|

Market Form

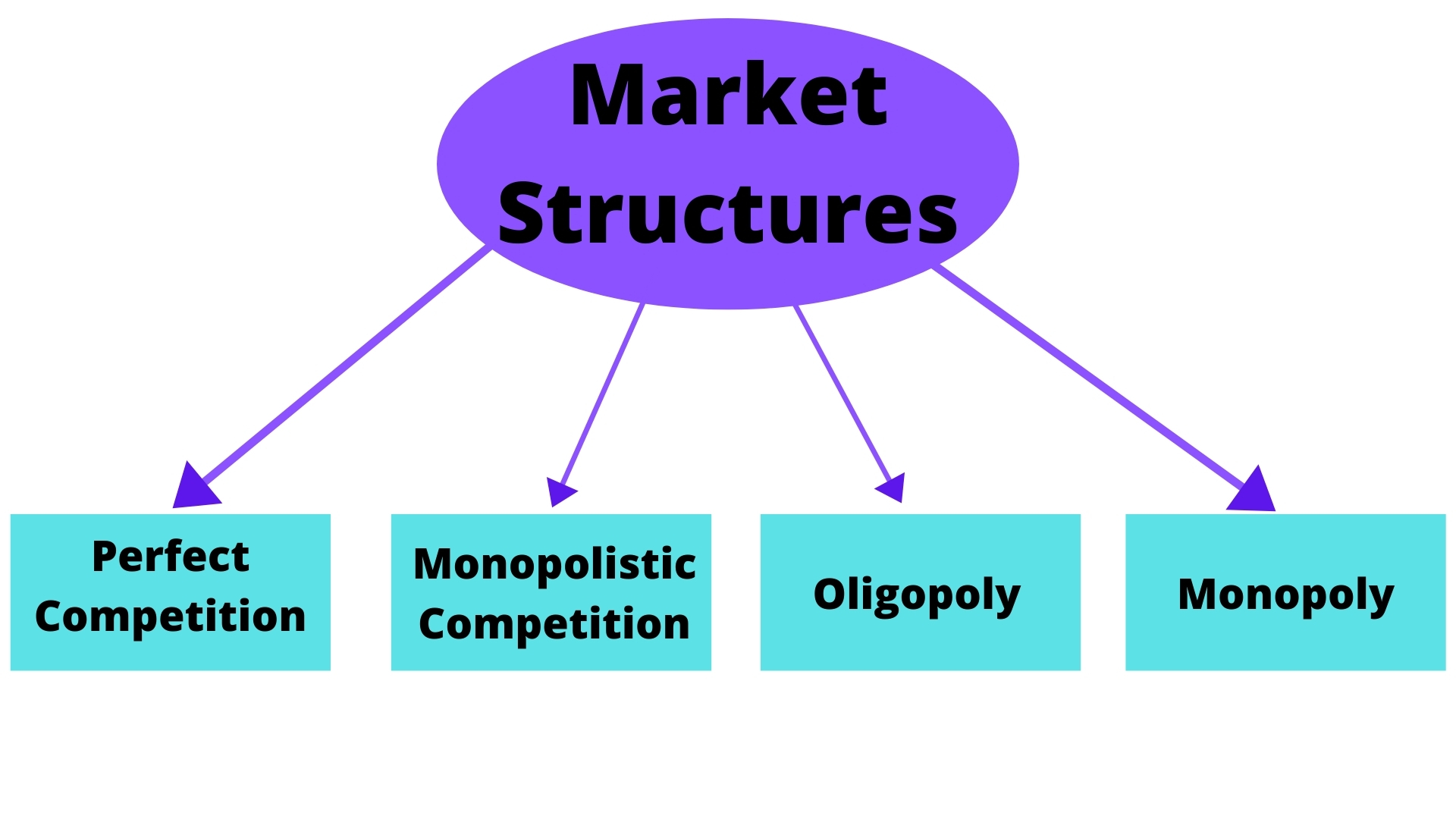

Market structure, in economics, depicts how firms are differentiated and categorised based on the types of goods they sell (homogeneous/heterogeneous) and how their operations are affected by external factors and elements. Market structure makes it easier to understand the characteristics of diverse markets. The main body of the market is composed of suppliers and demanders. Both parties are equal and indispensable. The market structure determines the price formation method of the market. Suppliers and Demanders (sellers and buyers) will aim to find a price that both parties can accept creating a equilibrium quantity. Market definition is an important issue for regulators facing changes in market structure, which needs to be determined. The relationship between buyers and sellers as the main body of the market includes three situations: the relationship between sellers (enterprises and enterprises), the relationship between buyers (enterprises or consumers) and the relationship be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adam Smith The Muir Portrait

Adam; el, Ἀδάμ, Adám; la, Adam is the name given in Genesis 1-5 to the first human. Beyond its use as the name of the first man, ''adam'' is also used in the Bible as a pronoun, individually as "a human" and in a collective sense as "mankind". tells of God's creation of the world and its creatures, including ''adam'', meaning humankind; in God forms "Adam", this time meaning a single male human, out of "the dust of the ground", places him in the Garden of Eden, and forms a woman, Eve, as his helpmate; in Adam and Eve eat the fruit of the tree of knowledge and God condemns Adam to labour on the earth for his food and to return to it on his death; deals with the birth of Adam's sons, and lists his descendants from Seth to Noah. The Genesis creation myth was adopted by both Christianity and Islam, and the name of Adam accordingly appears in the Christian scriptures and in the Quran. He also features in subsequent folkloric and mystical elaborations in later Judaism, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bertrand Competition

Bertrand competition is a model of competition used in economics, named after Joseph Louis François Bertrand (1822–1900). It describes interactions among firms (sellers) that set prices and their customers (buyers) that choose quantities at the prices set. The model was formulated in 1883 by Bertrand in a review of Antoine Augustin Cournot's book ''Recherches sur les Principes Mathématiques de la Théorie des Richesses'' (1838) in which Cournot had put forward the Cournot model. Cournot's model argued that each firm should maximise its profit by selecting a quantity level and then adjusting price level to sell that quantity. The outcome of the model equilibrium involved firms pricing above marginal cost; hence, the competitive price. In his review, Bertrand argued that each firm should instead maximise its profits by selecting a price level that undercuts its competitors' prices, when their prices exceed marginal cost. The model was not formalized by Bertrand; however, the idea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perfect Competition

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In Economic model, theoretical models where conditions of perfect competition hold, it has been demonstrated that a Market (economics), market will reach an Economic equilibrium, equilibrium in which the quantity supplied for every Goods and services, product or service, including Workforce, labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum. Perfect competition provides both allocative efficiency and productive efficiency: * Such markets are ''allocatively efficient'', as output will always occur where marginal cost is equal to average revenue i.e. price (MC = AR). In perfect competition, any Profit maximization, profit-maximizing producer faces a market price equal to its marginal cost (P = MC). This implies that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Power

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue.Syverson, C. (2019). Macroeconomics and Market Power. The Journal of Economic Perspectives, 33(3), 23-43. https://doi.org/10.1257/jep.33.3.23 This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. Such propensities contradict perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are consequently referred to as 'price takers', whereas market participants that exhibit market power are referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duopoly

A duopoly (from Greek δύο, ''duo'' "two" and πωλεῖν, ''polein'' "to sell") is a type of oligopoly where two firms have dominant or exclusive control over a market. It is the most commonly studied form of oligopoly due to its simplicity. Duopolies sell to consumers in a competitive market where the choice of an individual consumer can not affect the firm. The defining characteristic of both duopolies and oligopolies is that decisions made by sellers are dependent on each other. Duopoly models in economics and game theory There are two principal duopoly models, Cournot duopoly and Bertrand duopoly: * The Cournot model, which shows that two firms assume each other's output and treat this as a fixed amount, and produce in their own firm according to this. * Cournot Model in Game Theory In 1838, Antoine A. Cournot published a book titled "Researches Into the Mathematical Principles of the Theory of Wealth" in which he introduced and developed this model for the first ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oligopoly

