|

NBFC And MFI In India

Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 of India, engaged in the business of loans and advances, acquisition of shares, stock, bonds, hire-purchase insurance business or chit-fund business, but does not include any institution whose principle business is that of agriculture, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property. The working and operations of NBFCs are regulated by the Reserve Bank of India (RBI) within the framework of the Reserve Bank of India Act, 1934 (Chapter III-B) and the directions issued by it. On 9 November 2017, Reserve Bank of India (RBI) issued a notification outlining norms for outsourcing of functions/services by Non-Bank Financial Institution (NBFCs) As per the new norms, NBFCs cannot outsource core management functions like internal audit, management of investment portfolio, strategic and compliance ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

India

India, officially the Republic of India (Hindi: ), is a country in South Asia. It is the seventh-largest country by area, the second-most populous country, and the most populous democracy in the world. Bounded by the Indian Ocean on the south, the Arabian Sea on the southwest, and the Bay of Bengal on the southeast, it shares land borders with Pakistan to the west; China, Nepal, and Bhutan to the north; and Bangladesh and Myanmar to the east. In the Indian Ocean, India is in the vicinity of Sri Lanka and the Maldives; its Andaman and Nicobar Islands share a maritime border with Thailand, Myanmar, and Indonesia. Modern humans arrived on the Indian subcontinent from Africa no later than 55,000 years ago., "Y-Chromosome and Mt-DNA data support the colonization of South Asia by modern humans originating in Africa. ... Coalescence dates for most non-European populations average to between 73–55 ka.", "Modern human beings—''Homo sapiens''—originated in Africa. Then, int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Bank Of India

The Reserve Bank of India, chiefly known as RBI, is India's central bank and regulatory body responsible for regulation of the Indian banking system. It is under the ownership of Ministry of Finance, Government of India. It is responsible for the control, issue and maintaining supply of the Indian rupee. It also manages the country's main payment systems and works to promote its economic development. Bharatiya Reserve Bank Note Mudran (BRBNM) is a specialised division of RBI through which it prints and mints Indian currency notes (INR) in two of its currency printing presses located in Nashik (Western India) and Dewas (Central India). RBI established the National Payments Corporation of India as one of its specialised division to regulate the payment and settlement systems in India. Deposit Insurance and Credit Guarantee Corporation was established by RBI as one of its specialised division for the purpose of providing insurance of deposits and guaranteeing of credit facilit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Bank Of India Act, 1934

Reserve Bank of India Act, 1934 is the legislative act under which the Reserve Bank of India was formed. This act along with the Companies Act, which was amended in 1936, were meant to provide a framework for the supervision of banking firms in India. Summary The Act contains the definition of the so-called scheduled banks, as they are mentioned in the 2nd Schedule of the Act. These are banks which were to have paid up capital and reserves above 5 lakh. There are various section in the RBI Act but the most controversial and confusing section is Section 7. Although this section has been used only once by the central govt, it puts a restriction on the autonomy of the RBI. Section 7 states that central government can legislate the functioning of the RBI through the RBI board, and the RBI is not an autonomous body. Section 17 of the Act defines the manner in which the RBI (the central bank of India) can conduct business. The RBI can accept deposits from the central and state gover ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Factoring (finance)

Factoring is a financial transaction and a type of debtor finance in which a business ''sells'' its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount.O. Ray Whittington, CPA, PhD, "Financial Accounting and Reporting", Wiley CPAexcel EXAM REVIEW STUDY GUIDE, John Wiley & Sons Inc., 2014 A business will sometimes factor its receivable assets to meet its present and immediate cash needs.The Wall Street Journal, "How to Use Factoring for Cash Flo small-business/funding. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their receivables to a forfaiter.Please refer to the Wiki article forfaiting for further discussion on cites. Factoring is commonly referred to as accounts receivable factoring, invoice factoring, and sometimes accounts receivable financing. Accounts receivable financing is a term more accurately used to describe a form of asset based lending against accounts receivable. The C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deposit Insurance And Credit Guarantee Corporation

Deposit Insurance and Credit Guarantee Corporation (DICGC) is a specialised division of Reserve Bank of India which is under the jurisdiction of Ministry of Finance, Government of India. It was established on 15 July 1978 under the Deposit Insurance and Credit Guarantee Corporation Act, 1961 for the purpose of providing insurance of deposits and guaranteeing of credit facilities. DICGC insures all bank deposits, such as saving, fixed, current, recurring deposit for up to the limit of Rs. 500,000 of each depositor in a bank.The limit was increased from 1 lakh to 5 lakh on 4th February 2020. Framework The functions of the subsidiary are governed by the provisions of 'The Deposit Insurance and Credit Guarantee Corporation Act, 1961' (DICGC Act) and 'The Deposit Insurance and Credit Guarantee Corporation General Regulations, 1961' framed by the Reserve Bank of India in exercise of the powers conferred by sub-section (3) of Section 50 of the Act. A maximum of ₹5,00,000 (afte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Micro Finance

Microfinance is a category of financial services targeting individuals and small businesses who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings and checking accounts; microinsurance; and payment systems, among other services. Microfinance services are designed to reach excluded customers, usually poorer population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient.Christen, Robert Peck Christen; Rosenberg, Richard; Jayadeva, Veena. ''Financial institutions with a double-bottom line: Implications for the future of microfinance''. CGAP, Occasional Papers series, July 2004, pp. 2–3. ID Ghana is an example of a microfinance institution. Microfinance initially had a limited definition: the provision of microloans to poor entrepreneurs and small businesses lacking access to credit. The two main mechanisms for the delive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Regulatory And Development Authority

The Insurance Regulatory and Development Authority of India (IRDAI) is a regulatory body under the jurisdiction of Ministry of Finance , Government of India and is tasked with regulating and licensing the insurance and re-insurance industries in India. It was constituted by the Insurance Regulatory and Development Authority Act, 1999, an Act of Parliament passed by the Government of India. The agency's headquarters are in Hyderabad, Telangana, where it moved from Delhi in 2001. IRDAI is a 10-member body including the chairman, five full-time and four part-time members appointed by the government of India. History In India insurance was mentioned in the writings of many historical documents, which examined the pooling of resources for redistribution after fire, floods, epidemics and famine. The life-insurance business began in 1818 with the establishment of the Oriental Life Insurance Company in Calcutta; the company failed in 1834. In 1829, Madras Equitable began conducti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

