|

National Insurance (United Kingdom)

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948, the system has been subjected to numerous amendments in succeeding years. Initially, it was a contributory form of insurance against illness and unemployment, and eventually provided retirement pensions and other benefits. Currently, workers pay contributions from the age of 16 years, until the age they become eligible for the State pension. Contributions are due from employed people earning at or above a threshold called the Lower Earnings Limit, the value of which is reviewed each year. Self-employed people contribute partly through a fixed weekly or monthly payment and partly on a percentage of net profits above a threshold, which is revie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare State In The United Kingdom

The welfare state of the United Kingdom began to evolve in the 1900s and early 1910s, and comprises expenditures by the government of the United Kingdom of Great Britain and Northern Ireland intended to improve health, education, employment and social security. The British system has been classified as a liberal welfare state system. https://books.google.com/books/about/?id=zW2ungEACAAJ History The welfare state in the modern sense was anticipated by the Royal Commission into the Operation of the Poor Laws 1832 which found that the old poor law (a part of the English Poor laws) was subject to widespread abuse and promoted squalor, idleness and criminality in its recipients, compared to those who received private charity. Accordingly, the qualifications for receiving aid were tightened up, forcing many recipients to either turn to private charity or accept employment. Opinions began to be changed late in the century by reports drawn up by men such as Seebohm Rowntree and Cha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Actuary's Department

, type = Non-ministerial government department , logo = Actuary.svg , logo_width = 150px , logo_caption = , picture = , picture_width = , picture_caption = , formed = , dissolved = , superseding = , jurisdiction = United Kingdom , headquarters = Finlaison House, 15-17 Furnival Street, London, EC4A 1AB , region_code = GB , coordinates = , employees = c. 220 , budget = £0 (2020-2021) , minister1_name = , minister1_pfo = , chief1_name = Martin Clarke , chief1_position = Government Actuary , chief2_name = , chief2_position = , chief3_name = , chief3_position = , chief4_name = , chief4_position = , chief5_name = , chief5_position = , agency_type = , chief6_name = , chief6_position = , chief7_name = , chief7_position = , chief8_name = , chief8_position = , chief9_name = , chief9_position = , p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (United Kingdom)

In the United Kingdom, a tax return is a document that must be filed with HM Revenue & Customs declaring liability for taxation. Different bodies must file different returns with respect to various forms of taxation. The main returns currently in use are: *SA100 for individuals paying income tax *SA800 for partnerships *SA900 for trusts and estates of deceased persons *CT600 for companies paying corporation tax *VAT100 for value added tax Income tax self-assessment Most employees paying tax under the PAYE system are not required to file a tax return, because the PAYE system operates to withhold the correct amount of tax from their wages or salaries. However, some tax payers, including employees, may have income that has not been taxed at source and needs to be declared to HMRC, usually by submitting a self assessment tax return. Legally, a tax payer is obliged to submit a tax return when HMRC request one by sending a notice to file a tax return, either because the tax payer has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employment And Support Allowance

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and r ..., a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuity, gratuities, bonus payments or employee stock option, stock options. In some types of employment, employees may re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benefit In Kind

Employee benefits and (especially in British English) benefits in kind (also called fringe benefits, perquisites, or perks) include various types of non-wage compensation provided to employees in addition to their normal wages or salary, salaries. Instances where an employee exchanges (cash) wages for some other form of benefit is generally referred to as a "salary packaging" or "salary exchange" arrangement. In most countries, most kinds of employee benefits are taxable to at least some degree. Examples of these benefits include: housing (employer-provided or employer-paid) furnished or not, with or without free utilities; group insurance (health insurance, health, Dental insurance, dental, life insurance, life etc.); Disability insurance, disability income protection; retirement plan, retirement benefits; daycare; tuition reimbursement; sick leave; Annual leave, vacation (paid and unpaid); social security; profit sharing; employer student loan contributions; conveyancing; long s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK State Pension