An oligopoly (from Greek ὀλίγος, ''oligos'' "few" and πωλεῖν, ''polein'' "to sell") is a market structure in which a market or industry is dominated by a small number of large sellers or producers. Oligopolies often result from the desire to maximize profits, which can lead to collusion between companies. This reduces competition, increases prices for consumers, and lowers wages for employees. Many industries have been cited as oligopolistic, including civil aviation, electricity providers, the telecommunications sector, Rail freight markets, food processing, funeral services, sugar refining, beer making, pulp and paper making, and automobile manufacturing. Most countries have laws outlawing anti-competitive behavior. EU competition law prohibits anti-competitive practices such as price-fixing and manipulating market supply and trade among competitors. In the US, the United States Department of Justice Antitrust Division and the Federal Trade Commission are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly

A monopoly (from Greek language, Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or company, enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a Market (economics), market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic Competition (economics), competition to produce the good (economics), good or Service (economics), service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopolistic Competition

Monopolistic competition is a type of imperfect competition such that there are many producers competing against each other, but selling products that are differentiated from one another (e.g. by branding or quality) and hence are not perfect substitutes. In monopolistic competition, a company takes the prices charged by its rivals as given and ignores the impact of its own prices on the prices of other companies. If this happens in the presence of a coercive government, monopolistic competition will fall into government-granted monopoly. Unlike perfect competition, the company maintains spare capacity. Models of monopolistic competition are often used to model industries. Textbook examples of industries with market structures similar to monopolistic competition include restaurants, cereals, clothing, shoes, and service industries in large cities. The "founding father" of the theory of monopolistic competition is Edward Hastings Chamberlin, who wrote a pioneering book on the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopsony

In economics, a monopsony is a market structure in which a single buyer substantially controls the market as the major purchaser of goods and services offered by many would-be sellers. The microeconomic theory of monopsony assumes a single entity to have market power over all sellers as the only purchaser of a good or service. This is a similar power to that of a monopolist, which can influence the price for its buyers in a monopoly, where multiple buyers have only one seller of a good or service available to purchase from. History Monopsony theory was developed by economist Joan Robinson in her book ''The Economics of Imperfect Competition'' (1933). Economists use the term "monopsony power" in a manner similar to "monopoly power", as a shorthand reference for a scenario in which there is one dominant power in the buying relationship, so that power is able to set prices to maximize profits not subject to competitive constraints. Monopsony power exists when one buyer faces little ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

De Beers

De Beers Group is an international corporation that specializes in diamond mining, diamond exploitation, diamond retail, diamond trading and industrial diamond manufacturing sectors. The company is active in open-pit, large-scale alluvial and coastal mining. It operates in 35 countries and mining takes place in Botswana, Namibia, South Africa, Canada and Australia. From its inception in 1888 until the start of the 21st century, De Beers controlled 80% to 85% of rough diamond distribution and was considered a monopoly. Competition has since dismantled the complete monopoly; the De Beers Group now sells approximately 29.5% of the world's rough diamond production by value through its global sightholder and auction sales businesses. The company was founded in 1888 by British businessman Cecil Rhodes, who was financed by the South African diamond magnate Alfred Beit and the London-based N M Rothschild & Sons bank. In 1926, Ernest Oppenheimer, a German immigrant to Britain and later ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economies Of Scale

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time. A decrease in cost per unit of output enables an increase in scale. At the basis of economies of scale, there may be technical, statistical, organizational or related factors to the degree of market control. This is just a partial description of the concept. Economies of scale apply to a variety of the organizational and business situations and at various levels, such as a production, plant or an entire enterprise. When average costs start falling as output increases, then economies of scale occur. Some economies of scale, such as capital cost of manufacturing facilities and friction loss of transportation and industrial equipment, have a physical or engineering basis. The economic concept dates back to Adam Smith and the idea of obtaining larger production returns through the use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natural Monopoly

A natural monopoly is a monopoly in an industry in which high infrastructural costs and other barriers to entry relative to the size of the market give the largest supplier in an industry, often the first supplier in a market, an overwhelming advantage over potential competitors. Specifically, an industry is a natural monopoly if the total cost of one firm, producing the total output, is lower than the total cost of two or more firms producing the entire production. In that case, it is very probable that a company (monopoly) or minimal number of companies (oligopoly) will form, providing all or most relevant products and/or services. This frequently occurs in industries where capital costs predominate, creating large economies of scale about the size of the market; examples include public utilities such as water services, electricity, telecommunications, mail, etc. Natural monopolies were recognized as potential sources of market failure as early as the 19th century; John Stuart M ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |