies alike may have negative equity, as reflected on their balance sheets. History The term negative equity was widely used in the United Kingdom during the economic recession between 1991 and 1996, and in Hong Kong between 1998 and 2003. These recessions led to increased unemployment and a decline in property prices, which in turn led to an increase in repossessions by banks and building societies of properties worth less than the outstanding debt. Since 2007, those most exposed to negative equity are borrowers who obtained loans of a high percentage of the property value (such as 90% or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Economist Group, with its core editorial offices in the United States, as well as across major cities in continental Europe, Asia, and the Middle East. In 2019, its average global print circulation was over 909,476; this, combined with its digital presence, runs to over 1.6 million. Across its social media platforms, it reaches an audience of 35 million, as of 2016. The newspaper has a prominent focus on data journalism and interpretive analysis over original reporting, to both criticism and acclaim. Founded in 1843, ''The Economist'' was first circulated by Scottish economist James Wilson to muster support for abolishing the British Corn Laws (1815–1846), a system of import tariffs. Over time, the newspaper's coverage expanded further into ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negative Amortization

In finance, negative amortization (also known as NegAm, deferred interest or graduated payment mortgage) occurs whenever the loan payment for any period is less than the interest charged over that period so that the outstanding balance of the loan increases. As an amortization method the shorted amount (difference between interest and repayment) is then added to the total amount owed to the lender. Such a practice would have to be agreed upon before shorting the payment so as to avoid default on payment. This method is generally used in an introductory period before loan payments exceed interest and the loan becomes self-amortizing. The term is most often used for mortgage loans; corporate loans with negative amortization are called PIK loans. Amortization refers to the process of paying off a debt (often from a loan or mortgage) through regular payments. A portion of each payment is for interest while the remaining amount is applied towards the principal balance. The percentage ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Home Equity Protection

Home price protection is an agreement that pays the homeowner if a particular home price index declines in value over a period of time after the protection is purchased. The protection is for a new or existing homeowner that wishes to protect the value of their home from future market declines. Scholarly research In 1999, Robert J. Shiller and Allan Weiss published an overview of the idea. Two similar programs had been tried in Illinois by municipalities: a 1978 Oak Park plan, which had never had a claim as of 1999, and a broader program covering the city of Chicago passed by voter referendum in 1987 and implemented in 1990. Another program was initiated 2002 as several scholars at Yale University worked in conjunction with a program in Syracuse, NY, which was developed with the intent of increasing home ownership in neighborhoods on the verge of collapse that were marred by ever declining home prices. The Syracuse non-profit program, called Home Headquarters, was sponsored by t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity (finance)

In finance, equity is ownership of assets that may have debts or other liabilities attached to them. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets. For example, if someone owns a car worth $24,000 and owes $10,000 on the loan used to buy the car, the difference of $14,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business. A business that needs to start up or expand its operations can sell its equity in order to raise cash that does not have to be repaid on a set schedule. In government finance or other non-profit settings, equity is known as "net position" or "net assets". Origins The term "equity" describes this type of ownership in English because it was regulated through the system of equity law that developed in England during the Late Middle Ages to meet the growing demands of commercial activity. While the older common law courts dealt with questions of property title, equi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Strategic Default

A strategic default is the decision by a borrower to stop making payments (i.e., to default) on a debt, despite having the financial ability to make the payments. This is particularly associated with residential and commercial mortgages, in which case it usually occurs after a substantial drop in the house's price such that the debt owed is (considerably) greater than the value of the property — the property has negative equity or is ''underwater'' — and is expected to remain so for the foreseeable future, such as following the bursting of a real estate bubble. Such borrowers are called ''walkaways''. The process of strategically defaulting on a home mortgage has been colloquially called "jingle mail" — metaphorically, one mails the keys to the bank. Prevalence post-housing bubble Economists Paul Krugman and Hal Varian argued that strategic default would be an inevitable result of the collapse of the finance and property bubble of the era following 2006. They also noted ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loss Mitigation

Loss mitigation is used to describe a third party helping a homeowner, a division within a bank that mitigates the loss of the bank, or a firm that handles the process of negotiation between a homeowner and the homeowner's lender. Loss mitigation works to negotiate mortgage terms for the homeowner that will prevent foreclosure. These new terms are typically obtained through loan modification, short sale negotiation, short refinance negotiation, deed in lieu of foreclosure, cash-for-keys negotiation, a partial claim loan, repayment plan, forbearance, or other loan work-out. All of the options serve the same purpose, to stabilize the risk of loss the lender (investor) is in danger of realizing. Kinds of loss mitigation * Loan modification: This is a process whereby a homeowner's mortgage is modified and both lender and homeowner are bound by the new terms. The most common modifications are lowering the interest rate and extending the term to up to 40 years. Reduction in the princ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negative Amortization

In finance, negative amortization (also known as NegAm, deferred interest or graduated payment mortgage) occurs whenever the loan payment for any period is less than the interest charged over that period so that the outstanding balance of the loan increases. As an amortization method the shorted amount (difference between interest and repayment) is then added to the total amount owed to the lender. Such a practice would have to be agreed upon before shorting the payment so as to avoid default on payment. This method is generally used in an introductory period before loan payments exceed interest and the loan becomes self-amortizing. The term is most often used for mortgage loans; corporate loans with negative amortization are called PIK loans. Amortization refers to the process of paying off a debt (often from a loan or mortgage) through regular payments. A portion of each payment is for interest while the remaining amount is applied towards the principal balance. The percentage ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, and the term ''bankruptcy'' is therefore not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian ''banca rotta'', literally meaning "broken bank". The term is often described as having originated in renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment so that the public could see that the banker, the owner of the bench, was no longer in a condition to continue his business, although some dismiss this as a false etymology. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

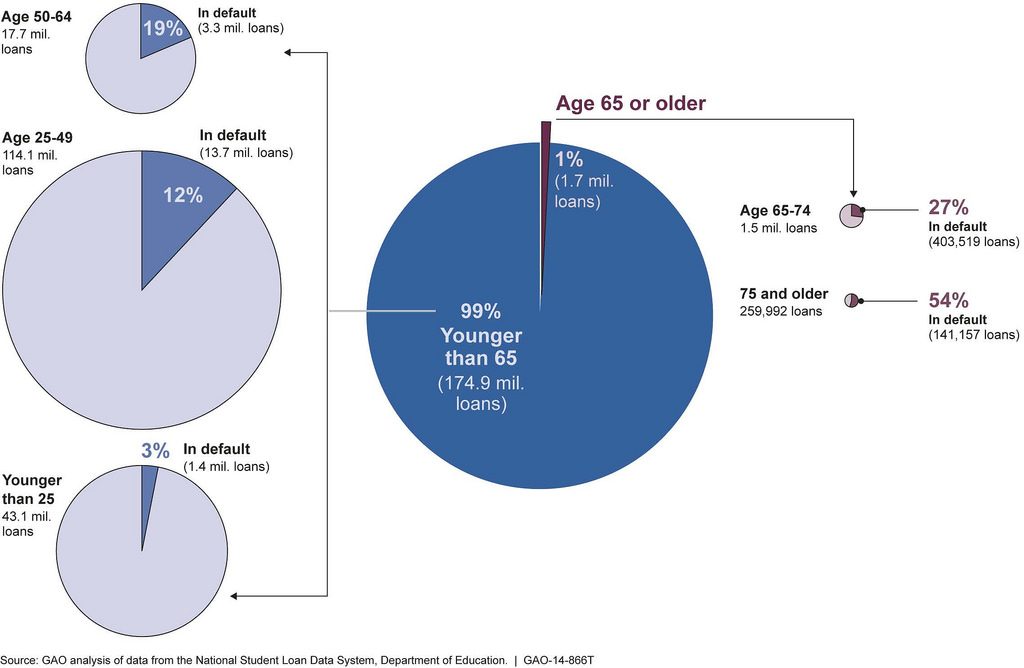

Student Loans

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries. Australia Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. Discounts are available for early repayment. The scheme is available to cit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Loan

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries. Australia Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. Discounts are available for early repayment. The scheme is available to citi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nonrecourse Debt

Nonrecourse debt or a nonrecourse loan (sometimes hyphenated as non-recourse) is a secured loan (debt) that is secured by a pledge of collateral, typically real property, but for which the borrower is not personally liable. If the borrower defaults, the lender can seize and sell the collateral, but if the collateral sells for less than the debt, the lender cannot seek that deficiency balance from the borrower—its recovery is limited only to the value of the collateral. Thus, nonrecourse debt is typically limited to 50% or 60% loan-to-value ratios, so that the property itself provides "overcollateralization" of the loan. The incentives for the parties are at an intermediate position between those of a full recourse secured loan and a totally unsecured loan. While the borrower is in first loss position, the lender also assumes significant risk, so the lender must underwrite the loan with much more care than in a full recourse loan. This typically requires that the lender have sign ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)