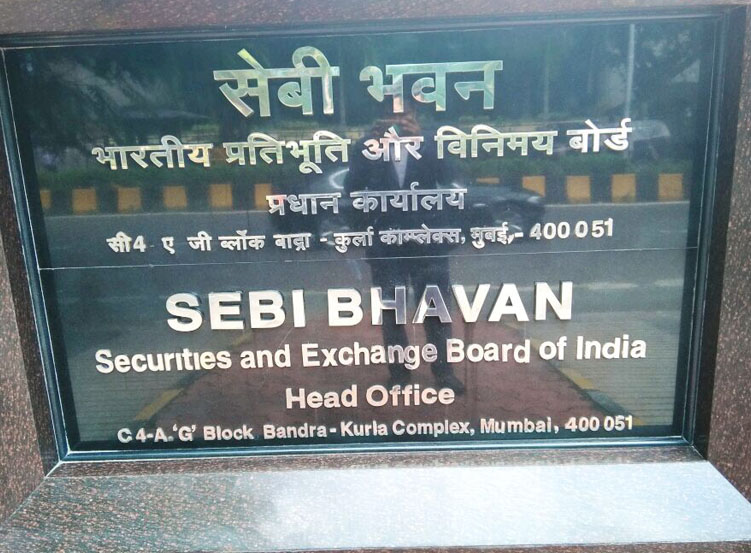

Securities And Exchange Board Of India

The Securities and Exchange Board of India (SEBI) is the regulatory body for securities and commodity market in India under the ownership of Ministry of Finance within the Government of India. It was established on 12 April 1988 as an executive body and was given statutory powers on 30 January 1992 through the SEBI Act, 1992. History Securities and Exchange Board of India (SEBI) was first established in 1988 as a non-statutory body for regulating the securities market. It became an autonomous body on 30 January 1992 and was accorded statutory powers with the passing of the SEBI Act 1992 by the Indian Parliament. SEBI has its headquarters at the business district of Bandra Kurla Complex in Mumbai and has Northern, Eastern, Southern and Western Regional Offices in New Delhi, Kolkata, Chennai, and Ahmedabad respectively. It has opened local offices at Jaipur and Bangalore and has also opened offices at Guwahati, Bhubaneshwar, Patna, Kochi and Chandigarh in Financial Year 2013 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Housing Bank

National Housing Bank (NHB), is the apex regulatory body for overall regulation and licensing of housing finance companies in India. It is under the jurisdiction of Ministry of Finance , Government of India. It was set up on 9 July 1988 under the National Housing Bank Act, 1987. NHB is the apex financial institution for housing. NHB has been established with an objective to operate as a principal agency to promote housing finance institutions both at local and regional levels and to provide financial and other support incidental to such institutions and for matters connected therewith. The Finance Act, 2019 has amended the National Housing Bank Act, 1987. The amendment confers the powers of regulation of Housing Finance Companies (HFCs) to the Reserve Bank of India The Reserve Bank of India, chiefly known as RBI, is India's central bank and regulatory body responsible for regulation of the Indian banking system. It is under the ownership of Ministry of Finance, Government ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nidhi Company

A nidhi company is a type of company in the Indian non-banking finance sector, recognized under section 406 of the Companies Act, 2013. Their core business is borrowing and lending money between their members. They are also known as Permanent Fund, Benefit Funds, Quasi Bank, Mutual Benefit Funds and Mutual Benefit Company. They are regulated by Ministry of Corporate Affairs, which is also empowered to issue directions to them in matters relating to their deposit acceptance activities. However, in recognition of the fact that these companies deal with their shareholder-members only. Nidhi means a company which has been incorporated with the object of developing the habit of thrift and reserve funds amongst its members and also receiving deposits and lending to its members only for their mutual benefit. Nidhi companies existed even prior to the existence of companies Act 2013. The basic concept of nidhi is "Principle of Mutuality" These companies are more popular in South India, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NABARD

National Bank for Agriculture and Rural Development (NABARD) is an apex regulatory body for overall regulation of regional rural banks and apex cooperative banks in India. It is under the jurisdiction of Ministry of Finance, Government of India. The bank has been entrusted with "matters concerning policy, planning, and operations in the field of credit for agriculture and other economic activities in rural areas in India". NABARD is active in developing and implementing financial inclusion. Background Source: NABARD was established on the recommendations of B. Sivaramman Committee (by Act 61, 1981 of Parliament) on 12 July 1982 to implement the National Bank for Agriculture and Rural Development Act 1981. It replaced the Agricultural Credit Department (ACD) and Rural Planning and Credit Cell (RPCC) of Reserve Bank of India, and Agricultural Refinance and Development Corporation (ARDC). It is one of the premier agencies providing Rs.14080 crore (100% share). The authorized sha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forbes

''Forbes'' () is an American business magazine owned by Integrated Whale Media Investments and the Forbes family. Published eight times a year, it features articles on finance, industry, investing, and marketing topics. ''Forbes'' also reports on related subjects such as technology, communications, science, politics, and law. It is based in Jersey City, New Jersey. Competitors in the national business magazine category include ''Fortune'' and ''Bloomberg Businessweek''. ''Forbes'' has an international edition in Asia as well as editions produced under license in 27 countries and regions worldwide. The magazine is well known for its lists and rankings, including of the richest Americans (the Forbes 400), of the America's Wealthiest Celebrities, of the world's top companies (the Forbes Global 2000), Forbes list of the World's Most Powerful People, and The World's Billionaires. The motto of ''Forbes'' magazine is "Change the World". Its chair and editor-in-chief is Steve Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)