The State Pension is part of the United Kingdom Government's pension arrangements. Benefits vary depending on the age of the individual and their contribution record. Anyone can make a claim, provided they have a minimum number of qualifying years of contributions. Background Basic State Pension The basic State Pension (alongside the Graduated Retirement Benefit, the State Earnings-Related Pension Scheme, and the State Second Pension) is payable to men born before 6 April 1951, and to women born before 6 April 1953. The maximum amount payable is £141.85 a week (April 2022 - April 2023). New State Pension The new State Pension is payable to men born on or after 6 April 1951, and to women born on or after 6 April 1953. The maximum amount payable is £185.15 a week (April 2022 - April 2023). Contribution record The State Pension is a 'contribution-based' benefit, and depends on an individual's National Insurance (NI) contribution history. To qualify for a full pension ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retail Prices Index (United Kingdom)

In the United Kingdom, the Retail Prices Index or Retail Price Index (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail goods and services. As the RPI was held not to meet international statistical standards, since 2013 the Office for National Statistics no longer classifies it as a "national statistic", emphasising the Consumer Price Index instead. However, as of 2018 the UK Treasury still uses the RPI measure of inflation for various index-linked tax rises. History RPI was first introduced in 1956, replacing the previous Interim Index of Retail Prices that had been in use since June 1947. It was once the principal official measure of inflation. It has been superseded in that regard by the Consumer Price Index (CPI). The RPI is still used by the government as a base for various purposes, such as the amounts payable on index-linked securities including index-linked gilt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

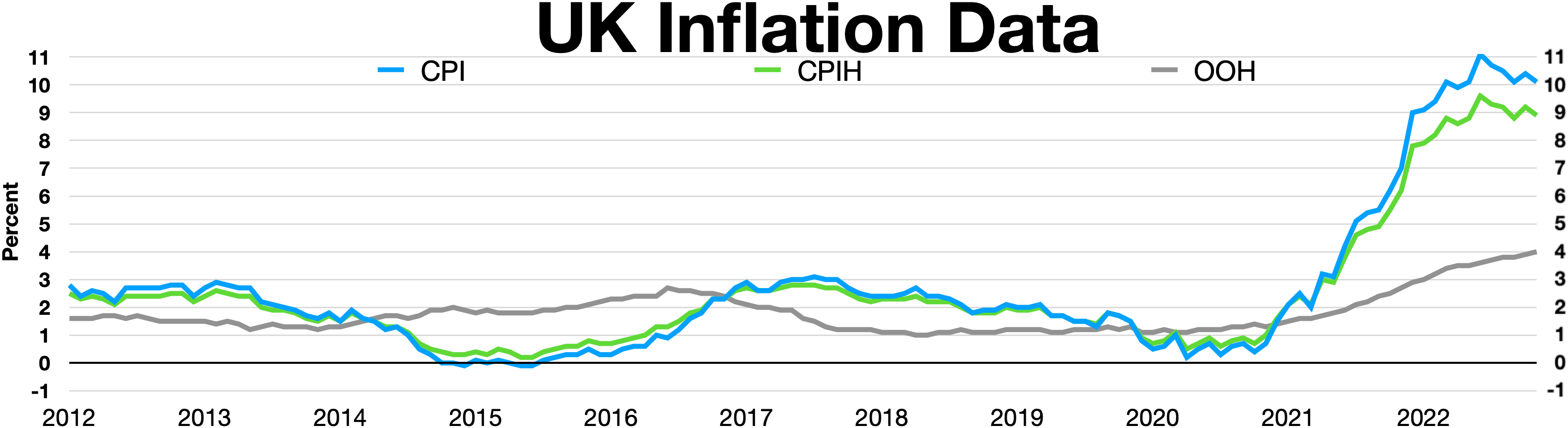

Consumer Price Index (United Kingdom)

The Consumer Price Index (CPI) is the official measure of inflation of consumer prices of the United Kingdom. It is also called the Harmonised Index of Consumer Prices (HICP). History The traditional measure of inflation in the UK for many years was the Retail Prices Index (RPI), which was first calculated in the early 20th century to evaluate the extent to which workers were affected by price changes during the First World War. The main index was described as the Interim Index of Retail Prices from 1947 to 1955. In January 1956, it was rebased and renamed the Index of Retail Prices. In January 1962 this was replaced by the General Index of Retail Prices, which was again rebased at that time. A further rebasing occurred in January 1987, subsequent to the issue of the first index-linked gilts. RPIX An explicit inflation target was first set in October 1992 by Chancellor of the Exchequer Norman Lamont, following the UK's departure from the Exchange Rate Mechanism. Initially, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |